Month: September 2013

From the comments, on the economics of food stamps

In response to my earlier food stamps post, here is Brian Donahue:

Context:

http://www.fns.usda.gov/pd/34snapmonthly.htm

Economic conditions have been improving, grudingly, for three years now. But between October 2010 and October 2013, the cost of the program has risen 25%. I understand the concept of ‘countercyclical stabilizers’. This is something else. The idea of a 10% cut in this context…ok.

Food stamps aren’t being singled out here. Just because entitlement reform is paralyzingly hard, it doesn’t mean we don’t keep moving on the other stuff. Summing up 2013: fiscal cliff tax increases on rich, medicare investment tax on the rich, ending payroll tax holiday, sequester (half defense.) Republicans are playing ball – at some point along the way, food stamps get a look. If a 10% cut here is a sacred cow, we’re not close to having the stomach for the real fights to come.

And here is PLW:

Explaining the Rs food stamp focus is a little more complicated. First of all, labeling the House nutrition title of the Farm Bill as “going after” the program seems unfair. The House food stamp proposals include uncoupling categorical eligibility for food stamps with receipt of a trivial non-cash TANF benefit (a technique used by many states to waive all asset requirements for food stamps and raise the net income test to twice the poverty line), getting rid of a loophole (i.e., “LIHEAP loophole”) that a small number of states in the (primarily in the Northeast) use to artificially reduce the net income of food stamp beneficiaries in order to raise their level of benefits, and taking away the Secretary of USDA’s work requirement waiver authority for non-disabled adults without dependents.

Second (and this is where it gets complicated), many of the policies that the Rs are pushing in the context of the Farm Bill are going after policies that were put in place as direct result or an unintended consequence of other R policies. For instance, the coupling of categorical eligibility to non-TANF cash benefits is the result of the 1996 welfare reforms which ended AFDC (how one used to become categorically eligible for food stamps) in replace of a much less clear TANF benefit (rather than cash linked to AFDC, one might receive a service in the form of a 1-800 hotline for pregnancy prevention linked to TANF), but continued to bestow eligibility for food stamps to the recipients of AFDC’s successor. At the same time, the 2002 Farm Bill streamlined eligibility by creating a number of state options for food stamps with the intention of pacifying the states who were getting penalized for having high food stamp error rates (those same error rates the USDA now brags about) as the result of having more food stamp participants with earned income as the result of the 1996 welfare reforms (i.e., administratively, it’s more difficult to assign benefits to people with earned income rather than unearned income… especially if those low-income people are in and out of work through the course of a month).

Colin Camerer wins a MacArthur Genius grant

The notice is here. Camerer is an economist at CalTech, a founding pioneer of neuroeconomics, and a former child prodigy, the standard set of links on him is here. You can follow Colin on Twitter here.

And don’t neglect these three winners (among others):

— Jeremy Denk, 43, New York City. Writer and concert pianist who combines his skills to help readers and listeners to better appreciate classical music.

— Angela Duckworth, 43, Philadelphia. Research psychologist at the University of Pennsylvania helping to transform understanding of just what roles self-control and grit play in educational achievement. [TC: Duckworth’s home page is here and her research focuses on conscientiousness as a major factor behind educational success]

— Vijay Iyer, 41, New York City. Jazz pianist, composer and bandleader and writer reconceptualizing the genre through compositions for his ensembles, as well as cross-disciplinary collaborations and scholarly writing.

Venezuelan Arbitrage

Flights out of Venezuela to anywhere are 100% sold out, months in advance. Yet many planes are flying half-empty. Why? The official exchange rate is 6.3 bolivars per dollar but the black market rate is more like 42 bolivars to the dollar. Few people are allowed to convert bolivars to dollars at the official rate but there is an exception for people with a valid airline ticket. As a result people with an airline ticket can convert bolivars to dollars at the official rate and then sell the dollars at the much higher black market rate. Reuters has the story:

“It is possible to travel abroad for free due to this exchange rate magic,” said local economist Angel Garcia Banchs.

The profit is realized from an arbitrage process known locally as “el raspao,” or “the scrape.”

Credit cards are used abroad to get a cash advance — rather than buying merchandise. The dollars are then carried back into Venezuela and sold on the black market for some seven times the original exchange rate.

The large profit margin easily absorbs the cost of flights and accommodation for a trip.

“I’ve been able to buy new clothes and give some cash to all my closest family members!” said one delighted Venezuelan lady, just back from a trip to Europe.

…Some Venezuelans do not even bother leaving the country, but merely send their credit cards to friends overseas, who swipe the cards and send the cash back to Venezuela.

“This is the reason many airlines are sending half-empty planes,” Ricardo Cusanno, head of a local tourism council, told Reuters, saying the government should cross-reference flight lists with those requesting foreign exchange to outwit the no-shows.

Hat tip: Carl Danner.

New markers of political and managerial hubris

Gillian Tett reports:

The number of “linguistic biomarkers” associated with hubris was highest for Mr Blair, followed by Thatcher – with Mr Major a long way behind. Hubris increased both in the speeches of Mr Blair and of Thatcher – with a particularly marked rise after periods of war (in the former case, this was the conflict in Iraq; for the latter, the Falklands war.) Mr Blair started using words such as “I”, “me” and “sure” more.

…Niamh Brennan and John Conroy, a professor and a graduate student, analysed the letters to shareholders issued by the chief executive of a European bank that expanded very dramatically during the boom and then suffered massive losses. Their analysis showed that during the eight years that he was in power, this chief executive also displayed rising hubris in his speech, with excessive optimism and a growing use of the royal “we”.

“From a total of 148 sentences identified as being good news, 57 per cent was attributed to the chief executive himself, while only 39 per cent was attributed to the company and a further 4 per cent to outside parties,” they write. But the chief executive “did not attribute any bad news to themselves or the company but stated it was the result of external factors.”

This research program is in its early stages.

Assorted links

1. The commercialization of the kaffeeklatsch.

2. Slide show of Haitian photos, which also indicates that about 1/4 of Haitian gdp is spent playing the lottery.

3. Schools are competing harder and harder for the best students.

4. Why the poor don’t work, in the words of the poor.

5. Will robots revolutionize Chinese manufacturing? The most interesting part is the discussion of how short product life cycles make robots harder to use. And wages for prostitutes are falling.

From the comments — why are the ACA exchanges behind schedule?

The primary issues are political and legal barriers to properly build a workable solution.

The first is that the ACA gives states the right to build and run their own exchanges. However, even if they rake the money HHS is still required to step in and fill the gap if they fail. So many states took the money (who wouldn’t) but the program is left to implement a system of unknown size. Just that would doom most IT implementations. In addition there weren’t any IT firms interested in helping to tackle the Federal system, instead they went to the bigger states where they don’t have to navigate the crazy laws that govern IT projects at the federal level. This also allowed them to integrate smaller less complex systems outside the gaze of an IG department who publishes reports that get national attention in their zeal to protect public money.

Second is that funding is discretionary and even though they mapped out the required headcount they Didn’t have the budget appropriated to hire even half what was needed (as defined by outside consultants like MITRE) which left them severely understaffed. My wife’s ‘team’ of 5 was actually 2. There is no chance that Congress would appropriate more money to fix this. It also isn’t like these people are all that great at their jobs. No person really good at their job in the private sector is going to take a big pay cut to work for HHS. These jobs aren’t a bunch of overpaid airport security people but are jobs that pay much much better in the private sector. This means promoting the inexperienced from within and there is no institutional experience to implement a complex system.

Next there is the political decision to fold the exchanges into CMS (Centers for Medicaid and Medicare Services). The congressional Republicans were using every power they could to harass the executives so HHS tried to shield them behind Medicare. However, it wan’t like CMS was any good at this type of implementation and it was now not the only priority for the contract shops to worry over.

The other problem on a technical level was the near impossible task of verifying eligibility of users for subsidies. All the data has to be verified to avoid fraud, this include income. That data is segregated at the IRS and they are prevented by law from sharing ANY of that information with other parts of the government. Thank Johnson and Nixon for their abuse of IRS info. So there is no easy way to automate the approval process based on tax returns. The only sensible way is to have the IRS do it, but that would require funding and no contract manager is going to go to jail to solve a problem without a new budget appropriated for them.

Last is just the factor that any large IT system like this has a horrible failure rate. Supposedly the success rate in the private sector is now above 50% but there aren’t many major news stories when private companies waste a billion dollars on a system that never does anything. The Government is even worse because of the hundreds of pages of regulations meant to ensure money isn’t “wasted”. Sure, the Federal Government generally gets the best pricing there is on products, but the massive overhead eats all of that up and delays the process by months. I think there is a reason that private companies don’t have the complex rules you see in the government. They also don’t have to worry about going to jail if they do break the rules.

I find it a miracle that there is ANY chance that the exchanges might actually be working in time. However, I think it would be wrong to say that it is some inherently governmental problem that couldn’t be solved with smart reform of the laws and congressional support to fix things. One party is invested in always excusing governmental problems and the other is opposed to the idea of trying to fix problems because they are invested in highlighting government failure for the simple purpose of killing it.

The high price of land in Singapore, educational Morlocks edition

At N.T.U., a group of researchers has spent the past year gathering available data on the university’s surface topography and subsurface geology.

The preliminary survey, completed late last month, found that the campus, which is in western Singapore, offers opportunities for underground space development. Extensive investigations indicated that rock strata 20 to 30 meters, or 66 to 98 feet, below the surface, are suited for cavern construction with spans as wide as 20 meters wide.

“In the long term, the university may need to go underground” to accommodate projected increases in the student population, said Zhao Zhiye, one of four researchers who worked on the study.

…Designed for both learning and socializing, the learning complex — a group of interconnected caverns — would include the university’s main library, a museum, study rooms, cafeterias and conference halls. The sports hall, beneath the existing university sports complex, would house basketball, badminton and table tennis courts, swimming pools and spectator stands.

There is more here, and here is the previous installment in the series.

http://www.macrodigest.com/

The site is here, and it presents recent macro discussions on an issue-by-issue basis in easy to use, easy to scan form. Furthermore it covers links which I otherwise would not see. I not only visit the site every day (or more), I use it every day, and there are no more than half a dozen aggregator sites where I would say that.

Definitely recommended, and it comes from the LSE Department of Economics.

Some perspective on malfunctioning ACA exchanges

It is fairly pathetic that they may not be up and running in proper form by October 1, but it is not the main issue either. Dan Diamond has some good remarks, here are two excerpts:

Overwhelmingly, the Americans who will be shopping through the exchanges this fall are the ones who have pined for this moment for months, if not years: The chronically ill who wanted coverage but couldn’t get it, or the low-income Americans who couldn’t afford it. They likely won’t be deterred by a few software glitches.

That is a very good point, though I wonder if it will contribute to insurance company enthusiasm in the early stages of actual implementation. Dan also notes:

There already were a mix of offline ways to purchase coverage through the exchanges, whether through call centers or in person; the AP notes that 30% of applicants were expected to use paper.

But software delays may spur additional solutions, too. Oregon, for example, will rely on insurance brokers to help state residents obtain coverage until the state’s exchange website is ready to go.

And an enormous number of stakeholders want the exchanges to be successful, from insurers that are hoping to see new business to hospitals that want to lower their uncompensated care costs. Basically, CMS can raise a virtual volunteer army if necessary.

Meanwhile, the enrollment period runs through March 31. There’s no “early bird special” as Dave Morgan, a California employee benefits adviser, pointed out on Twitter; premium prices for 2014 will be the same whether you’re purchasing coverage on Oct. 1 or Dec. 15.

Dan adds, however:

All bets are off if the software problem isn’t fixed in a few days or weeks. The exchanges were touted with the promise that they’d be like Orbitz or Amazon, just for buying health coverage.

So I still say all bets are off.

Coming from other directions, Timothy Taylor offers some useful perspectives on ACA, which now it seems will cover only about 40% of the previously uninsured.

Assorted links

1. Why are so few people breaking 115 years of age?

2. Insight into the bankless, and Jon Hilsenrath on Yellen’s management style. People, I say it’s time to think twice on this one. It’s showing multiple classic signs of “employee who should not be promoted.”

3. Was Bach a reformed teenage thug?

4. Diane Coyle reviews Joe Studwell’s How Asia Works.

5. Steve Teles on kludgeocracy in America.

6. Stanley Fischer opposes forward guidance from the Fed. Let’s face it: right now we are living under pure monetary discretion. From the article: “You can’t expect the Fed to spell out what it’s going to do,” Mr. Fischer said. “Why? Because it doesn’t know.”

Do Awards Reduce Productivity?

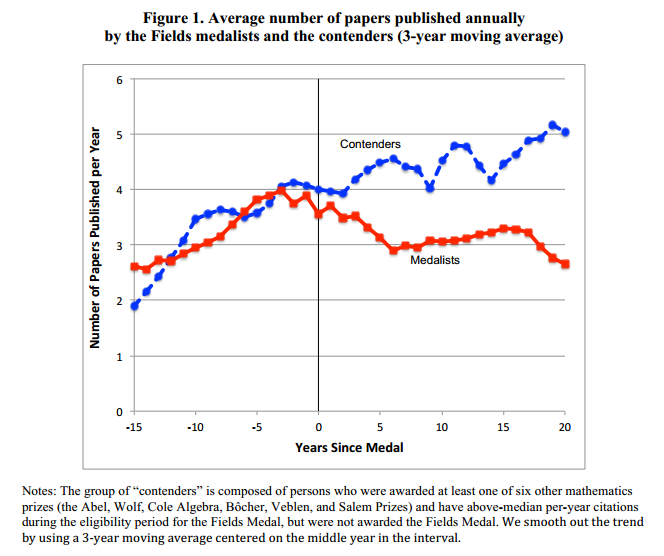

George J. Borjas and Kirk B. Doran find that the productivity of mathematicians who win the Fields Medal, the mathematics “Nobel” awarded to mathematicians under the age of 40, declines after they win. Borjas and Doran look at productivity on a number of margins including papers, citations, and graduate students mentored. At right is a graph of average number of papers compared to a contender group. Productivity falls by a statistically significant ~1 paper per year (in the regression that I think the strongest, in a few variants the decline is a bit more.)

George J. Borjas and Kirk B. Doran find that the productivity of mathematicians who win the Fields Medal, the mathematics “Nobel” awarded to mathematicians under the age of 40, declines after they win. Borjas and Doran look at productivity on a number of margins including papers, citations, and graduate students mentored. At right is a graph of average number of papers compared to a contender group. Productivity falls by a statistically significant ~1 paper per year (in the regression that I think the strongest, in a few variants the decline is a bit more.)

Not all of the decline is due to resting on laurels. Borjas and Doran also find that mathematicians who win the Fields tend to branch out into other areas and this branching out requires them to learn new material which takes time. Steve Smale did work in economics and biology, for example, Rene Thom developed catastrophe theory and David Mumford works in vision and pattern theory. Exploring new topics can also lead to breakthroughs so branching out is not necessarily a negative effect. Borjas and Doran estimate that about half of the productivity effect is resting on laurels and half greater exploration.

(FYI, Borjas and Doran speak of prizes but I prefer to call them awards because awards such as the Fields or Clark Medal are quite different from prizes for purpose, such as the XPrizes, the H Prize or the historically important Orteig Prize, that I discuss in Launching as alternatives to patents.)

Winning the Fields is presumably good for the winner but even taking into account the enhanced incentive to explore it’s not obviously good for mathematics. The explicit purpose of the Fields was to increase not decrease achievement. What can be done?

The Fields Medal may be too important for its own good. In economics the closest thing to the Fields is the John Bates Clark award, given to that American economist under the age of 40 judged to have made the most significant contributions. Chan et al. (2013) find that recipients of the Clark award increase their productivity after winning. But the Clark award is widely seen as a future portent of the Nobel, thus it may have a more stimulative effect as the winner realizes that the next big award is within reach (see the final sentence). In a tournament, it’s important to tier the awards for multiple levels of ability.

In thinking about whether awards increase or decrease productivity on net. the precise counter-factual is important. Let us accept as Truth that winners of the Fields Medal decrease in productivity, even so that doesn’t mean that eliminating the Fields Medal would increase productivity let alone that eliminating all awards would increase productivity (remember, the productivity of the contenders may be more important than the productivity of the winners). Perhaps the most justifiable policy recommendation is that one shouldn’t give awards to young people, a Fields Medal for lifetime achievement, much as the economics Nobel is given, might encourage more achievement.

Paul Samuelson wrote of Chasing the Bitch Goddess of Success:

Scientists are as avaricious and competitive as Smithian businessmen. The coin they seek is not apples, nuts, and yachts; nor is it the coin itself, or power as that term is ordinarily used. Scholars seek fame.

But, paraphrasing Tyler, what price early fame?

The meaning of Merkel’s victory

It is not possible to rerun the election under different economic policies, but still it seems pretty clear. German voters very much like low inflation and no Eurobonds, or in other words I call this the primacy of public choice and political economy over macroeconomics. The set of Eurozone options “on the table” was never that large to begin with, Merkel is not “history’s greatest monster,” and it is surprising that Eurozone (and German) policy has come as far as it has. The next time you are tempted to write “Government should,” or “Germany should,” try instead subbing in “short-term economic nationalists should” and see what the new sentence looks like.

Another way to put this is that short-term policy is long-term policy, relative to constraints. Nations and perceived national interests really do matter, and once we take that into account, it is scary to realize how much harder it would be to do better. Merkel understand this, many of her critics do not.

Model this taper and show your work, if only verbally

Shortly following the announcement of a delayed taper:

The rupee rallied 2.8 percent to 63.4950 per dollar, according to prices from local banks compiled by Bloomberg. Thailand’s baht rose 1.2 percent to 31.850, the Philippine peso gained 1.4 percent to 43.87 and Malaysia’s ringgit appreciated 1.2 percent to 3.29. Global funds pumped $5.7 billion into the stock markets of India, Indonesia, the Philippines, South Korea, Taiwan and Thailand this week, according to exchange data.

Pay special heed to quantitative magnitudes. For how long are we delaying the taper? One or two months? How much is the taper anyway, relative to the stock of relevant financial assets? Taking $10 to $15 billion off of $85 billion a month in purchases, when the asset stocks are in the trillions? Woo hoo.

Here are some interesting comments from Stephen Jen.

I’ll say it again: none of you understand what is going on here, and neither do I. I am not seeing enough admission of this basic fact.

Addendum: Scott Sumner offers a response.

Assorted links

1. Will Baude on the role of lawyers in *Average is Over*.

2. Our new service sector jobs (homeless iPhone fight edition, hat tip Alex).

3. Ashok Rao’s perfect policy platform.

4. Kathryn Davis remains one of our most creative writers.

5. 1981 debate: David Friedman vs. George Smith. And equine cloning services. But will this cloning episode work?

Markets in everything

University of Toronto students desperate for scarce seats in fully booked classrooms are offering cash to classmates willing to give up a spot, turning registration into a bidding war.

“$100 to whomever drops (History of Modern Espionage),” posted Christopher Grossi on Facebook Tuesday. “I really need this course.”

The third-year history student said the 180-person course filled up before his designated registration time. After talking to the professor without success, he said offering money was his last chance to coax someone to trade with him.

Here is more information, and supposedly, after some point in the process, a near-simultaneous drop and add will in fact allow the trade to take place.

For the pointer I thank Larry Deck.