Month: September 2011

The consumer hourglass theory?

P&G isn’t the only company adjusting its business. A wide swath of American companies is convinced that the consumer market is bifurcating into high and low ends and eroding in the middle. They have begun to alter the way they research, develop and market their products.

Food giant H.J. Heinz Co., for example, is developing more products at lower price ranges. Luxury retailer Saks Inc. is bolstering its high-end apparel and accessories because its wealthiest customers—not those drawn to entry-level items—are driving the chain’s growth.

Citigroup calls the phenomenon the “Consumer Hourglass Theory” and since 2009 has urged investors to focus on companies best positioned to cater to the highest-income and lowest-income consumers. It created an index of 25 companies, including Estée Lauder Cos. and Saks at the top of the hourglass and Family Dollar Stores Inc. and Kellogg Co. at the bottom. The index posted a 56.5% return for investors from its inception on Dec. 10, 2009, through Sept. 1, 2011. Over the same period, the Dow Jones Industrial Average returned 11%.

“Companies have thought that if you’re in the middle, you’re safe,” says Citigroup analyst Deborah Weinswig. “But that’s not where the consumer is any more—the consumer hourglass is more pronounced now than ever.”

…Firms catering to low-income consumers, such as Dollar General Corp., also are posting gains, boosted by formerly middle-class families facing shrunken budgets. Dollar stores garnered steady sales increases in recent years, easily outpacing mainstream counterparts like Target Corp. and Wal-Mart Stores Inc., which typically are more expensive.

Here is more, no need to click on their silly links.

Bond markets in everything

But there is a backdoor onto Centre Court. About 2,500 seats are reserved for investors in the club’s so-called debentures, or bonds.

The club has issued these since the 1920s to finance development. But instead of paying cash coupons, like regular bonds, Wimbledon debentures pay interest in something much more valuable: tickets.

Holders get one ticket for each day of the Wimbledon tournaments during the five-year life of the bond. And here is the kicker: If you don’t feel like going on any given day, you can sell it—legally.

Such mini-bonds are a new trend in the UK, in part because the banking system is skittish about allocating credit to many small firms.

Assorted links

1. Business investment as a key to recovery, from Greg Mankiw. Lots of important truth in this piece.

2. Dalit classical liberalism, and here (pdf).

3. Robert Barro’s recipe for change.

4. Good analysis of how the second Greek bailout relates to the first, cynical piece. Here is an intelligent piece on doing the unthinkable for Europe.

5. Raghuram Rajan argues against a dose of inflation. And surprise as a reason to drink cheap wine, via The Browser.

Douglas Irwin on the 1937-38 contraction

If we are to avoid the mistakes of the past, it is important to have an accurate assessment of what those past mistakes were. The severity of the Recession of 1937-38 was not due to contractionary fiscal policy or higher reserve requirements. By contrast, the policy tightening associated with gold sterilisation was not modest – it did not simply reduce the growth of the monetary base by a few percentage points, it stopped its growth altogether. While the Federal Reserve is often blamed for its poor policy choices during the Great Depression, the Treasury Department was responsible for this particular policy error.

Here is more, and the paper is here. This should be considered the new default view.

Sentences to ponder

“China is a poor country with only $4,000 per capita income,” Yu Yongding, a Chinese top economist and former member of the central bank’s monetary policy committee said in an interview in China. “To talk and think about China to rescue countries with $40,000 per capita incomes is ridiculous.”

The article (mostly on Europe) is here. I can imagine a minimum of three theories of geopolitical influence:

1. You get it by having a nice country and it is then more or less automatic, possibly proportional to size as well.

2. It is hard to get in any case, as most countries do what they want anyway and are not much susceptible to outside influence.

3. Geopolitical influence is proportional to how much a government invests in it.

To the extent #3 is true, it does not bode well for the future of the welfare state.

Predictions on Greece and Germany

From Yanis Varoufakis:

Greece will not be allowed to default before Germany first puts in place a decent plan for splitting Greece’s monetary system from that of the surplus countries. But if I am right that such a plan cannot involve the mere expulsion of Greece from the euro, as it will kick off a chain reaction that will eventually knock France out for a sixer before returning to Frankfurt and Berlin to haunt the ‘planners’, the only logical conclusion that I can come to is that, behind all the talk of a German plan to contain a Greek default or to push Greece out of the euro, lies the groundwork for a pragmatic plan that sees Germany bailing itself out; a plan according to which Germany will round up countries it truly deems worthy of sharing its new currency with (the other three surplus countries of the existing eurozone plus perhaps Poland, the Czech Republic and even Estonia) and exiting in the most orderly manner possible; offering, for example, to the eurozone countries that will be left behind (fretting France in particular) a few gifts (e.g. Germany may choose to foot the bill for existing bailouts), an illusion of unity (e.g. suggesting that the new Germanic currency is also minted and administered by the ECB – which will now be responsible for more than one currency at once), and some vague promises (of possible fusion of these currencies, once the ‘right’ discipline has been knocked into the hearts and minds of the undisciplined).

Here is more, interesting throughout. Maybe the Germans who resigned from the ECB basically see something like this coming, and wish to husband their political capital with the hard money factions of German politics.

Here is Yanis on Twitter, he covers Greece.

From the comments, on local employment of teachers

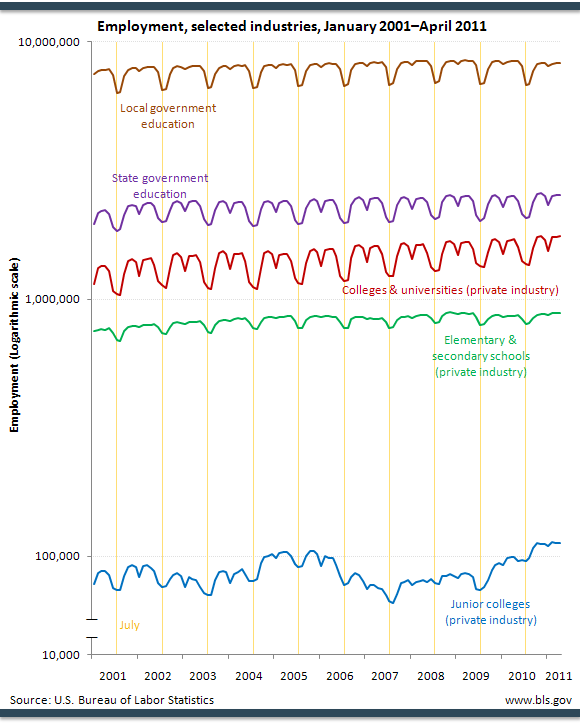

The scaling in the chart makes a big difference. Here’s the data behind the chart, which can by found by following a link on the site that Tyler links to: http://1.usa.gov/oOQXeO. For the local government column only and April figures. (May would be better but the series runs out at April 2011.) April 2011 was at 8.3 million, about 160K less than the peak two Aprils earlier. That’s about 1.5% difference.

That is from RZO, the link and context is here. In the same comment thread, Frank Howland notes that:

K-12 enrollments fell by 0.85% from 2007 to 2009

That’s not exactly the same years and the data go only to 2009 but could it be a general trend across 2009-2011? Given that context, there is still some decline in per capita local teacher employment. Note this is a sector where there is a growing realization that quite a few of the workers should, for non-cyclical reasons, be fired anyway.

Addendum: Karl Smith has a useful graph with seasonal adjustment, coming up with somewhat different numbers.

Is Social Security a Ponzi Scheme?

Matt Yglesias says anyone who thinks social security is a Ponzi scheme is nuts. So let’s take a look at some of these nuts. First up is Nobel prize winner Paul Samuelson who wrote:

The beauty of social insurance is that it is actuarially unsound. Everyone who reaches retirement age is given benefit privileges that far exceed anything he has paid in — exceed his payments by more than ten times (or five times counting employer payments)!

How is it possible? It stems from the fact that the national product is growing at a compound interest rate and can be expected to do so for as far ahead as the eye cannot see. Always there are more youths than old folks in a growing population. More important, with real income going up at 3% per year, the taxable base on which benefits rest is always much greater than the taxes paid historically by the generation now retired.

…A growing nation is the greatest Ponzi game ever contrived.

Samuelson wrote that in 1967 riffing off his classic paper of 1958. By “as far as the eye cannot see” he apparently meant not very far because it soon became clear that the system could not count on waves of youths or rapid productivity growth to generate the actuarially unsound returns that made the program so popular in the early years.

Milton Friedman and Paul Samuelson rarely agreed on much but Friedman also called social security a Ponzi scheme. In fact, he called it The Biggest Ponzi Scheme on Earth but perhaps Yglesias puts Friedman in the nut category so let’s go for a third Nobel prize winner who recognizes the Ponzi like nature of social security, none other than…..Paul Krugman (writing in 1996):

Social Security is structured from the point of view of the recipients as if it were an ordinary retirement plan: what you get out depends on what you put in. So it does not look like a redistributionist scheme. In practice it has turned out to be strongly redistributionist, but only because of its Ponzi game aspect, in which each generation takes more out than it put in. Well, the Ponzi game will soon be over, thanks to changing demographics, so that the typical recipient henceforth will get only about as much as he or she put in (and today’s young may well get less than they put in). (ital added, AT)

Of these, I agree the most with Krugman. Social Security is not necessarily a Ponzi scheme but it only generated massive returns in the past because of its Ponzi-like aspects. The Ponzi-like aspects are now over and social security is turning into what is essentially a forced savings/welfare program with, as Krugman recognizes, crummy returns for average workers. Social security is thus a Ponzi scheme which has not gone bust but it has gone flat.

How many unemployed teachers are there?

This bit from Bruce Yandle challenges the conventional wisdom:

As to hiring teachers, total employment in local government education is already up by one million workers since August 2010. Teacher employment in state government nationwide is up 300,000 workers. The unemployment rate in education and health services at 6.3% is one of the nation’s lowest unemployment rates. While the president implied that teachers were being cut from payrolls at a heavy pace, the data say otherwise. The president’s efforts are seen as misguided if the goal is to ease some of the pain in high unemployment sectors.

Here is another source:

As Figure 1 shows, state government education employment is up by 2.1 percent since the start of the recession while all other state government employment is down 1.9 percent — a substantially larger decline than in other parts of the state-local sector. State government non-education employment began falling less than a year into the recession, and fell below its pre-recession level about a year and a half after the start of the recession.

Do you wish to see more, including on local government education employment?

This BLS graph (look under “And which industries show declining employment over the summer?”) shows a strong seasonal trend which may confound some month-specific citations, but still the number seems to be back to where it had been in earlier years (admittedly the scaling and visuals are not what I would wish for) and more importantly it is hard to spot much effect of the recession at all:

So what exactly is the case here for stimulus of this sector? Is this really a sector to target? I would gladly see and consider alternate numbers and interpretations, but so far I file this under: “Yet another example of something the press should have reported about a President’s speech but didn’t.” Once again, it is the disaggregated demand which matters.

Assorted links

1. Property value calculator for the board game Monopoly.

3. Excellent piece by Stephen King on our current economic predicament, highly recommended.

4. In defense of Georgia Work$.

5. How to get out of our mess, by Jim Manzi. Notice the emphasis on wealth creation. And are scientists well-suited to be entrepreneurs?

New edition of Econ Journal Watch

The link is here, and there is a symposium of articles on property as a “bundle of rights,” including a contribution from Richard Epstein. There is also a podcast on whether papers with lemmas give rise to propositions which are tested in subsequent research.

When did the U.S. labor market slow down?

Scott Winship, at his new Brookings gig, reports:

The bleak outlook for jobseekers has three immediate sources. The sharp deterioration beginning in early 2007 is the most dramatic feature of the above chart (the rise in job scarcity after point C in the chart, the steepness of which depends on the data source used). But two less obvious factors predated the recession. The first is the steepness of the rise in job scarcity during the previous recession in 2001 (from point A to point B), which rivaled that during the deep downturn of the early 1980s. The second is the failure between 2003 and 2007 of jobs per jobseeker to recover from the 2001 recession (the failure of point C to fall back to point A).

Unemployment increased during the 2001 recession, but it subsequently fell almost to its previous low (from point A to B and then back to C). In contrast, job openings plummeted—much more sharply than unemployment rose—and then failed to recover. In previous recoveries, openings eventually outnumbered job seekers (where a rising blue line crosses a falling green line), but during the last recovery a labor shortage never emerged.

…Whatever the causes, the evidence is clear that the health of labor markets were compromised well before the recession.

There is much more at the link, including some very good graphs.

The economics of bombs

As the bombs get more difficult to construct or operate, the costs rise. Bombs activated with a remote detonator like a cellphone cost a mere $345 and accounted for a surprisingly small — 12.6 percent — of attacks, perhaps owing to the U.S.’ hard-won ability to jam the detonator signal. (One would imagine the major cost component is the cellphone.) For insurgents to turn a car into a bomb or convince someone to kill himself during a detonation — or both — the cost shoots up into the thousands: $10,032 for a suicide bomber; $15,320 for a car bomb; nearly 19 grand to drive a car bomb. All together, those relatively expensive attack methods accounted for fewer than six percent of bomb attacks in 2009.

Most of those bombs have gotten cheaper to produce. In 2006, victim-operated IEDs cost an average of $1,125. Command-wire bombs were $1,266. Remote detonation bombs? The same. And as the costs dropped, victim-operated and command-wire detonated bombs skyrocketed. Back in 2006, they accounted for merely 21.3 percent and a piddling 1.9 percent of all bomb attacks, respectively.

But the sophisticated bombs have gotten more expensive. Car bombs cost $1,675 on average in 2006 — which seems absurdly low, given the cost of one involves acquiring and then tricking out a car. And the going rate on suicide bombers appears to have risen, from $5,966 in 2006 to nearly double that in 2009. Accordingly, both accounted for over 16 percent of IED attacks in ‘06. And JIEDDO says it has preliminary reporting indicating that suicide bombers cost $30,000 as of January.

Here is more and for the pointer I thank David Curran.

Assorted links

1. What’s not getting cheaper (best charts on the second page of the link).

3. U.S. individual stock correlations are running fearfully high.

4. New book on the economics of sex.

5. Alex on the Obama jobs bill, Bryan on the Obama jobs bill, I’ve been traveling.

U.S. fact of the day

Univision dominated its English-language counterparts last night [Monday night], winning Monday night in adults 18-49 (2.3/6), adults 18-34 (2.5/7) and total viewers (5.7 million) with the three-hour finale of Pequeños Gigantes. Fox (2.0/5, 4.5 million) was second in the demo, paced by a new Hell’s Kitchen (2.6/6, 5.8 million) at 9 PM, which was the top-rated program of the night despite slipping 10% in the demo from last Monday. (It followed a Hell’s Kitchen rerun, which dragged down the network’s nightly average.) ABC’s two-hour Bachelor Pad (1.8/5, 5.9 million), was also down 10% from last week and edged Hell’s Kitchen as the most watched program of the night. The only other original last night was NBC’s Children of 9/11, the first of a slew of 9/11 specials to unspool on the broadcast networks this week. It drew a 1.1/3 demo rating at 10 PM, tying CBS’ Hawaii Five-0 rerun for the top spot in the hour.

The link is here.