Month: January 2004

You are a better bargainer than you think

Negotiators tend to think they are more transparent than they truly are. They believe that their negotiating partners can discern their thoughts, and negotiating positions, when in fact the partners are clueless. See the experimental evidence from this recent paper by Leaf van Boven, Thomas Gilovich, and Victoria Medvec. There is good evidence that we send involuntary signals of our own trustworthiness. Still, we do not always have a good sense of how those signals are interpreted by others.

The basic result may stem from a kind of excess sympathy. The negotiator tries to put herself in the position of the “other mind,” but cannot eradicate the knowledge of her own bargaining position. So the model of the other mind contains more self-knowledge than is rationally justifiable. Related results have been found in other areas. Individuals overestimate how much others pick up on the cues from their facial expressions. Similarly, individuals who are laughing think they appear more expressive than they do to others. As for bloggers, well, they probably think that readers pick up more of the nuances of their writing than is the case.

The Endangered Species Act

Lynne Kiesling offers a thorough discussion of how the act does little to protect endangered animals. I had started my own post on this topic, but stopped writing once I came across Lynne’s, which is replete with excellent links. Juan Non-Volokh offers an equally biting critique of the Act.

The return of Horatio Alger

Paul Krugman published a December article in The Nation called “The Death of Horatio Alger.” He argued “America actually is more of a caste society than we like to think. And the caste lines have lately become a lot more rigid.”

Recent research by Kerwin Kofi Charles and Erik Hurst looks at intergenerational mobility in more detail. Here is a brief summary of the article, and here is a pdf of an earlier version of the paper.

The published version, “The Correlation of Wealth Across Generations,” in the December 2003 Journal of Political Economy, tells us the following:

1. “Age-adjusted parental wealth, by itself, explains less than 10 percent of the variation in age-adjusted child wealth.”

2. 20 percent of parents in the lowest quintile of the parent’s wealth distribution have children who end up in the top two quintiles of their generation. One-quarter of the parents in the highest wealth quintile end up with kids in the two lowest quintiles.

3. The age-adjusted intergenerational wealth elasticity is 0.37. What does this mean? If parents have wealth 50 percent over the mean in their generation, the wealth of their children will be 18 percent above the mean in the childrens’ generation.

4. Income levels account for about one-half of the parent-child wealth relationship. In other words, high income parents tend to produce high income children, to some extent. The children earn much of their wealth. Education and financial gifts account for very little of the correlation across parents and children.

5. Parents and children allocate their financial portfolios similarly, whether for reasons of genes or learned behavior. These common patterns of investment and savings are the second biggest factor behind the intergenerational wealth correlations we observe.

Note that the figures above do not include income from bequests. In this regard they underestimate some of the intergenerational correlation. On the other hand, large numbers of individuals do not receive bequests until they are at least in the 50s, so the figures measure the opportunities open to them in the earlier stages of their lives. And note that the data are recent, the wealth of the children is measured in 1999.

So what is the bottom line? Yes, there is some correlation in wealth across the generations. But most of that correlation (almost seventy percent) comes from continued hard work and savings. The authors do not examine Krugman’s claim that mobility once was greater, but it seems premature to suggest that the American dream is gone.

Addendum: Cardinalcollective.com offers some useful discussion and links, here is Daniel Drezner’s treatment, again replete with links.

Arthur Miller fails the test

On his recent visit to Cuba a group of writers practically begs Arthur Miller for help, for words of support, for some protection against their oppressive government and Miller is stumped. He’s so enthralled with Castro and his “fantastic shrimp” and “spectacular pork” that he is clueless to their plight. Morality does not require that we risk our lives, as some Cuban writers do, to speak truth to power but it does require that we honor those who do. What then to think of someone who laughs off their plight while enjoying wine with their oppressor? No Brad, it’s not just you, what Miller did was despicable.

A meeting had been arranged the previous afternoon, no doubt through the writers union, with some fifty or so Cuban writers. Initially the organizers had expected only a few dozen on such short notice, but they had had to find a larger space when this crowd showed up. We encountered a rather barren auditorium, a speaker’s platform and an odd quietness for so large a crowd. What to make of their silence? I couldn’t help being reminded of the fifties, when the question hanging over any such gathering was whether it was being observed and recorded by the FBI.

It was hard to tell whether Styron’s or my work was known to this audience, almost all of them men. In any case, with the introductions finished, Styron briefly described his novels as I did my plays, and questions were invited. One man stood and asked, “Why have you come here?”

Put so candidly, the question threw my mind back to Eastern Europe decades ago; there too it was inconceivable that such a meeting could have no political purpose. Styron and I were both rather stumped. I finally said that we were simply curious about Cuba and were opposed to her isolation and thought a short visit might teach us something. “But what is your message?” the man persisted. We had none, we were now embarrassed to admit. Still, as we broke up a number of them came up to shake hands and wordlessly express a sort of solidarity with us, or so I supposed. But in some of them there was also suspicion, I thought, if not outright, if suppressed, hostility to us for failing to bring a message that would offer some hope against their isolation. But back to the dinner with Fidel…

There were fantastic shrimp and spectacular pork, dream pork, Cubans being famous for their pork….

Why do Japan and China keep on buying dollars?

The dollar has fallen about twenty percent against the Euro in the last year but China and Japan continue to accumulate large dollar surpluses. At the same time, many economists worry that they will dump their holdings, sending the dollar into a free fall.

Michael Dooley, Peter Garber, and David Folkerts-Landau suggest that this financial policy is no accident. They view the Chinese and Japanese as pursuing deliberate full employment policies. They buy and hold dollars, not as an investment, but rather to subsidize their own exports. Read this summary of the argument, or buy an NBER working paper here. Garber puts the point bluntly:

“The fundamental global imbalance is not in the exchange rate,” Garber told the IMF forum in November. “The fundamental global imbalance is in the enormous excess supply of labor in Asia now waiting to enter the modern global economy.”

Garber estimates that there are 200 million underemployed Chinese who must be integrated into the global economy over the next 20 years. “This is an entire continent worth of people, a new labor force equivalent to the labor force of the EU or North America,” he explains. “The speed of employment of this group is what will in the end determine the real exchange rate.”

Garber likens the global labor imbalance to the collision of two previously independent planets — one capitalist and one socialist. “Suddenly they were pushed together to form one large market,” he says. The best way to restore equilibrium is for the former socialist economies to pursue export-led growth — and for the United States to act as a buffer and absorb the world’s exports.

Brad DeLong says he doesn’t believe the argument because the U.S. trade deficit is too large relative to the American economy. Brad predicts a revaluation of the Asian currencies within three years. Garber predicts that the new arrangement can last until another 200 million migrating Chinese find jobs. Either scenario would be better for the U.S. economy than some of the scare stories suggest. A weaker dollar in Asia would help correct the U.S. trade imbalance and it is unlikely that the Chinese would allow the yuan to rise so rapidly that the dollar would plummet. And if the current arrangement can continue, so much the better. The bottom line is this: the world economy, in real terms, is drawing on a massive “free lunch,” namely migrating Chinese labor.

Wacky Warnings

The Michigan Lawsuit Abuse Watch has posted the winners from their Wacky Warning Labels contest. First prize was for a warning on a bottle of drain cleaner which says: “If you do not understand, or cannot read, all directions, cautions and warnings, do not use this product.” Fifth prize went for a fishing lure which warns, “Harmful if swallowed.” Check out who won second prize.

Against Broken Windows

James Q. Wilson’s broken windows theory is simple: broken windows, or other symbols of public disorder, invite crime. Thus, if you clean up the neighborhood, crime should go away. The NY Times discusses research conducted by Felton Earls, Rob Samson, Steve Raudenbush and Jeanne Brooks-Gunn testing this theory. They drove an SUV through *thousands* of Chicago streets and recorded with a video camera just about everything that was visible on the street – garbage, loitering, grafitti, etc. They also had data on crime and the attitudes and behavior of residents. Analysis of data showed that public signs of disorder such as garbage were not linked to crime. Instead, concentrated poverty and the willingness of residents to self-police (“collective efficacy”) explained the incidence of crime. The Times quotes Earls:

“If you got a crew to clean up the mess,” Dr. Earls said, “it would last for two weeks and go back to where it was. The point of intervention is not to clean up the neighborhood, but to work on its collective efficacy. If you organized a community meeting in a local church or school, it’s a chance for people to meet and solve problems.

“If one of the ideas that comes out of the meeting is for them to clean up the graffiti in the neighborhood, the benefit will be much longer lasting, and will probably impact the development of kids in that area. But it would be based on this community action – not on a work crew coming in from the outside.”

This point should be taken to heart by all students of crime. Yes, of course, police are necessary for public order and safety. But the police are finite resource – they can’t possibly monitor every street and corner. Thus, on a fundamental level, public safety comes from a community’s ability to regulate itself. The next time you hear a call for more police, or more prisons, or more public works, think about this insight.

Cool stuff

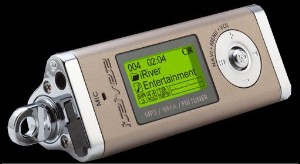

I am wowed by my flash-memory MP3 player, the IRiver 190T. It has enough memory (256 MB) to store 5 or 6 albums at CD quality and more at slightly lower quality. There are no moving parts so it doesn’t jog or skip and one AA battery (included!) will run it for 20 hours or so. It weighs just slightly more than the battery and will fit on a key chain. It has a surprisingly good FM radio and can also record FM radio or voice. Finally, you can set it up like a small hard drive so it can store any file, not just music – handy for carrying around backup power-point files (USB cable needed but included). The only thing I dislike is the ear buds – I hate ear buds, they just fall out of my ears! I recommend instead the Sony MDR-CD180s headphones which are a great value at less than $20 (Consumer Reports rates them higher than headphones costing 3 or 4 times as much) – you can buy better headphones but these are cheap enough to lose on an airplane – an important factor in my book. Here is a picture of the 190T (actual size is a little larger at 80 x 32 x 25 mm).

Movie Cramming

So many great films to see, so little time. Return of the King, Mystic River, Monster, House of Sand and Fog – all are Oscar contenders and all are showing now. Roger Ebert rates Monster as the best film of 2003 despite the fact that it opened – in NY and LA only – on December 24. Of the last 25 Best Picture Oscar winners, 12 were released in December and only 3 were released in the first half of the year. Why?

I think the main reason is the pull of the Academy Awards – this year the awards are on Feb. 29 and voting occurs in late January and early February. The studios figure, probably correctly, that Oscar voters have poor memories so a film that opens late in the year has a better chance of winning than one that opens early. (The theory is a little hard to test because of the self-fulfilling prophecy problem but I think there is some truth to it.)

The unfortunate result is to reduce total movie revenues. We and the studios would probably be better off if the good movies were spread throughout the year, giving us more time to see each one, but such a situation is not stable because opening late gives a movie an advantage even if that advantage tends to disappear when all the studios act similarly (the prisoner’s dilemma).

Can the problem be fixed? The Academy could ask for ratings several times a year although this would require rating on absolute scale (like 1 to 10) rather than just voting for the best film. A graduated tax based on release date would do it in theory but I’m not optimistic about the practice. What I’d really like to see is other organizations such as the LA Film Critics go to a fiscal-year award cycle and make their awards in July. I know, it’s an idea only an economist (or an accountant) would like.

Reparations for Haiti?

Many Haitian politicians, including Aristide, are demanding $21 billion in reparations from the French government. They seek the return of the 1825 “blood money” they paid to Paris for their 1804 independence, with compound interest of course.

Today the Haitian government pulls in a mere $237 million a year. I have seen per capita income estimates ranging from $250 to $400 a year, depending on which numbers you trust. So $21 billion would make a big splash in at least a few bank accounts. One of the European papers I picked up on honeymoon cited a Haitian politician as claiming, without irony or apology. that “claims to restitution” were now his country’s chief national asset. That same politician objected to the rest of the world viewing Haiti as “barbarians.”

And the not so surprising response?

The French government has balked at the demand, citing “bad governance” and the 200 million Euros (about $250 million) of aid already dedicated to Haiti since 2000.

Samuel Bowles, in his recent book, suggests that Haiti may have been the richest place in the world at the end of the eighteenth century. While this estimate may be exaggerated, there is little doubt that the place once was prosperous. Even after the French tribute and blockade, Haiti was considered to be richer than its island neighbor the Dominican Republic. But today the DR has a per capita income over $2,000, many times that of Haiti. More generally, calls for long-term restitution face a problem of benchmarking damages. If the oppression in question had not happened, what is the relevant comparison? A Haiti where the French confer all relevant benefits and then act like gentlemen? Or a Haiti where the French never show up at all? And if the Haitian economy has been shrinking, should we not compound the 1825 loss at a negative rate of interest rather than a positive rate? It is difficult to believe that those funds would have been saved and invested at positive rates of return, reaching into the present day.

Is it better to be a small nation?

Of the ten richest countries in the world in terms of GDP per head, only two have more than 5m people: the United States…and Switzerland, with 7m. A further two have populations over 1m: Norway, with 4m and Singapore, with 3m. The remaining half-dozen have fewer than 1m people.

The Size of Nations, a new book by Alberto Alesina and Enrico Spolaore, addresses why some small countries have done so well. Here is a related working paper by Alesina, here are some related working papers by Spolaore. As some of the larger empires of the past break up, questions of national size increase in importance. More than half the world’s countries have fewer than six million people, roughly the population of the state of Massachusetts.

The Economist offers the following summary:

The book argues that the best size for countries is the result of a trade-off between the benefits of scale and the costs of heterogeneity; and that openness to trade alters this trade-off. The gains from being big are considerable. Large countries can afford proportionately smaller government (although they often don’t). Essential running costs can be spread over many taxpayers. Embassies, armies and road networks are all likely to cost less per head in populous countries. Defence in particular is cheaper for giants. “It is only safe to be small in a peaceful world,” say the authors (who, unusually for economists, offer two stimulating chapters on conflict, war and the size of nations).

Large countries are able not only to spend more efficiently; they can also raise taxes in more cost-effective ways. Income taxes are more efficient than customs duties, but require a bigger initial bureaucracy. Large countries have bigger internal markets, allowing more specialisation and returns to scale. And they can redistribute resources geographically, providing insurance when one part of the country is hit by disaster or recession and shifting income from rich regions to poor ones.

So why don’t all countries merge into one large superstate? Well, smallness has its benefits too:

…large countries are also likely to have a diverse population whose varying preferences and demands a government may find hard to meet: America, Brazil and India are cases in point. A study of local government in the United States suggests that Americans are willing to put up with the higher running costs of small municipalities and school districts in exchange for living in communities with little variation in income, race or ethnicity. This could imply that people also prefer to live in more homogeneous countries. With the main exception of America, successful big countries (such as Japan) have relatively homogeneous populations.

The authors argue that a worldwide regime of free trade will make the optimal size of nations smaller. If you can trade with other nations, there is no need to be large to ensure an open internal marketplace. So rising globalization should make secession easier to endure, which indeed seems to be the case.

My take: I am less convinced of the benefits of smallness. Think of small countries as having greater scope for experimentation, and thus a higher variance of outcomes. They also pop in and out of existence at a higher rate. Brazil will always be Brazil, but the fortunes of Croatia have varied over the years. If we look at the small countries that continue to exist, there is positive selection bias. We should expect them to do better than average, as the failures disappear, unlike with the less politically fluid larger countries. The observed superior performance of small countries does not mean that ex ante you should prefer to live in San Marino. In a small country, you face some very real chance that your system will fail, and that you will cease to exist, possibly under unfavorable terms. Especially if you are risk-averse, there is much to be said for the security of living in a larger nation.

Violence and Economy Building

Vadim Volkov’s “Violent Entrepreneurs” has an interesting discussion of protection rackets in the Russian economy. An interesting point is that Russian business and oranized crime have become symbiotic. Once a gang provides “protection” to a business, the gang considers the business their “turf” and becomes dependent on the income from the business. Eventually, gangsters come to guarantee transactions of the businesses they protect, a sort of underwriter that facilitates business. Volkov points out that a later wave of ex-army “protectors” came to provide a more legitimate, institutionalized form of protection against these earlier gangsters, which in turn opens the door for the reclaiming of the Russian state’s monopoly over violence. Robert Cottrell has a nice discussion in his New York Review of Books essay.

Oxford Encyclopedia of Economic History

Oxford University Press has just published a five-volume Encyclopedia of Economic History, edited by Joel Mokyr of Northwestern University.

Virginia Postrel offers a good review and some interesting details:

Did you know that the oldest records of chemical pest control date back 4,500 years, to Sumerian farmers who used sulfur compounds to kill insects and mites?

Or that a century ago, railroad companies accounted for half the securities listed on the New York Stock Exchange? (Before the railroads, with their huge demand for capital, securities markets traded almost entirely in government debt.)

Or that in 1850, shoemaking employed more workers in the United States than any other manufacturing business?

The past doesn’t look quite like we tend to picture it: many of the people who got rich from the Industrial Revolution were not industrialists, but landowners who held urban real estate or property with access to water power or mines. From 1880 to 1914, unions went on strike at least 50 times to stop American employers from hiring black workers. Above all, Professor Mokyr says, “in the Middle Ages and in classical antiquity, the destitute were the vast majority of the population.”

And what is the bottom line to economic history?

Professor Mokyr says: “There are certain unifying themes that you see everywhere. People have to make a living. People would rather have more than to have less. On the whole, they don’t behave stupidly. They do as well as they can under the circumstances. The variation is in the circumstances, in the richness and diversity of human economic institutions that have emerged over time.”

That is not all:

“Economic history,” Professor Mokyr writes in the preface, “covers nothing less than the entire material existence of the human past.” The encyclopedia gives theoretical economists a way to check their ideas against the realities of the past. “You guys can’t write these big, fancy models without looking at the details,” Professor Mokyr says.

I have not yet seen the volumes but most likely the set will not be surpassed anytime soon.

Facts about gift-giving

A recent Australian article cites some facts about gift-giving:

1. 28 per cent of surveyed respondents admitted that they “recycle gifts.”

2. Women give Christmas gifts to more people than do men. The average difference is 12.5 versus eight.

3. Women devote more time to selecting the appropriate gift, 2.4 hours per recipient versus 2.1 hours for male gift shoppers. [I will surmise, without any systematic data, that the real difference is far greater.]

4. Women are more successful in finding desired gifts. 10 per cent of women’s gifts were returned to the shop, as opposed to 16 per cent for gifts given by men.

A good theory of gift giving should account for the greater popularity of gifts among females. I could not help but notice that during my recent honeymoon, my wife bought gifts for many of her friends. I bought family-related gifts, but did not buy a gift for a single friend.

The linked article notes one theory of gifts, called the search theory:

…gift giving makes sense in cases where the giver’s knowledge of where to find something the recipient wants is greater than the recipient’s own knowledge. Or if the giver is in a position to get it cheaper. So the rule is that the giver gives a gift only when her “search costs” for the gift are lower than those of the recipient.

This emphasis on the hassle involved in finding suitable presents helps explain why, even though it’s regarded as poor form to give money, parents are more likely to resort to money as their children get older. The parents’ search costs rise as they become less certain what their kids would like, whereas the kids’ search costs fall as they become more independent. This theory also helps explain why people who go on trips return with presents. Their gifts tend to be things that are dearer or harder to find at home. Even so, it’s hard to believe the theory accounts for more than a fraction of gifts.

The search theory explains some of observed practice, but not why women devote more attention to gift-giving. Perhaps women, having lower average wages, also have lower average search costs. More likely, women find it more worthwhile to invest in a tight network of extended family and close friends. Men might find it more worthwhile to invest in a goal-oriented mentality, which will discourage large amounts of time spent shopping. When it comes to shopping more generally, gifts or not, men take less time, are more decisive, more prone to impulse purchases, and less likely to look at the price tag. Read this account of gender differences in shopping. Buying gifts may require an attention to shopping detail that men simply do not have in the first place.

Arab stock markets are up

Middle Eastern stock markets have turned out to be some of the year’s best performers. The Saudi exchange is up by 74 percent and Kuwaiti shares have doubled in value, according to the 3-9 January issue of The Economist. Here is another on-line summary, as of late November. It is not just high oil prices, the All-Arab Index, which covers 79 stocks in 12 Arab countries, is up 50% in dollar terms for 2003. Furthermore the Egyptian market is up 60% for the year, you can follow the Egyptian market here. The U.S. officially accredited the Egyptian stock just this year. By the way, you can follow the Palestine Stock Exchange, and the associated Al-Quds index with 28 listed companies, through this page. I would not in general recommend this investment, but for the year it is up an improbable 12.15%. Not surprisingly, the capture of Saddam was good for most Middle Eastern markets.

I have been in many ways skeptical of the postwar Iraq policies of the Bush administration. But in light of this information it is more difficult to argue that we are destabilizing the entire Middle East, at least relative to previous expectations of investors.