Tuesday assorted links

1. Perplexity, Deutsche Telekom, and an AI smartphone.

2. GPT 4.5 and Bishop Berkeley!

3. Stocks vs. flows, blah blah blah you still can compare two numbers.

4. “That men once stood before the Rokeby Venus and gawped means nothing to us.”

5. GDP forecasts getting worse.

6. Australian who blood saved the lives of 2.4 million babies dies. James Harrison, RIP.

Regime Uncertainty

Robert Higgs coined the term regime uncertainty to illustrate the challenge faced by business under Franklin Roosevelt’s New Deal, when a flurry of unpredictable legislation such as the expansive and often unclear mandates of the National Industrial Recovery Act (NIRA), attempts at court packing, abrupt tax increases, and shifting labor policies, meant businesses couldn’t reliably forecast returns or risks. Uncertainty magnified bad policy causing investment to collapse and remain unprecedently low.

For the eleven-year period of 1930 to 1940, net private investment totaled minus $3.1 billion. Only in 1941 did net private investment ($9.7 billion) exceed the 1929 amount.

The data leave little doubt. During the 1930s, private investment remained at depths never plumbed in any other decade for which data exist.

Real options theory explains why uncertainty can reduce investment even more than predictable but unfavorable policies. Suppose you’re deciding whether to build a factory in North Carolina or South Carolina. Both locations are viable, but one of the Carolina’s might offer a tax concession—though the decision won’t be announced for six months. Even if investing immediately would still be profitable without the concession, you might choose to delay building the factory. The potential benefit of waiting (the real option) only needs to offset the costs associated with waiting. Thus, even modest uncertainty can incentivize investors to delay big investments. Recent studies confirm Higgs’ insights: spikes in uncertainty strongly correlate with declines in private investment.

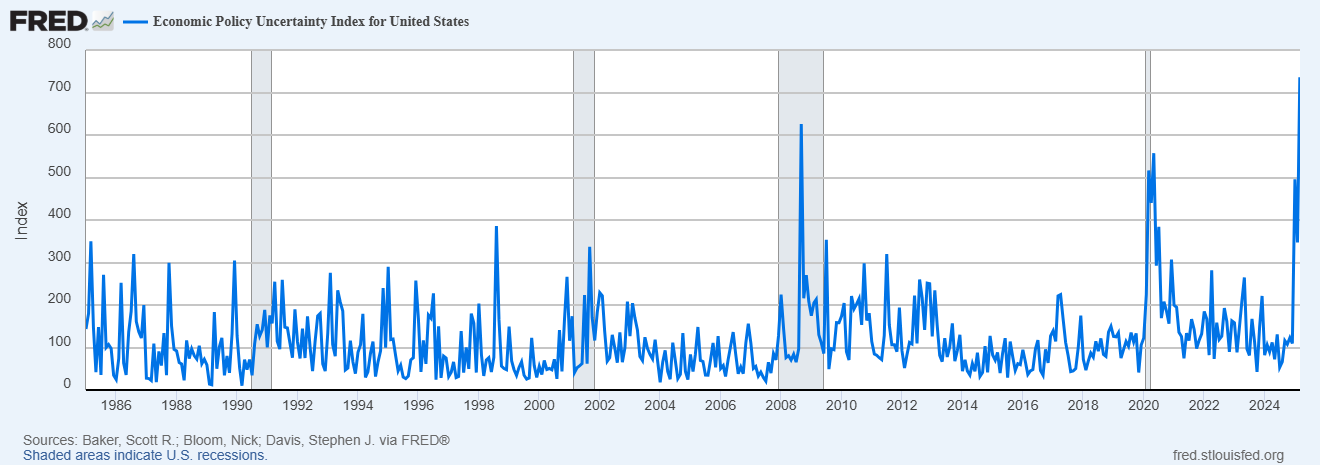

Ok, so where do we stand? We are now at a greater level of uncertainty than anything over the last 40 years, barring the worst weeks of the 2008 financial crisis (updated graph as of today!). Investment has begun a modest decline. Some, very preliminary data (take with a grain of salt) are already predicting a recession.

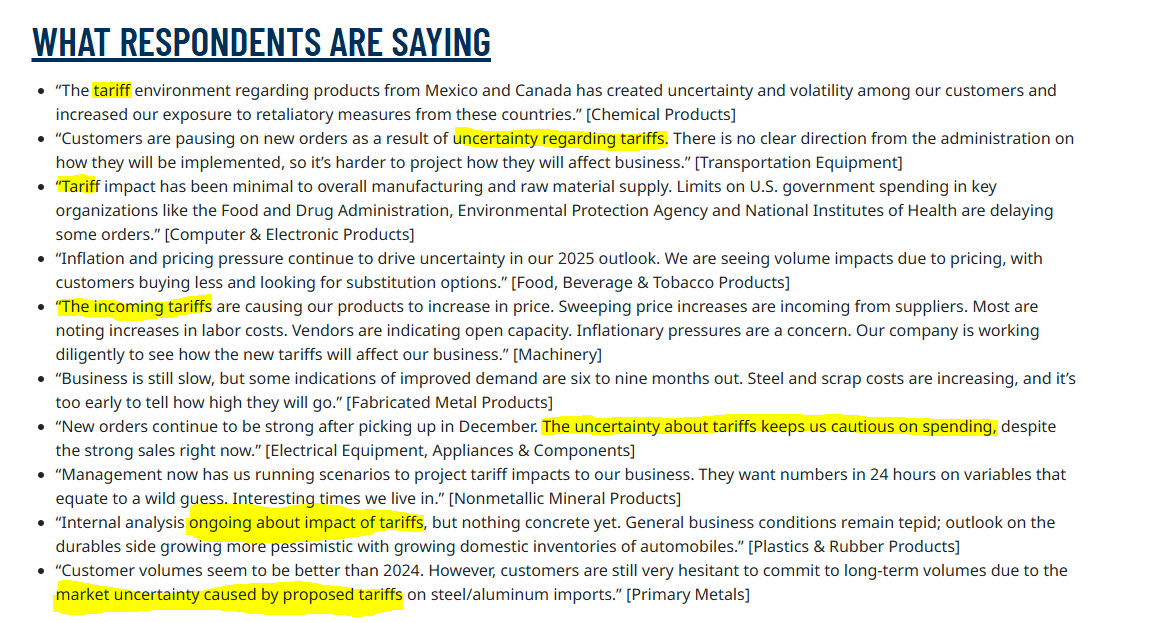

Tariff policy is especially bad because it is uncertainty about bad events. Here are comments from the latest ISM survey (h/t Joe Weisenthal).

Much of the Trump administration’s agenda promises long-term benefits, but chaos and uncertainty threaten its success. Tariff policy, in particular, is bad economics and even worse foreign policy. Even if Trump’s tariff strategy stabilizes, global responses—and their ripple effects—remain unpredictable and with potentially severe downsides. This uncertainty could spark an economic downturn, jeopardizing the administration’s otherwise strong policies.

All of this is unnecessary. We need to get back to the best case for a Trump Presidency.

New results on AI and lawyer productivity

From a new piece by Daniel Schwarcz, et.al., here is part of the abstract:

This article examines two emerging AI innovations that may mitigate these lingering issues: Retrieval Augmented Generation (RAG), which grounds AI-powered analysis in legal sources, and AI reasoning models, which structure complex reasoning before generating output. We conducted the first randomized controlled trial assessing these technologies, assigning upper-level law students to complete six legal tasks using a RAG-powered legal AI tool (Vincent AI), an AI reasoning model (OpenAI’s o1-preview), or no AI. We find that both AI tools significantly enhanced legal work quality, a marked contrast with previous research examining older large language models like GPT-4. Moreover, we find that these models maintain the efficiency benefits associated with use of older AI technologies. Our findings show that AI assistance significantly boosts productivity in five out of six tested legal tasks, with Vincent yielding statistically significant gains of approximately 38% to 115% and o1-preview increasing productivity by 34% to 140%, with particularly strong effects in complex tasks like drafting persuasive letters and analyzing complaints. Notably, o1-preview improved the analytical depth of participants’ work product but resulted in some hallucinations, whereas Vincent AI-aided participants produced roughly the same amount of hallucinations as participants who did not use AI at all.

Of course those are now obsolete tools, but the results should all the more for the more advanced models.

How Bureaucratic Practices Preserve Elite Multigenerational Wealth

Here is a new paper from Doron Shiffer-Sebba, I found this most amusing but yes tragic too:

How do wealthy families preserve their fortunes across generations? A historic peak in wealth inequality in the United States has inspired research on how economic elites benefit from markets, tax rates, and legal entities. However, the ongoing practices through which families maintain their fortunes across generations are less understood. Using six months of ethnographic observations at a wealth manager for the top 0.1 percent, as well as interviews with the manager’s clients and a wider sample of managers, I argue that wealthy families adopt what I call “bureaucratic practices”—activities like meetings, presentations, and signing documents—to preserve wealth intergenerationally. After erecting legal entities such as corporations, trusts, and foundations, wealth managers help wealthy families implement bureaucratic practices. These practices, which privilege bureaucratic form over substance, constitute a crucial behavioral layer atop the legal infrastructure, facilitating a greater degree of wealth preservation compared with using entities alone. Thus, preserving wealth at the top should be understood not merely as a set of discrete transfers from parents to children, but as an enduring multigenerational process of professional socialization that introduces new behaviors into family life.

Via the excellent Kevin Lewis.

Emergent Ventures, Taiwan cohort

Thanks to a very generous donor, we now will be starting a Taiwan cohort in Emergent Ventures. If you are in Taiwan, or know anyone in Taiwan who might be a good choice, of course consider applying or recommending as such. Thank you!

Male coaches increase the risk-taking of female teams—Evidence from the NCAA

Highlights from the article:

The coach’s gender has a sizable and significant effect on the team’s risk-taking, a finding that is robust to an instrumental variable approach.

Women’s teams with a male head coach make risky attempts 6 percentage points more often than women’s teams with a female head coach.

The difference is persistent within games and does not change with intermediate performance.

Risk-taking has a positive effect on winning a game and teams with a female coach would win more often if they chose risky attempts more often.

The gap in risk-taking of female teams by their coach’s gender is the greater, the more experienced their head coach is.

That is from a new paper by René Böheim, Christoph Freudenthaler, and Mario Lackner.

Monday assorted links

1. Increased (Platform) Competition Reduces (Seller) Competition.

2. GPT 4.5 on Bernard Williams. It is quite funny on the AI skeptics, I might add.

3. AI bookmarks. And AI-generated sheet music for classical music. And the Luddites they ain’t.

4. 2005 redux, my idea of how to clean up the house.

5. I never knew the median voter theorem was this powerful.

6. How is Australian state capacity doing?

Stripe’s Annual Letter

Stripe’s Annual Letter is eminently quotable and insightful. As a payments company, Stripe has a unique data on the entire business landscape. But who else about the Collison brothers would cite the O-ring model in their annual report?

Businesses on Stripe generated $1.4 trillion in total payment volume in 2024, up 38% from the prior year, and reaching a scale equivalent to around 1.3% of global GDP.

The businesses on Stripe span every chromosome of the economic genome.

The US corporate sector is both a cradle of invention and a densely populated graveyard of companies that had fabulous futures in their pasts.

How is AI making it’s presence felt beyond chatbots?

…we started with ChatGPT, but are now seeing a proliferation of industry specific tools. Some people have called these startups “LLM wrappers”; those people are missing the point. The O ring model in economics shows that in a process with interdependent tasks, the overall output or productivity is limited by the least effective component, not just in terms of cost but in the success of the entire system. In a similar vein, we see these new industry specific AI tools as ensuring that individual industries can properly realize the economic impact of LLMs, and that the contextual, data, and workflow integration will prove enduringly valuable.

Examples in this vein include Abridge, Nabla, and DeepScribe, which are rethinking medical and patient care, while Studeo is reshaping how real estate businesses market property. Architects are using SketchPro to instantly render designs with simple text prompts, restaurants are using Slang.ai to take phone reservations, and property managers are unifying customer support with HostAl. Harvey, whose Al legal assistant is used by many Fortune 500 companies, quadrupled revenue in 2024.

AI and SAAS make small businesses competitive with big business:

From 2005 to 2017, independent pizzerias in the United States saw a decline in numbers as the industry franchised. Then that trend in 2017. By 2023, more independent pizzerias in America than in any other year on record.

We think the rise of vertical SaaS is at least partly responsible. From a platform like Slice, dedicated specifically to the needs of pizzerias, new businesses can get a logo, website, payment system, ordering system, marketing toolkit, and branded boxes—basically everything else they need to operate their pizza

business (except an oven and the perfect sauce). They can remain independent while still benefiting from a franchisee’s economies of scale.

Crypto has found product market fit with stablecoins, “room temperature superconductors for financial services”.

Why care about stablecoins? Improvements to the basic usability of money make economies more prosperous. Consider the transitions from coins to banknotes, from the gold standard to fiat currency, and from paper instruments to electronic payments. Stablecoins are a new branch of the money tree. Such transitions occur with some regularity over the centuries, and the effects tend to be large.

Stablecoins have four important properties relative to the status quo. They make money movement cheaper, they make money movement faster, they are decentralized and open-access (and thus globally available from day one), and they are programmable. Everything interesting follows from these

characteristics.

(See also my talk to Congressional staff with Garett Jones on stablecoins and President Trump’s Crypto Executive Order.)

Finally, Europe needs to wake up:

We don’t think that anyone in Europe deliberately made it a policy goal to discourage the creation or success of new firms, but this has been the inadvertent result. GDPR alone is estimated to have reduced profits for small tech firms in Europe by up to 12%. Those cookie banners hurt, whether you accept them or not.

What I’ve been reading

1. Eric Topol, Super Agers: An Evidence-Based Approach to Longevity. Longevity research goes mainstream! Very clearly written, well argued, and focused on the science. I cannot pretend to evaluate the details of the material, but this seems a step ahead of the other, typically less serious books on the same topic.

2. Daniel Dain, A History of Boston, 772 pp., clearly written and consistently interesting. Most of all one receives the sense of Boston as a place with a long history of radical ideas. Has it moved away from that tradition or cemented it in? I find that more and more of America has little acquaintance with New England and its history, and this book is one good way to remedy that. Remember Rt.128? Paul Revere?

3. Stephen Macedo and Frances Lee, In Covid’s Wake: How Our Politics Failed Us. A reasonable, evidence-based, non-crazy account of governance failures and excesses during the Covid crisis. For me there was not so much new here, but I am glad to see saner voices moving into the discourse.

4. Making and Meaning: The Wilton Diptych, National Gallery of London. If you want to learn about a historical figure (in this case Richard II), read a book about an art work associated with them.

5. Zaha Hadid, Complete Works 1979-Today. Architecture, plus excellent preliminary sketches of the works. The Weil am Rhein works are my favorite of what I have seen by her. Exactly the kind of picture book that will become more valuable in an age of strong AI. Here are seventeen buildings by her.

John McWhorter, Pronoun Trouble: The Story of Us in Seven Little Words. Mostly about actual pronouns, not the PC debates.

There is Paul Bluestein, King Dollar: The Past and Future of the World’s Dominant Currency.

Sunday assorted links

“What do I think of the Trump-Zelensky dust-up?”

A reader requests that in the comments, but it is exactly the kind of topic I can tire of. Nonetheless I will jot down a few quick pointers on how I think about it:

1. Downweight almost every opinion you read on Twitter, instead check the Ukrainian bond market. If need be, query with Grok on matters such as this. You can however consider Twitter opinions as sociological data of a sort, so downweight them for truth value but do not ignore them. Especially downweight comments designed to raise or lower various individuals in status, they are a kind of epistemic poison.

2. Look for say commentary from China, among other unusual sources. They have a stake in the matter, are often quite perceptive, and won’t be trapped by the same ol’ mood affiliations (they do of course have their own).

3. Consult with some friends and contacts involved in Ukraine, with good inside perspectives.

Triangulate and aggregate!

You will end up with something quite different from what either (American) “side” is saying.

Do female experts face an authority gap? Evidence from economics

This paper reports results from a survey experiment comparing the effect of (the same) opinions expressed by visibly senior, female versus male experts. Members of the public were asked for their opinion on topical issues and shown the opinion of either a named male or a named female economist, all professors at leading US universities. There are three findings. First, experts can persuade members of the public – the opinions of individual expert economists affect the opinions expressed by the public. Second, the opinions expressed by visibly senior female economists are more persuasive than the same opinions expressed by male economists. Third, removing credentials (university and professor title) eliminates the gender difference in persuasiveness, suggesting that credentials act as a differential information signal about the credibility of female experts.

Here is the full paper by Hans H. Sievertsen and Sarah Smith, via the excellent Kevin Lewis.

Some reasons why I do not cover various topics much

1. I feel that writing about the topic will make me stupider.

2. I believe that you reading more about the topic will make you stupider.

3. I believe that performative outrage usually brings low or negative returns. Matt Yglesias has had some good writing on this lately.

4. I don’t have anything to add on the topic. Abortion and the Middle East would be two examples here.

5. Sometimes I have good inside information on a topic, but I cannot reveal it, not even without attribution. And I don’t want to write something stupider than my best understanding of the topic.

6,. I just don’t feel like it.

7. On a few topics I feel it is Alex’s province.

Addendum: Pearl, in the comments, adds an excellent #8: “8. Choosing sides in these debates would reduce my overall influence and access to new information”

Personality traits and gender gaps

This paper examines the effects of the Big Five personality traits on labor market outcomes and gender wage gaps using a job search and bargaining model with parameters that vary at the individual level. The analysis, based on German panel data, reveals that both cognitive and noncognitive traits significantly influence wages and employment outcomes. Higher conscientiousness and emotional stability and lower agreeableness levels enhance earnings and job stability for both genders. Differences in the distributions of personality characteristics between men and women account for as much of the gender wage gap as do the large differences in labor market experience.

That is from German data, published in the JPE by Christopher J. Flinn, Petra E. Todd, and Weilong Zhang.

Saturday assorted links

2. Writing for the AI is paying off.

3. You’ve quoted Gerhard Richter as saying that a good picture “takes away our certainty,” and suggested (Philip Guston) that doing so enables us to “begin to see the push and pull of impulse, recanting, and reconfiguration that constitute painting and, by extension, life itself.” From Prudence Crowther.

4. Details on DOGE history (NYT).

5. Anthropic wants someone to write on the economic effects of AI.

6. “Access to legal status reduces the probability of immigrants intermarrying with natives by 40% and increases the hazard rate of separation for intermarriages by 20%.” USA data — incentives matter!