Month: March 2014

Assorted links

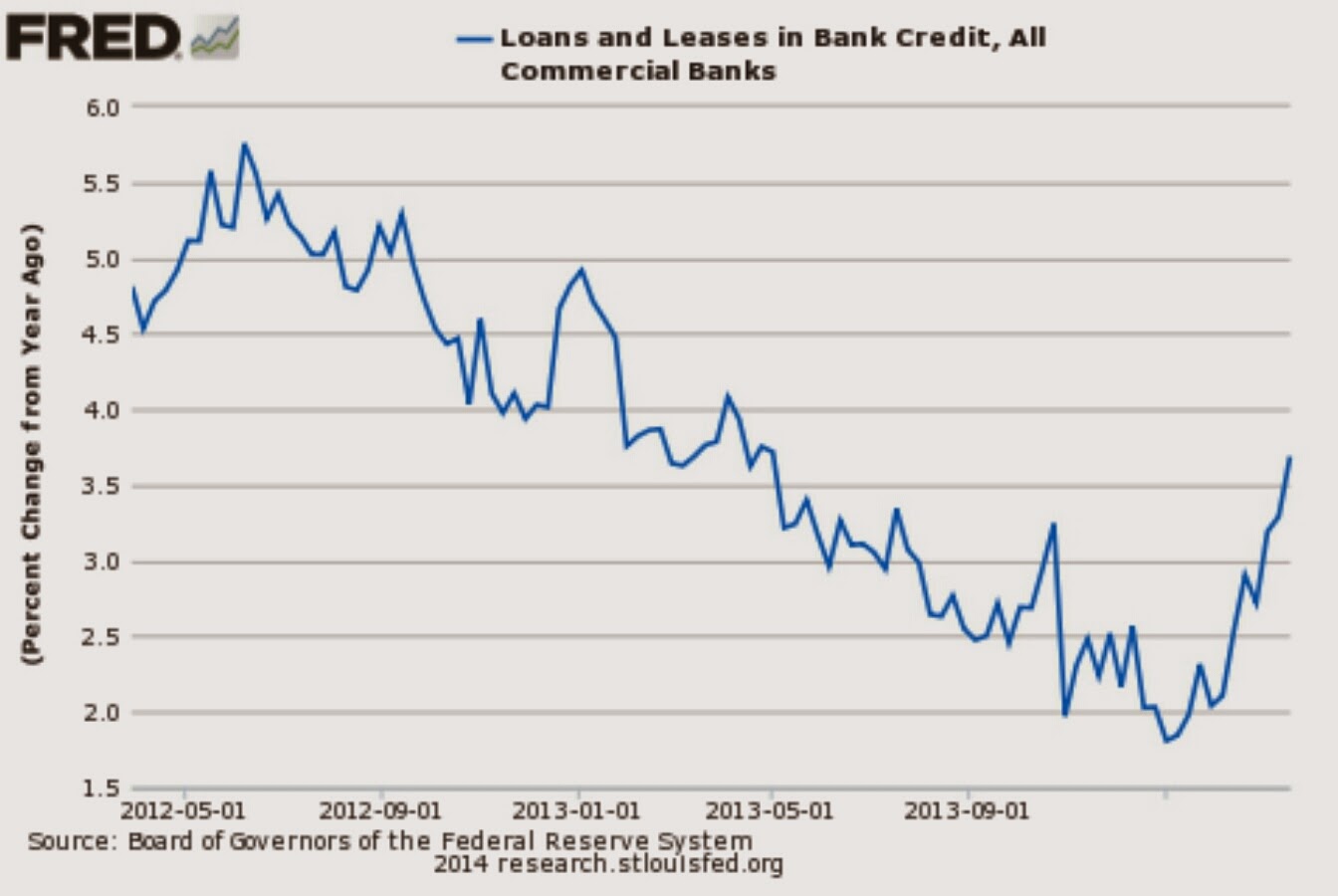

Loan growth and the taper

From Sober Look, there is further discussion and pictures here.

*The Transformation of the World*

The author is Jürgen Osterhammel and the subtitle is A Global History of the Nineteenth Century. The book’s home page is here. Piketty’s tome is French and this one is…um…German. Very German. Translated from the German. Imagine a 1165 pp. German Braudel-like take on the importance of the 19th century and here you go.

I was expecting a review copy but I saw a bookstore which put it out prematurely and so I spent $40 to give you all advance notice and read it sooner myself. That is an endorsement of sorts, but also a confession of my own weak discipline.

So far I am on p.44 and I plan to continue. I learned for instance that:

In continental Europe, Norway was the first country to have a free press (from 1814); Belgium and Switzerland joined it around 1830, and Sweden, Denmark, and the Netherlands by 1848.

My final verdict is not yet in, but I suppose the bottom line is that I expect to have a final verdict.

Was Marx right?

Here is an NYT forum, involving myself, Michael Strain, Brad DeLong, and others. My piece is here, excerpt:

Marx pointed out, again perceptively, that capitalism might be subject to a declining rate of profit, and indeed the rate of productivity growth generally has been lower since the 1970s. But why? I would cite energy price shocks, greater investments in environmental goods (which may well be optimal), political dysfunction, the difficulty of topping the amazing achievements of the early 20thcentury, a bit of cultural complacency, and a generally greater aversion to risk, failure and also the new NIMBY “not in my backward” mentality. Most of Marx’s analytical constructs are convoluted, replete with contradictions, and in any case not ideally suited toward analyzing those problems.

We should always be willing to learn from the past, and I do count Marx, for all his flaws, among the great economists. But we should not forget that he was in fact wrong about most things, not just about the totally impractical nature of his communist alternative.

Are negative supply shocks expansionary at the zero lower bound?

In a new paper, Johannes Wieland reports (pdf):

Standard sticky-price models predict that temporary, negative supply shocks are expansionary at the zero lower bound (ZLB) because they raise inflation expectations and lower expected real interest rates, which stimulates consumption. This paper tests that prediction with oil supply shocks, an earthquake, and inflation risk premia, demonstrating that negative supply shocks are contractionary at the ZLB despite also lowering expected real interest rates. These findings are rationalized in a model with financial frictions, where negative supply shocks reduce asset prices and net worth, translating into larger borrowing spreads so that consumption contracts. In this data-consistent model fiscal stimulus at the ZLB is substantially less effective than in standard sticky-price models.

This accords both with common sense and recent experience.

For the pointer I thank Karl Smith.

New Michael Lewis book on finance and high-frequency trading

Flash Boys: A Wall Street Revolt.

This was mentioned by Jason Kottke on Twitter.

Assorted links

The economics of the Detroit art museum

Fortunately, costs are easier to estimate, and those for displaying a painting derive largely from its market value. Consider “The Wedding Dance,” a 16th-century work by the Flemish painter Pieter Bruegel the Elder. Detroit museum visitors have enjoyed this painting since 1930. How much would it cost to preserve that privilege for future generations?

A tidy sum, as it turns out. According to Christie’s, this canvas alone could fetch up to $200 million. Once interest rates return to normal levels — say, 6 percent — the forgone interest on that amount would be approximately $12 million a year.

If we assume that the museum would be open 2,000 hours a year, and ignore the cost of gallery space and other indirect expenses, the cost of keeping the painting on display would be more than $6,000 an hour. Assuming that an average of five people would view it per hour, all year long, it would still cost more than $1,200 an hour to provide the experience for each visitor.

That is from Robert H. Frank.

Austrian business cycle theory refuses to die

There is a new paper from Princeton by Matthew Baron and Wei Xiong (pdf), preliminary draft but the results are striking:

This paper examines financial instability associated with bank credit expansion in a set of 23 developed countries over the years 1920-2012. We find that credit expansion, measured by the three-year change in bank credit to GDP ratio, predicts a significantly increased crash risk in the returns of the bank equity index and equity market index in the subsequent one to eight quarters. Despite the increased crash risk, credit expansion predicts both lower mean and median returns of these indices in the subsequent quarters, even after controlling for a host of variables known to predict the equity premium. Furthermore, conditional on credit expansion of a country exceeding a modest threshold of 1.5 standard deviations, the predicted excess return for the bank equity index in the subsequent four quarters is significantly negative, with a magnitude of nearly -20%, while the positive predicted excess return subsequent to a credit contraction of the same size is substantially more modest. These findings present a challenge to the views that credit expansions are simply caused by either banks acting against the will of shareholders or by elevated risk appetite of shareholders, and instead suggest a role for optimism of bankers and stock investors.

The pointer is from Hyun Song Shin. I would continue to stress, however, that Austrian approaches still need more Hyman Minsky and should cease putting all of the “blame” — causal, moral, or otherwise — on the monetary expansion of the central bank. Don’t forget my banana point:

Let’s say that the government subsidized the price of bananas, you bought so many bananas, put them on your roof, and then the roof collapsed. Is that government failure or market failure? The price was distorted, but I still say this is mostly market failure. No one made you put so many bananas on your roof.

What I’ve been reading

The new Simon Schama book on the history of the Jews did not grab my attention, nor did the new short (derivative) novel by David Grossman. Possibly the latter is better in the original Hebrew, given how much poetry it contains. The new Siri Hustved book also didn’t thrill me.

The Rough Guide to Economics, by Andrew Mell and Oliver Walker, is another attempt to thread the needle between popular econ book and text. I would have wished for a more dramatic and intuitive treatment of a) core microeconomic reasoning in the old Chicago/UCLA style, and b) a far greater and more central place for the truly dramatic importance of economic growth in boosting human welfare.

John Drury, The Life and Poetry of George Herbert is a beautiful treasure and it will make my best books of the year list. Here is Herbert’s best poem.

Mai Jia’s Decoded: A Novel was a bestseller in China, and so far I am finding it compelling, and most other readers seem to agree.

Arrived in my pile are:

Cass Sunstein, Conspiracy Theories and Other Dangerous Ideas.

Romain D. Huret, American Tax Resisters.

Peter H. Schuck, Why Goverment Fails So Often, And How It Can Do Better.

Matt Grossman, Artists of the Possible: Governing Networks and American Policy Change Since 1945. And a related blog post Do policymakers ignore voter agendas and priorities?, by Matt.

Assorted links

The Peltzman Effect in Children

David Ball, a professor of risk management at Middlesex University, analyzed U.K. injury statistics and found that as in the U.S., there was no clear trend over time. “The advent of all these special surfaces for playgrounds has contributed very little, if anything at all, to the safety of children,” he told me. Ball has found some evidence that long-bone injuries, which are far more common than head injuries, are actually increasing. The best theory for that is “risk compensation”—kids don’t worry as much about falling on rubber, so they’re not as careful, and end up hurting themselves more often.

From The Overprotected Kid by Hanna Rosin in the Atlantic.

Addendum: More on the Peltzman Effect.

From the comments, Charles Mann on Chinese coal

In any case, according to most analysts — see, e.g., Bloomberg, “The Future of China’s Power Sector”, Aug. 2013 http://about.bnef.com/white-papers/the-future-of-chinas-power-sector/ — China won’t stop putting in coal plants. Indeed. Bloomberg projects that 343-450 gigawatts of new coal generation will be built in China over the next fifteen years, more than the total capacity of the entire US coal base (300 gigawatts). China’s power needs are so big that even if it installs solar and wind facilities faster than any other nation has ever emplaced them, the nation will still bring online 1 large 500 MW coal plant *per week* from now until 2030.

Even if somehow China *could* build enough solar and wind plants in time, it still would be building coal plants, too. The basic reason is that solar panels in China typically produce <20% of their annual peak capacity (China has few sunny regions) and wind 80% of peak capacity and do it all the time, so to get reliable power you have to build vastly more peak capacity from renewables than coal, and China can’t afford that.

There is more, including more from Mann, here.

Danish price discrimination markets in everything

Danish travel company offers “ovulation discount” for couples, rewards if you conceive on holiday. Furthermore:

…if you can subsequently prove that you conceived a child on the trip, they’ll give you three years’ worth of baby-stuff and a family holiday.

Hat tip goes to Tim Harford.

Flex-price markets in everything, cable TV edition

Time Warner Cable customers looking to lower their bills would be able to hire “professional negotiators,” to squeeze discounts out of the cable provider under a trial service being offered by Yipit, a New York-based daily deals startup.

Yipit sent out an email on Thursday to a small group of people on its distribution list directing them to a link to submit their Time Warner Cable account information. Then Yipit said it would have employees who are “professional negotiators” try to haggle for better rates with the cable company.

The service is being tested as consumers are being hit with cable bills rising faster than the rate of inflation and as cable companies find it harder to hold onto customers who are defecting to newer entrants such as Verizon FiOS.

Yipit was founded in 2009 and offers an email newsletter roundup of top daily deals from websites such as Groupon and Gilt Groupe.

A representative from Yipit verified the authenticity of the offer but declined to comment further. A Time Warner Cable spokeswoman said “there’s no need for our customers to pay someone to call us on their behalf.”

The website cites potential savings of $564 per year. Yipit will not charge customers if it is unable to extract better rates but customers do have to pay a 20 percent cut of savings if it succeeds, according to the offer on its website.

There is more here, via the excellent Daniel Lippman.