Month: July 2013

Assorted India links

1. How is Indian higher education evolving?

2. The culture that is India, laughing club and laughing exercises (video, funny).

3. Good update on the Indian economy, and Indian poverty declines to record lows.

4. Feud between Sen and Bhagwati. Here is where the feud stood in 1998.

5. Bollywood is falling out of love with the Swiss Alps.

6. Famous Indian economists debate…India.

7. The economics of menstrual hygiene in India, a very important topic and a very good story, recommended.

Eating in Bangalore

Many of you useful MR reader recommendations here. I’ll recommend the Muslim food stalls along Cock Burn avenue, especially during Ramadan. First-rate for haleem is Hotel Fanoos (the attached restaurant) in Richmondtown, near the Hosur Water Tank. The Chinese restaurant in the Oberoi is not to be missed. For South Indian food, try Athityam in Jayanagar 5th block, make sure you order some specials and go beyond the dosas, which are excellent but not the best item here. My favorite was the Pesarattu.

Joke from India

Why were Adam and Eve the happiest married couple ever?

Because neither had a mother-in-law.

Detroit Taxes and the Laffer Curve

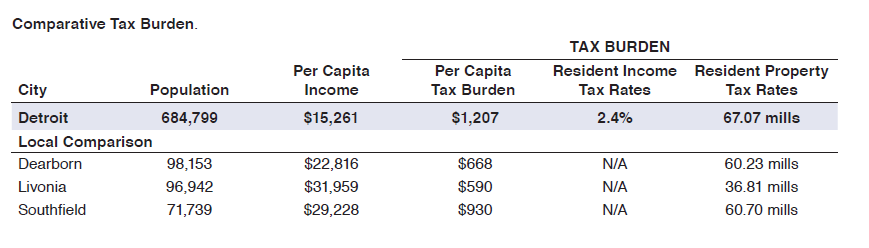

Detroit’s Emergency Manager Kevyn Orr has issued a clearly written report that outlines Detroit’s situation and its improvement plan. Here are a few highlights on taxes:

- [The] per capita tax burden on City residents is the highest in Michigan. This tax burden is particularly severe because it is imposed on a population that has relatively low levels of per capita income.

- The City’s income tax… is the highest in Michigan.

- Detroit residents pay the highest total property tax rates (inclusive of property taxes paid to all overlapping jurisdictions; e.g., the City, the State, Wayne County) of those paid by residents of Michigan cities having a population over 50,000.

- Detroit is the only city in Michigan that levies an excise tax on utility users (at a rate of 5%).

Detroit taxes are high not only relative to per-capita income but also, of course, relative to the delivery of services. Forty percent of Detroit’s street lights aren’t working, the violent crime rate is the highest in the country (for cities over 200,000) and fire and police services are slow and outdated. Although taxes are high they often aren’t paid. Only 53% of city property owners, for example, paid their 2011 property taxes.

As the report notes, Detroit is probably on the wrong end of the Laffer curve–lower rates would increase revenues in the long run.

Hat tip: Brian Blase.

Why is U.S. corporate investment not more robust?

Here is an excellent FT survey article on that question, by Robin Harding. It may be gated for many of you, in any case this part is worth reproducing:

But perhaps the most remarkable result comes from newly available data on private companies studied by Alexander Ljungqvist and colleagues at Harvard and New York University. They find that, keeping company size and industry constant, private US companies invest nearly twice as much as those listed on the stock market: 6.8 per cent of total assets versus just 3.7 per cent.

Private companies are four times more responsive to new investment opportunities and, when a private company goes public, it changes its behaviour.

Mr Ljungqvist says he has not examined the effect of this difference on overall investment in the economy. Given the size of the S&P 500, however, investment might be percentage points of GDP higher if its members invested like private companies.

A few other points:

1. How non-residential investment looks depends a great deal on whether you consider the gross or net figure. The net figure is much lower because computer equipment depreciates quite rapidly.

2. We may be undercounting intangible investment, as discussed in the article.

3. Amazon is one company which invests a great deal, yet it is not obvious they are making profits from such investments.

4. Apple is constrained in its investments, and for a good while has been insanely profitable. Of course this may not last so very much longer.

5. Paul Krugman discusses monopoly rents and investment here.

The full article is here, I hope you can read it, high quality throughout.

“How Should Long-Term Monetary Policy be Determined?”

Here is the jstor link, from the Journal of Money, Credit, and Banking, and the author is Lawrence H. Summers. I very much liked the piece when it came out in 1991 and I think it has held up especially well with time (please do note that Summers’s views very likely have evolved since then and you should not take this short article as any kind of definitive touchstone for what he would be like as Fed chairman.)

Given the sudden sensitivity of this topic, I am reluctant to summarize it in my own possibly misleading or overgeneralizing words, so if need be I hope you can get through the gate.

Summers did see, circa 1991, the time consistency problem with limiting inflation as more important than most monetary economists would believe today, but that was a common view at the time and given the historical experience up until then it was hardly a mistake.

I’ve read a lot of recent commentary on Summers, often by those who write on monetary economics, yet none of those writers seems to be aware of this piece nor do they discuss his other writings on monetary economics, virtually all of which are insightful.

Update: This link probably works better for you, plus it gives you a download option for $44.00.

Chinese austerity, sort of

China has banned the construction of government offices for the next five years, ratcheting up an austerity campaign that has already taken a toll on the economy.

The State Council, China’s cabinet, and the Communist party late on Tuesday said the ban, which takes immediate effect, would also apply to the expansion of existing buildings.

They seem to mean it, and in part they wish to improve the moral image of Chinese government. Here is a bit of background:

Beijing has previously tried to stop local governments from building massive new offices, but only with limited success. Even in poorer parts of China, cities and villages have built monolithic offices, replicas of the US Capitol building and faux-European palaces. In one notorious case, the government of the poor Yingquan district in Anhui province spent a third of its budget on a White House replica.

Under the new ban, renovations of outdated offices will be permitted, but the approval process will be extremely strict and there will be no tolerance for “luxurious decorations”.

The full FT story is here.

Assorted links

Aid for disabilities should look more like the EITC

Don’t forget this:

An estimated 23 percent of people with cognitive disabilities were employed in 2011, according to the U.S. Census Bureau.

Many do not seek employment, in part because of concerns about losing federal subsidies.

Again, insofar as it is possible, we should pay people to work, rather than paying them not to work.

By the way, I am not suggesting that bad policy is the only reason for unemployment in this context.

The article is here.

Your sequester update

By Marjorie Censer and Jim Tankersley:

Big defense contractors are weathering the federal budget sequester far more easily than they projected, in part because they have gradually eliminated jobs over the past few years in anticipation of spending cuts.

Bethesda-based Lockheed Martin, the world’s largest defense contractor, reported Tuesday that its profit rose 10 percent, to $859 million, during the second quarter even as revenue dipped slightly. Northrop Grumman and General Dynamics, two other large contractors, are scheduled to report results Wednesday.

…Contractors seem pleasantly surprised that the automatic spending cuts are not hurting nearly as much as the industry’s lobbying arm warned they would in the months leading up to the sequester that took effect in March.

Lockheed Martin had predicted that sequestration would wipe out $825 million in revenue this year, but it no longer expects such a big hit. In fact, the company said, profit will be higher than initially projected.

The story is here, and of course this is both good and bad news.

Why does South Indian food taste better when you eat it with your fingers?

I can think of three reasons.

First, there is a placebo effect. For the Westerner/outsider, eating with your fingers seems exotic. For (many, not all) South Asians, eating with your fingers brings back memories of family and comfort foods.

Second, your fingers are highly versatile and they are often the best implements for consuming these foods and blending together spices, condiments, and foodstuffs themselves. There is a reason why humans evolved fingers rather than forks.

Third, and how shall I put this? A lot of South Indian food is vegetarian and eating with your fingers adds flavors of…meat. The fleshy sort.

Eating a dosa with fork and knife is a very different experience, for Tamil food on the palm leaf all the more so.

*Revolutionary Iran*

The author is Michael Axworthy and the subtitle is History of the Islamic Republic. It is already out in the UK. This is one of the few must-read books of this year (How Asia Works and China’s War With Japan are the other two, plus Knausgaard), excellent and insightful from beginning to end.

Penn State uses the stick to enforce medical exams

By November, faculty and their spouses or domestic partners covered by university health care must complete an online wellness profile and physical exam. They’re also required to complete a more invasive biometric screening, including a “full lipid profile” and glucose, body mass index and waist circumference measurements. (Mobile units from the university’s insurance company, Highmark, will visit campuses to perform these screenings.)

Employees and their beneficiaries who don’t meet those requirements must pay the monthly insurance surcharge [$100] beginning in January.

And if you don’t trust the employer, they have reassured us:

“It is important to note that screening results are confidential and will not be used to remove or reduce health care benefits, nor raise an individual’s health care premium,” a university announcement reads. “The results only are for individual health awareness, illness prevention and wellness promotion.”

Assorted links

1. A theory of Spain’s political class.

2. When have econ blogs changed people’s (i.e., Noah’s) minds?

3. When will the sun set over the British empire? (Debraj Ray is blogging, in this case with some help from Peter Hammond.)

4. Changing a flat while driving on two wheels.

5. The culture that is Japan (baseball).

Eminent domain and the decline of Detroit

Ilya Somin reports:

Detroit’s sixty year decline, culminating in its recent bankruptcy, has many causes. But one that should not be ignored is the city’s extensive use of eminent domain to transfer property to politically influential private interests. For many years, Detroit aggressively used eminent domain to promote “economic development” and “urban renewal.” The most notorious example was the 1981 Poletown case, in which some 4000 people lost their homes, and numerous businesses were forced to move in order to make way for a General Motors factory. As I explained in this article, the Poletown takings – like many other similar condemnations – ended up destroying far more development than they ever created. In his prescient dissent in Poletown, Michigan Supreme Court Justice James Ryan warned that there was no real reason to expect that the project would produce the growth promised by GM and noted that Detroit and the court had “subordinated a constitutional right to private corporate interests.”

Here is a bit more.