Singapore’s Pay Model Isn’t India’s: Market Wages vs. Civil-Service Rents

In my post How High Government Pay Wastes Talent and Drains Productivity I pointed to evidence that high government compensation in poorer countries creates tremendous waste and drains the private sector of productive talent. A reader asked: What about Singapore?—famous for paying its top officials very well.

Singapore, however, is hardly comparable to India. Its GDP per capita is about 37 times India’s (~$91k vs. $2.4k) and its population is ~1/233rd the size (6m vs. 1.4b). Still, lets take a closer look.

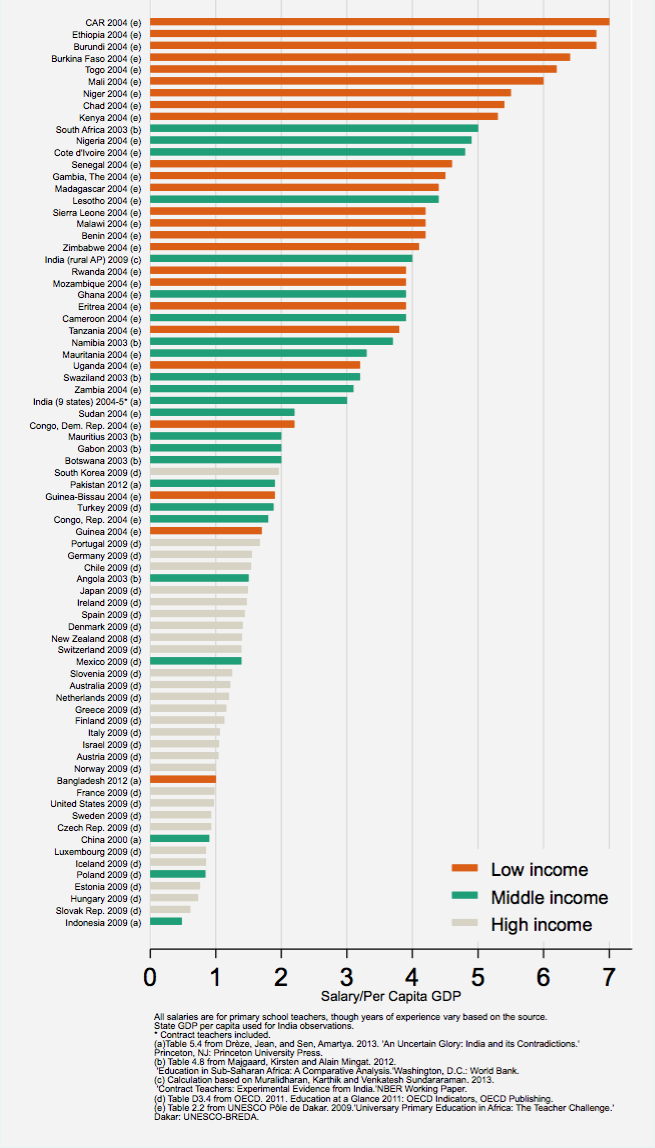

When I discuss high public pay in places like India, Greece, or Brazil, I don’t mean a few top ministers. I mean millions of railway clerks, office staff, and civil servants. Teachers illustrate the point well, since their work is broadly similar worldwide. As Justin Sandefur shows in the data at right, teacher salaries relative to GDP per capita tend to be highest in the poorest countries—sometimes five times GDP per capita or more.

Sandefur comments:

This may come as a bit of a surprise to many rich-country readers. There’s no doubt that teachers in, say, India earn much less than teachers in Ireland, but relative to context, they tend to be very well paid. Dividing by per capita GDP is a rough and ready way to put salaries in context.

The evidence suggests supply and demand can’t explain this. For example, in countries where teachers are highly paid relative to GDP per capita, they’re also paid far above private-sector wages for the same job. Sandefur presents more evidence on this question and concludes:

…Public school teachers in many developing countries earn civil service salaries that are far higher than market wages. This is what economists traditionally refer to as “rents.”

Singapore does NOT fit this pattern. Its teachers earn on the order of 70–80% of GDP per capita, market wages, not inflated packages. What’s unusual in Singapore is only at the top: a small number (fewer than 500) of elite officials and politicians have salaries pegged to the highest 1,000 Singapore-citizen income earners.

The issue Singapore is tackling is wage compression. In many democracies, collective bargaining combined with fairness, envy and inequality concerns pushes pay up at the bottom and down at the top. Denmark and heavily unionized firms are classic cases. Singapore, meritocratic and unapologetic, instead says its highest-ranking officials should be paid like CEOs.

Unlike India, Italy, Greece or Brazil, Singapore’s policy is not to pay any government workers above market wages but to pay competitive salaries to its entire civil service, even those at the top. Crucially, Singapore does not use mass exams to limit entry–it doesn’t have to because by keeping wages consistent with similar jobs in the private sector it matches supply to demand. As a result, we do not see in Singapore thousands or even millions of over-qualified people applying for a handful of over-paid government jobs, as in this example from Italy (quoted in Geromichalos and Kospentaris):

Italy’s chronic unemployment problem has been thrown into sharp relief after 85,000 people applied for 30 jobs at a bank [. . . ] The work is not glamorous – one duty is feeding cash into machines that can distinguish banknotes that are counterfeit or so worn out that they should no longer be in circulation. The Bank of Italy whittled down the applicants to a “shortlist” of 8,000, all of them first-class graduates with a solid academic record behind them. They will have to sit a gruelling examination in which they will be tested on statistics, mathematics, economics and English [. . . ] The high level of interest was a reflection of the state of the economy but also of the Italian obsession with securing “un posto fisso” – a permanent job.

So far from being a counter-example, Singapore illustrates the lesson: Singapore pays market wages, not rents—thereby avoiding the rent-seeking and talent misallocation that plague countries where civil servants are paid far above their market value.