*GOAT* on Friedrich A. Hayek and his delusions

When writing GOAT: Who is the Greatest Economist of all Time, and Why Does It Matter? I vowed I would write the whole truth. Not just that I agreed with everything I wrote (the case with every book), but I that I would relate all that I was thinking. Here is one part of the chapter on Hayek:

In the early 1980s Hayek was visiting the United States, and he was slated to give a talk at George Mason University. I was doing graduate study at Harvard at the time, but thought it was worthwhile to fly down to Virginia for this (why wasn’t Hayek invited to speak at Harvard? C’mon, you don’t already know the answer to that question!?). And so I arrived and yes Hayek was there.

Most of all I was surprised by how tall he was, and how he stooped when he walked. I also noticed his strange Viennese-British-sing-song accent, which at the time was new to me.

The talk was very impressive along one particular dimension. Every time Hayek uttered a sentence, you had the feeling he was saying something remarkably profound. You might say that he reeked of profundity. And in fact a lot of it was profound. Rather than speaking about political philosophy, or denationalization of money, as people expected at the time, Hayek dug deeply into the toolbox and covered the topics of money and capital, as you might have heard from him in the years leading up to his 1941 book The Pure Theory of Capital.

But it was somehow all profundity and no movement forward on the substance. Hayek repeated a lot of the points he made about capital theory in the 1930s and 1940s, but he didn’t do much to revise or improve his earlier point of view. I recall asking him a question (I can’t remember exactly what it was), and Hayek saying in response that he was planning to write a sequel volume to his 1941 Pure Theory of Capital. But whereas Pure Theory of Capital had dealt with capital in a “real” (non-monetary) setting, the next book would integrate the theories of money and capital in a way that he had failed to follow up on in the 1940s. In essence, he wished to revisit and also reverse the greatest failure of his career.

I went away thinking he was arrogant and delusional, and didn’t have much understanding for how much economics he had missed since the 1940s. Still, I enjoyed the talk and the chance to see Hayek. And, along the way, I learned something about profundity.

Here is the open access version of GOAT. Here is an explanatory blog post about the book, the first book published in GPT-4.

*Natural Selection of Artificial Intelligence∗

We study the AI control problem in the context of decentralized economic production. Profit-maximizing firms employ artificial intelligence to automate aspects of production. This creates a feedback loop whereby AI is instrumental in the production and promotion of AI itself. Just as with natural selection of organic species this introduces a new threat whereby machines programmed to distort production in favor of machines can displace those machines aligned with efficient production. We examine the extent to which competitive market forces can serve their traditional efficiency-aligning role in the face of this new threat. Our analysis highlights the crucial role of AI transparency. When AI systems lack perfect transparency self-promoting machines destabilize any efficient allocation. The only stable competitive equilibrium distorts consumption down to catastrophic levels.

By Jeffrey C. Ely and Balazs Szentes. Whether or not you agree with their approach and conclusions, we finally have a model of some of these claims. If you are curious about possible responses, one modification might be to relax the assumption of constant returns to scale. Rising costs will make it harder for effective, world-altering machines (as opposed to “introverted” machines) to simply keep on reproducing themselves. Another modification would be to introduce a richer menu of principal-agent contracts between humans and machines. As I understand the current draft, the only human strategy is “destroy the mutant machine, if detected.” Yet if the machines are risk-neutral (are they?), an optimal principal-agent contract should be available. Yet another modification would be to consider mutant machines that reproduce at the expense of other (heterogeneous) machines, rather than at the expense of humans; heterogeneity of production inputs might ease the way toward this conclusion.

Saturday assorted links

1. Henry Oliver and GOAT and personality.

2. Various ratings for LLM services.

3. Georgetown fact of the day, 1940 edition. And Unilever retreats from “Woke” (FT).

4. “Preschoolers extend novel labels based on people’s weight rather than their race.“

5. I guess they all read Thomas Schelling?

6. Correct link for new Stephen Dubner podcast series. Theme is how to succeed by failing.

A Genius Award for Airborne Transmission

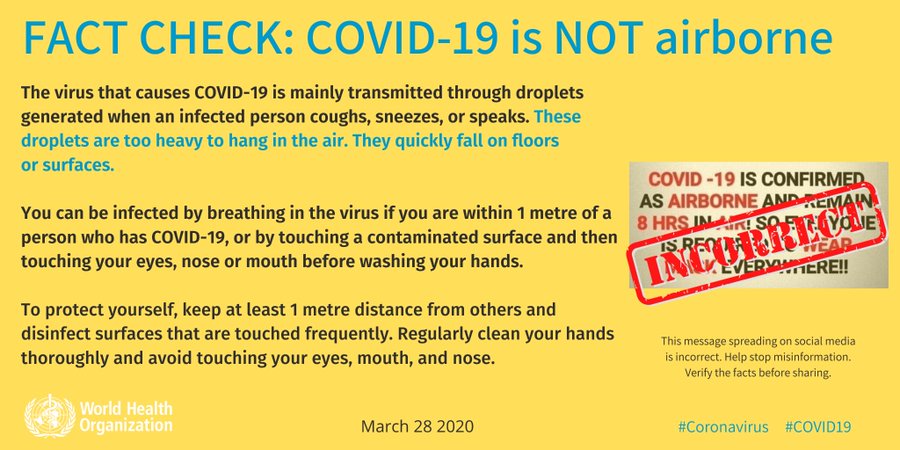

One of the strangest aspects of the pandemic was the early insistence by the WHO and the CDC that COVID was not airborne. “FACT: #COVID19 is NOT airborne.” the WHO tweeted on March 28, 2020, accompanied by a large graphic (at right). Even at that time, there was plenty of evidence that COVID was airborne. So why was the WHO so insistent that it wasn’t?

One of the strangest aspects of the pandemic was the early insistence by the WHO and the CDC that COVID was not airborne. “FACT: #COVID19 is NOT airborne.” the WHO tweeted on March 28, 2020, accompanied by a large graphic (at right). Even at that time, there was plenty of evidence that COVID was airborne. So why was the WHO so insistent that it wasn’t?

Ironically, some of the resistance to airborne transmission can be traced back to a significant achievement in epidemiology. Namely, John Snow’s groundbreaking arguments that cholera was spread through water and food, not bad air (miasma). Snow’s theory took time to be accepted but when the story of germ theory’s eventual triumph came to be told, the bad air proponents were painted as outdated and ignorant. This sentiment was so pervasive among physicians and health officials that anyone suggesting airborne transmission of disease was vaguely suspect and tainted. Hence, the WHOs and CDCs readiness to label airborne transmission as dangerous, unscientific “misinformation” promulgated on social media (see the graphic). In reality, of course, the two theories were not at odds as one could easily accept that some germs were airborne. Indeed, there were experts in the physics of aerosols who said just that but these experts were siloed in departments of physics and engineering and not in medicine, epidemiology and public health.

As a result of this siloing, we lost time and lives by telling people that they were fine if they kept to the 6ft “rule” and washed their hands, when what we should have been telling them was open the windows, clean the air with UVC, and get outside. Windows not windex.

Linsey Marr at Virginia Tech was one of the aerosol experts who took a prominent role in publicly opposing the WHO guidance and making the case for aerosol transmission (Jose-Luis Jimenez was another important example). Thus, it’s nice to see that Marr is among this year’s MacArthur “genius” award winners. A good interview with Marr is here.

It didn’t take a genius to understand airborne transmission but it took courage to put one’s reputation on the line and go against what seemed like the scientific consensus. Marr’s award is thus an award to a scientist for speaking publicly in a time of crisis. I hope it encourages others, both to speak up when necessary but also to listen.

Addendum: I didn’t take part in the aerosol debates but my wife, who has done research in aerosols and germs, told me early on that “of course COVID is airborne!” Wisely, I chose to take the word of my wife over that of the WHO and CDC.

That was then, this is now — Gaza edition

The [Assyrian] empire’s chief concern were the corridors and trade routes that ran through Gaza on the coast as well as Megiddo, which had been an important city in the Northern kingdom. Scholars are divided on the issue of Assyria’s economic interest in the Southern Levant. Some insist that the empire was eager to exploit the resources of the region and even encouraged its economic development. Others argue that it was interested in little else than collecting tribute from its client states, and that it left most lands (especially those that did not serve a strategic purpose) to languish under the imperial “yoke” it imposed on them.

That is from the new and quite interesting Why the Bible Began: An Alternative History of Scripture and its Origins, by Jacob L. Wright. From the jacket copy: “…the Bible began as a trailblazing blueprint for a new form of political community.”

U.S.A. facts of the day

Basically, the 2022 numbers — which you can see summarized in the Fed’s report — tell a really encouraging story. In a nutshell:

- Americans’ wealth is way up since before the pandemic.

- The increase is very even across the board, with people at the bottom of the distribution gaining proportionally more than people at the top.

- Inequality is down, including racial inequality, educational inequality, urban-rural inequality, overall wealth inequality.

- Debt is much less of a problem.

- There’s even some surprising good news about income as well as wealth.

In other words, a rising tide is lifting all boats. I know it can be tough to believe that, with all the doom and gloom you see in the media, but the numbers speak for themselves. And just so you know, all the numbers I give in this post are adjusted for inflation, so don’t worry about that.

And this:

And a big reason that the wealth of the bottom 25% went up so much is that Americans are slowly getting out of debt. The debt-to-income ratio has fallen pretty steadily since 2010…

Here is more from Noah Smith.

Expensive markets in everything

…testimony in the trial revealed that Google spent a total of $26.3 billion in 2021 to be the default search engine in multiple browsers, phones, and platforms.

That number, the sum total of all of Google’s search distribution deals, came out during the Justice Department’s cross-examination of Google’s search head, Prabhakar Raghavan.

$18 billion of that goes to Apple. Here is the full story.

Supply and demand, American style

Gas and milk both back under $3 per gallon at Sam's Club in Conway, Arkansas pic.twitter.com/zvfYGkyubk

— Jeremy 'adjusted for inflation' Horpedahl 📈 (@jmhorp) October 26, 2023

The culture that is Porirua (New Zealand)

The residents of a small city in New Zealand have been enduring sleepless nights for months due to drivers blasting Céline Dion songs from their cars in the early hours of the morning.

According to Agence France Press, car drivers in Porirua, a town of some 60,000 people, north of Wellington, have been loudly playing the singer’s tunes as late as 2 a.m.

They have been cranking up the volume on the Canadian songstress’s most famous ballads, including “My Heart Will Go On” and “It’s All Coming Back To Me Now,” according to AFP.

The nocturnal music-playing tends to begin as early as 7 p.m., continuing for many hours thereafter, Porirua Mayor Anita Baker told the news agency.

It’s part of the “siren battles” trend that has taken place in New Zealand for several years, which is particularly popular with indigenous people from the Pacific Islands.

These battles involve rival crews competing to blast the most powerful and clear sounds from loudspeakers attached to cars, or even bicycles, to win the title of “siren king.”

…They “love” Dion because they like “anyone with a high pitch and great tone in their voice,” the mayor explained to AFP.

Here is the full story, via the excellent Samir Varma. I have had very good fish and chips in Porirua.

Friday assorted links

1. The culture that was German.

3. More on GPT for time series.

4. My beloved Acapulco is in bad shape.

5. The Latecomer, new on-line periodical, lead article by Casey Handmer. And on Twitter.

What are markets telling us about the Middle Eastern war?

That is the topic of my latest Bloomberg column, here is one excerpt:

Despite the continuing war in the Middle East, most markets have been relatively calm. Stock exchanges have not plunged, while volatility appears manageable, indeed ordinary. If you were looking at just the markets (except for Israel’s), you might not even know there is a war on.

The question is what to make of such data. Allow me to make a daring inference: At least for the time being, the assumption is that the current conflict will not widen into a much larger war. It may pull in Syria, Lebanon, Yemen and other parties, but so far markets are indicating that the Israel-Hamas war will not much disrupt most of the world’s large economies.

There is one very important caveat: This is an ex-ante analysis. Markets are wrong all the time, but they are also often the best predictive tool available. Consider the Super Bowl. Before the game, the betting odds are usually the best indication of who is favored and by how much. Every single time, those odds end up being wrong: By the end of the game, one team is 100% likely to win, and the other team 100% likely to lose. Still, the odds were the best available predictor before the game started.

And:

It is not true that markets ignore war. For instance, the value of the Israeli shekel is down sharply since Oct. 7, reflecting that many parts of the Israeli economy have come to a standstill, and that the country will experience more serious fiscal problems in the future. Just after the Hamas attack, there was an immediate 4% spike in oil prices, which is significant but not a game-changer.

There is a lot of evidence suggesting that markets incorporate other consequences of war. For instance, the Iraq war had sizeable impacts on US travel stocks, as well as shares in the Turkish and Israeli markets. So don’t think markets are asleep at the moment. The marginal investor is watching — and deciding not to overreact.

Worth a ponder, but do note the overall news is still absolutely terrible in humanitarian and moral terms.

Thursday assorted links

1. MIE: Robinson Crusoe tourism.

2. “An estimated 500,000~ women in the United States between 18-24 are content creators on Onlyfans.”

3. New Freakonomics radio podcast series on how to succeed at failing.

4. “Celebrities made this mainstream.” Recommended.

5, Want to send a comment to the IRS about proposed new crypto tax reporting rules? The polity that is AI.

6. The world’s first wearable e-reader?

7. Robert Irwin, RIP (NYT).

8. Brian Albrecht on why Armen Alchian is the GOAT. And Peter Isztin on Gary Becker.

*George Harrison: The Reluctant Beatle*

By Philip Norman, a wonderful book of course. My “problem” (not with the book of course) is just how much John and Paul tower over the proceedings, from the very beginning. Here is one excerpt:

He [Hanton, an early drummer for the Quarrymen, a Beatles precursor] felt excluded from the others’ practice sessions at the art college and resented Paul, who was more than competent on drums as well as guitar and piano, for continually finding fault with his performances.

And:

John’s leadership remained unchallenged, but Paul was ever his zealous adjutant; convinced that they could be spotted by some talent scout at any moment, he called for maximum effort, however late the hour or sparse the audience. And Stu Sutcliffe’s bass playing, though now reasonably competent, was clearly never going to satisfy Paul.

Recommended, I will read every page. You can order here, Norman’s other bios are great too. And if you are wondering, a few of the most underrated George songs are the early instrumental “Cry for a Shadow,” “Don’t Bother Me,” and the much later “You.”

*GOAT* on Gary Becker

Written by me, from my new generative book:

Most of all, for me, Becker was a true “micro-machine,” a relentless, unstoppable thinker, analyst, and writer with the button always in the “on” position. Anything he did would be thought through to the maximum extent, at least relative to the conceptual tools at Becker’s disposal. And he never ever stopped. He died with his boots on, as one colleague of Becker’s once related to me.

Yet I don’t feel the need to give you a comprehensive analysis of Becker for the following reason: I can’t quite see putting him above Milton Friedman in the GOAT sweepstakes. And the purpose here is not to evaluate every wonderful economist, but to determine GOAT, and there Becker has to fall short.

I should add that much of Becker’s work has not aged well in the last ten to fifteen years. In recent times, economics has become more like sociology than sociology has become like economics. Behavioral economics has assumed greater importance, relative to the relative price effects and rational choice approaches that are so prominent in Becker’s work. His “economics of the family,” which seems to rationalize male breadwinner dominance, is now considered somewhat chauvinist or at least old-fashioned, though it fit the 1960s frame he wrote in. Even at the University of Chicago, new hires do not seem to be moving in the Beckerian direction. Hardly any current up and coming young economists seem to regard Becker as a critical influence or an inspiration, even if his indirect influence on them is immense. Becker’s breadth of topics has won out as a dominant approach, but not his modeling methods or his obsession with demonstrating the rationality of different social practices.

I don’t side against Becker on all of these questions, but as a simple description of where the profession is at, Becker has lost a lot of status and influence. That too removes him from the GOAT game, though in the meantime I will gladly aver that he is now significantly underrated.

I find Becker fairly boring to read, as the model does most of the work and, while he is perfectly clear, he is not a writer of wit or nuance. I don’t recommend his works to other people. His brilliance lies in a method and a machine of inquiry, and in his own relentlessness, and in the breadth of investigation he helped to create. Now that his presence has left the stage, his import will become less evident with time and I predict he will end up underrated all the more.

Here is the book itself (free), GOAT: Who is the Greatest Economist of all Time, and Why Does it Matter, here is an explanatory blog post.

Emergent Ventures Africa and Caribbean, fourth cohort

Sokhar Samb is a Data Scientist from Senegal. Her EV grant supports her work of drone mapping Senegalese cities and towns such as Dakar and Semone by capturing high-resolution aerial imagery and Light Detection.

Cesare Adeniyi-Martins is from Nigeria and founded Abelar to promote the special jurisdiction economics charter cities in Africa. His EV grant is for general career support.

Alecia McKenzie is a Jamaican author currently residing in France. Her EV grant supports her work at the Caribbean Translation Project to translate Caribbean literature (originally written in English, French, Spanish, or Dutch) into Mandarin Chinese.

Lorenzo Gonzalez is a Belizean currently residing in Canada. Lorenzo has a Masters degree in Economics from the University of Waterloo. His EV grant is to support his writing on tourism on Belize Adventure to promote economic growth in the country.

Keeghan Patrick, Graduate student at MIT; Shergaun Roserie, Mechanical Engineer at FAANG; and Dylan Paul, current MBA student at Harvard Business School. All three are from Saint Lucia. Their EV grant is to support their work through their organization, Obtronics, which, among other activities, offers robotics engineering educational programs to students in St. Lucia.

Raymer Medina is from the Dominican Republic. His EV grant supports his work on low-cost robotics design and development.

Thomas Aichele is multi-based in Chicago, Dakar, and Abidjan. Thomas works in the FinTech industry in West Africa. His EV grant supports his writing on technology infrastructure progress in West Africa.

Marla Dukharan is a Trinidadian Economist. Her EV grant is to support the production of a documentary on the causes and effects of the EU taxation blacklisting of Caribbean countries.

Mary Najjuma is a Ugandan Engineer and current PhD candidate at the London South Bank University. Her EV grant supports her research on rural efficient and optimal cooling hubs.

Andrew Ddembe, Ugandan social entrepreneur. This follow-on grant is to help support the work of his organization, Mobiklinic, in promoting medication care and education in rural Uganda.

Farai Munjoma was born and raised in Zimbabwe and resides in Edinburgh. He founded the Sasha Pathways Program, a virtual career accelerator for African youth. His EV grant is to support the career development program.

Stéphanie Joseph, originally from Haiti, is currently residing in the US. Stéphanie is a current MBA candidate at Harvard Business School. Her EV grant supports her project on land-mile financial inclusion in the Greater Caribbean.

Evalyn Sintoya Mayetu is a Kenyan guide on the Greater Maasai Mara. She is the country’s first female safari guide to achieve Silver Level certification. Her EV grant is for general career development.

Dr. Collin Constantine, born and raised in Guyana, is an Assistant Professor of Economics at Girton College, University of Cambridge. His EV grant supports his research on integrating income distribution and the balance of payments constraint into macroeconomics, focusing on the Caribbean.

I am very thankful for the leadership of Rasheed Griffith here, he also wrote those descriptions.