Month: October 2008

The countercyclical asset, a continuing series

Nicer than tasers:

Mr. Borg, past

president of the North American Securities Administrators Association,

adds that in past market downturns he saw people turn to chinchillas, worm farms and super-breeds of rabbits.

Emus, too, were big. "Eventually, people got tired of them and just let them go," he says. "To this day, you’ll be in West Texas and a big

emu running wild will just come up next to your car."

Here is the link and thanks to John De Palma for the pointer. The National Alpaca Registry is doing well:

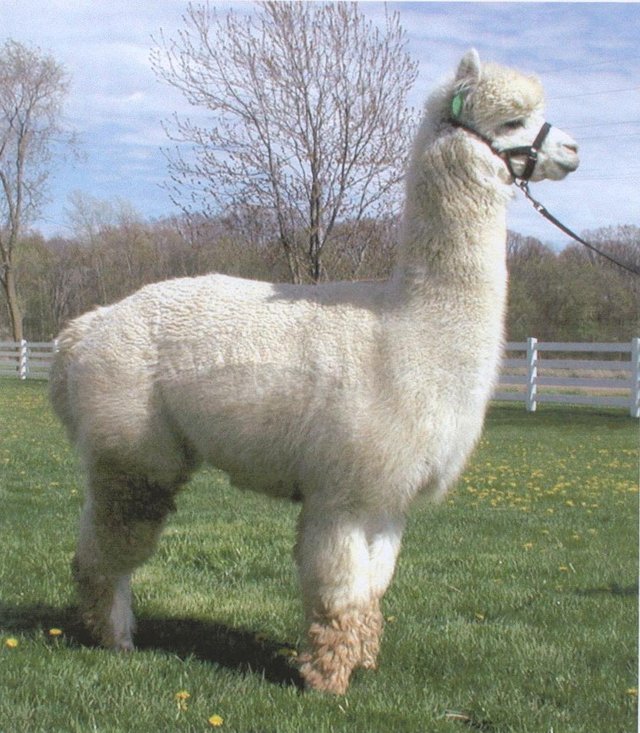

Peggy Parks, a 49-year-old auditor in Johnstown, Pa., turned to an

unusual farm animal. "I’ve lost a fortune in stocks, and my 401(k) is

falling through the floor. I feel comfortable in alpacas," she says.

She invested $56,000 in a small herd that she believes has a better

outlook than most mutual funds because of the animals’ breeding

potential.

Markets in everything

Kiwi song videos about chess boxing. The interviews produce several remarks of interest plus some nice accents.

Over the last year a few of you sent me links about chess boxing. I thank you all but I rejected your mainstream taste to hold out for something quirky.

Prophets of Accountancy

Here is Franklin Allen and Elena Carletti, circa 2006:

When liquidity plays an important role as in times of financial crisis, asset prices in some markets may reflect the amount of liquidity available in the market rather than the future earning power of the asset. Mark-to-market accounting is not a desirable way to assess the solvency of a financial institution in such circumstances. We show that a shock in the insurance sector can cause the current value of banks’ assets to be less than the current value of their liabilities so the banks are insolvent. In contrast, if historic cost accounting is used, banks are allowed to continue and can meet all their future liabilities. Mark-to-market accounting can thus lead to contagion where none would occur with historic cost accounting.

Here is a comment on that same paper. I thank Scott Cunningham for the pointer.

The Economic Consensus v. Politics

The consensus among economists is now clear, the best strategy for dealing with the financial crisis is to recapitalize the banks that need recapitalization. Paul Krugman, John Cochrane, Luigi Zingales, Douglas Diamond, Raghuram Rajan and many others all advocate some form of recapitalization as do Tyler Cowen and myself. Krugman would prefer a recapitalization in the form of nationalization. In my view, there is still plenty of private money to buy banks at the right price and my preferred model is the FDIC leading a speed bankruptcy procedure, as was done brilliantly with Washington Mutual (Cochrane also supports this model.) In the middle are most of the others who have a variety of good ideas to require the banks to raise equity in various ways.

The consensus policy of economists would put most of the burden of adjustment on politically powerful holders of equity and bonds.

There is also a consensus among economists that the bailout bill is not the right policy. None of the above economists, for example, is enthusiastic about the bailout. My bet is that all of us think that the bailout has a substantial likelihood of failing. The support that exists is born out of hope and fear not judgment and experience. Nevertheless, the political consensus is that a bailout is what we will get whether it is likely to work or not.

Addendum: Lynne Kiesling draws the Olsonian conclusion.

Concise Encyclopedia of Economics

It is now on-line. Contributors include Armen Alchian, Gary Becker, Avinash Dixit, Claudia Goldin, Greg Mankiw, Paul Romer, Pete Boettke, Tyler Cowen, Bryan Caplan, Russ Roberts and many others.

On another topic, from elsewhere, here is Arnold Kling on net worth certificates. And here is Russ Roberts on home prices. Here is Bill Easterly’s Op-Ed on development and the crash.

How did the credit rating agencies misfire?

A second view is that because the methodologies used for rating CDOs are complex, arbitrary, and opaque, they create opportunities for parties to create a ratings “arbitrage” opportunity without adding any actual value. It is difficult to test this view, too, although there are reasons to find it persuasive. Essentially, the argument is that once the rating agencies fix a given set of formulas and variables for rating CDOs, financial market participants will be able to find a set of fixed income assets that, when run through the relevant models, generate a CDO whose tranches are more valuable than the underlying assets. Such a result might be due to errors in rating the assets themselves (that is, the assets are cheap relative to their ratings), errors in calculating the relationship between those assets and the tranche payouts (that is, the correlation and expected payout of the assets appear to be higher and therefore support higher ratings of tranches), or errors in rating the individual CDO tranches (that is, the tranches receive a higher rating than they deserve, given the ratings of the underlying assets). These arguments are complex and subtle…

That is from a very interesting paper by Frank Partnoy. The paper is not always easy reading but so far it is the best piece on its topic I have found. This was another good section:

If the mathematical models have serious limitations, how could they support a $5 trillion market? Some experts have suggested that CDO structurers manipulate models and the underlying portfolio in order to generate the most attractive ratings profile for a CDO. For example, parties included the bonds of General Motors and Ford in CDOs before they were downgraded because they were cheap relative to their (then high) ratings.67 The primary reason that the downgrades of those companies had an unexpectedly large market impact was that they were held by so many CDOs.

Thus, with respect to structured finance, credit rating agencies have been functioning more like “gate openers” rather than gatekeepers. The agencies are engaged in a business, the rating of CDOs, which is radically different from the core business of other gatekeepers. No other gatekeeper has created a dysfunctional multi-trillion dollar market, built on its own errors and limitations.

There is also a good discussion of how the ratings agencies have claimed First Amendment protection for their activities, more or less successfully. p.96 offers some good policy conclusions.

Sentences to ponder

I think it’s very telling that in two days of hearings and two weeks of discussion we have yet to see *any* detailed mechanism for how Paulson’s plan will increase the supply of, say, inventory loans.

Here is more, mostly on the commercial paper market, interesting throughout.

Assorted links

1. What could $700 billion buy in the developing world?

2. Nobel predictions, via Greg Mankiw

3. The crisis in pictures, via Chris F. Masse

The Economic Organization of a Prison

A famous paper in economics showed how cigarettes became a medium of exchange in a POW camp (even leading to booms and slumps depending on Red Cross deliveries). For a long time cigarettes were the money of choice in American prisons as well but today, according to a great piece in the WSJ, the preferred medium of exchange is mackerel.

There’s been a mackerel economy in federal prisons since about 2004,

former inmates and some prison consultants say. That’s when federal

prisons prohibited smoking and, by default, the cigarette pack, which

was the earlier gold standard.Prisoners need a proxy for the dollar because they’re not allowed to

possess cash. Money they get from prison jobs (which pay a maximum of

40 cents an hour, according to the Federal Bureau of Prisons) or family

members goes into commissary accounts that let them buy things such as

food and toiletries. After the smokes disappeared, inmates turned to

other items on the commissary menu to use as currency…in much of the federal prison system mackerel has become the currency of choice.

I loved this point which raised the possibility of significant mack seignorage.

…Mr. Muntz says he sold more than $1 million of mackerel for federal

prison commissaries last year. It accounted for about half his

commissary sales, he says, outstripping the canned tuna, crab, chicken

and oysters he offers.Unlike those more expensive delicacies, former prisoners say, the

mack is a good stand-in for the greenback because each can (or pouch)

costs about $1 and few — other than weight-lifters craving protein —

want to eat it.

Thanks to Brandon Fuller for the link.

Net worth certificates, from the FDIC

One alternative is a "net worth certificate" program along the lines of

what Congress enacted in the 1980s for the savings and loan industry.

It was a big success and could work in the current climate. The FDIC

resolved a $100 billion insolvency in the savings banks for a total

cost of less than $2 billion.

Here is more. Here is an FDIC summary of the program, under the heading "Other Resolution Alternatives." To the extent bank recapitalization is needed, this is the best way to do it. As Andrew Sullivan will tell you, experience really does matter. I would like to see more economists promote this idea as an alternative to Treasury warrants.

What will happen with the dollar?

Keith asks, as do others:

I had been curious as to how this whole situation will effect the dollar…If you find the time, I would like to know or see the future of the dollar in this situation.

Please note that I am a "buy and hold" guy, not a trader, and I am certainly not a currency trader. But I’ll cover the dollar vs. the Euro.

My inclination is to think the dollar will hold its value. I don’t trust any of the macro models of currency values and we do know that purchasing power parity, while very approximate, and exerting its force only in the long run, does not imply a bearish stance toward the dollar.

Here is a list of European banks with assets greater than the gdp of their respective home countries. And read this.

As for this country, the Chinese now regard us as "battle tested." We have been through some truly major bumps, yet no major U.S. politician has called for "not paying back the Chinese." We’ve even guaranteed the $350 billion in agency securities held by the Chinese central bank and without a stir. I think the Chinese are shocked by that and in many ways they now trust their investments more than before, not less.

The Chinese do not have comparable trust in "Europe." If something went wrong in the financial realm, who would they call up on the phone? Which country? What do they think is the power base of the head of the ECB? What political party does that person belong to? What favors can be traded and with whom? Whose answer would count as definitive? Keep in mind that for all of China’s modernity, their leaders are still communist party functionaries.

The negative scenario for the dollar is where the Chinese economy collapses, not where the Chinese become too afraid to buy dollar-denominated assets.

Bush, Bernanke, Paulson — we call them leaders. The Chinese think of them as the customer service department. I suspect the Chinese get straighter answers from them than we ever do.

Plans, plans, plans

There is the O’Neill plan:

His plan to deal with the crisis would start with a "discounted cash-flow analysis” of distressed instruments that are clogging the financial system. The government would guarantee the assets, paring back the support as principal and interest payments were made, he said. "That should take care of the liquidity problem because if they have a government guarantee at a specified level they should trade just like cash,” O’Neill said.

Or the Soros plan. And here is a "SuperBond" plan to recapitalize the banking system.

And then there is the Phelps plan for capital injection in return for warrants. Not to mention the French plan.

Or how about the Wright plan:

…to let any American with a mortgage swap it out for a government one at 7% for up to 50 years (to get the monthly payment down to where the borrower can handle it). The Treasury will pay off the existing mortgage with bonds (which it can sell cheap right now). If a borrower wants to default instead s/he can do so, and then the lender can mortgage the property on the above terms.

So many plans!

Here are some solar greenhouse plans. And here are Silly Billy’s World’s Elementary Lesson Plans.

Roger Congleton’s notes on the credit crisis

They are a good outline to many events behind the current crisis; many of you have been writing to me and asking for background reading.

Another of my colleagues, David Levy, just published this short piece (with Sandra Peart) on the ratings agencies and the idea of experts.

The best parenthetical statement I read today

(The fictional 18th century heroine, Moll Flanders, recognized that a high self-regard can be dangerous, arguing that women who believe themselves beautiful are easier to seduce: “If a young woman once thinks herself handsome, she never doubts the truth of any man that tells her he is in love with her; for she believes herself charming enough to captivate him, ’tis natural to expect the effects of it.”)

Here is the link.

Heard in the Halls at GMU

R: "I’m quite pessimistic about the current financial system. I’ve been buying gold."

A: "Gold? That’s not pessimistic enough. I’ve been buying rice."