Month: October 2003

I don’t make macroeconomic predictions myself

Ray Fair is a prominent macroeconomic forecaster. He tells us:

Real Growth and the Unemployment Rate: The predicted growth rates for the next four quarters are 4.1, 3.6, 3.5, and 3.4 percent, respectively. The unemployment rate is predicted to fall to 5.6 percent by the middle of 2004.

Inflation: Inflation as measured by the growth of the GDP deflator (GDPD) is predicted to rise to 2.5 percent by the middle of 2004.

Here is the whole memo. The link is from Econopundit.com. Here is Paul Krugman telling us not to be too happy about today’s announced quarterly 7.2 growth rate, Brad Delong adds to Krugman’s concerns. Andrew Sullivan gets his digs in on Krugman.

Here is a thoughtful defense of macroeconomic forecasting. Here is a more critical view of forecasting, closer to my own view.

My take: You can squabble about the numbers all you want, at this point the Bush people have to be pretty happy.

What do Scandinavians export?

It is commonly known that Sweden and Norway stand among the top five nations for foreign aid per capita.

It is less commonly known that, in per capita terms, they are among the top five arms exporters in the world. Here is the whole list, along with a color-coded map.

And who is number one on the list? Macedonia. The U.S. is number ten, France number seven.

From Nationmaster.com, a valuable data source, growing by the day.

Do you want to know cinema attendance per capita? The U.S. is number two, just behind Iceland. Georgia is number six, and Lebanon is number ten.

Suicide and multiple equilibria

I don’t aim to be the cynical economist that Tyler writes “might suggest social stigma for suicide, rather than forgiveness” but it is frightening how easy it seems to be to jump to the sad equilibrium. The story of suicide among young boys in Micronesia (I recommend Malcolm Gladwell’s The Tipping Point for a discussion but will cite some online material) illustrates how actions and social attitudes reinforce one another. As the action becomes more common, perhaps reaching a “tipping point”, condemnation declines, and the action increases even further. Here, from one of the researchers who first documented the story, is a chilling description of suicide in Micronesia:

As suicide has gained familiarity among youth, the act itself has become increasingly more acceptable or even expected. Suicides appear to acquire a sort of contagious power. One suicide might serve as the model for successive suicides among friends of the first victim. There has been an apparent increase in suicides among very young children, aged 1ï¼-14. Evidently the idea of suicide has become increasingly commonplace and compelling, and young children are now acquiring this idea at earlier ages.

Another of the earlier researchers writes:

Love songs mention suicide, youths discuss the subject openly among themselves and at times make suicide pacts with one another, and youngsters express admiration of those who have taken their own lives and are mourned so terribly by their families and friends. What is even more shocking, however, is that a number of adults in our communities seem to share the belief that these young people have died altruistic and even heroic deaths. If the majority of Micronesians really believe that suicide is an honorable option, then this paper is thoroughly useless and all of us had better resign ourselves to continuing high rates of suicide in the future. Young people, after all, are very quick in sensing the basic values of their elders. If they get the impression that we ourselves honor suicide, then they will be only too happy to oblige by hanging themselves.

Note that one could tell similar stories in the United States about divorce, having children out of wedlock, welfare dependence etc. (also teenage suicide at a local level).

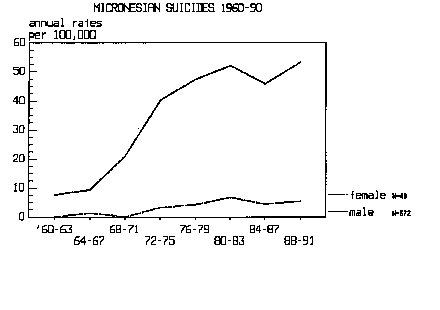

Here is a graph of suicide rates in Micronesia indicating a massive increase in a few short years in the early 1970s. The tipping theory generates credence when we note that virtually all the suicides take a similar, ritualistic form involving hanging.

Lynne Kiesling has moved house

Here is her new blog address, the simpler www.knowledgeproblem.com. Lynne is one of the smartest and most articulate bloggers out there. Her basic focuii are energy, electricity, environment, telecom, and infrastructure more generally, but she covers many areas of interest. Here is one of her recent posts about the FCC and media deregulation.

Speaking of the FCC, I was quite taken by this quotation from Clay Shirky:

Yesterday, the FCC adjusted the restrictions on media ownership, allowing newspapers to own TV stations, and raising the ownership limitations on broadcast TV networks by 10%, to 45% from 35%. It’s not clear whether the effects of the ruling will be catastrophic or relatively unimportant, and there are smart people on both sides of that question. It is also unclear what effect the internet had on the FCC’s ruling, or what role it will play now.

What is clear, however, is a lesson from the weblog world: inequality is a natural component of media. For people arguing about an ideal media landscape, the tradeoffs are clear: Diverse. Free. Equal. Pick two.

I’ll jettison equal. I’d rather have the chance to learn from Lynne’s blog, whether or not it has the drawing power of network television. And on the numerical comparison, well, we can only keep our fingers crossed.

How much do advertisements save you?

Naomi Klein argues that ads are a rip-off, a perversion of culture, and should be ignored or boycotted whenever possible. The well-known “Adbusters” group continues the campaign, calling for “Creative Resistance.”. Here is a useful article about the whole movement.

It is less commonly recognized that ads support free speech. No, I don’t mean that the ad itself is free speech, although this of course is true. Rather ads subsidize the free speech of others.

A simple example makes the point. A full issue of Forbes, without ads, would cost about $9.

The figure is taken from Why Not?, by Barry Nalebuff and Ian Ayres, click here for more information on the book and their web site.

An hour of network television, without commercials, would cost an additional 32 cents an hour to finance. This seems like less of a good deal to me, I would rather pay the 32 cents to eliminate the ads (that’s only 16 cents per Seinfeld episode!), but then again, I am not a typical viewer. I wouldn’t watch much TV, with or without the ads, and that is one reason why we have them, even in this age of cable TV. The people who are truly bothered by ads move to other forums, such as books, that stick few advertisements in your face.

Update on economic prospects

Yes, we have reasons to be optimistic about the economy. Read this excellent post by Daniel Drezner, full of useful links.

More on remittances

1. Almost one Mexican in five receives remittances from relatives working in the United States.

2. These payments help feed, house, and educate at least a quarter of the 100 million people in Mexico.

3. The total sent amounts to about $14.5 billion for this year.

4. Some 450,000 Mexicans entered the United States illegally last year.

The New York Times notes:

Most of the money is spent on food, clothing and housing. But Mr. Suro said a growing portion was invested in small business or helped to pay for high school and college educations.

Across much of central Mexico, where men and women have migrated to the United States for so many decades that crossing the border has become more a rite of passage than an escape from poverty, remittances exceed state public works budgets and pay to build roads, schools, water systems and baseball stadiums.

In recent years the United States and Mexico carried out reforms aimed at making it easier and more affordable for migrants to transfer money home. Companies like Western Union cut the fees they charged for wire transfers, halving the cost of transferring money, and American banks have begun allowing illegal immigrants to open accounts so relatives at home can withdraw funds from automatic teller machines.

Bravo, I say. I have spent a good deal of time in rural Mexico and I can attest that these funds make an enormous difference in the lives of millions. By the way, Daniel Drezner offers insightful commentary on my earlier post on remittances.

Athletes will be the first

Athletes will be the first to be genetically engineered. Suspicions have already been raised about the 14 and 15 year old record-breaking track stars from China. He-Man mice have been created in the lab. All this makes me blase about drug doping and the recent banning by the FDA of a previously difficult to detect steroid. Indeed, I look forward to seeing the new superathletes in action. Imagine the possibilities in all fields of human endeavour. The new concertos written for 12 fingered pianists will be glorious.

Cell phone switching costs

On Nov. 24 cell phone users will, for the first time, be able to take their phone numbers with them when they switch carriers. The added convenience is a good thing but comes at a price. A locked-in customer is a valuable customer so when switching costs are important firms compete especially vigorously at the entry level. Today, you can get a cell phone for free if you sign up for a phone plan. After Nov. 24, I expect to see up-front giveaways become less generous. Overall, consumers will be better off as the competition for switchers lowers the price of service plans. Consumers who use their phones intensively will benefit the most, less intensive users will benefit less because the fall in service plan rates may not compensate for the rise in up-front fees. That at least, is my prediction. A good dissertation lies here.

Marginal Revolution Milestone

Yesterday we breached 10,000 visitors for the first time. Keep coming – you are in good company!

Technology and the environment

How many persistent toxins, such as PCBs, would be in the environment a century hence if Bush were president vs. Gore? He didn’t like my answer–that on that question, the election results made no difference. The time scales are off. Technological innovation, not environmental regulation, will determine the state of the earth in 100 years.

This is Virginia Postrel, here is her complete blog post. And I couldn’t agree more.

Why does unemployment remain high?

Here is the take of Brad DeLong:

First, and most important, the unemployment rate is high because the Federal Reserve misjudged how much investment spending would fall in the aftermath of the collapse of the NASDAQ bubble, and because the Federal Reserve then misjudged how fast productivity would grow. If the Federal Reserve had had an accurate forecast of the investment-spending slowdown, it would have taken appropriate action and the labor market would be in good shape. And if labor productivity growth had exhibited its “normal” recession-and-stagnation slowdown rather than zooming ahead, the amount of demand growth we have had in the past two years would have been enough to put the labor market in good shape. However, don’t blame the Federal Reserve too much: it has a very hard task, it’s policies can’t be perfect, and all-in-all its performance over the past two decades has been amazing.

Plus the Bush tax cuts have not had much of a stimulatory effect on employment. Most of all, Brad tells us, we should not blame trade with China. I am less negative toward the Bush economists than is Brad, but I agree with the core of his analysis.

Can suicide attempts be rational?

…after people attempt suicide and fail, their incomes increase by an average of 20.6 percent compared to peers who seriously contemplate suicide but never make an attempt. In fact, the more serious the attempt, the larger the boost–”hard-suicide” attempts, in which luck is the only reason the attempts fail, are associated with a 36.3 percent increase in income. (The presence of nonattempters as a control group suggests the suicide effort is the root cause of the boost.)

Here is a link to the original research.

Now, you may wonder, how can this be?

Why should suicide be an economic boon? Once you attempt suicide you suddenly have access to lots of resources–medical care, psychiatric attention, familial love and concern–that were previously expensive or unavailable. Doubters may ask why the depressed don’t seek out resources earlier. But studies have demonstrated that psychological and familial resources become “cheaper” after a suicide attempt: It is difficult to find free medical care when you are sad, but once you try to kill yourself, it’s forced on you.

So what should we do? The Slate.com article, the source of this post, suggests “well funded educational campaigns”. A cynical economist might suggest social stigma for suicide, rather than forgiveness. Personally, I suspect that few people attempt suicide for the resulting free medical care, but rather for the attention. We can’t precommit to ignoring them, so perhaps we are simply stuck. I invite Alex to offer some suggestions on how to limit the number of suicides; keep in mind it is a bigger killer in the United States than is homicide.

Addendum: Thanks to Fabio for the pointer. And Eric Crampton suggests the following: “I have a different take on the suicide post – mean reversion. Assume that people are hit with heterogeneous shocks, positive and negative. If people are most likely to commit suicide at the worst point (after the biggest negative shock), then future income increases are just mean reversion. People who just contemplate it have had negative shocks, but not as strongly negative.”

Thank you all for reading

Alex told me that today we broke 10,000 readers for the first time! Many thanks to you all for reading, and for your feedback and ideas. I’ve found blogging to be an enormously rewarding experience.

My favorite article on blogs, by the way, is this piece by Clay Shirky. It tells me, among other things, that I shouldn’t expect to make any money blogging. No problem, and I look forward to writing tomorrow’s posts.

Has Google peaked?

The economic theory of adverse selection suggests that we should be suspicious when companies go public. Here is a summary of some research on the topic. If your big idea has such a stunning future, why let other people in on the action?

Google.com will be going public, and John Gapper at The Financial Times has his doubts. Are they trying to cash out at their peak? Here is part of his critique:

The more pertinent question is whether its business model will retain the lead. To start with, it can no longer rely on others failing to grasp the importance of search. Algorithmic search engines are tough to design and maintain but others such as Teoma, owned by Ask Jeeves, and Yahoo’s Inktomi are catching up.

So is Microsoft, which is developing an algorithmic search engine that may be launched by spring next year – the likely time of Google’s IPO. By 2006, it will be bundled into the next generation of Windows – Microsoft’s usual tactic when faced with superior technology owned by others.

The biggest uncertainty is whether its focus on internet searches to the exclusion of anything else will remain the best strategy. Although it has clearly been popular so far – Google performs 200m searches a day and is responsible for an estimated 75 per cent of all referrals to websites – it could become an Achilles’ heel. It means that Google has no unique content, and no long-term customer relationship with the individuals who use its technology; it is only as good as its last search. That contrasts with sites that have their own databases and customer networks, such as Yahoo, with its 100m registered users, or Amazon, which holds a mass of data about the products that it sells.

The difficulty for Google will come as rivals combine search with other resources in ways that it will find hard to match. The launch of Amazon’s “Search Inside the Book”, which allows customers to search pages on its database for references and information, is one example of how search technology can be applied to data within internet sites.

Yahoo is augmenting internet search with its own information. Its Yahoo Shopping service not only allows users to search for the cheapest outlet for different models of digital cameras but also combines the results with its own guide to buying cameras, and with user reviews. Google’s own shopping service, known as Froogle, also displays the cheapest prices but looks flat by comparison.

My take: I’m not buying any shares. My understanding of the technical issues is weak. But I understand the theory of adverse selection pretty well.