Category: Economics

Markets in Everything: Butts

Producers often hire body doubles to save money on insurance. It

might cost a huge amount in risk coverage to have a high-priced star

dangle her leg off a ladder, for example. Instead, the production

company could pay a few hundred bucks for a much less valuable actor to

put her leg in harm’s way.When a movie needs a parts double for a "celebrity insert," the director or casting agent submits a notice to a set of casting services known as the "breakdowns." Talent agents

can supply doubles for very specific age ranges and body sizes, or for

skin tones like "peaches and cream," "warm vellum," and "golden

caramel." They can also send talent with special skills. For example, a

commercial director might want a hand model with "tabletop

skills"–someone who can pour a glass of beer at a constant rate or cut

a tomato into perfectly even slices.

That’s from Slate. I also liked this from Anita Hart the new bum of Slendertone:

They checked out my CV and saw that I had doubled for some of the greatest bums in Hollywood. I guess if I was good enough for Pammy and Liz, I was good enough for them. I sent them photos of my bum and the rest is history. It’s a real honour, lots of people have been the ‘faces’ of various products – no one has ever been a ‘bum’, so it really is a great privilege. If I continue to use their products, I hope to remain the bum of Slendertone for many more years.’

Thanks to Carl Close for the pointer.

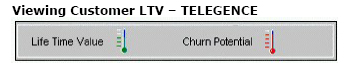

Price Discrimination Thermometer

When customers call Cingular threatening to switch to another firm or asking for discounts operators see a handy thermometer that tells them the life time value (LTV) of the customer to the company. The higher the meter reading the more discounts the operator is allowed to offer the customer. The Consumerist has the details including excerpts from company documents explaining the system.

Currency *is* disappearing, finally…

Monopoly board game players can now pay for properties with debit

cards. Game makers Parker have phased out the standard multi-coloured

cash in a new version. Players will instead use a Visa mock debit card

to keep track of how much they win or lose. It is inserted into an

electronic machine where the banker taps in cardholders’ earnings and

payments. Parker said replacing of cash with plastic showed the game

was moving with the times.

Here is the link, with echoes of Fischer Black and Neil Wallace. Here is another account.

Dollars for Dialing

Guess how much would it cost a farmer to get telephone service in a small rural county far from a major city? Let’s say $800 for satellite service.

Now guess how much the government subsidizes rural phone carriers to provide this service. The answer? As much as $13,000 per line per year.

That litte gem is from an excellent report by my new colleague, Tom Hazlett, on where all the money from those little telephone taxes ends up going.

How to Unemploy Immigrants

In a shocking op-ed in the NYTimes two well known liberals, Michael Dukakis and Daniel Mitchell (a former price-control Czar), acknowledge that the minimum wage creates unemployment. Nevertheless, they are in favor of raising the minimum wage. Why? Because it will create even more unemployment among immigrants than among natives.

The mean-spirited, Machiavellian nature of their op-ed is chilling but I will give Dukakis and Mitchell this, their logic is impeccable. The minimum wage creates unemployment among the low-skilled. As a result, the minimum wage tends to create disproportionate unemployment among teenagers and young African Americans.

Similarly, since many immigrants have lower-skills than natives, Dukakis and Mitchell are correct that a well-enforced minimum wage will put immigrants out of work reducing the pull of the American economy to workers in foreign countries.

I wonder if the NYTimes would have printed an op-ed that advocated minimum wages as a way of creating unemployment among

African Americans and raising white wages?

(Long-time readers will know that the original proponents of the minimum wage had in mind exactly that so Dukakis and Mitchell are true progressives.)

How to make foreign aid work

Here is an interesting article by Abhijit Banerjee of MIT; here are many responses, most prominently by Angus Deaton (the most incisive), Nicholas Stern, and Jagdish Bhagwati.

Why is the UK so expensive?

A loyal MR reader, Erik Alberts, writes:

I’ve made several

trips to the UK in the past few months in preparation and it amazes me

how much more things cost there (in London) then here in California.

What I’m trying to understand is why. I realize that some things like

gasoline cost more in the UK due to taxes. But for other things, it

appears that prices in the UK are 40 to 50% higher. How would you

explain this?Here are a few examples:1. Apple iTunes –

costs $0.99 per download in the US, costs $1.47 (0.79 pounds at 1.8594

pounds/$) in the UK. Why should downloading a song in the UK cost 48%

more when on the internet you can just download them off the US site?I realize that higher

taxes and higher labor costs may be factors (although at my company UK

labor is cheaper than it is in California), but I find it difficult to

believe that this would explain a 50% difference. Could this be a sign

of currency imbalance like the big mac index, a supply and demand

issue, or are UK consumers simply used to paying more?

I have wondered the same about Switzerland. The standard explanation is that expensive countries are extremely productive with their tradables (North Sea oil and London finance?). That appreciates their exchange rates and renders non-tradables quite dear. This is the flip side of cheap barbers and prostitutes in Thailand. But are the Brits really so productive? If so, why can’t they get both hot and cold water coming out of the same tap? And aren’t some of the expensive goods tradables rather than non-tradables?

One factor for sure is that American retailing is the most efficient and most productive in the world. Perhaps the Brits are especially inept in this regard.

A further factor may be that foreigners, even those who are considering moving, sample British prices in biased fashion. We see lots of hotel rooms, cab rides, and restaurants. Fish and chips is still pretty cheap outside of London. As for Marmite I could not say, but that is exactly the point. Your preferred consumption basket will always look expensive in another country; just try getting Ocean Spray grapefruit juice in Western Samoa.

Your thoughts?

Got subsidies?

Name a white powder that is consumed by millions, generates huge profits, and is smuggled in and out of the United States. Nope. It’s milk. Here’s another classic story of how our farm program wastes billions.

For years, the government has periodically purchased powdered milk

— as well as butter and cheese, the other byproducts of raw milk — as

part of a congressionally mandated price-support program for milk

producers. By 2003, the Agriculture Department had accumulated a record

1.4 billion pounds of powdered milk in warehouses and in a huge

limestone cave in the Kansas City area.The bulging stores

coincided with a drought that left livestock pastures burned in about a

dozen states. Some livestock owners were faced with selling their

herds, Farrish said. Giving them the powdered milk as an emergency

source of feed seemed like a good way to help out….In 2003,

the government released 390 million pounds of powdered milk for the

ranchers, giving it to the states for $1 a truckload.

The true value of the milk was somewhere on the order of 3 thousand dollars a truck load (the article is a little unclear) so you can imagine that the milk did not long stay with the ranchers.

Thanks to Ramin Seddig for the pointer.

Poverty traps and demands for loyalty

The new Roland Fryer paper looks promising:

This paper develops a model of social interactions and endogenous

poverty traps. The key idea is captured in a framework in which the

likelihood of future social interactions with members of one’s group is

partly determined by group-specific investments made by individuals. I

prove three main results. First, some individuals expected to make

group-specific capital investments are worse off because their observed

decision is used as a litmus test of group loyalty – creating a

tradeoff between human capital and cooperation among the group. Second,

there exist equilibria which exhibit bi-polar human capital investment

behavior by individuals of similar ability. Third, as social mobility

increases this bi-polarization increases. The models predictions are

consistent with the bifurcation of distinctively black names in the

mid-1960s, the erosion of black neighborhoods in the 1970s, accusations

of ‘acting white,’ and the efficacy of certain programs designed to

encourage human capital acquisition.

I have observed similar behavior among small ideological groups. The more some members from that group succeed, the stronger the litmus/loyalty test required from remaining members. Polarization accelerates. Those who are left behind are often worse off than if a pooling equilibrium — everyone together in the same boot — had held.

How a proto-Economist Runs for Charity

Back in high school we had a run for charity, x laps around the track for so many dollars per lap. I forget the charity but showing early signs of an economic mind, or perhaps a lazy body, I decided that it would be much more efficient to get the money and avoid the running (today, I would say avoid the rent seeking). Thus, I solicited donations with the promise that I would run just one lap.

Unsurprisingly, the other students were most displeased when I sauntered around the track finishing just as everyone else was beginning to work up a sweat. More surprisingly, the charity organizers didn’t like my methods even though I raised a lot of money.

I had to go to graduate school in economics before I really began to understand why. Eric Crampton, subbing for Bryan Caplan at EconLog, has the details.

By the way, its been said that crazy people go to graduate school in psychology in an effort to understand themselves. Perhaps the socially obtuse go to graduate school in economics for reasons that are somewhat similar. See here on yours truly and also Greg Mankiw’s related comments.

Papers I wish I had written

What is truly scarce inside the human mind? Hayek (The Sensory Order) and the neuroeconomists have grasped this as a central question of economics. Here is a new paper:

Common intuition and experimental psychology suggest that the ability

to self-regulate, willpower, is a depletable resource. We investigate

the behavior of an agent who optimally consumes a cake (or paycheck or

workload) over time and who recognizes that restraining his consumption

too much would exhaust his willpower and leave him unable to manage his

consumption. Unlike prior models of self-control, a model with

willpower depletion can explain the increasing consumption sequences

observable in high frequency data (and corresponding laboratory

findings), the apparent links between unrelated self-control behaviors,

and the altered economic behavior following imposition of cognitive

loads. At the same time, willpower depletion provides an alternative

explanation for a taste for commitment, intertemporal preference

reversals, and procrastination. Accounting for willpower depletion thus

provides a more unified theory of time preference. It also provides an

explanation for anomalous intratemporal behaviors such as low

correlations between health-related activities.

My approach to willpower deletion, of course, is to always leave oneself wanting to do a little more of the virtuous task, rather than to overdiscipline. If you have promised yourself 200 push-ups, stop at 198. Here is the link.

New interview with Milton and Rose Friedman

Read most of it here, the pointer is from New Economist blog.

Heard in Riyadh, Teheran and Caracas

We have got to end our dependence on foreign dollars. Their dollars are the lifeblood our economy. Our standard of living is in the hands of the Great Satan! This isn’t just an economic problem, it’s a political problem. If they reduce their supply of dollars they could blackmail us. We need to think about our future and that of our children. We must embark immediately on a plan to increase our domestic consumption of oil. Keep the oil at home and stop fueling our oppressors!

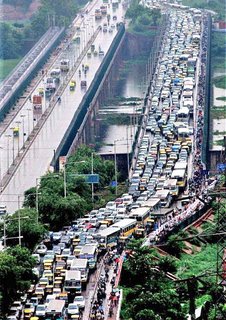

Marginal returns vs. average returns

I was not surprised to learn this is Delhi. Here are some musings on the photo. Here is an earlier post on Indian infrastructure.

The French wealth tax

Via Don Boudreaux, excerpt:

On average, at least one millionaire leaves France every day to take up

residence in more wealth-friendly nations, according to a government

study.

….[France’s] wealth tax — officially called the solidarity tax — is

collected on top of income, capital gains, inheritance and social

security taxes. It’s part of the reason France consistently ranks at

the top of Forbes magazine’s annual Tax Misery Index — a global

listing of the most heavily taxed nations.Wealthy citizens’ tax

bills can be higher than their incomes, according to tax analysts.

President Jacques Chirac’s government attempted to rectify that

disparity last year with changes intended to guarantee that no one

would pay more than 60 percent of income in taxes. But many

businesspeople say actual maximum tax rates still hover at around 72

percent.

Addendum: Here is a new French council, via Chris Coyne.