Month: August 2011

Toward a theory of autocracy

The Russian head of the World Chess Federation said he spoke Tuesday with Libyan leader Moammar Gadhafi and that he remains in Tripoli and defiant.

Kirsan Ilyumzhinov has known Gadhafi for years. His visit to Tripoli in July was among the last times the Libyan leader was seen in public after NATO airstrikes began.

…He said Gadhafi sounded full of vigor and told him he was “certain we will win.”

Ilyunzhinov said he also talked to Gadhafi’s son Mohammed, Libya’s Olympic chief, who said his father’s forces would “drive the rats out of

the city.”

The link is here, via @JamesCrabtree and Natasha. Of course I also could have titled this post “Toward a theory of the World Chess Federation.”

Assorted links

1. Die Welt on Ireland, and the FT on Ireland, lots of Irish comments here.

2. The illusion of asymmetric insight, good starting point for understanding the blogosphere.

3. Scorsese trailer for the George Harrison movie to come.

4. Is the Iranian economy improving?

5. How to get 211 tons of gold to Venezuela.

6. How likely are ob-gyns (of various religions) to provide abortions?

Ouch!, yet sometimes markets work

For-profit colleges are facing a tough test: getting new students to enroll.

New-student enrollments have plunged—in some cases by more than 45%—in recent months, reflecting two factors: Companies have pulled back on aggressive recruiting practices amid criticism over their high student-loan default rates. And many would-be students are questioning the potential pay-off for degrees that can cost considerably more than what’s available at local community colleges.

There is more detail here. The graphic on the paper version of the article (not on-line) shows that new University of Phoenix enrollment is down over 40 percent from last year, 47 percent from Kaplan.

Would shoplifting create jobs?

Matt says yes. Having fewer goods on the shelves prompts retailers to replenish their inventories, which spurs economic activity. You don’t even need to break any windows! But there’s more to it than that. As Matt points out, a key question is what storeowners expect to be the future rate of shoplifiting. If a lot of shoplifting is expected, costs of supply go up and output will shrink, with some offsetting employment boost in the security guard sector. In other words, the shoplifters who do the most good are those who don’t get caught and who in fact leave no trace. If you are caught shoplifting, insist that you have no compatriots or allies and that you are a fully atypical individual and therefore that no Bayesian updating should go on about the likelihood of future retail crime. Don’t dress or talk like a shoplifter! (Be creative.) Similarly, it is best if the invading aliens insist that they too are bothered by the Fermi paradox.

If it’s a durable good monopolist, the shoplifter is destroying/restricting output, benefiting the shop owner, raising prices, and helping the economy only in the strangest of the liquidity trap models. The benevolent shoplifter will seek out the more competitive markets or perhaps grab ripe strawberries, put down those hardcover books.

Shanghai ranking of world universities in the social sciences

I can’t vouch for the method, but the top ten are quite plausible: Harvard, Chicago, MIT, Berkeley, Columbia, Stanford, Princeton, Yale, U. Penn, and NYU. The top twenty and thirty are plausible too. GMU, by the way, turns up at #41. Economics/Business rankings are here, with a nearly similar top ten.

For the pointer I thank Dan Houser.

Ireland ten-year bond rates

Link here, CDS spreads are down too, and that happened during a period when the euro crisis got much worse overall. Don’t get me wrong, there is still plenty wrong with the Irish economy, most of all the need to cough up many years of illusory gains and re-plan accordingly. I’m just pointing out that not many of the classic Keynesians predicted this outcome, to say the least.

I thank TallDave for a related pointer.

Facts about Ireland

Yet despite cutbacks and tax rises, the country still chalked up a 1.3 per cent expansion in gross domestic product in the first three months of this year.

There is more here, and also here, maybe best of all is here. Mind you, this is not a stunning performance. Nor can we expect it to continue, if the eurozone and America are headed for broader troubles, as indeed appears to be the case. Nonetheless it’s a result which most Keynesian theories very strongly predicted against. Ireland also achieved this during a weak time for its major trading partners. Since the crisis started, Ireland’s cumulative adjustment has been about thirteen percent of gdp and now they are growing again. Yet we are not hearing a peep about this.

Assorted links

Republican Tax Increases

If Republicans have their way, taxes will increase next year by $120 billion. Republicans in favor of tax increases? Sadly, yes.

Last year the payroll tax on employees was cut from 6.2% to 4.2%, a policy that President Obama supported. Economists from across the political spectrum have also expressed support for a payroll tax cut including Keynes, Mankiw, Robert Reich, Dani Rodrik, Tyler and myself. The CBO scored a payroll tax cut as among the most effective policies for increasing employment, although it would have been better to cut the employer side of the tax.

The payroll tax cut was temporary, however, and is scheduled to expire next year. So who is in favor of increasing taxes?

Many of the same Republicans who fought hammer-and-tong to keep the George W. Bush-era income tax cuts from expiring on schedule are now saying a different “temporary” tax cut should end as planned. By their own definition, that amounts to a tax increase.

The tax break extension they oppose is sought by President Barack Obama. Unlike proposed changes in the income tax, this policy helps the 46 percent of all Americans who owe no federal income taxes but who pay a “payroll tax” on practically every dime they earn.

House Republicans appear to be most in favor of increasing taxes although some Republican Senators have also said they want to raise taxes. The failure of Republicans on this issue lends credence to Paul Krugman’s arguments:

How can [Repubicans not want to cut the payroll tax], when Republicans love tax cuts? The answer is, they don’t. They love tax cuts for the rich. Tax cuts for ordinary workers, many of whom will be those hated lucky duckies whose incomes are too low to pay income tax, are if anything something Republicans dislike.

Also, the GOP is against any idea that (a) comes from Obama (b) might help the economy before the 2012 election.

To their credit Romney and Gingrich are more supportive:

Former Massachusetts Gov. Mitt Romney did not flatly rule out an extra year for the payroll tax cut, but he “would prefer to see the payroll tax cut on the employer side” to spur job growth, his campaign said.

Former House speaker Newt Gingrich said Republicans will fall under increasing pressure to extend the payroll tax cut. If they refuse, he said in a recent speech, “we’re going to end up in a position where we’re going to raise taxes on the lowest-income Americans the day they go to work.”

Unfortunately, outside of the White House, Democrats are also not pushing for an extension of the tax cut.

Many Democrats also are ambivalent about Obama’s proposed tax cut extension. They are more focused on protecting social programs from deep spending cuts.

It’s a bad idea to raise taxes on working Americans in a weak economy and with interest rates so low the gains from reducing the deficit from current spending are low. Our political system is so dysfunctional, however, that Republicans may fail to support effective tax cuts precisely because a Democratic President regards them as important for economic growth.

Hat tip: Erik Brynjolfsson

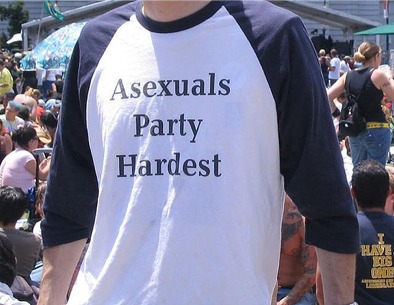

Washing Away Sin

Attendees at a nationalist, right-wing concert in Germany were duped into wearing souvenir T-shirts…the t-shirts originally read “hardcore rebels” and sported a skull and nationalist flags. However, once the garment had been washed, the shirt revealed a new message:

“If your t-shirt can do it, you can do it too — we’ll help you get away from right-wing extremism.”

Hat tip: Jeffrey Goldberg at The Atlantic.

Eurobond points

How many Op-Eds can people write saying that without a eurobond the eurozone will fall apart? I don’t think SPD would support the idea if they were in power; it is instead a way to set up an “I told you so” on Merkel, when things go badly, as they will. It is hard to imagine that all the eurozone countries would sign off on it, and how does the market handle the political uncertainty in the meantime? Finland has been demanding collateral for its loans to Greece and other countries wish to follow suit, and that is what any agreement would look like ex post. That’s assuming every country finds it constitutional, a heroic leap. Or what if German bond rates skyrocket after a eurobond announcement? Does everyone go read Jean Tirole on renegotiation-proof agreements? A eurobond without Germany, and possibly without France, also collapses inductively. Or say Merkel agreed tomorrow to a eurobond and managed to hang on to power. What fiscal management conditions would be demanded in return and would anyone expect Greece to accede to them? How long does it take seventeen nations to agree anyway? Does all borrowing get run through the eurobond or just some? How are borrowing adjustments at the margin to be settled? What if a country won’t put its fair share into a eurobond reimbursement fund, instead preferring to prioritize its individual creditors? Who or what punishes them? Are markets these days good at picking apart bundled assets?

It’s easy fodder to criticize Merkel for saying no to the eurobond idea, but it’s a non-starter which could not make it off the drawing board. I haven’t even considered the extreme moral hazard problems which would result from actually doing the idea.

Assorted links

1. La Nacion interview with me.

2. Why they smuggle U.S. drugs into Mexico.

3. What would Lord Monboddo say (video)?

Portfolio effects?

Here is much more, interesting throughout, hat tip to The Browser.

Childrens Books With Economics Lessons

NYTimes: Justin Wolfers, a professor at the Wharton School of the University of Pennsylvania, cited “Click, Clack, Moo: Cows That Type” by Doreen Cronin and Betsy Lewin, a book about cows that withhold milk from a farmer until he provides electric blankets. Mr. Wolfers read the book to his 1-year-old daughter, Matilda, during the Wisconsin protests against Gov. Scott Walker’s attack on union rights.

Me? I read my kids The Little Red Hen–sort of like Atlas Shrugged for children.

A Bridge to Somewhere (but in the wrong place)

Here is an excellent economics puzzle by David Kestenbaum at NPR:

You would never look at a map of the Hudson River, point to the spot where the Tappan Zee Bridge is, and say, “Put the bridge here!”

The Tappan Zee crosses one of the widest points on the Hudson — the bridge is more than three miles long. And if you go just a few miles south, the river gets much narrower. As you might expect, it would have been cheaper and easier to build the bridge across the narrower spot on the river.

So I wanted to answer a simple question: Why did they build the Tappan Zee where they did, rather than building it a few miles south?

MR readers will no doubt guess the correct answer in general terms, Kestenbaum had to dig hard to find the interesting specifics.

The Port Authority — the body that proposed putting the bridge further south — had a monopoly over all bridges built in a 25-mile radius around the Statue of Liberty.

If the bridge had been built just a bit south of its current location — that is, if it had been built across a narrower stretch of the river — it would have been in the territory that belonged to the Port Authority.

As a result, the Port Authority — not the State of New York — would have gotten the revenue from tolls on the bridge. And Dewey needed that toll revenue to fund the rest of the Thruway.

So Dewey was stuck with a three-mile-long bridge.

The decision to locate the bridge at the much longer location has had continuing costs and repercussions:

Today, the Tappan Zee is in bad shape, and the State of New York is looking into fixing or replacing it. But none of the proposals would move the bridge to a narrower spot on the river. It’s too late now: Highways and towns have grown up based on the bridge’s current location.

We’re stuck with a long bridge at one of the widest spots in the river. The repairs are expected to cost billions of dollars.

Hat tip: Monique van Hoek and Mark Perry at Carpe Diem.