Month: November 2021

Wednesday assorted links

1. The economics of on-line news, and Melika Liporace is on the job market.

2. Stubborn Attachments and Burkean futurism.

3. Should courtroom algorithms be open source?

4. Why are men more vulnerable to Covid-19? (NYT)

5. Tse Chi Lop. “Some Chinese triads have been known to require 36 separate oaths.”

6. Charlotta Stern interviews David Autor. And Winsome Sears speaking.

The Treasury report on stablecoin regulation

I’ve now read it, and I don’t get it. OK, so stablecoins should be Fed regulated, brought into the FDIC network, and prohibited from mixing with commerce. In essence, the stablecoin issuers become like banks in the regulatory sense. Let’s put aside whether or not you think that is a good idea and ask a simpler question: what about “all of crypto”? Does that have to be put through the same legal ringer? What does it mean to ban general crypto from affiliating with commerce at the institutional level? To guarantee crypto issues with the FDIC?

You might say this is only for “stablecoins,” but does the document give a rigorous legal definition of that term? No. How stable does it have to be, to be a stablecoin? What if there is no stability guarantee, but the issuer acts to create an expectation of relative stability. Is that a stablecoin? Or just crypto? What if the price fluctuates “a bit”?

You may feel “I know a stablecoin when I see one,” and maybe you do, but I very much suspect that under these proposed regulations you either kill all of crypto, or hardly anything ends up being legally classified as a stablecoin, though it still might be pretty stable!

What about a “not quite stable coin,” but you buy a separate contract with a “separately capitalized” intermediary, so that you are each time made whole, and can de facto treat the value as really quite stable?

Maybe they have clever answers to these questions, and just didn’t see fit to include them in a 26-page document. But I am sooner inclined to think that Treasury is not currently handling this issue at a sufficiently high conceptual level.

Attention Cycles

Using data from US public firms’ regulatory filings and financial statements, we document that firms’ attention to macroeconomic conditions is counter-cyclical and their propensity to make production mistakes is pro-cyclical. Attentive firms make smaller mistakes, and mistakes of the same size are punished more by financial markets during downturns. We explain these phenomena with a business cycle model in which firms, owned by risk-averse investors, rationally allocate costly attention across states. When aggregate productivity is low, there are higher rewards for delivering profits, and firms optimally pay more attention and make smaller mistakes. Endogenously counter-cyclical attention generates quantitatively significant asymmetric, state-dependent shock propagation and stochastic volatility of output growth.

That paper is by Joel P. Flynn and Karthik A. Sastry of MIT, noting that Sastry is on the job market this year.

Should the Roma be more Woke?

The members of Pretty Loud, possibly the world’s first all-Roma female hip-hop group, don’t write saccharine love songs.

Their lyrics focus instead on the pains Roma women experience: marrying and having children too young, feeling like second-class citizens and not finishing high school.

“Don’t force me, Dad, I’m too young for marriage,” the six members, who hail from Serbia and are in their midteens to late 20s, sing in one song. “Please understand me, or should I be quiet?” they rap in another. “No one hears when I use my Roma girl’s voice.”

Here is more from the NYT. And more from YouTube:

Tuesday assorted links

1. Creeque Alley (that was then, this is now).

2. “We further document that the labor-market premium to action-oriented personality traits has rapidly increased over the past two decades.” And here is a new paper on Finnish extraversion (not joking).

3. Banning non-compete agreements in Austria didn’t really help worker earnings.

4. On the benefit of early promotion. Suandi is on the job market from Berkeley.

5. “We find that the introduction of potatoes led to a sizeable and permanent reduction in conflict.” Joris Mueller on the market from Northwestern.

Pseudoviruses and Luciferase

Testing whether a drug or vaccine inhibits a virus can be especially difficult if the virus is dangerous and thus requires cumbersome biosafety level-3 conditions. A now common alternative is to create a pseudovirus, a harmless, non self-replicating virus core that has been modified to exhibit the same surface proteins as the dangerous virus. In the case of SARS-CoV-II, for example, pseudoviruses were created with the same spike proteins as the real virus. In addition, the pseudovirus is given a Luciferase gene. The Luciferase gene (aka light bearer gene) is a gene for creating the kinds of enzymes which light up fireflies and it is only expressed after entering a cell. Thus, scientists can test whether a virus has been successfully neutralized by measuring how much light virus-exposed cells exhibit. Neat!

Here’s a nice picture of the idea from Berthold Instruments who sell luminometers which measure the intensity of Luciferase activity.

The welfare effects of eviction policies

This paper studies the implications of rental market policies that address evictions and homelessness. Policies that make it harder to evict delinquent tenants, for example by providing tax-funded legal counsel in eviction cases (“Right-to-Counsel”) or by instating eviction moratoria, imply eviction and homelessness are less likely given default. But higher default costs to landlords lead to higher equilibrium rents and lower housing supply. I quantify these tradeoffs in a model of rental markets in a city, matched to micro data on rents and evictions as well as shocks to income and family structure. I find that “Right-to-Counsel” drives up rents so much that homelessness increases by 15% and welfare is dampened. Since defaults on rent are driven by persistent income shocks, stronger protections are ineffective in preventing evictions of delinquent tenants, and lead to a large increase in default premia. In contrast, rental assistance lowers renters’ default risk and as a result reduces homelessness by 45% and evictions by 75%, and increases welfare. Eviction moratoria can prevent a spike in evictions following a rare economic downturn, as long as they are used as a temporary measure.

Here is the paper, that is by Boaz Abramson, who is currently on the job market from Stanford.

What I’ve been reading

1. Stephen Crane, The Red Badge of Courage. I read this as a kid, and was surprised how well my reread held up. To the point, subtle, and with an economy of means. I hope the new Paul Auster biography of Crane (which I will read soon) will revive interest in this classic.

2. Frank Herbert, Dune Messiah. #2 in the Dune series, I disliked this one as a tot, but currently am marveling at its political sophistication. Somewhat uneven, but better than its reputation. The Wikipedia page for the book also indicates that Villeneuve is likely to do a Dune 3 based on this story.

3. Elisabeth Anderson (not the philosopher), Agents of Reform: Child Labor and the Origins of the Welfare State. Considers the political economy of child labor reform Germany, France, the United States, and the failed case of Belgium. Pathbreaking, a major advance on the extant literature. The explanations are messy rather than monocausal, but often focus on the success or failure of individual policy entrepreneurs.

4. Gordon Teskey, Spenserian Moments. No one seems to care about poor old Edmund Spenser, yet there seem to be quite a few good books about him.

5. Patrick McGilligan, Alfred Hitchcock: A Life in Darkness and Light. The best book on Hitchcock, John Nye recommended it to me eight years ago.

There is Howard Husock, The Poor Side of Town, And Why We Need It.

And Mary Roach, Fuzz: When Nature Breaks the Law.

Richard A. Williams, Fixing Food: An FDA Insider Unravels the Myths and Their Solutions, covers the food regulatory side of the FDA, and:

Markus K. Brunnermeier, The Resilient Society.

Monday assorted links

1. Impressions of an Indian graduate student visiting America.

2. A trucker reports on the supply chain crisis (too pessimistic?).

3. Reddit thread on what does America get right, what they leave out is more interesting than what they list.

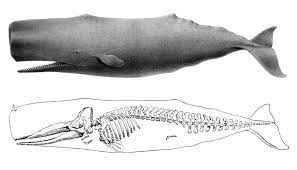

4. Once we start talking to whales, what will they say back to us? Will we even understand it?

5. Hanania’s new theory of politics: “We once more find a Democratic bias towards the written word.” Recommended.

6. Vitalik on crypto cities, recommended.

*Apprentice to Genius*

An excellent book, the author is Robert Kanigel and the subtitle is The Making of a Scientific Dynasty. It is strongest on the role of mentors and lineages in scientific excellence, the radically inegalitarian and “unfair” nature of scientific achievement and also credit, and it offers an interesting look at the early days of the NIH. Here is one excerpt:

But Brodie simply saw no reason to become an expert in an area to launch a study of it. Rather, as Sid Udenfriend says, “he would just wander into a new field and make advances that people fifteen years in the field couldn’t.” Poring through scientific journals didn’t appeal to him; picking the brains of colleagues did. “He’d go up to you,” Jack Orloff remembers, “and say, ‘Tell me what you know about X and Y.’ Sometimes he’d already know a lot, but he could come across as almost stupid.” Indeed, he could seem downright ignorant, asking disarmingly simple, even hopelessly naive questions, like a child. But as one admirer notes, “He’d end up asking just the questions you should have asked ten years ago.”

And:

Beginning around 1955, the big stir at LCP was over serotonin. (“When the experiments were good, we called it serotonin,” Brodie would later recall…”When I heard it pronounced serotonin, I knew the experiments were bad and I stayed home.”)

And:

Martin Zatz, a veteran of Julius Axelrod’s lab and a scientist with an uncommonly broad cast of mind, was talking about mentoring and its role in science. “Are you going to talk about the disadvantage of the mentor chain?” he asked me, smiling broadly.

What’s that? “That you don’t get anywhere,” he replied, now quite serious, “unless you’re in one.”

Recommended. Why are there not more excellent conceptual books on the history of science?

Revenue Driven Policing

The NYTimes has a good piece on revenue driven policing:

Many municipalities across the country rely heavily on ticket revenue and court fees to pay for government services, and some maintain outsize police departments to help generate that money, according to a review of hundreds of municipal audit reports, town budgets, court files and state highway records.

…In Bratenahl, Ohio, the town government is so dependent on traffic enforcement that the police chief castigated his officers as “badge-wearing slugs” in an email when a downturn in ticket writing jeopardized raises. Ticket revenue helped finance sheriff’s equipment in Amherst County, Va.; a “peace officers annuity and benefit fund” in Doraville, Ga.; and police training in Connecticut, Oklahoma and South Carolina.

Revenue driven policing can be most extreme when the people you are ticketing are not voters.

Newburgh Heights, a frayed industrial village of about a half square mile with 2,000 residents just south of Cleveland, doggedly monitors traffic on the short stretch of Interstate 77 that passes through.

…All told, revenue from traffic citations, which typically accounts for more than half the town’s budget, totaled $3 million in 2019.

My paper, To Serve and Collect (with Mike Makowsky and Thomas Stratmann) shows that there is a notable increase in revenue generating arrests when local governments are facing a deficit. More from Makowsky in this thread.

Tyrone on crypto assets

Egads, what a fool this man is! Nonetheless he has grown wealthier as of late, so I thought I would give him the indulgence of another MR post. Little did I know what arrant nonsense he would come up with. Here is what he started with, the transcription from the Pig Latin being mine:

“Tyler, let’s play the envelope game. I give you an envelope with $100, and I tell you it is going to either double or half in value. (Think of it like a floating exchange rate that either will go to 2-1 or 1-2, with equal probability.) So you will end up with either $200 or $50, the expected value therefore being $125. That is a good deal for you! You started with $100, and you can expect now $125.

You would love to keep on playing this envelope game of course, except no one will play that envelope game with you even once. Until now.

In essence, by “tolerating” cryptocurrency, big-time fiat money holders have agreed to keep on playing this game. And so, if this continues, over time crypto will absorb more and more of the wealth in an economy. Just by playing the envelope game!

After all, the indirect utility function is convex in prices and the rest of the world is creating a floating exchange rate game for us for free! That is why so many different crypto assets keep proliferating!

The only joke about dogecoin is that it isn’t doing even better than it is.

What is philanthropy going to look like in five years’ time? All life extension technologies?

The envelopes game, of course, doesn’t boost the quantity of real resources, so eventually the purchasing power of non-crypto holders will shrink, shrink, shrink. That is why we will need a UBI, not because of AI.

Of course you might think that the fiat holders won’t tolerate the crypto game forever. And maybe not. But as long as there is any chance whatsoever that crypo assets turn out to have real value, at least some of those fiat money sows will be lining up at the trough to trade at some exchange rate…the envelopes game thus will continue!

At this point I had to push Tyrone down the stairs. Such fallacies! Such absurdities! I even offered him an envelope of his very own if he would shut up, but to no avail. I demanded that he write down the transversality condition for this fool game he had postulated, but all he could was recite the envelope theorem, another sign of his deep and utter confusion.

As he was falling down the stairs, he kept on insisting that Satoshi really was Satan, that all of the world’s wealth would fall into the hands of The Whales, that we all needed to reread Melville, and Johan Jensen, and ponder the Leviathan from Psalms, Jonah, and Job, and our sins, and that everyone trading with crypto holders was caught in a massive prisoner’s dilemma — collectively handing them volatile exchange rates and thus envelope games for free — and yes this was a long and deep stairwell…

Dear reader, I hope you never have to suffer under such sophistries and indignities again.

I return you now to your regularly scheduled programming, for however long it may last…at the very least writing this blog does not require much money. Yes, my cherished reader, it is my UBI…and so crypto will be allowed to proceed…