Month: September 2013

*Vodka Politics*

The author is Mark Lawrence Schrad and the subtitle is Alcohol, Autocracy, and the Secret History of the Russian State. This is a gripping and original book, even if it overstates its conclusions sometimes. Here is one bit:

Shcherbakov — Stalin’s today drunkard — died from a heart attack two days after the Nazi surrender…at the ripe old age of 44. While Stalin valorized him, Khrushchev and the rest of the circle “knew that he died from drinking too much in an effort to please Stalin and not because of any insatiable urge of his own.” Likewise, Andrei Zhdanov — once thought of as Stalin’s heir apparent — died less than three years later at 52, to the end ignoring his doctors’ frequent warnings to stop drinking. It was clear to all that this situation was disastrous both for their work and their physical health. “People were literally becoming drunkards, and the more a person became a drunkard, the more pleasure Stalin got from it.”

…the use and abuse of alcohol is crucial to understanding the dynamics of autocratic rule in Russia.

What else do you learn from this book? It seems that Raymond Llull, still an underrated figure, is the one who spread vodka-making techniques to much of Europe (he also discovered an early version of social choice theory in the 13th century, not to mention he advanced the theory of computation).

I liked this bit:

The financial needs of the early Russian state dictated pushing the more potent and more profitable distilled vodka over less lucrative beers and meads. To maximize its revenue, the state not only benefited from its subjects’ alcoholism, but actively encouraged it.

As late as 1927, the state’s vodka monopoly accounted for ten percent of government revenue.

Gorbachev, by the way, was known as “Mineral Water Secretary,” because he did not drink like the others did. Here is a joke from the book:

Q: What is Soviet business?

A: Soviet business is when you steal a wagonload of vodka, sell it, and spend the money on vodka.

From the Yeltsin years to the Putin years, the average Russian boy lost a measured eighteen percent of his muscle mass.

Recommended, and you can pre-order the book here. Here is my earlier post, “The culture of guns, the culture of alcohol.”

The new service sector jobs

Motivation and inspiration will become more important jobs, and this time the story is from China:

Life coaching is big business the world over, perhaps nowhere more so than in the US. China is still a newcomer, with self-help books and motivational talks beginning to gain traction just 15 years ago. But as in so many other areas of the Chinese economy, the gap is closing quickly. The “success studies” industry, as it is known in China, is dominating bestseller lists, filling conference halls and generating phenomenal wealth for star speakers…

On this occasion, though, Chen [a major motivational coach] needs no extra help. The audience is raring to go. Bursting on to the stage, he asks: “Who wants to be number one?” All 1,500 hands fly up in the air. Then a dose of realism: “You’re dreaming. Only 3 per cent of you will succeed. And to get there, you need the right coach. You need to be in a circle of winners.” A slideshow follows, pictures of Chen posing next to or somehow squeezing himself into the frame with Barack Obama, Bill Clinton, Formula 1 driver Michael Schumacher, basketball star Michael Jordan and more. He replays a phone message from Huang Xiaoming, a Chinese actor, thanking Chen for his coaching.

The message – that Chen is a winner and that his tutelage is a prerequisite to success – proves startlingly effective. At the end of his speech, he gives the audience a two-minute countdown to sign up for a special deal to join his circle of winners: Rmb29,800 [TC: 6.12 Rm to one U.S. dollar] for a year’s access to his Shanghai club and more self-improvement courses. About 150 people seize the opportunity, dashing up to the front of the room. Chen’s assistants form a ring around them with handheld bank card swiping machines, ready to collect their money on the spot.

The fascinating FT article, by Simon Rabinovitch, is here, possibly gated. Of course the greater is income inequality, the easier it will be to market such services, because the promised gain from leaping the divide will be that much greater.

The food stamps program

In an ideal policy world, would food stamps exist as a program separate from cash transfers? Probably not. But as it stands today, they are still one of the more efficient programs of the welfare state and the means-testing seems to work relatively well. And giving people food stamps — since almost everyone buys food — is almost as flexible as giving them cash. It doesn’t make sense to go after food stamps, and you can read the recent GOP push here as a sign of weakness, namely that they, beyond upholding the sequester, are unwilling to tackle the more important and more wasteful targets, including Medicare and also defense spending, not to mention farm subsidies. Here are a few basic numbers on when food stamps have grown and what has driven that growth. It has not become a “problem program” in the way that say disability has.

Assorted links

The decline of the U.S. labor share of national income

That’s the new paper by Elsby, Jobijn, and Sahin, presented at Brookings earlier in the week. It’s less pathbreaking than some people are suggesting, but it is absolutely on the mark. The main finding of significance is that competition from cheap imports is a major source driving wage declines in the United States and shifting income toward owners of capital. The full abstract is here, with other points of note:

Over the past quarter century, labor’s share of income in the United States has trended downwards, reaching its lowest level in the postwar period after the Great Recession. Detailed examination of the magnitude, determinants and implications of this decline delivers five conclusions. First, around one third of the decline in the published labor share is an artifact of a progressive understatement of the labor income of the self-employed underlying the headline measure. Second, movements in labor’s share are not a feature solely of recent U.S. history: The relative stability of the aggregate labor share prior to the 1980s in fact veiled substantial, though offsetting, movements in labor shares within industries. By contrast, the recent decline has been dominated by trade and manufacturing sectors. Third, U.S. data provide limited support for neoclassical explanations based on the substitution of capital for (unskilled) labor to exploit technical change embodied in new capital goods. Fourth, institutional explanations based on the decline in unionization also receive weak support. Finally, we provide evidence that highlights the offshoring of the labor-intensive component of the U.S. supply chain as a leading potential explanation of the decline in the U.S. labor share over the past 25 years.

As I reported two weeks ago, Autor, Dorn, and Hanson already found similar results.

There is an entire chapter in Average is Over suggesting that trade effects on U.S. wages, in the negative direction, are stronger than many economists think, through factor price arbitrage, and that the topic deserves further investigation. But it turns out my discussion did not go far enough in the direction of attributing observed wage changes to trade, and because of this paper, and because of Autor, Dorn, and Hanson, I hereby revise my views accordingly.

Please note of course that this trade is still output-expanding and welfare-improving by traditional criteria, at the global scale. It simply has within-nation distribution effects which not everyone likes, though global inequality falls.

Arnold Kling, Michael Mandel, and Rob Atkinson, among others, have been ahead of the consensus on this question.

Along America’s barbecue belt (sentences to ponder)

…nuclear weapons became increasingly more lethal as they became smaller and more numerous. Their growing numbers meant more near-accidents and system failures, too, as when in 1961 a B-52 crashed and burned as it neared Johnson Air Force Base outside Goldsboro, N.C., dropping a nuclear warhead that buried itself deep into the ground near the intersection of two state highways without exploding. As far as anyone knows, it’s still there.

That is from Arthur Herman, reviewing Eric Schlosser’s Command and Control.

Homeless markets in everything, with reference to YouTube, Bitcoin and new service sector jobs

Angie does not have a formal residence, but he does have a job:

The park offers free wireless access, and with his laptop, Angle watches YouTube videos in exchange for bitcoins, the world’s most popular digital currency.

For every video he watches, Angle gets 0.0004 bitcoins, or about 5 cents, thanks to a service, called BitcoinGet, that shamelessly drives artificial traffic to certain online clips. He can watch up to 12 videos a day, which gets him to about 60 cents. And he can beef up this daily take with Bitcoin Tapper, a mobile app that doles out about 0.000133 bitcoins a day — a couple of pennies — if he just taps on a digital icon over and over again. Like the YouTube service, this app isn’t exactly the height of internet sophistication — it seeks to capture your attention so it can show you ads — but for Angle, it’s a good way to keep himself fed.

Angle, 42, is on food stamps, but that never quite gets him through the month. The internet provides the extra money he needs to buy a meal each and every day. Since setting up a bitcoin wallet about three or four months ago, he has earned somewhere between four or five bitcoins — about $500 to $630 today — through YouTube videos, Bitcoin Tapper, and the occasional donation. And when he does odd jobs for people around Pensacola — here in the physical world — he still gets paid in bitcoin, just because it’s easier and safer. He doesn’t have to worry as much about getting robbed.

The full story is here, excellent photos, and for the pointer I thank Mike Komaransky.

Assorted links

1. Russ Roberts on causes of the financial crisis.

2. Hyperinflation interactive site.

3. Have we reached peak “adult education”?

4. The romantic appeal of savers (speculative).

5. Very good Paul Krugman post on Latvia. It deserves its own post but it is not that easy to excerpt, so read the whole thing.

6. But on the liquidity trap, John Cochrane is essentially correct. He has worked through some of the key details, and it’s time to lay that one to rest.

Insect Gear

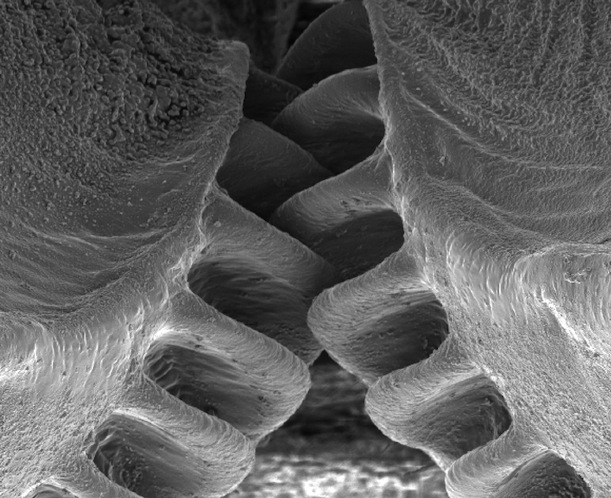

The only functional gears ever found in nature belong to a small insect. The gears lock the insect’s back legs together giving it a synchronized and powerful jump. The electron microscope picture of the gears is stunning:

The original paper is here and you can find a summary with more pictures of the gear in action here.

*The Economist* reviews *Average is Over*

The very interesting and provocative review is by Lexington, here is one excerpt:

Mr Cowen’s vision is neither warm nor fuzzy. In his future, mistakes and even mediocrity will be hard to hide: eg, an ever-expanding array of ratings will expose so-so doctors and also patients who do not take their medicines or otherwise spell trouble. Young men will struggle in a labour market that rewards conscientiousness over muscle. With incomes squeezed, many Americans will head to the sort of cheap, sun-baked sprawling exurbs that give the farmers’-market-and-bike-lanes set heartburn. Many will accept rotten public services in exchange for low taxes. This may sound a bit grim, but it reflects real-world trends: 60% of employers already check the credit ratings of job candidates; young male unemployment is high and migrants have been flooding to low-tax, low-service Texas for years.

Read the whole thing. And here is further book coverage from The Economist.

One of those new service sector jobs you have heard about (artisanal markets in everything)

Someone just paid David Rees, of Beacon, N.Y., $35 to sharpen a pencil.

“I think people think: ‘Wow, I can’t believe he actually did it,'” Rees said. “I wasn’t sure what would happen when I sent this guy my money.”

Now before you write him off as some con-artist whittling away on pre-packaged No. 2s from a farmhouse upstate you should know Rees is a sharp guy. He considers himself an artisanal pencil sharpener.

“Internet commenters have definitely made this argument before,” Rees said. “Now, a pencil is a completely transparent communication tool. There’s no secret to it.”

As for his pencils, he began sharpening those after leaving a job as a political cartoonist to work for the 2010 Census, where he spent all day recording his findings with a No. 2 pencil.

“I thought there’s got to be a way to get paid to sharpen pencils for people,” he said.

1,804 flawlessly sharpened mostly No. 2 pencils later, Rees has penned a book on his art form, collected an arsenal of different sharpeners, and taught classes to students who sharpen better than he does.

The article is here. And yet our artisan is not happy:

When Rees started, he hoped every busted tip would lead the writer to pay for a sharpening. Instead, most customers order David’s pencil points and display them as artwork.

“The whole point of the business is to remind people to appreciate yellow, No. 2 pencils because they’re really cool and interesting,” he said. “And to make a ton of money.”

But at this point, work feels like work.

“You do anything long enough for money, it just starts to become a job,” he said.

So as he nears the nice round number of 2,000 sharpenings, Rees suggested that soon he’d like to clean out his sharpeners for good, leaving the world a much duller place.

His website sells his book and sharpened pencils. The books ship quickly, the pencils take approximately six weeks to ship, and cost more than the book.

As I argue in Average is Over, marketing — in the broad sense of that term — is a growth sector for the future. You might recall that three years ago he was charging only $15 per pencil.

For the pointer I thank Samir Varma.

Danish markets in everything (hail Coase 1972!)

“We had all worked in kitchens or supermarkets and seen how much food was thrown away, and we wanted to do something about it,” said Sophie Sales, a co-founder of “Rub og Stub”, which translates as “lock, stock, and barrel”.

Denmark is already home to an active community of “freegans”, people who eat discarded edible food to reduce waste.

But unlike activists, Rub og Stub won’t go rummaging through trash to find its ingredients, and the restaurant doesn’t accept food that’s been found through so-called “dumpster diving”.

Instead, they’re trying to get to the food before grocery stores and other retailers throw it out.

There is more information here, noting that the restaurant had to start out buying some food to sell, because no one believed them at first. And there is this:

“If we get it on the last day before it expires, we can either put it in the freezer or use it on the same day,” she said.

Rub og Stub doesn’t accept food that’s already been prepared elsewhere, and because of its sourcing methods, the menu changes every day.

On Tuesday, it was serving meat patties known as “frikadeller”, with red cabbage.

The menu also included a vegetarian version of the traditional Danish dish, a pasta salad, and apple muffins with marzipan and nougat ice cream.

For the pointer I thank Ruy Lopez.

Which emotions are shared and magnified on-line most easily? (hint: anger)

Joy is still a viral emotion, while sadness and disgust are much less so. But anger wins out. As Technology Review points out, a lot of this anger was found to be in relation to politics, both international and domestic. That’s not surprising, as political problems tend to be popular as well as incite anger and frustration. … I’d also venture to guess that sadness and disgust simply don’t translate as well. People want to share things they’re either passionate about or that they feel smart about sharing, and sad or disgusting things are harder emotions to fit into either of those categories. I guess the retweet barrier for ”This guy is a shithead” is much lower than for “Life sux,” perhaps because sadness and disgust don’t jive with our carefully-manicured online images.

And, when it comes to China, what does this mean?:

…conflicts between China and foreign countries, such as the military activities of the US and South Korea in the Yellow Sea and a collision in September 2010 between a Chinese and Japanese ship. The second are domestic social problems like food security, government bribery and the demolition of homes for resettlement; all hot topics in China. “This can explain why the events related to social problems propagate extremely fast in Weibo,” say Rui and co.

I first saw this in a post by Andrew Sullivan.

Assorted links

1. India’s vanishing jobs (slideshow).

2. Unique hotels (some with giraffe, elephant, pink dolphin), recommended link.

3. More on why you should watch Orphan Black.

4. Noon, October 30th, a statistics “unconference,” on-line.

6. An older post on household size and stagnant median income; good readers will recall this passage from TGS, which I also blogged: “Since 1989, the size-adjusted and size-unadjusted measures have been rising at roughly the same rate, and post-1979 the difference between the size-adjusted and the size-unadjusted median income measures is never more than 0.3 percent.” Note also that the economic problems of 1973-1982 or so were from two oil price shocks (very directly TGS) and also from a required disinflation. In this sense too changing household size from that earlier period is a red herring.

The QE multiplier

Felix Salmon writes:

If you take the amount of tapering that the market expected yesterday, and the amount of tapering that the market expects today, what’s the difference, in dollar terms? In other words, by the time tapering ends, and the Fed is no longer engaging in quantitative easing, how much extra money will it have spent buying bonds, if current market expectations hold, compared to what the market expected on Wednesday?

Then comes the next question, which is this: how much did the value of US fixed-income assets rise on Thursday? And, for that matter, how much did the value of US stocks rise on Thursday?

I don’t know the exact answers to the questions, but I’m pretty sure that the latter numbers are much larger than the former — that the market reaction, in dollar terms, was hugely greater than the extra amount of QE that the market now expects.

If that is indeed the case, then what we’re seeing is what you might call the QE multiplier — the amount by which every dollar of QE effects the markets as a whole. I don’t know what we thought the QE multiplier was on Wednesday, but in light of Thursday’s market action we might need to revise our guesses: the QE multiplier is, I suspect, much larger than most of us would have pegged it at.

Unlike Felix, I am, these days, made nervous by the size of the QE multiplier.