Month: August 2013

The new economics of Hollywood

Pacific Rim, Guillermo del Toro‘s robots v monsters action movie, is likely to get a sequel after its $9m (£5.9m) record-breaking opening in China, according to Deadline.

The film, which has performed poorly at the US box office, is currently at the top spot internationally. It is yet to be released in over half of global territories including Spain, Brazil and Japan.

The story is here, and here is a good geopolitical analysis of the film. I actually preferred the often unheralded Godzilla vs. Mechagodzilla II, and no sequels are not always worse. Just ask Cervantes.

Is the United Kingdom currently suffering from an aggregate demand problem?

1. CPI annual inflation stands at 2.9% in June.

2. Core inflation stands at 2.3% and has not been below 2% in some time.

3. The producer price index is showing 4.2% inflation (see the first link).

4. Unemployment is falling, and is becoming increasingly a problem of long-term unemployment, which has less to do with aggregate demand.

5. There is now a surge in residential building.

6. Manufacturing PMI just rose to 54.6, a strong performance and one which cannot be attributed to the glitter of the global economy.

The following, however, may still be true claims and indeed likely are true claims:

7. AD problems from the past still have persistent effects in July 2013, including on long-term unemployment.

8. The UK government cut back on some critical investments, and furthermore those cutbacks created enduring sectoral shift problems when it comes to employment.

9. The path of ngdp growth should have been higher in the recent past.

Still, when I look at the UK economy of July 2013, I don’t see an economy wracked with current aggregate demand problems.

In case you were wondering where the money comes from

…if banks are able to obtain 25 basis points by simply placing their funds at the Federal Reserve why would anyone be willing to lend another bank fed funds (deposits at the Fed) unsecured at less than 25 bps? The answer is actually very simple. The GSEs, consisting primarily of Fannie Mae and Freddie Mac, maintain accounts at the Federal Reserve but do not receive interest on their balances since they are not depository institutions. So Fannie Mae and Freddie Mac are the primary suppliers of funds to the banks at rates below the “floor”. Since their return on idle reserves is zero, they are willing to lend to banks at less than 25 bps while the banks are more than willing to pick up a margin on their intermediation of GSE “loans” to the Fed.

That is Peter Stella. There is more here (pdf), which leads to an interesting (but technical) discussion of how the Fed will unwind its current positions. The original pointer was from FTAlphaville blog.

Assorted links

1. Why is the U.S. Passport Office in New York so efficient?

2. Robert Bellah has passed away.

3. Films Stanley Kubrick liked.

4. Cloned quarter horses win antitrust suit.

5. The Chinese are scalping Genius Bar appointments.

6. India’s short-term yield goes vertical at 10% and foreign funds are leaving equities.

Competition in higher education

When undergraduate students at Southern Methodist University peruse their course catalogs this fall, several listings may strike them as odd.

First, the courses will be taught entirely online—an option that Southern Methodist has never before offered to undergraduates.

Second, the courses will be taught by professors at other universities—including Emory University, the University of Notre Dame, and Washington University in St. Louis, among others.

Southern Methodist, along with Baylor University and Temple University, plans to announce on Tuesday that it will allow undergraduate students to take online courses from other colleges for credit.

The courses, offered through the online-education company 2U, will come from a consortium of colleges participating in 2U’s Semester Online program, which is focused on undergraduate education at selective institutions.

Southern Methodist, Baylor, and Temple will be “affiliates” of the program, meaning they will not produce courses but will list certain courses developed by other members of the consortium and will grant “elective credit”—that is, general-education credit—to students who pass.

Participating in the 2U consortium as an affiliate will allow Southern Methodist to see how well online courses work for its students without committing resources to building its own, said Stephanie Dupaul, associate vice president for enrollment management at the university.

In California, however, plans for for-credit MOOCs in public universities have been put on hold.

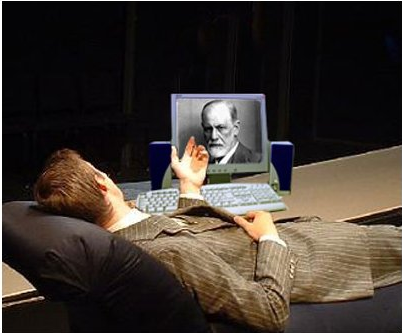

Online Therapy as Good as Face to Face

A small study suggests that online therapy is as effective as face to face.

Online psychotherapy is just as efficient as conventional therapy. Three months after the end of the therapy, patients given online treatment even displayed fewer symptoms.

Six therapists treated 62 patients, the majority of whom were suffering from moderate depression. The patients were divided into two equal groups and randomly assigned to one of the therapeutic forms. The treatment consisted of eight sessions with different established techniques that stem from cognitive behavior therapy and could be carried out both orally and in writing. Patients treated online had to perform one predetermined written task per therapy unit – such as querying their own negative self-image. They were known to the therapist by name.

“In both groups, the depression values fell significantly,” says Professor Andreas Maercker, summing up the results of the study. At the end of the treatment, no more depression could be diagnosed in 53 percent of the patients who underwent online therapy – compared to 50 percent for face-to-face therapy. Three months after completing the treatment, the depression in patients treated online even decreased whereas those treated conventionally only displayed a minimal decline: no more depression could be detected in 57 percent of patients from online therapy compared to 42 percent with conventional therapy.

If therapy works well online imagine what else might work online?

Will Uruguay legalize marijuana?

Members of Uruguay’s House of Representatives have passed a bill to legalise marijuana.

If it goes on to be approved by the Senate, Uruguay will become the first country to regulate the production, distribution and sale of marijuana.

The measure is backed by the government of President Jose Mujica, who says it will remove profits from drug dealers and divert users from harder drugs.

Under the bill, only the government would be allowed to sell marijuana.

There is more here, and reports indicate that approval for the bill is expected.

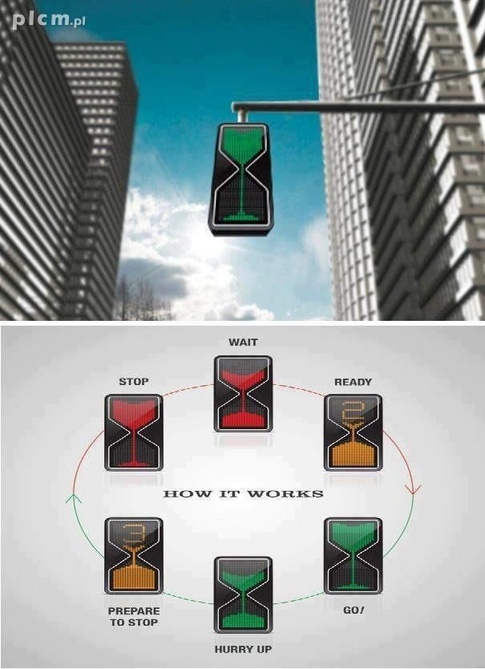

What are the best new products that people don’t know about?

From Quora, you will find a good list, with photos, here. I like “Traffic Signal with Hour glass timer.”

What percent of the products listed are net social positives?

For the pointer I thank the excellent @elrob.