Results for “China” 2949 found

Mysteries of growth

Matt writes:

To me the most pointed contrast is between the Soviet Bloc and pre-reform China. Why was East Germany so much poorer than West Germany? That’s easy—Communism! And that’s why North Korea is poorer than South Korea. It’s also why Taiwan is richer than China. But Communism hardly explains why the Soviet Union was always much richer than China. But it was a lot richer despite broadly similar political systems and ideological commitments, and the human suffering involved in the PRC’s failure to implement Communism as successfully as the USSR was enormous.

I would say this: Stalin favored industrialization (albeit of a strange sort) more than did the Chinese communists, China had a more damaging heritage of conquest and civil war, Russia was far more urbanized, Russia had greater access to European ideas (some of them bad of course), and the Russian experience of nation-building was mostly behind them, whereas China is still going through this process. For Russia/Soviet Union, the major structures of 20th century European growth were largely in place, though “liberal institutions” were rejected. Russia had an advanced European educational system in place, albeit not for everyone. If you look at the economic history of the more Asiatic “Stans,” which of course were part of the Soviet Union communist experience, the importance of already-industrializing and European connections looks all the more stronger. The relative prosperity of Estonia also bears out this thesis, though it would be interesting to ponder Kaliningrad/Königsberg in this regard.

New Cities

In 2009, the percentage of the planet’s population living in urban areas crossed the 50% threshold…this year the population of the world’s cities will grow by a further 65 million people, equal in size to the total population of France…

As recently as 1990 the United States had the highest number of one million plus inhabitant urban agglomerations globally with a total of 33….by the year 2020 China will lead the world with 121 followed by India with 58…

Remarkably, in 2009 China generated some 40.9% of GDP from just 16.6% of its population living in the 35 largest cities.

From an interesting Credit Suisse report, Opportunities in an urbanizing world (pdf).

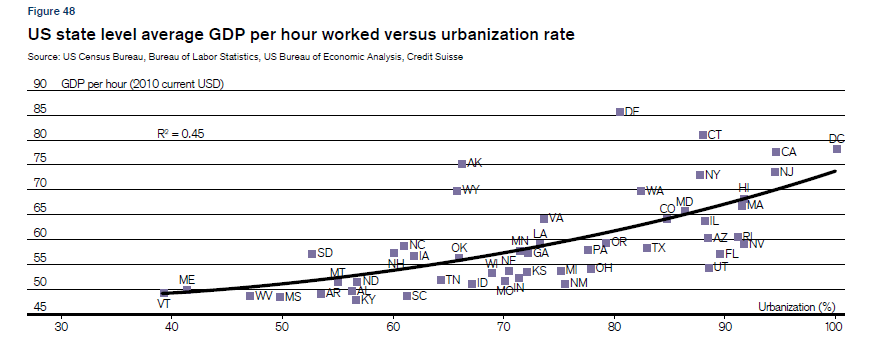

I was surprised at how close the association is between state level GDP and the urbanization rate (Ryan Avent in The Gated City and Matt Yglesias in The Rent is Too Dammed High make similar points.)

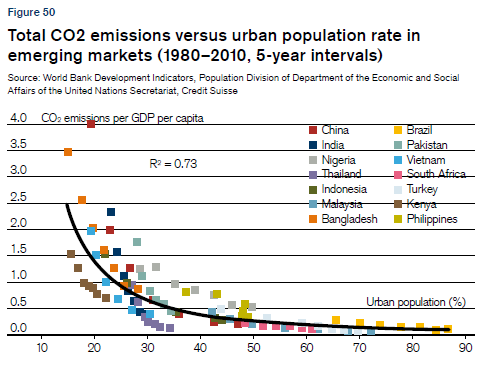

Urban dwellers also have much lower levels of carbon dioxide production than rural dwellers [Addendum: this seems to be per unit of GDP]. Moreover, the half of the world’s population that lives in cities occupies only approximately 2.7% of the world’s land area.

Hat tip: Gulzar at Urbanomics.

What happened to Alywn Young’s Hong Kong vs. Singapore contrast?

From 1992, the paper is here (note by the way an interesting written comment from Paul Krugman at the end). The basic story was that Hong Kong and Singapore had obtained their prosperity by two different paths. Hong Kong had made real productivity gains, but Singapore grew just by throwing more factors of production at the problem of economic growth, including a massive dose of savings and investment, including foreign investment. The share of investment in Singapore’s gdp rose from 9% in 1960 to 43% in 1984, while Hong Kong’s remained roughly steady at about 20%. If you back this out from national income statistics, you can measure that Singapore had very low levels of total factor productivity growth.

But should we believe that story, which by now is twenty years old? After all, these days, Singapore is extremely interested in cutting-edge science and on the frontier in the biosciences and with satellite launches, among other areas. Hong Kong has done fine, but as a finance center and entrepot for the China trade. Not many people look to them as ideas leaders. Maybe both countries somehow turned on the proverbial dime, but I don’t believe the initial Young result for a few reasons:

1. Ever since Michael Mandel, I am skeptical about backing out productivity claims from “value-added” data for extremely open economies. The quality of the data do not support extremely strong claims, and Krugman stresses this point in his comment. By the way, in the Singapore data TFP growth is negative in some sub-periods; see pp.24-5, can you believe -8% for 1970-1990? I take this as indicative of problems in the data and I am not persuaded by Young’s suggestion that it results from cyclical factors.

2. There is much talk about Singapore bringing in so much capital, and they did. But getting all that capital is not as simple as throwing a switch. Presumably the capital — especially the foreign capital — comes in part because investors expect a favorable productivity environment, if only prospectively.

3. Sometimes capital can “carry” or “contain” TFP growth; imagine spending money on a new industrial robot.

4. Some of the measured “TFP growth” may in fact reflect underpriced labor, including underpriced labor migrating from the PRC into Hong Kong. Those workers turned out to be more productive than people were expecting, which creates an apparent TFP residual, and migration of this nature played a larger role in the Hong Kong economy than in Singapore.

5. Young’s measures make him sound skeptical about the future (post-1992) course of economic growth in Singapore, and this has hardly been borne out by the facts. I wouldn’t call this an explicit or formal prediction of his theory but read the paper and the pessimism seeps through, albeit subtly. Is this passage (p.32) prescient or a sign of a mistaken assessment?:

Although I have presented evidence earlier, on the remarkable rate of structural transformation of the Singaporean economy, I feel that the words of Goh Keng Swee, Singapore’s Minister of Finance, in March 1970 are equally compelling: “. .. the electronics components we make in Singapore require less skill than that required by barbers or cooks, involving mostly repetitive manual operations.” By 1983 Singapore was the world’s largest exporter of disk drives. By the late 1980s, Singapore was one of Asia’s leading financial centers. As of today, the Singaporean government is targeting biotechnology and, no doubt, with its deep pockets, will achieve “success” in this sector. One cannot help but sense that this is industrial targeting taken to excess.

To flesh out this history, note two further points:

1. Young is long renowned for the care and quality of his empirical work. He is the sort of researcher who might obsess for six months over a footnote. That is one reason why he has not produced a greater number of papers.

2. This line of research (there are other papers here) was immediately hailed as successful upon its appearance. I read it too at the time and simply assumed it was likely to be true. Even Krugman, despite his insightful worries in his comment, ended up endorsing the Singapore result as true (that link is also an excellent essay for background on this entire set of ideas and debates).

The funny thing is, Young’s hypothesis still could be true. It hasn’t been refuted.

But if you ask me — I don’t believe it, not any more. I take this to be a cautionary tale of how difficult it can be to establish firm knowledge through economics.

Ronald Coase has a new book coming out

With Ning Wang, it is called How China Became Capitalist, due out later in April.

Here is their Op-Ed in today’s WSJ. Ronald Coase, Nobel Laureate, is now 101 years old.

Why I think the Mexican government is winning the drug war

Mexico is still growing, and quite robustly, even after the drug lords have given it their best shot. The currency is up over nine percent this year.

If Mexico keeps on getting richer, and the drug lords keep on killing each other, eventually Mexico will win. Think rates of return, or think of government revenue as rising over time. I’m not saying the drug problem will ever disappear there.

Murder rates have stabilized or fallen in some key northern cities, including Juarez. Sending in the army seems to yield returns, in light of scared and corrupt local police forces.

Both the American recovery and the slowdown in China, combined with higher Chinese wages, will help Mexico and thus help the government against the drug gangs.

I fully admit this is speculation on my part, but it is my view.

Who would be a better president of the World Bank?

I see so many tweets and posts on this question. None of you know, I suspect. A few questions:

1. It is widely recognized that the Bank’s board “interferes” in WB activities too much, often meeting two times a week and also pushing through contracts which should be stopped or reexamined. Who can best stand up to that board when necessary? Can that be done at all, while keeping the contract-addicted major economic powers still interested in the Bank?

2. The WB is financially fairly dependent on China, which for whatever reason prefers to borrow from the Bank rather than use its reserves to finance projects. What should a president do if China starts seeing itself as “graduating” from this relationship? Or what if China falls apart economically? Will the World Bank end up like the UN, losing some of its talent and being hat in hand, asking for funds?

3. Let’s say the BRICS continue with their plan to set up a separate lending facility, as endorsed recently by Zoellick. How should a president keep the BRICS interested in the World Bank? Should the new lending facility be fought, co-opted, subsidized, or whatever? Competition or collusion?

4. The U.S. President tries to pressure the WB to create projects in Afghanistan or Iraq which the Bank doesn’t really want to do. Stand up to the President, fold, or meet him halfway? How should project demands involving the West Bank be finessed?

Maybe, maybe, maybe — if you knew the major candidates well — you could have some sense who would perform better at those tasks. And at about fifty others. Maybe. Maybe not.

It is hard to predict how any particular candidate would do. We do know who is likely to get the job. We don’t know what it is like to have a non-American facing those kinds of problems.

Addendum: Chris Blattman comments.

Assorted links

2. John Cochrane on the mandate, again.

3. Peter Marber’s critique of economic statistics.

4. A jobless recovery means the routine jobs never come back.

5. China markets in everything.

6. The Minerva Project, on-line higher ed., Summers chairs the advisory board.

The King’s Gambit story turns out to be false.

The new casinos and how they induce you to spend money

Using the Panoscope method, Finlay compared the mental effects of classic casinos, with low ceilings and a mazelike layout, to those of casinos designed by Thomas. Subjects surrounded by footage of Thomas’s interiors exhibited far higher levels of what Finlay terms mental “restoration”—that is, they were much more likely to say that the space felt like a “refuge” and reduced their stress level. They also manifested a much stronger desire to gamble. In every Panoscopic matchup, gamblers in Thomas’s rooms were more likely to spend money than those in Friedmanesque designs. Although subjects weren’t forced to focus on the slot machines, the pleasant atmosphere encouraged them to give the machines a try.

Finlay refers to Thomas’s environments as “adult playgrounds,” since they provide an atmosphere in which people are primed to seek pleasure. “These casinos have lots of light and excellent way-finding,” she told me. “They make you feel comfortable, of course, but they also constantly remind you to have fun.”

…Thomas’s designs have a particularly marked effect on those guests who normally don’t gamble. The seduction of his décor, perhaps, is that it doesn’t feel like a gambling environment. The beauty is a kind of anesthesia, distracting people from the pain of their inevitable losses.

I just noticed exactly this from my trip yesterday to the newer complexes. While I felt no temptation to gamble, I found them far more pleasant than the traditional casinos, and if I were going to gamble, I would do it there. My refuge I found in Jose Andres’s restaurant China Poblano (in the Cosmopolitan), which I recommend if you are also here for the APEE meetings.

Matthew Bishop’s new book

With Michael Green, In Gold We Trust: The Future of Money in an Age of Uncertainty, Kindle Single. Here is a short video about the book.

From the authors:

It provides a lively analysis of the big economic questions currently facing America, such as the danger to the dollar posed by gridlock in DC, especially over deficit reduction, the euro crisis, the growing risk of inflation and the changing attitude of China towards America. We argue that the renaissance of gold, plus the development of virtual currencies such as Bitcoin, reflect weaknesses in the technology of money that we all need to take seriously and try to fix.

International PPP for faculty salaries

Not exactly what I would have thought:

Canada comes out on top for those newly entering the academic profession, average salaries among all professors and those at the senior levels. In terms of average faculty salaries based on purchasing power, the United States ranks fifth, behind not only its northern neighbor, but also Italy, South Africa and India.

Assorted links

1. Scott on lunch at China Star.

2. Aristide update, the bottom line, worth a read.

3. High school graduation rate is showing progress.

4. Europe puts solar energy on standby, that was the headline in the print version of the story.

Assorted links

2. Who’s afraid of development?

3. The world’s fastest reader?

4. Markets in everything homeless hot spots.

5. Economic origins of the Sicilian Mafia.

6. A new study of RomneyCare and health outcomes. I have yet to read the paper.

Assorted links

Markets in Everything: US Public Schools

Reuters: Across the United States, public high schools in struggling small towns are putting their empty classroom seats up for sale.

In Sharpsville, Pennsylvania, and Lake Placid, New York, in Lavaca, Arkansas, and Millinocket, Maine, administrators are aggressively recruiting international students.

They’re wooing well-off families in China, Saudi Arabia, Pakistan, Russia and dozens of other countries, seeking teenagers who speak decent English, have a sense of adventure – and are willing to pay as much as $30,000 for a year in an American public school.

The end goal for foreign students: Admission to a U.S. college.

So far the numbers are small. US high schools do outperform those in many other countries but the quality is modest relative to other developed countries and it’s hard for me to see this as a boom market. Nevertheless, I think I will warn my teenager that an exchange program with South Korea is an option.

Hat tip: Daniel Lippman.

Assorted links

1. Emily Chamlee-Wright is to be provost and dean at Washington College.

2. NBA geography.

3. A Straussian reading of Tabarrok’s Launching the Innovation Renaissance, by the excellent Eli Dourado; “Launching the Innovation Renaissance represents Alex Tabarrok standing athwart history, yelling “Back up 800 years!””.

4. Guns don’t kill people, cannonballs do.

5. The language that is German, a response to Michael Lewis.