Month: June 2008

Focal points

He [Glenn Gould] disliked giving autographs for the same reason he was wary of writing checks for fear the results might be unlucky. But when he did give an autograph or sign a check (or any other document, for that matter), he always misspelled his own first name writing it as "Glen." Kazdin once asked him why, and Gould explained that he had discovered years earlier that once he got his hand to start forming the two n’s he couldn’t stop and would keep going and write three, so he decided to abort the exercise after one. Kazdin was skeptical. "This supposed lack of manual control is a little hard to swallow coming from the man who could play an unbroken stream of thirty-second notes faster and cleaner than any other pianist on the face of the earth."

That is from A Romance on Three Legs: Glenn Gould’s Obsessive Quest for the Perfect Piano, by Katie Hafner. This is an excellent book showing that the choice of piano really matters. For the pointer I thank Kat.

Krugman gets a Rotten Tomato

Paul Krugman is attacking Milton Friedman (again) for rotten tomatoes. Here’s Krugman in 2007:

These are anxious days at the lunch table. For all you know, there

may be E. coli on your spinach, salmonella in your peanut butter and

melamine in your pet’s food and, because it was in the feed, in your

chicken sandwich.Who’s responsible for the new fear of eating?

Some blame globalization; some blame food-producing corporations; some

blame the Bush administration. But I blame Milton Friedman.…Without question, America’s food safety system has degenerated over the past six years.

and here he is today repeating himself:

Lately, however, there always

seems to be at least one food-safety crisis in the headlines – tainted

spinach, poisonous peanut butter and, currently, the attack of the

killer tomatoes.How did America find itself back in The Jungle?

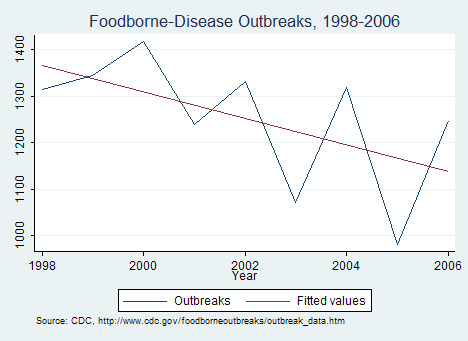

I was curious so I collected data from the Center for Disease Control on Foodborne Disease Outbreaks from 1998-2006. The data only go back to 1998 because in that year the CDC changed its surveillance system creating a discontinuity but note that we are covering a chunk of the Clinton years and are well within the time frame over which Krugman says the safety system has degenerated. Here’s the result:

What we see is a lot of variability from year to year but a net downward trend. You can also look at cases per year which are more variable but also show a net downward trend. No evidence whatsoever that we are back "in The Jungle."

Your Favorite Things China?

I’m off to China next week. A few days in Beijing, then Kunming in the South then Hong Kong – two weeks in all. Recommendations, reviews, ideas are all welcome.

Why *Entertainment Weekly* rules the world

Here is a mini-dialogue that Seth Roberts and I worked up; it is about Entertainment Weekly, arguably my favorite magazine. Seth starts off:

When my friends look puzzled that I subscribe to EW I say “entertainment” means art. It’s about art. They could have called it Art Weekly but they didn’t want to scare people.

Later, I wrote this:

I find the grades for books are the least reliable section of EW.

Which for me means they are the most reliable section. If they like a

book, I know to stay away. How could a critic be better or more

trustworthy than that? Too many readers are too concerned about

affiliating themselves with prestigious magazines, rather than learning

something.

I enjoyed experimenting with the dialog format. Seth and I often think alike, while having different things to say, which I think makes us suitable partners in such a venture.

Is the NBA fixed?

Tim Donaghy, the ref who was caught gambling, says it is. Here’s a good deal of evidence that it isn’t. Small market teams do well in the draft and reach the Finals at a high rate.

Yet I haven’t seen any MSM source, at least not in the context of these allegations, which admits the obvious: star players get favored treatment from the refs. And this equilibrium is self-sustaining without any direct instructions from the Commissioner. As a ref, you know you are expected to allow offensive fouls from LeBron James, the crowd expects it, other refs act that way, and you are never reprimanded for the non-calls. So in at least this one way the NBA is clearly fixed and by the demand of the fans, even if they do not prefer to think of it as such.

But now imagine a nervous ref who wonders — if only with p = 0.2 — whether the NBA wouldn’t prefer to see the Los Angeles Lakers beat Sacramento and move on in the playoffs. That same ref knows about the convention to favor star players. And hey, the Sacramento team in those days didn’t in fact have any real stars. What inference should you draw and how should you behave in your calls?

If the NBA has been tolerating at least one (and surely more) crooked ref, it is unlikely that other ref pathologies have been absent as well. Toss in the $50 billion or so a year bet on NBA games and maybe you have some real action.

So it’s hard to avoid the conclusion that the NBA is at least partially fixed, although not necessarily in the conspiratorial sense that many people might be expecting.

Here is what a professional gambler thinks.

The point taken from economics is that there are many ways of enforcing implicit collusion, not to mention that at some margin gains from trade do kick in. If wealthy CEOs will cheat, why won’t NBA refs?

Becker, Spence, Phelps, and Scholes

On the global economy and the recent downturn. The pointer is to www.bookforum.com.

Which candidate would Derek Parfit prefer?

Matt Yglesias says that, as a philosopher, Derek Parfit would (should?) prefer Barack Obama. In Matt’s view Obama as President means a smaller chance of existential catastrophe and Parfit is especially concerned (correctly, in my view) with preventing such catastrophes. It’s also worth pointing out that Parfit is not such a committed egalitarian. In his view inequality across different time slices of your life is in principle as bad as inequality across different persons; on the self he is a Humean nominalist so what’s "a person" anyway? (Has not voter registration in Chicago mastered this perspective some time ago?) So we should worry more about the temporarily suffering and less about the poor, at least insofar as we are driven by egalitarian intuitions.

It always struck me as an awkward question for egalitarians whether the dying elderly — arguably the poorest people of them all, adjusting for human capital valuations — should be first in line for claims upon resources. You might argue that the dying elderly had lots of fun in the past, maybe so, but we don’t refuse to help out the high-time preference poor on these grounds so why should life history diminish the claims of the elderly?

I don’t wish to speak for Parfit but having spent two days in a room with him and Richard Epstein, I can say that a Parfit endorsement of McCain would very much surprise me, existential risk or not.

How good can financial regulation become?

Megan McArdle asks and here is her follow-up post. I would suggest the following:

1. Given the existence of a lender of last resort, *everyone* favors capital requirements of some kind, at least if you prefer to close down bankrupt institutions rather than to let them continue borrowing from the Fed and gambling with the money.

2. It makes sense for some of these capital requirements to be upfront and clear ex ante, noting that any attempt in this direction will be imperfectly realized.

3. Most observers overestimate how effective capital requirements will be. Many a crisis has happened right under their nose and that includes Japan and Bear Stearns, among others.

4. As Megan suggests, regulators are not very good at outguessing the market; read Arnold Kling as well.

5. Regulation can discourage leverage at the margin; the social costs of leverage are higher than the private costs, due to contagion effects and the inability of the lender of last resort to precommit to no bailouts. This need not require selective regulatory intervention or regulatory outguessing of the market.

6. A good deal of regulation requires voluntary compliance on the part of the financial institutions rather than foresight or intelligence on the part of bureaucrats. Banks of course don’t *have* to follow the rules they are given and sometimes they don’t. But for a bank to cross the line of systematic legal disobedience, observable by potential whistle-blowers and the like, is a big step and many of them are not willing to do this. Much of the power of financial regulation derives from this fact rather than from any particular abilities of regulators.

7. We should make capital requirements as symmetric as possible across different kinds of banking activities, at least to the extent systemic risk is present. That said, this still probably won’t prevent the next bubble and blow-up. It will limit some of the damage ex post.

8. It would be nice to have greater use of clearinghouses and netting of positions for the unregulated "shadow banking sector."

The Citadel, or development through tourism

I have long wanted to go there (a sign that it isn’t actually a good standard tourist site) and now I read it is the focal point of the new promotion of tourism in Haiti:

The Western Hemisphere’s largest fortress, it was built atop a 3,000-foot mountain in the tumultuous years after Haiti broke from France in an 1804 slave revolt and became a symbol of triumph over bondage for descendants of African slaves everywhere.

The trip there is a two-hour crawl over unpaved roads and through garbage-strewn, traffic-clogged streets of Cap-Haitien. The final ascent, a steep cobblestone path, is traversed on foot or on undersized horses beaten with sticks by local guides.

Here is a painting of The Citadel.

The roots of sticky prices

Apparently the beasts are back in charge:

Now we’re beginning to find out that eBay’s seemingly revolutionary core – the online auction – may have been a fad all along. As Business Week reports, eBay’s auctions are “a dying breed.” Buyers and sellers are reverting to the traditional retailing model of fixed prices:

Auctions were once a pillar of e-commerce. People didn’t simply shop on eBay. They hunted, they fought, they sweated, they won. These days, consumers are less enamored of the hassle of auctions, preferring to buy stuff quickly at a fixed price … “If I really want something I’m not going to goof around [in auctions] for a small savings,” says Dave Dribin, a 34-year-old Chicago resident who used to bid on eBay items, but now only buys retail …

At the current pace, this may be the first year that eBay generates more revenue from fixed-price sales than from auctions, analysts say. “The bloom is well off the rose with regard to the online-auction thing,” says Tim Boyd, an analyst with American Technology Research. “Auctions are losing a ton of share, and fixed price has been gaining pretty steadily.”

Hat tip to Andrew Sullivan. Chris Masse sends me more.

How the military subsidizes is subsidized by private industry

An American military supercomputer, assembled from components

originally designed for video game machines, has reached a

long-sought-after computing milestone by processing more than 1.026

quadrillion calculations per second.

From the NYTimes.

When worlds collide

The very famous and very impressive James Q. Wilson has been blogging over at Volokh.com, here is one of his posts. Excerpt:

It is not hard to study deterring crime, but I

can’t imagine trying to teach someone in a blog how to do a regression

analysis. I wish I could do that, but it would take time, and blog

commenters seem not to have much time.Now for a few more facts, but I warn you that to believe my

assertions you will actually have to go out and read something.

Intensive Probation: This is a good idea, but so far the studies of it

have not suggested it lowers the crime rate. I wish it did, because it

is cheaper than prison. The chief study, done at RAND, compared

probationers under intensive supervision with similar ones not under

such control. There as no difference in their crime rates while under

supervision. There are two possible explanations for this: Either there

was no difference in crime rates, or those under intensive supervision

had more crimes noticed by their probation officers.

This earlier post was instructive:

Some readers have asked whether the population of American prisons is

large because we lock up so many drug users. It is true that the

proportion of inmates described as drug offenders has gone up

dramatically, but as Jonathan Caulkins and Mark Kleiman point in their

essay in Understanding America, very few are in prison because of drug

possession. Many are either major dealers or plead down to a drug

possession charge in order to avoid being convicted of a more serious

offense. There are more than one million arrests every year for drug

possession, but very of them result in prison or jail time. Cannabis

possession, when it is punished at all, is typically with a fine or

probation.

Chris Scoggins, marginalist

Concerning my previous post, he sends me this email:

So if the typical person today couldn’t hack it in 1000 AD (I agree that we probably can’t) What is the furthest back someone from today could go and have a fighting chance to make ends meet?

I like the idea of walking into an LSE seminar in 1932 and making some nice points.

If we try going back further, I don’t think 1700 would be so much easier for me than 1000. Even if I fell into London, patronage would be hard to come by and I would expect that I would end up earning the subsistence wage. Sorry guys, but I just don’t know much useful: blogging starts around 2001. In most eras I would expect the subsistence wage, but after the late 1800s I could teach and write for greater pay and better working conditions. As for the start date for effective insider trading, maybe that is the late 19th century as well. You need some start-up capital: does anyone know the minimum market investment circa 1815 and could you sell short?

In most eras my best bet is to be a shyster of some kind.

I don’t, by the way, think I would die in 1000, at least assuming I could avoid the plague and a few other maladies. Temporary aid is the natural human tendency, among the poor too, and it is unlikely I would be killed for being a witch. I would end up doing hard physical labor, just like most other people at the time. The economic lesson here is that complementarity really matters.

Markets in everything, Japanese edition

The Shouting Vase. "Stress Relieving Vase Takes Your Verbal Abuse So Others Don’t Have To."

I guess that is why the Metro was so quiet there.

Thanks to Caleb Eboch for the pointer.

Addendum: From Ben Cunningham, this looks pretty neat too.

Why do people oppose globalization?

Dani Rodrik writes:

So the "us" and "them" characterization that Tyler attributes to irrational nativism perhaps has more to do with the absence of a common set of international rules on labor standards, environment, consumer safety, and so on.

(There is much more at the link.) I was surprised to read this. In the 1980s people were very hostile to Japan and Japanese imports, even though Japan at the time was quite wealthy and had relatively high standards in these areas. I also receive a fair number of emails — some of them of the hate variety — by people who are suspicious of the rise of China. I believe it is Chinese success which bothers them even though they sometimes come up with ancillary stories about unfairnesss. These people are not less upset when other countries use capital rather than labor or when foreign production does not create much pollution.

Most of all, many people in poorer countries object to having to compete with America, with McDonald’s, with Hollywood, and so on. Those objections are usually more strenuous than the complaints of Americans about a poorer China and of course the poorer countries tend to be more protectionist, in part for this reason. That’s where feelings of unfairness are truly strong. There’s nothing special about the "regulatory arbitrage" unfairness story and in fact it is one of the weaker feelings of unfairness out there. In reality the entire past of the world is unfair but cosmopolitanites can look past that to appreciate the gains from ongoing trade.

Rodrik himself seems to object to when Americans trade with countries in which first world labor standards are violated. But doesn’t such trade raise wages in these countries and also give a long-run boost to labor standards? And where does the net unfairness lie? Haven’t the Western powers — if only through imperialism — usually treated these countries much worse than vice versa? Didn’t we steal Panama from Colombia for instance and take away a huge chunk of Mexico? (Were Europeans so nice to the Ottoman Empire?) Maybe the American worker ought to feel those folks deserve a bit of regulatory arbitrage (and that’s not what most of the trade is based upon) in return. But it is striking how infrequently such a fairness calculus — whether correct or not — is even considered. That again is because most people engage in "in group, out group" thinking.

The bottom line is that most people support their countries to a highly irrational degree in most international questions or disputes. That’s just obvious — watch the World Cup — and yes Jonathan Swift understood that too.