Month: March 2021

Monday assorted links

1. “Our estimation shows that wildfire damages in 2018 totalled $148.5 (126.1–192.9) billion (roughly 1.5% of California’s annual gross domestic product), with $27.7 billion (19%) in capital losses, $32.2 billion (22%) in health costs and $88.6 billion (59%) in indirect losses (all values in US$).” Link here.

2. More on the who is Satoshi debate.

3. “… the presence of immigrant students has a positive effect on the academic achievement of US-born students, especially for students from disadvantaged backgrounds. Moreover, the presence of immigrants does not affect negatively the performance of affluent US-born students, who typically show a higher academic achievement compared to immigrant students.” Link here.

4. “We find that elderly suicide rate decreases by 8.7% during the Chinese Lunar New Year.”

5. Hitler’s parents.

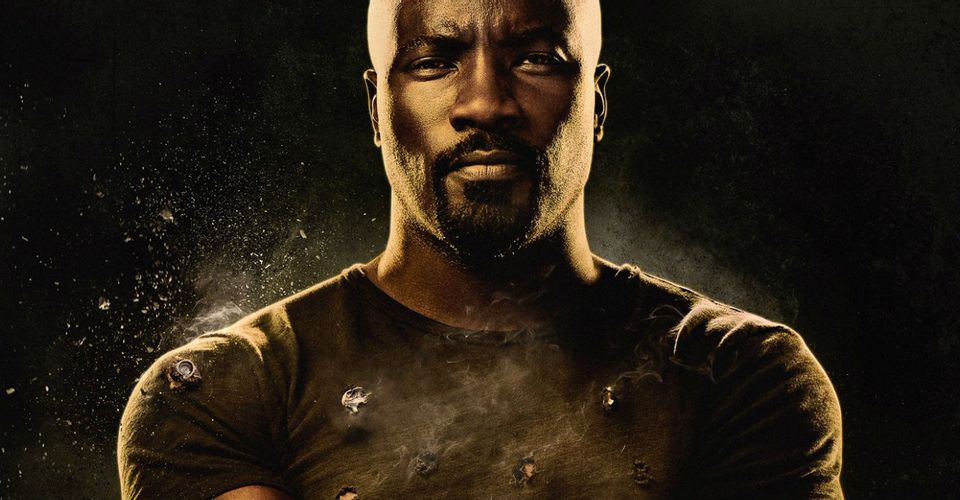

Power Up!

Two weeks ago I was bitten by the equivalent of a radioactive spider and now I have superpowers! Including the power of immunity and the power to fly! Awesome. As I said earlier, the SARS-COV-2 virus killed more people this year than bullets “so virus immunity is a much better superpower than bullet immunity!”

I got the J&J vaccine–one of the first in the world to do so–which seemed appropriate as I have been calling for first doses first and the J&J vaccine is single dose. I will probably supplement with Novavax at a later date when supplies are plentiful.

Addendum: Also, I can get free donuts at Krispy Kreme.

India collateralized smart phone markets in everything

…the easiest way for retailers and online stores to get high-end devices into working-class people’s pockets has been through a new method of lending: collateralizing smartphones. Vendors are selling smartphones to first-time borrowers on high-interest payment plans financed by loan companies, but only after users install an undeletable app at the point of sale. The apps can then monitor repayment behavior throughout the duration of the loan. One late payment leads to instant blocking of the phone, rendering it useless. For loan providers and smartphone sellers, this form of lending opens their products to a new class of consumers…

Datacultr uses a laundry list of techniques to force borrowers into paying. The app starts by sending audiovisual prompts in regional languages as reminders. If the user misses their first repayment, it forcefully changes the wallpaper on their cellphones. If Datacultr’s data scrape reveals a user to be a prolific selfie-taker, for instance, the app will send notifications every time the camera function is opened. If the user continues to default on the loan, frequently used messaging and social apps like Facebook or Instagram are progressively blocked, severely restricting the use of the device and ultimately shutting down all of the phone’s functionalities.

Be careful if you buy a used phone! Here is the full story, via the excellent Samir Varma.

The wisdom of Scott Sumner

Meanwhile, young tweeters seem to forget the Great Inflation happened, or perhaps that it was caused by some sort of oil shock. How oil shocks cause double digit NGDP growth has never been explained. Everything we learned about unreliable Phillips Curves and shifting inflation expectations seems to have been forgotten. You simply can’t have too much stimulus.

I suppose their ignorance is understandable. If parents expertly adjust the thermostat to keep the house temperature at 71 to 73 degrees for 20 years, with a 72 degree target, can you blame the kids who grew up in that house for thinking that thermostats don’t have much impact on temps? (Let’s hope Powell knows!)

My views are orthogonal to this intra-Keynesian debate. I don’t think the fiscal stimulus is a good idea, but not because I expect much inflation. The inflation rate will be determined by the Fed. Rather it’s a reckless policy because it will lead to higher tax rates in the future and won’t do much to generate growth beyond Q3. (Deficits do cause higher interest rates, but only slightly higher in a country like the US.)

For 250 years of American history, politicians have held the peacetime budget deficit in check because of fears of either inflation or higher interest rates (or perhaps a loss of confidence in the gold standard.) What would happen if they begin to sniff out that the actual risk is not inflation or much higher interest rates next year, rather the risk is higher taxes in 20 years, after they’ve safely retired? How would they respond to this information?

I fear that we are about to find out.

There is more at the link. As an aside, I am amazed how much “but the job market recovered so slowly last time” is considered a relevant argument here.

Sunday assorted links

Inflation and complacency

While I agree with those who predict a higher rate of price inflation from the current stimulus plan, it just doesn’t upset me so much (I am much more worried about the poor way we are spending much of the money, and the political precedents being set for vote-buying). It has long struck me as the utmost in complacency that the rate of price inflation has to be 1.8% every year. Even if that is “the best inflation rate” (under what ceteris paribus conditions?), how important a regularity is that? How well does a totally predictable rate of price inflation predict prosperity? I would suggest we simply do not know, but it is far from obvious that the predictive power here is strong, if it is present at all. The empirical case here is quite weak, especially if you adjust for the quality of the government in question.

I am thus happy with average inflation targeting over the previous operating regime of the Fed.

When someone says “The rate of price inflation has to be 1.8%,” what I really hear is “we cannot impose very large pay cuts on what are effectively tenured bureaucrats.”

That all said, I really do not regard higher rates of price inflation as any kind of tonic for an ailing labor market, and I see that many respondents are not able to outline what a mechanism might be connecting inflation and higher employment, rather they simply restate that one will lead to the other without telling us how. The important thing is to prevent deflationary pressures in the first place.

Libertarian PBS

This is great.

The juvenile legal culture that is North Carolina

The 6-year-old dangled his legs above the floor as he sat at the table with his defense attorney, before a North Carolina judge.

He was accused of picking a tulip from a yard at his bus stop, his attorney Julie Boyer said, and he was on trial in juvenile court for injury to real property.

The boy’s attention span was too short to follow the proceedings, Boyer said, so she handed him crayons and a coloring book.

“I asked him to color a picture,” she said, “so he did.”

He didn’t know it, but no matter what the judge decided, the experience could change the boy’s life, experts say, from how he sees the court system to increasing his chance of getting into trouble again and being sent to alternative school.

Seems crazy! By the way, 82% of the complaints were against boys. Via Anecdotal.

That was then, this is now, the median voter theorem remains underrated

In March 2020, the Trump administration put into place one of the most controversial and restrictive immigration policies ever implemented at the U.S. border — and in January, President Biden quietly continued it.

The Biden administration says the Trump-era policy known as Title 42, which relies on a 1944 public health statute to indefinitely close the border to “nonessential” travel, remains necessary to limit the spread of the coronavirus. At the same time, Biden officials say, migrants at the southern border still can seek protection in the United States, a right afforded to them under U.S. law.

Yet since March 20, 2020, when the Centers for Disease Control and Prevention issued its order invoking Title 42, U.S. border officials have claimed unchecked, unilateral authority to summarily expel from the country hundreds of thousands of immigrant adults, families and unaccompanied minors who didn’t have prior permission to enter, without due process or access to asylum — let alone testing for the coronavirus.

In a year of Title 42, of more than 650,000 encounters with migrants at the U.S.-Mexico border, fewer than 1% have been able to seek protection, the Los Angeles Times has learned…

“The Biden administration’s use of Title 42 is flatly illegal,” said Lee Gelernt of the American Civil Liberties Union, who sued the Trump administration over the policy, which the Biden administration is defending in court. “There is zero daylight between the Biden administration and Trump administration’s position.”

Here is the full story, via Rich. Here is further coverage. And why is the problem not going away? Here is the FT:

Experts said Biden’s decision to exempt minors from expulsion will keep the numbers flowing. “It’s a no-brainer”, said Jasmin Singh, a New York-based immigration lawyer. “It’s all kids at the moment,” said one person in Guatemala involved in the smuggling, or coyote, trade.

Ongoing…

Saturday assorted links

1. DNIonUFOs.

2. Florida bans pythons: ““People have literally spent millions and even moved to Florida from out of state, built cages and started businesses, and now they have to get rid of everything,” said Brian Love, a founding member of the group’s state chapter.”

3. Maps of the names of Donald Duck’s brothers in different countries.

4. “In Germany, there’s a very great reluctance to countenance imposing affirmative harm on people in trade-off situations,” Dr. Persad said. “It’s a very strong emphasis on not causing harm, even if you allow much more harm through inaction.” (NYT link)

India Should Embrace Not Ban Crypto

Should India ban crypto in a return to foreign currency regulations of the past or embrace cryptocurrency? Shruti Rajagopalan has an excellent column reminding us of India’s old system of currency control under the License Raj.

If India proceeds with a rumored ban on cryptocurrency, it wouldn’t be the country’s first attempt to impose currency controls. This time, however, a ban is even less likely to succeed — and the consequences for India’s economy could be more dire. The country shouldn’t make the same mistake twice.

In the 1970s and 80s, at the height of what was known as the License Raj, Indians could only hold foreign currency for a specific purpose and with a permit from the central bank. If a businessman bought foreign exchange to spend over two days in Paris and one in Frankfurt, and instead spent two days in Germany, the Reserve Bank of India would demand to know why he’d deviated from the currency permit. Violators were routinely threatened with fines and jail time of up to seven years.

Imports required additional permits. Infosys Ltd. founder Narayana Murthy recalls spending about $25,000 (including bribes) to make 50 trips to Delhi over three years, just to get permission to import a $150,000 computer. Plus, since any foreign exchange that the company earned notionally belonged to the government, the RBI would release only half of Infosys’s earnings for the firm to spend on business expenses abroad.

Naturally a black market, with all its unsavory elements, emerged for foreign currency. The government doubled down, subjecting those dealing in illicit foreign exchange to preventative detention, usually reserved for terrorists. Businessmen selling Nike shoes and Sony stereos were arrested as smugglers.

The system impoverished Indians and made it impossible for Indian firms to compete globally. There’s a reason the country’s world-class IT sector took off only after a balance of payments crisis forced India to open up its economy in 1991.

…While details of the possible crypto ban remain unclear, a draft bill from 2019 bears eerie resemblance to the 1970s controls. It would criminalize the possession, mining, trading or transferring of cryptocurrency assets. Offenders could face up to ten years in jail as well as fines. Such a blanket prohibition would be foolish on multiple levels….

A related problem is that you may think you are banning a cryptocurrency but if you are banning something like Ethereum or Elrond what you are really banning is an experimental workspace, a platform capable of supporting an ecosystem of innovations in finance, art and new forms of cooperation and organization. As I said some time ago:

The Decentralized Autonomous Organization (DAO) is a new organizational form potentially as important as the creation of the corporate form in the 1600s.

and that’s just one example of how crypto will–in one form or another–under-gird much of our life in the 21st century in ways we don’t yet fully see. Banning is premature to say the least.

Moreover, the irony is that India has one of the world’s most advanced identity and payments systems, the India stack. By integrating the India stack with crypto systems regulated similarly to foreign currencies under India’s Foreign Exchange Management Act, India could become a leader in fintech. Balaji Srinivasan presents practical steps forward:

Basically, India doesn’t need to take a risk with a novel ban on the financial internet. It can just modify FEMA to regulate decentralized cryptocurrencies and national digital currencies as foreign assets. A 64-page report by the Indian law firm Nishith Desai Associates outlines in detail how that could work. In brief, the report recommends:

- Treating crypto as a foreign asset. FEMA provides language that could be used to expressly classify digital assets as “securities”, “goods”, “software”, or “foreign currencies” depending on their features and attributes.

- Regulating exchanges with startup-friendly licensing. RBI could use FEMA to regulate crypto exchanges as “authorised persons” per the Act, thereby permitting them to deal in foreign currency. Some provision would need to be made to accommodate startups, perhaps by monitoring small new licensees under a regulatory sandbox framework. By repurposing this well-established regulatory mechanism, crypto-assets become subject to all the existing safeguards that the Act provides, including RBI oversight and KYC/AML.

- Adopting KYC/AML rules. Most developed jurisdictions, including Australia, Canada, the EU, Japan, South Korea, and the US, have brought crypto-asset business activity within their AML regimes. Such an approach has also been recommended by the FATF. India can do this with a simple Central Government notification under the Prevention of Money-Laundering Act.

The FEMA-based model (or a close alternative) would allow us to turn all licensed, regulated Indian exchanges like CoinDCX, WazirX, Coinswitch, Zebpay, Unocoin, and Pocketbits into well-lit venues for trading cryptocurrency. Over time, they will also become huge drivers of remittances for Indians abroad performing remote work, thereby bringing capital into India.

Nominal Taiwanese salmon arbitrage

Have your fun while you can:

A Taiwanese official has pleaded with people to stop changing their name to “salmon” after dozens made the unusual move to take advantage of a restaurant promotion.

In a phenomenon that has been labelled “salmon chaos” by local media, about 150 mostly young people visited government offices in recent days to officially change their name.

The cause of this sudden enthusiasm was a chain of sushi restaurants.

Under the two-day promotion, which ended on Thursday, any customer whose ID card contained “gui yu” – the Chinese characters for salmon – would be entitled to an all-you-can-eat sushi meal along with five friends…

The United Daily News reported that one resident decided to add a record 36 new characters to his name, most of them seafood themed, including the characters for “abalone”, “crab” and “lobster”.

Here is the full story, via Jeremy Rubinoff.

Twitter economics has again led us astray

Do read through my whole argument, here is just one segment from my latest Bloomberg column:

One theory about the benefits of an overheated labor market stems from the work of Robert E. Lucas in the 1970s, which in turn built upon ideas from Milton Friedman. In Lucas’s model, if the central bank boosts the money supply and the rate of price inflation, some people will work more or expand their businesses because they think there is a real and enduring increase in the demand for their output.

That makes sense theoretically, but subsequent empirical studies showed the effect is typically small. In 1986, Lawrence H. Summers wrote a critique of these and related ideas, and the economics profession rightly decided to move on. Inflation does change people’s work and production plans, but not by very much.

A second argument has remained more robust: the Keynesian idea of money illusion, outlined in Keynes’s General Theory. According to Keynes, a central bank can boost the rate of employment by inflating. If nominal wages are sticky, and the rate of price inflation goes from 0% to 5%, inflation-adjusted wages will suddenly be 5% lower. Businesses will hire more workers.

Even if you are an unreconstructed Keynesian economist, you might notice a problem with this mechanism: It boosts employment but not real wages. In fact, it boosts employment by lowering real wages, which is a pretty typical economic mechanism. So if the idea is to “run labor markets hot to raise worker pay,” this approach isn’t going to help. Instead it will increase the temptation to solve employment problems by looking for ways to cut real wages, not raise them.

“Running the economy hot” is a metaphor — it is better to respond with an actual model/argument, and noting the recovery was slow last time does not suffice!

Friday assorted links

Does expertise make consumers emotionally numb?

I consider this a speculative idea, but of interest, here is the paper abstract:

Expertise provides numerous benefits. Experts process information more efficiently, remember information better, and often make better decisions. Consumers pursue expertise in domains they love and chase experiences that make them feel something. Yet, might becoming an expert carry a cost for these very feelings? Across more than 700,000 consumers and 6 million observations, developing expertise in a hedonic domain predicts consumers becoming more emotionally numb – i.e., having less intense emotion in response to their experiences. This numbness occurs across a range of domains – movies, photography, wine, and beer – and across diverse measures of emotion and expertise. It occurs in cross-sectional real-world data with certified experts, and in longitudinal real-world data that follows consumers over time and traces their emotional trajectories as they accrue expertise. Further, this numbness can be explained by the cognitive structure experts develop and apply within a domain. Experimentally inducing cognitive structure led novice consumers to experience greater numbness. However, shifting experts away from using their cognitive structure restored their experience of emotion. Thus, although consumers actively pursue expertise in domains that bring them pleasure, the present work is the first to show that this pursuit can come with a hedonic cost.

That is by Matthew D. Rocklange, Derek D. Rucker, and Loran F. Nordgren. For the pointer I thank the excellent Kevin Lewis.