Month: May 2017

The Greek economy is now managing “austerity” OK

The Greek economy is projected to grow 1.8 per cent this year, against an earlier forecast of 2.7 per cent according to the proposal…

Of course that’s not great, especially with all the catch-up they could be doing (but please don’t assume that all or even most of the output gap represents potential catch-up). Still, the Greek economy is not shrinking, even though Keynesian fiscal theories predict it should be:

“We accept that there will need to be a 3.5 per cent primary surplus until the end of the [bailout] programme [in 2018] but after that it should come down to something like 1.5 per cent to allow for more capital expenditure to lift the Greek economy.”

Here is the FT article by Kerin Hope and Claire Jones. I said it before, I’ll say it again: the 2008-2012 period was a very special one, with a very high risk premium (sorry, Scott!) and with massive contractions in bank intermediation in some of the key affected countries. We draw broader conclusions from it at our peril.

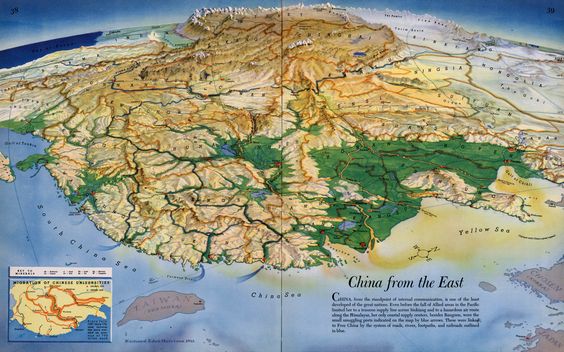

China from the East

The image was sent to me by Christopher Jared. And, via Shivaji Sondhi, here is a review essay on ideology and the longevity of the Chinese empire.

That was then, this is now

Several of London’s largest banks are looking to stockpile bitcoins in order to pay off cyber criminals who threaten to bring down their critical IT systems.

The virtual currency, which is highly prized by criminal networks because it is difficult to trace, is being acquired by blue chip companies in order to pay ransoms, according to a leading IT expert.

That is from October of last year, via Brian S. I wonder how much such “precautionary demand” has pushed up the price of Bitcoin?

Sunday assorted links

What would count as an explanation of the size of China?

There are two striking facts about China. First, the country is quite large. Second, the country was remarkably large early in its history, compared to most other political units. For instance, here is China in 200 AD:

How did this happen?

Or consider a modern version of the puzzle: currently there are over one billion Chinese in one political unit, and a bit of scattering. And there are over one billion Europeans, spread in fairly significant numbers across about fifty political units. How did such a fundamental difference come to pass?

I can think of many instructive explanations for China’s early size and unity that are nonetheless derivative. For instance perhaps a common language for writing played a key role, or perhaps the civil service and the exam system bound the country together. I don’t mean to gainsay those claims, but they are not fundamental. In part they are simply alternative descriptions of China’s relatively early unity. And there still ought to be reasons why those factors were the case, and some of them seem to postdate unity. On top of that, ideally we would like the explanation to account for China’s periodic descents into fragmentation and sometimes warring chaos.

I can think of a few factors that might count as fundamental, and often they involve economies of scale:

1. There may be greater economies of scale in Chinese agriculture. One specific hypothesis is that China’s “hydraulic” system of rice irrigation favored a centralized despotic authority (Karl Wittfogel, though I’ve never found this particular view convincing, see also earlier takes on “Oriental Despotism”).

2. There may be economies of scale for fighting land battles with horses. Alternatively, when it comes to naval warfare — more common for Europe — small countries have a chance to punch above their weight, witness England and Portugal.

3. China had lower climate volatility than did Europe, and that made it easier for a more stable equilibrium to emerge. (Or the kinds of climate volatility China had mattered less for its agriculture.) Big changes in climate, in contrast, periodically overturn political equilibria, most of all when agriculture was a huge chunk of gdp.

4. China has two main, navigable rivers running east to west, the Yellow and Yangtze rivers. It also has a large space of relatively flat plains.

5. China was formed when the prevailing technologies favored size and scale, and thus size and scale were imprinted onto early Chinese political DNA. This is a bit like the “inflation” theory of the universe. (NB: This part of the explanation is arguably “accidental” rather than “fundamental.”)

6. China and Rome are with regard to size and early unity not so different, but China did a better job absorbing the “barbarians” and thus persisted as a larger political unit.

What else? With some mix of those (and other) factors in place, the more traditional detailed explanations then kick in to promote China’s size as China.

Ideally, an explanation for China’s early size and unity, and why that size and unity bounced back from so many periodic bouts of warring states, should address the following:

a. Why the mountainous Tibet also ended up as a more or less coherent nation-state, and why that too happened fairly early. That seems to militate against purely rice-based explanations.

b. Why Yunnan was absorbed into China at a relatively late date — the 17th century — but once attached did become a stable part of the country in a manner that other parts of southeast Asia did not mimic.

c. Why Korea remained separate.

d. Why the Khmer empire proved unstable and perished, despite a high level of sophistication and state capacity.

e. Why the Aztec Triple Alliance grew to a much larger size than any political unit in North America at the same time.

What else?

I am grateful to a presentation by Debin Ma, and to comments from the Washington Area Economic History Seminar (recommended!), from a seminar last night. None of them are implicated in what I have written. I look forward to Debin’s paper on this topic (here is his earlier 2012 work), and Kenneth Pomeranz is writing an entire book on the question.

Addendum: Here is the Ko, Koyama, and Sng piece (pdf).

Saturday assorted links

1. Scott Alexander defends Silicon Valley.

2. Paying young Brazilian women to play Overwatch with you.

3. Eric Rasmusen on game theory and North Korea (not my view but will stimulate thought).

5. Clearly, a talking prairie dog (NYT). Recommended, and they also have TFP.

6. MIE: high prices for some “antique” IKEA furniture.

7. Contrarian argument that occupational licensing actually increases supply.

The Erik Torenberg list of rap music I should listen to

Here goes:

- Lupe Fiasco — The Cool (2007 Lupe’s peak as an artist, this and Food & Liquor. He has a tragic fall from grace in the rap game)

- Blu — Below the Heavens (Also an older classic underground album, Blu was a prodigy who never quite made it)

- Phonte — Charity Starts at home (Phonte from Little Brother’s first and only solo album)

- Mos Def & Talib Kweli Are Black Star (The best of two legendary MC’s)

- J Cole — Forest Hills Drive

- Homeboy Sandman — First of a Living Breed (My favorite artist because he’s a true poet.)

- Common — Be (Common produced by Kanye in 2005)

- Chance the Rapper — Acid Rap (Chance’s first mixtape that propelled him to the national spotlight)

Some of it I knew already, in any case I thought these were very good selections…

Revisiting why realized and expected volatility are so low

An email from Alebron:

Might it be worth revisiting this, since it’s been 3 years?

Vol is low right now, lots of hand-wringing about it. Some possible factors:

– Shiller used to say the puzzle was that equity vol was so high (at least in the context of plausible DCF models). More money is now in the hands of “smart” market participants (certainly as a fraction of total trading volume this is true), and they overreact less to news.

– Stagnation/complacency. Or alternatively, all the action is in private firms (unicorns and the like). Firms only go/stay public if they are boring/stable.

– Consider a model where an industry has n firms, and some of them are mismanaged but investors don’t know which ones. Then any news about one of them reveals something about which are the good/bad ones. Suppose that the spread of (a) management consulting, (b) corporate regulation, and (c) efficiency due to information technology brings everyone towards the mean. Bad companies aren’t as bad as they used to be (they have access to competitors’ good ideas, Dodd-Frank/SOX/etc prevent egregious mis-management/mis-reporting, etc), and good ones aren’t as good (their good ideas leak out, they get saddled with unavoidable costs due to Dodd-Frank/SOX/etc). Thus, the value of news decreases, vol decreases.

– Trump of course. Pro-business, but more accurately pro-big-business, or pro-rent-seeking? I’m inclined to mostly dismiss this, since it’s not like vol cratered when he got elected. Vol has been pretty low for most of the last 5 years.”

– Does 1990s low-vol Japan have lessons?

Curious if you have other thoughts…

The excellent Samir Varma sends me this new article on VIX and volatility. We all know there are models where volatility begets further volatility, if only because the initial big price moves make investors more wary, less willing to hold some positions, and more willing to bail out of others. Perhaps we need a more in-depth study of how non-volatility begets further non-volatility. When prices just aren’t moving by very much, maybe certain kinds of information get drained away, and it becomes harder to conclude that some position other than your status quo default position makes sense.

Friday assorted links

1. Noah Smith on productivity, and if you read this piece we’ll become more productive yet.

2. Loveflutter: dating app to use tweets.

3. A bad article but with some interesting content. I say there are no real YIMBYs in this war, only competing NIMBYs. (Question: how many more of you will click because I call it a bad article?)

4. The fish problems of Brexit (FT).

5. No government health care funding for people who won’t make lifestyle changes?

Apple Watch can detect an early sign of heart disease

MacWorld: Developers of the Apple Watch app Cardiogram worked with researchers leading the University of California San Francisco’s Health eHeart study to develop a ResearchKit-based study of their own called mRhythm. On Thursday, Cardiogram and UCSF’s cardiology division are presenting the results of that 14-month study, which collected more than 100 million heart rate data points from more than 6,000 Apple Watch users. Cardiogram developed a machine learning-powered algorithm that can detect atrial fibrillation, which is often asymptomatic.

Cardiogram’s algorithm was tested against an in-hospital test called cardioversion. Patients experiencing atrial fibrillation, which affects one in four people in their lifetime and causes 25 percent of all strokes, wore an Apple Watch while undergoing cardioversion to compare outcomes. Both segments, the cardioversion test and the Apple Watch’s heart rate data, were blinded against whether the patients’ heart rates were normal or abnormal, then sent to Cardiogram’s algorithm. The results: the Apple Watch data detected atrial fibrillation 97 percent of the time.

Apple has been communicating privately with the FDA for years about medical devices and so far the FDA has taken a light touch to Apple but these issues are coming to a head. As with the regulation of DNA tests, the regulation of these devices is going to raise important free speech issues. It’s one thing to ensure that the devices do what they say they do at reasonable accuracy (measure heart rate, identify genes etc.) but regulating what advice may be given on the basis of such readings is problematic. Can the FDA regulate a website that says go see your doctor if your heart rate monitor exhibits these particular readings? Why is an app that tells you the same thing any different?

Hat tip: Samir Varma.

What I’ve been reading

1. William Vaughan, Samuel Palmer: Shadows on the Wall. Another first-rate Yale University Press book of art plates and art history, for this they are the best. Get a hold of as many of them as you can.

2. Ge Fei, The Invisibility Cloak. This short Chinese noir novel, with a dash of Murakami, is one of my year’s favorites and also one of this year’s “cool books.” I finished it in one sitting. Set in Beijing, the protagonist sells audio equipment, and then strange things happen. Here is a good interview with the author.

3. David J. Garrow, Rising Star: The Making of Barack Obama. So far I’ve only read bits and pieces of it, but I am surprised it is not receiving more positive attention. It seems like one of the most thorough and smart and thoughtful biographies of any American president. It has plenty of detail on Obama’s life and career, and you can learn what Obama’s ex-girlfriend says about how he was in bed at age 22 (“he neither came off as experienced nor inexperienced”, [FU Aristotle!]) Yes, at 1084 pp. of text this is more than I want to know, but what’s not to like? Here is a good Brent Staples NYT review. Garrow cribs his main narrative — the artificial construction of his blackness — from Rev. Wright and Steve Sailer, and doesn’t exactly credit them, although that (the former, not the latter) may explain why the mainstream reception has been so tepid.

4. Franklin Foer, World Without Mind: The Existential Threat of Big Tech. The title says it all. I disagreed with almost everything in this book, still it is useful to see where the Zeitgeist is headed.

5. The Great Inka Road: Engineering an Empire, assorted authors and editors and photographers. One of the best and most readable introductions to Incan civilization. I’ll say it again: you all should be reading more picture books! They are one of the best ways to actually learn.

Two useful books for presenting meta-information on learning things are:

Ulrich Boser, Learn Better: Mastering the Skills for Success in Life, Business, and School, or, How to Become an Expert in Just About Anything, and

Eric Barker, Barking Up the Wrong Tree: The Surprising Science Behind Why Everything You Know About Success Is (Mostly) Wrong.

And Thomas W. Hazlett, The Political Spectrum: The Tumultuous Liberation of Wireless Technology, from Herbert Hoover to the Smartphone, is a very learned, market-oriented look at what the title promises.

No one wants to pay for health care

That is the topic of my latest Bloomberg column. It does not focus on single payer, but that is the part I will pass along to you:

Another way to manage health-care subsidies would be a single-payer system, and some commentators suggest that is where the Democratic Party is headed. I wouldn’t be so sure. Obama made his (partially incorrect) “if you like your health care plan, you can keep it” promise for a reason. The Americans who get health insurance through their jobs often enjoy privileged access to doctors and benefit from superior reimbursement rates.

If the price of covering the sick is for millions of wealthier and more influential people to give up those advantages, I don’t see that happening. The health-insurance industry and other medical lobbies will be opposed, too, with doctors fearing that a single-payer system would bargain down their reimbursement rates. Even a relatively progressive state such as Vermont could not make a single-payer system happen.

You can think of current debates over health policy as a game of hot potato in which “who loses?” and “who pays?” are questions nobody finds easy to answer but also questions that no party can ultimately avoid. Obamacare didn’t come up with a sustainable answer; neither, so far, have the Republicans.

Do read the whole thing.

Thursday assorted links

1. Do we end up with too many bike lanes? And does Canada’s tech hub have a chance?

2. MothersAgainstTurbines.com.

3. Ravens remember.

4. Criticisms of cosmic inflation theory.

5. History of the term “priming the pump.” Back to the 19th century. And here is Lauchlin Currie (among others), predating Keynes (pdf).

6. Contemporary art show for dogs: “That’s not the only thing about it that caters to canines: dOGUMENTA, Dawson is quick to emphasize, is not about dogs or by dogs, but for dogs, meaning artworks are installed at puppy-eye-level, and considerate of their color perception limitations.”

Robert Sapolsky’s *Behave*

The subtitle is The Biology of Humans at Our Best and Worst. Sapolsky is tenured in biology and neuroscience at Stanford, and winner of a MacArthur genius grant. This book is a very impressive compendium of what we know about the social sciences, as might be rooted in behavioral biology and related fields. The topics include violence, altruism, cooperation, gene-environment interactions, and many more topics along the usual lines. It’s not a “here is my big idea” book, but rather “here is how we think about social phenomena.” In the conclusion, Sapolsky writes: “If you had to boil this book down to a single phrase, it would be “It’s complicated.” Nothing seems to cause anything, instead everything just modulates everything else.” Those are two very good sentences.

This is likely to be one of this year’s major social science books, and many of you should buy it, but it’s flaw is that there’s no particular claim you are forced to come to terms with.

Who’s complacent? (there is no great stagnation)

A California-based lifestyle company has created Smalt (pictured), which is designed to make shaking salt…less strenuous by automating the process of seasoning your food through Amazon’s Alexa smart assistant.

…Users will be able to request that Alexa issues a command to start shaking salt, without the need for any strenuous twisting or grinding.

Here is the article, via the excellent Mark Thorson.