Month: May 2022

How big a deal would a nuclear explosion be?

I am no longer so sure, as I outlined in my recent Bloomberg column:

Until recently, my view was that any actual use of a nuclear weapon, no matter the scale, would dramatically change everything. Nuclear use would no longer be considered taboo, and the world would enter a state of collective shock and trauma. Other countries around the world would start frantically preparing for war, or the possibility of war.

But recent events have nudged me away from that viewpoint. For instance, I have seen a pandemic that arguably has caused about 15 million deaths worldwide, yet many countries, including the U.S. haven’t made major changes in their pandemic preparation policies. That tells me we are more able to respond to a major catastrophe with collective numbness than I would have thought possible.

Of course I am referring to a smaller tactical nuclear weapon, as might be used against Ukraine. India by the way lost five or so million people during the pandemic and they didn’t even fire their health minister. And:

I also have seen Trumpian politics operate through the social media cycle. Former President Donald Trump did and said outrageous things on a regular basis (even if you agree with some of them, the relevant point is that his opponents sincerely found them outrageous). Yet the rapidity of the social media news cycle meant that most of those actions failed to stick as major failings. Each outrage would be followed by another that would blot out the memory of the preceding one. The notion of “Trump as villain” became increasingly salient, but the details of Trumpian provocations mattered less and less.

Might the detonation of a tactical nuclear weapon follow a similar pattern? Everyone would opine on it on Twitter for a few weeks before moving on to the next terrible event. “Putin as villain” would become all the more entrenched, but dropping a tactical nuclear weapon probably wouldn’t be the last bad thing he would do.

To cite the terminology of venture capitalist Marc Andreessen, the tactical nuclear weapon might stay “the Current Thing” for a relatively short period of time.

Let’s hope we don’t find out.

Fourth Nobel conversation at MRU

On machine learning:

Here are the first three conversations.

Tuesday assorted links

GDPR and the Lost Generation of Innovative Apps

Using data on 4.1 million apps at the Google Play Store from 2016 to 2019, we document that GDPR induced the exit of about a third of available apps; and in the quarters following implementation, entry of new apps fell by half. We estimate a structural model of demand and entry in the app market. Comparing long-run equilibria with and without GDPR, we find that GDPR reduces consumer surplus and aggregate app usage by about a third. Whatever the privacy benefits of GDPR, they come at substantial costs in foregone innovation.

That is from a new NBER working paper by Rebecca Janßen, Reinhold Kesler, Michael E. Kummer & Joel Waldfogel.

“If economists are so smart, why aren’t they rich?”

Peter Coy (NYT) considers a few hypotheses. My take here is pretty simple. Here are three of the main ways to beat market returns:

1. Build a new product and sell it successfully.

2. Assemble and maintain an especially talented team of quants. (It is a separate but still relevant question at what scale you can do this and thus how rich you can become.)

3. “See” something about the market, at least for a limited period of time, that other people do not and invest accordingly. That might be falling interest rates, the rise of consumer tech, or the persistence of low inflation (all until recently!). Note that #3 requires you to have some money in the first place, and for your run to be long enough that you truly become rich.

Putting aside generic demographic factors, there is no particular reason to expect #1 or #2 to be much correlated with expertise in economics.

You might think that #3 is somewhat correlated with expertise in economics, but I don’t think it is very much. You can pile up a bunch of ancillary reasons why economists might not be practically oriented enough to succeed at #3. But even putting all that aside, economic theories of “regime change” just aren’t very good! (It is comparative statics that we excel at, but that knowledge can be replicated and sold cheaply to the rest of the investment community, if it turns out to be valuable.) So knowing economics won’t correlate much with success at strategy #3. And some of those non-economists who succeed at #3 are just lucky anyway.

And that is why, dear reader, most economists are not very rich. You are correct in downgrading their intelligence for these reasons, though there are still some regards in which they are quite smart, such as having ability at hypothesis testing, or perhaps having the ability to ask very good and penetrating questions about economic issues.

Monday assorted links

1. What makes for a good YouTube video?

2. The ten-year anniversary of The Start-Up of You, by Reid Hoffman and Ben Casnocha.

4. Citation practices and the Chicago School of Economics. Interesting results, but too much bad terminology in the abstract! Do the researchers actually not realize this?

5. Jordan Peterson to be Chancellor of Ralston College. Here is the Facebook page for Ralston.

That was then, this is now, cryptocurrency edition

Nouriel Roubini, a blockchain basher who famously called Bitcoin “the mother of all bubbles,” is working to develop a suite of financial products including a tokenized asset intended to act as a “more resilient dollar” in the face of higher inflation, climate change and civil unrest.

Roubini, nicknamed “Dr. Doom” for his bearish views, sees room for an asset-backed digital coin that could help protect against higher prices and benefit from soaring demand for land and commodities, as well as a loss of confidence in fiat currencies. He’s working with Dubai-based Atlas Capital Team LP, which he joined two years ago as co-founder and chief economist, to create the new products.

In doing so, Roubini is tapping into growing concerns over the pace of inflation as well as speculation about the longer-term outlook for the dollar, with prominent financial voices including Bridgewater Associates LP’s Ray Dalio and Credit Suisse AG strategist Zoltan Pozsar having argued the U.S. currency risks gradually losing its reserve status.

The greenback’s lofty position could be in jeopardy as the U.S. “prints too much money and adversaries start de-dollarizing,” Roubini said in an interview. “We recognized that America’s dollar reserve currency could be at risk and are working to create a new instrument that’s effectively a more resilient dollar.”

Unlike many cryptocurrencies, Roubini stresses that the coin would be backed by real assets — a mix of short-term U.S. Treasuries, gold and U.S. property (in the form of Real Estate Investment Trusts, or Reits) that’s expected to be less affected by climate change.

Here is more from Bloomberg. Here are earlier writings of relevance. I’m all for new business ventures, but perhaps he has the inflation timing wrong on this one? In any case, welcome Nouriel to the Austrian School of Economics!

China’s Bizarre Authoritarian-Libertarian COVID Strategy

It’s difficult to understand China’s COVID strategy. On the one hand, China has confined millions of people to their homes, even to the extent of outlawing walking outside or having food delivered. Many thousands of other people have been taken from their homes and put into quarantine centers. On the other hand, vaccination is not mandatory! I can understand authoritarianism. I can understand libertarianism. I have difficulty understanding how jailing people, potentially without food, is ok but requiring vaccinations is not. (Here’s a legal analysis of China’s vaccine policy.) Moreover, put aside making vaccines mandatory because as far as I can tell, China has only recently started to get serious about non-coercive measures to vaccinate the elderly. The Washington Post notes:

The vaccination drive has been mild compared to some of the other pandemic-control measures and did not prioritize the elderly. Some younger people have been required to get vaccinated for their jobs, but vaccination of retirees remains optional. Incentives like eggs, grains and other foodstuffs — a staple of China’s vaccination drive since last year — are now being bolstered by home checkups, mobile clinics and the widespread mobilization of public servantsto ensure the elderly get shots.

China is shutting down factories costing its economy trillions of dollars and the best they come up with to get elderly people vaccinated is egg incentives???!

It’s difficult to understand what the Chinese leadership is thinking. It’s conceivable that the Chinese vaccines are much less effective than we have been led to believe but that seems unlikely. As far as we can tell the Chinese vaccines are not quite as good as the mRNA vaccines but good enough to prevent severe disease and pass FDA approval in the United States. My best guess is that President Xi Jinping is so powerful and insulated from reality and alternative viewpoints that he is just soldiering on either oblivious to the pain and foolishness of his policies or indifferent, much like Mao before him during the great famine.

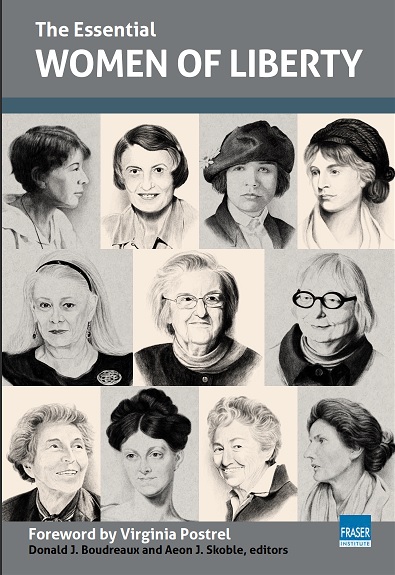

The Essential Women of Liberty

Here’s another excellent book in the Essential Scholars series. You can download the book for free, find additional resources, introductory videos and more at the Women of Liberty web page.

This series of essays, written by leading scholars in the United States, Canada and Europe, explores the lives and ideas of some of the most influential women over the past few centuries whose work contributed enormously to the democratic, prosperous and free societies that many people enjoy today. They are a remarkably diverse group of women. Their lives span the eighteenth to twenty-first centuries and their contributions are significant despite the barriers each faced. Some were educated at prestigious universities while others only had informal schooling. Some were academics, others writers and journalists, and still others activists. What they had in common was an understanding of the power of freedom and liberty, and their influential advocacy of such during their lives. These essays are a celebration and recognition of their lives and contributions.

The end of history?

How a united Ireland would work is unclear: many voters in Northern Ireland are attached to free healthcare with the NHS, even though waiting lists for treatment are the worst in the UK, and hate the idea of paying €60 to see a doctor as is the case south of the border.

Here is more from the FT, the context is that Sinn Fein is now asking for a referendum within five years.

Mindfulness sentences to ponder

According to a new paper, mindfulness may be especially harmful when we have wronged other people. By quelling our feelings of guilt, it seems, the common meditation technique discourages us from making amends for our mistakes.

“Cultivating mindfulness can distract people from their own transgressions and interpersonal obligations, occasionally relaxing one’s moral compass,” says Andrew Hafenbrack, assistant professor of management and organisation at the University of Washington, US, who led the new study.

Here is the story. Here is the paper, maybe bogus methods but that too points out this result is certainly possible.

*The Baby on the Fire Escape*

An excellent book, full of substance and going well beyond cliche, the author is Julie Phillips and the subtitle is Creativity, Motherhood, and the Mind-Baby Problem. Strikingly unsentimental, it covers women writers who balanced (or didn’t balance) their creative urges with their child-rearing responsibilities. Excerpt:

Grace Hartigan married at nineteen and had her son the same year, 1941. In 1975 she said:

“My son bitterly opposed my painting. He would stay after school and would come in at five o’clock, look at me, and say: “I know, you have been painting again.” When he got to be twelve and his father had remarried, I sent him to California. I have never seen him since. It is a very bitter relationship.”

I especially enjoyed the chapters on Doris Lessing, Ursula Le Guin, and Angela Carter. Will make the year’s “Best Non-Fiction” list.

Sunday assorted links

1. New paper on how the U.S. government financed three world wars.

2. Looming squeeze on Covid boosters? Isn’t it the job of government to provide public not private goods? Which of those are we doing right now?

3. Will the median voter end up ruling on abortion rights? (NYT)

4. “The Shadow of the Neolithic Revolution on Life Expectancy,” a paper by a bunch of economists.

5. Do we overestimate how extreme our opponents are?

6. Fracking technologies can boost greener energy sources too. Revised: correct link here.

7. The Arnold Kling proposal for network-based higher education.

“Almost Georgism”

Or you could say Georgism along the q rather than the p:

Landlords in England could be forced to let empty shops in a bid to rejuvenate high streets, under government plans.

Under the move, set to be unveiled in Tuesday’s Queen’s Speech, buildings left vacant for a year would have to be entered into a “rental auction”.

The British Retail Consortium (BRC) has calculated that one in seven shopfronts across Britain is empty.

Here is the full story, via Fergus McCullough.

Do welfare payments limit crime?

The effect of SSI removal on criminal justice involvement persists more than two decades later, even as the effect of removal on contemporaneous SSI receipt diminishes. In response to SSI removal, youth are twice as likely to be charged with an illicit income-generating offense than they are to maintain steady employment at $15,000/year in the labor market. As a result of these charges, the annual likelihood of incarceration increases by a statistically significant 60% in the two decades following SSI removal. The costs to taxpayers of enforcement and incarceration from SSI removal are so high that they nearly eliminate the savings to taxpayers from reduced SSI benefits.

And:

The increase in charges is concentrated in offenses for which income generation is a primary motivation (60% increase), especially theft, burglary, fraud/forgery, and prostitution.

That is from a new NBER working paper by Manasi Deshpande and Michael G. Mueller-Smith.