Revolving Door Patent Examiners

The revolving door between government and private industry creates opportunities for regulatory capture. Dick Cheney’s moves between Secretary of Defense, CEO of Halliburton and Vice-President certainly raised eyebrows. Secretaries of the Treasury, Robert Rubin, Hank Paulson and Steve Mnuchin were all former bankers at Goldman Sachs. Former members of Congress who become lobbyists are common as are bureaucrats and congressional staffers who turn to lobbying on behalf of the industries they previously regulated. At the same time, it seems desirable that government should be able to draw from top notch people in the private sector and it’s not surprising that private sector firms would want to hire people with government experience. It’s unfortunate (in my view) that government is so entwined with the private sector but that is inevitable in a mixed economy. Nevertheless, it would be useful if we had more data and less anecdote when it comes to the revolving door.

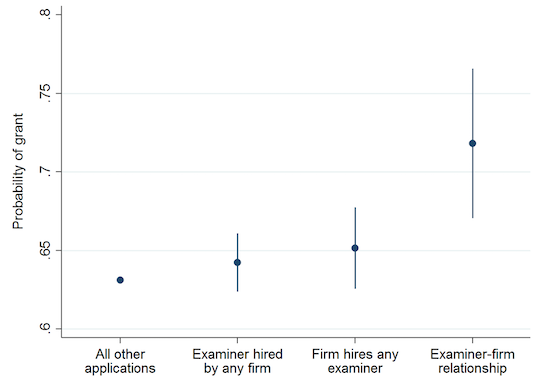

In a new and impressive paper (summary here), Haris Tabakovic and Thomas Wollmann take a detailed look at this issue using patent examiners. Using data on over 1 million patent decisions they find that examiners grant significant more patents to firms that later hire them.

It’s possible that examiners want to work for firms that have high quality patents but several considerations suggest that this is not the explanation for the correlation between grant probability and firm hiring. First, the firms doing the hiring are law firms that handle patent applications. We are not talking about USPTO examiners all wanting to work for Google.

It’s possible that examiners want to work for firms that have high quality patents but several considerations suggest that this is not the explanation for the correlation between grant probability and firm hiring. First, the firms doing the hiring are law firms that handle patent applications. We are not talking about USPTO examiners all wanting to work for Google.

Second, in a very clever analysis the authors show that USPTO examiners who leave for the private sector tend to go to a city near their college alma mater. Moreover, examiners who leave are more likely to approve patents to firms located their alma mater (even when these firms subsequently do not hire them). In other words, it looks as if (on the margin) patent examiners are more generous to firms that they might want to subsequently work for because they are located in places desirable to them. Patent examiners who do not leave do not show a similar bias which removes a home-city boosterism effect. All of these effects are after taking into account examiner fixed effects–so it’s not that examiners who leave are different on average it’s that examiners who leave act differently when firms are located in regions that are potentially desirable to those examiners.

Finally, the authors show that patent quality, as measured by future citations, is lower for patents granted to firms that later hire the examiner or to firms in the same city who are granted patents by the examiner (i.e. to firm-patents the examiner might have given a pass to in order to curry favor). The authors also find some evidence in the patents themselves. Namely, patents that are grant to subsequent employers tend to have claims that are shorter (i.e. stronger) because fewer words were added during the claims process.

The policy implications are less clear. Waiting periods are crude–in other contexts we call these non-compete clauses and most people don’t like them. Note also that these relationships appear to be driven by norms rather than explicit bargaining. USPTO examiners are paid substantially less than their private sector substitutes and that nearly always seems like a bad idea. Paying examiners more would reduce the incentive to rotate.