Month: March 2012

Assorted links

1. By subject, the best textbooks? They get some of them right.

2. Kauffman does a very flattering three-minute Sketchbook of me.

3. A Puerto Rican Social Security number goes for $8-10 on the black market.

4. The collapse of Indian exports, worrying.

5. The rising hostility to foreign firms in India, worrying.

Markets in everything the culture that is India

German carmaker Audi makes special horns for its vehicles sold in India where local drivers hoot so much as they fight their way through chaotic traffic, the firm’s country director has revealed.

“Obviously for India, the horn is a category in itself,” Michael Perschke, director at Audi India, told Monday’s Mint newspaper.

“You take a European horn and it will be gone in a week or two. With the amount of honking in Mumbai, we do on a daily basis what an average German does on an annual basis.”

Perschke said the horns are specially adapted for driving conditions in India, a booming market where Audi is one of many foreign car brands competing for increasingly wealthy customers.

“The horn is tested differently – with two continuous weeks only of honking, the setting of the horn is different, with different suppliers,” he said.

Perschke also added that so many Audi owners in India have personal chauffeurs that car interiors have been redesigned so that “you can be more in command from the rear seat.”

The story is here, and for the pointer I thank Mark Thorson.

Felix Salmon on the Spot Market, Stripes Too!

http://youtu.be/14IerE0rIEs

*Early Retirement Extreme*

That is the title of an erratic but interesting book by Jacob Lund Fisker, and the subtitle is A philosophical and practical guide to financial independence. Think of it as a study in “least cost living,” his web site is here.

Here is his post on a middle class lifestyle on 7k a year, health insurance included, sans young children, don’t skip the section on the lentils. How does it compare to how people lived fifty years ago? To how I lived thirty-two years ago as an undergraduate?

“Not buy very much” seems to be his main strategy.

I transplant these scenarios to a foreign setting. Let’s say you had 10k a year, net, to live in either India or Mexico. How high would your standard of living be? What kind of health insurance could you buy? How would your level of happiness compare to working at a job you don’t like for 80k a year for twenty more years?

When it comes to modern society, I sometimes wonder, what is the true secession point with decent utility? What kinds of options are your savings giving you? Is there any chance you will take those options?

For the pointer I thank CR.

*Darwin’s Devices*

The author is John Long and the subtitle is What Evolving Robots Can Teach Us About the History of Life and the Future of Technology. Excerpt:

4. Evolve predatory robots. If you or the enemy employ Pell’s Principle, you’ll need to be prepared to capture or destroy swarms. For starters, you’ll need to let your evolving predators have the capacity and capability of filter feeders like baleen whales. Consider behavioral adaptation first in your predators because the shorter generation tie of the prey will limit opportunities for hardware evolution in the predators.

File under: Whole new class of worries.

Assorted links

Matthew Bishop’s new book

With Michael Green, In Gold We Trust: The Future of Money in an Age of Uncertainty, Kindle Single. Here is a short video about the book.

From the authors:

It provides a lively analysis of the big economic questions currently facing America, such as the danger to the dollar posed by gridlock in DC, especially over deficit reduction, the euro crisis, the growing risk of inflation and the changing attitude of China towards America. We argue that the renaissance of gold, plus the development of virtual currencies such as Bitcoin, reflect weaknesses in the technology of money that we all need to take seriously and try to fix.

*A Capitalism for the People*

The author is Luigi Zingales, and the subtitle is Recapturing the Lost Genius of American Prosperity. I know you have book fatigue, popular economics book fatigue, policy book fatigue, and books-with-subtitles-like-this fatigue, all at once. But this book is really, really good. It hits all the right notes, is clearly written, and refers to academics as the new crony capitalists.” I agreed with almost all of it.

If I had to pick out one book, of this entire lot of books, to explain what is going on right now to a popular audience of non-economists, this might well be it. It is due out in June.

A future without ACA?

I think that path would look something like this: With health-care reform either repealed or overturned, both Democrats and Republicans shy away from proposing any big changes to the health-care system for the next decade or so. But with continued increases in the cost of health insurance and a steady erosion in employer-based coverage, Democrats begin dipping their toes in the water with a strategy based around incremental expansions of Medicare, Medicaid, and the Children’s Health Insurance Program. They move these policies through budget reconciliation, where they can be passed with 51 votes in the Senate, and, over time, this leads to more and more Americans being covered through public insurance. Eventually, we end up with something close to a single-payer system, as a majority of Americans — and particularly a majority of Americans who have significant health risks — are covered by the government.

One question is whether having both Medicaid and Medicare (and other programs) function as a “single payer” system, but that is arguably semantics. In any case the American system is likely to remain fragmented. I am also not sure if this process would take a decade, as sometimes a single election cycle can feel like an eternity. In any case, I see that as likely a superior outcome to the current ACA track. I have never thought that a mandate is workable in a fragmented system with employer-based care and high health care costs and high income inequality.

I also would not be surprised to see Romney, if elected, and if ACA is struck down, resurrect some version of the McCain health care plan with tax credits, maybe some more federalism, and less of a Medicaid extension than was in ACA. I don’t know if that would pass but I suppose I think not. I also don’t see much hope for a much-needed “supply-side” competitiveness plan.

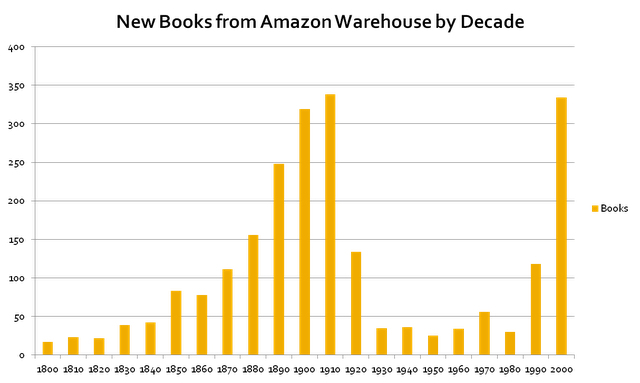

What happens to books when they come out of copyright?

For the United States, 1922 is the cut-off year for the end of public domain:

Here is more from Eric Crampton, drawing upon Paul Heald.

Assorted links

1. Does New Zealand policy stand within the ambit of the Democratic Party?

2. Profile of Jonathan Gruber.

5. The decline of human piano tuners.

6. Kaufmann webblogger forum, live broadcast tomorrow, many luminaries.

Markets in everything there is no great stagnation

You can now get rolls of toilet paper especially printed with the Twitter feed of your choice.

That is from Tim Worstall.

Good overview of the legal battle over eBooks

You will find it here, by Tim Carmody, and there are more issues involved than I had thought:

Knebel says there are three major points of law at stake in both the class-action suit and the Justice Department investigation against Apple and the five publishers:

- Whether and how the agency model applies to virtual goods;

- Whether Apple and publishers engaged in a “hub-and-spoke” conspiracy or simply “conscious parallelism”;

- The status of the “most-favored nation” clause, common to many legal contracts today, which Apple used to ensure that books could not be sold elsewhere at a lower price than in the iBooks store.

On the latter point there is this:

The last point at issue is Apple’s agreement with publishers that their books be sold at the same price to all other competitors. In contract law, this is called “the most-favored nation” clause.

“The most-favored nation clause has been suspicious under antitrust laws for years,” says Knebel. But at the same time, it’s extraordinarily common. “Most law firms, including mine, will agree to charge one client the lowest possible price for the same services,” he says.

So even though Apple’s insistence that HarperCollins, Hachette Book Group, Macmillan, Penguin Group Inc. and Simon & Schuster Inc all charge the same prices for their books at all e-book stores is what seems on its face the fishiest about the whole affair, it’s actually the part that, in the absence of a conspiracy, is most hallowed by practice. A change in its status under federal antitrust law would require the largest revision to current legal agreements, in industries widely separated from publishing and software.

My view is simple, namely that in the face of massive disruptive innovation, antitrust law rarely does a good job. The law should stay out of this. In any case the prices of books have been falling for some time.

Why hasn’t Britain recovered more quickly?

Ryan Avent has an excellent post, channeling an Adam Posen report (pdf). Here is one summary bit:

Financial issues, euro crisis, austerity and oil can account for a lot. It seems possible that structural factors are more of an issue in Britain than in America.

It’s worth noting that the main “austerity” culprit here seems to be the increase in the VAT, not the spending cuts (proposed or real) per se.

The Coase theorem in Somalia

Whether Somalia’s home-grown al-Qaeda franchise, al-Shabaab, had a hand in the abduction is a moot point. While the group denies involvement, many believe it was a militia allied to al-Shabaab that launched the original kidnap operation, in return for providing it with a cut of any ransom money. That militia is then said to have sold Mrs Tebbutt on to a pirate group for $300,000 shortly after, knowing the pirates could negotiate a considerably higher ransom. Then again, al-Shabaab was never likely to claim responsibility; while British government policy does not forbid the payment of ransoms to criminal gangs such as pirates, it does forbid them to terrorist groups.

Here is more, interesting throughout, and for the pointer I thank Ashok Hariharan.