Month: August 2012

300 Million Without Electricity In India After Restoration Of Power Grid

According to estimates, roughly one-third of a billion Indian citizens were left without power Wednesday after workers successfully repaired the nation’s electrical grid and brought all of its systems back online. “Since restoring our infrastructure to 100 percent capacity following Monday and Tuesday’s blackouts, vast swaths of India are now completely without access to electricity,” said the country’s power minister, Veerappa Moily, who confirmed that three out of every four residents lacked access to such basic amenities as lighting, food refrigeration, and the use of simple appliances now that the country’s grid had fully recovered. “We are currently not monitoring the situation, as everything appears to be functioning normally again in India.” Government officials also stated that the widespread power outage had in no way compromised their ability to provide adequate sanitation to 31 percent of India’s citizens.

The Onion hits on a hard truth.

An event study of ACA winners and losers

I have not had the chance to read through this paper, by Jonathan Hartley, but thought I should pass along the abstract and link:

Abstract:

The Patient Protection and Affordable Care Act of 2010 marked a substantial shift in US healthcare policy. We create an event study observing the returns of healthcare stocks in the S&P 500 when on June 28, 2012 the US Supreme Court very unexpectedly ruled that the individual mandate, a provision requiring that Americans maintain a certain level of health insurance or face a monetary penalty, was not unconstitutional. The paper finds that as a result of the upheaval, over two days following the ruling the cumulative average abnormal return of managed care stocks was -6.7% (equal to -$6.9 bn in market capitalization), while the same metric was -1.2% (-$1.5 bn) for biotechnology companies, 3.2% ($0.4 bn) for hospital firms, 1.9% ($1.6 bn) for healthcare service firms, and 0.5% ($4.8 bn) for pharmaceutical companies. Healthcare equipment, distribution, and technology sub-industry stocks had relatively flat cumulative abnormal returns over the period.

Do those results make you more or less favorable toward ACA?

Iran fact of the day

In public universities, female students now outnumber males 65% to 35%, leading to calls in parliament for affirmative action for men.

Here is more.

Assorted links

2. More from Diamond, Acemoglu, and Robinson.

4. The charcoal industry in Manila, a photo essay.

“Back to the Future of Green Powered Economies”

From Juan Moreno Cruz and M. Scott Taylor:

The purpose of this paper is to introduce the concept of power density [Watts/m²] into economics. By introducing an explicit spatial structure into a simple general equilibrium model we are able to show how the power density of available energy resources determines the extent of energy exploitation, the density of urban agglomerations, and the peak level of income per capita. Using a simple Malthusian model to sort population across geographic space we demonstrate how the density of available energy supplies creates density in energy demands by agglomerating economic activity. We label this result the density-creates-density hypothesis and evaluate it using data from pre and post fossil-fuel England from 1086 to 1801.

Many of you have been asking for more coverage of this topic, so here is a starter. Ungated copies are here.

What’s with the eurozone update?

A few of you have emailed and asked. I understand the latest as follows: Draghi basically understands the problem, but is hemmed in by Germany. He is now to some extent freelancing and daring Germany to pull him back in. He’ll print money to target short-term yields for the debt of the periphery, which he feels Germany might eventually accept, for lack of better alternatives and because it also keeps up the pressure for policy reforms. He’s rather audaciously trying to redefine what the ECB’s mandate should be taken to mean by defining a lot of “extracurricular” activity as keeping the system up and running. He’ll push for the banking license for ESM (which would allow them to significantly expand what they do and in essence bypass some of the charter restrictions on the ECB itself), which he probably feels Germany won’t accept but what the heck he’s gotten this far so why not keep on trying? It’s easy enough to criticize him for not having made any kind of full commitment, but he’s already played more of a dare game than most observers thought possible. I say he is doing a high-quality tightrope act which probably will fail but which increases the chance of the whole thing pulling through.

He’s daring the Germans to zap him, knowing he stands some chance of going down in history as the central banker who saved the eurozone, knowing that he has nowhere else to go, knowing the Germans have nowhere else to go, and knowing that he has nothing to lose from being fired or otherwise emasculated. He also knows he has a lot of other eurozone nations on his side.

Just not the ones who will end up paying the bills.

Brad Plumer adds useful comment with a survey of opinion.

Stephen L. Carter has a new novel out

The Impeachment of Abraham Lincoln. I should teach it next year for my Law and Literature class…

EconJobRumors.com

That site specializes in…economics job market rumors. It is also a more general bulletin board for discussing matters involving the economics profession.

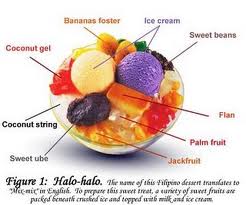

Halo-halo (yes I am in the Philippines)

Assorted links

2. Overview of why the Romney tax plan doesn’t add up.

3. The business of Bond, flip the toggle to adjust for inflation.

4. China markets in everything, hire a prison proxy.

Investment vs. the Warfare-Welfare State

In Launching the Innovation Renaissance and my Atlantic article The Innovation Nation vs. the Warfare-Welfare State I showed that the Warfare-Welfare state has crowded out federal investment in research in development.

In a short report titled Collision Course: Why Democrats Must Back Entitlement Reform, Jessica Perez, Gabe Horwitz, and David Kendall cut the data in a slightly different way but come to the same conclusion:

Entitlements are squeezing out public investments. In 1962, spending on investments was two and a half times that of entitlements. But today, as a result of this Great Inversion, entitlement spending is three times that of investments. And this trend will only accelerate in time as the Baby Boomers retire and their benefits grow faster than inflation and wages.

…The fact that entitlement spending is crushing investments is bad news for U.S. growth.

Hat tip: Arnold Kling.

What is a socially optimal level of bike-riding danger?

Maxim Massenkoff writes to me:

You’ve blogged about bike laws before; I have a question about a particular cyclist (me). As bikers go, I’m very considerate. I obey red lights and stop signs. But I’ve noticed that many DC drivers expect me to break the law, eg., if one reaches an intersection a little before me, he’ll often get frustrated when I stop and give him the right-of-way.

This makes me wonder: if my only goal is to save other bikers from injury and death, should I follow or break the rules? Say that right now 50% of bikers break rules and 50% don’t. Then I figure most normal drivers will be cautious and hesitant around bikers. But if only 5% break rules, then cycling for that subset is way more dangerous as drivers will expect law-abiding bikers.

This model is rather simplistic, as it certainly goes both ways–bikers adjust their strategies to the habits of drivers. But we can consider DC and the marginal effect of one additional rule-abiding or rule-breaking cyclist. Which side should I choose, given my selfless utilitarian preferences above?

Dennis Rodman on the Philippines

Apparently, aging former NBA stars do some barnstorming here, as my taxi driver from the airport told me almost immediately upon my arrival in Manila. From an excellent Grantland article on the topic, no love of sports required, here is one excerpt:

Before tip-off, a sideline reporter snags a short interview with Pippen. “Scottie, what have you heard of the Philippine league?” she asks. “Well, I haven’t heard too much about it.” The moment was a flashback to the unintentional comedy bonanza at the press conference the day before the game, where Pippen & Co. strained to find polite answers to questions like “Besides the Philippines, what other countries have you guys been to?” and “I’m not a press but how is it when you arrive here, how do you feel that you are playing in this country where basketball is one of the popular sports?” Rodman, predictably, punctured the air of false ceremony when he was asked how he found the Philippines on this, his second trip to the country. “The same [as] when I left it,” he said. “You guys still look the same, so what the hell.”

In contrast, I have been here only once.

*From Miracle to Maturity: The Growth of the Korean Economy*

That is the forthcoming book by Barry Eichengreen, Dwight Perkins, and Kwanho Shin. I just pre-ordered my copy to arrive in October…

Assorted links

1. From Washington Monthly: monetary policy, gargoyles, and the emotions. I say focus ruthlessly on substance and do your best to explore and present the limits and drawbacks of your own ideas and recommendations. Years down the road — or sooner — one will end up wiser and better informed. The reasoning in this article is an excuse to dismiss moderating or inconvenient ideas, or ideas which de-moralize a topic somewhat.

2. Wage stagnation isn’t due to a compositional shift.

3. Old Germans who die and leave their estates to Israel.