Month: October 2016

The Performance Pay Nobel

The Nobel Prize in economics goes to Oliver Hart and Bengt Holmstrom for contract theory, the design of incentives. See Tyler’s posts below for overviews. In our textbook, Modern Principles, Tyler and I have a chapter called Managing Incentives which covers some of this work, especially related to Holmstrom’s work on performance pay. Let’s give a simplified precis (fyi, the textbook doesn’t have the math).

Suppose that you are a principal monitoring an agent who produces output. The output depends on the agent’s effort but also on noise. It wouldn’t be a very efficient contract to just reward the agent based on output since then you would mostly be responding to noise—punishing hard-working agents when the noise factors were bad and rewarding lazy agents when the noise factors were good. Not only is that unfair–if you setup a contract like this the agents will a) demand that you pay them a lot of money in the good state because they will be taking on a lot of risk and b) the agents won’t put in much effort anyway since their effort will tend to be overwhelmed by the noise, either good or bad. Thus, rewarding output alone gets you the worst of all worlds, you have to pay a lot and you don’t get much effort.

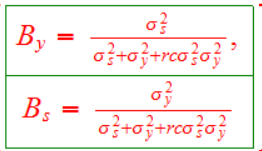

But perhaps in addition to output, y, you have a signal of effort, call it s. Both y and s signal effort with noise but together they provide more information. First, lesson – use s! In fact, the informativeness principle says you should use any and all information that might signal the agent’s effort in developing your contract. But how should you combine the information from y and s? Suppose you write a contract where the agent is paid a wage, w=B0+By*y+Bs*s where Bo is the base wage, By is the beta on y, how much weight to put on output and Bs is the weight on the s signal–think of By as the performance bonus and Bs as a subjective evaluation bonus. Then it turns out (under some assumptions etc. Canice Prendergast has a good review paper) you should weight By and Bs according to the following formula:

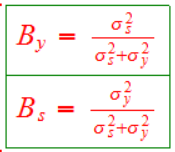

that looks imposing but it’s really not. σ^2s (sorry for the notation) is the variance of the s signal, σ^2y is the variance of the y signal. Now for the moment assume r is zero so the formula boils down to:

Ah, now that looks sensible because it’s an optimal information theorem. It says that you should put a high weight on y when the s signal is relatively noisy (notice that By goes to 1 as σ^2s increases) and a high weight on s when the y signal is relatively noisy. Notice also that the two betas sum to 1 which means that in this world you put all the risk on the agent. Ok, now let’s return to the first version and fill in the details. What’s r? r is a measure of risk aversion for the agent. If r is zero then the agent is risk neutral and we are in the second world where you put all the risk on the agent. If the agent is risk averse, however, then r>0 and so what happens? If r>0 then you don’t want to put all the risk on the agent because then the agent will demand too much so you take on some risk yourself and tamp down By and Bs (notice that the bigger is r the smaller are both By and Bs) and instead increase the base wage which acts as a kind of insurance against risk. So the first version combines an optimal information aggregation theorem with the economics of managing the risk-performance-pay tradeoff.

(c, by the way, is a measure of how costly effort is to the agent and so it also makes sense that the higher is c the less weight you put on performance incentives and the more on the base wage.)

Let’s also discuss some further work which is closely related to Holmstrom’s approach, tournament theory (Lazear and Rosen). When should you use absolute pay and when should you use relative pay? For example, sometimes we reward salespeople based on their sales and sometimes we reward based on which agent had the most sales, i.e. a tournament. Which is better? The great thing about relative pay is that it removes one type of noise. Suppose, for example, that sales depend on effort but also on the state of the economy. If you reward based on absolute sales then you are rewarding a lot of noise. Once again, that has two bad effects it means that you have to pay your agents a lot since you are imposing risk on them and it means that they won’t work that hard since they know they will be paid a lot when the economy is good and hardly at all when the economy is bad so in neither case do the agents have strong incentives to work hard. Suppose, however, that you have a relative pay scheme, a tournament. Now you have removed the noise coming from the state of the economy–since all the salespeople face the same economy and since there is always a first, second and third place the agent’s now have an incentive to work hard in good or bad times. Not only do they have an incentive to work hard you don’t have to pay them much of a risk premium since more of their pay is now based on their own effort rather than on noise.

But relative pay isn’t always better. If the sales agents come in different ability levels, for example, then relative pay means that neither the high ability nor the low ability agents will work hard. The high ability agents know that they don’t need to exert high effort to win and the low ability agents know that they won’t win even if they do exert high effort. Thus, if there is a lot of risk coming from agent ability then you don’t want to use tournaments. Or to put it differently, tournaments work best when agent ability is similar which is why in sports tournaments we often have divisions (over 50, under 30) or rounds.

FYI, in our textbook Tyler and I use this model to discuss when students should prefer an absolute grading scale and when they should prefer grading on a curve. Work it out!

Holmstrom’s work has lot of implications for structuring executive pay. In particular, executive pay often violates the informativeness principle. In rewarding the CEO of Ford for example, an obvious piece of information that should used in addition to the price of Ford stock is the price of GM, Toyota and Chrysler stock. If the stock of most of the automaker’s is up then you should reward the CEO of Ford less because most of the gain in Ford is probably due to the economy wide factor rather than to the efforts Ford’s CEO. For the same reasons, if GM, Toyota, and Chrysler are down but Ford is down less then you might give the Ford CEO a large bonus even though Ford’s stock price is down. Oddly, however, performance pay for executives rarely works like a tournament. As a result, CEOs are often paid based on noise.

The basic framework has since been applied in many different circumstances because principal-agent can be interpreted in many different ways employer-worker, teacher-student, regulator-banker and so forth. Thus the basic insights have been reflected in a wealth of applications each of which adds to the body of theory.

Bengt Holmström, Nobel Laureate

Again, I’ll be refreshing this post throughout the morning, keep on hitting refresh. Here is Bengt Holmström’s home page, which includes a CV, short biography, and links to research papers. Here is his Wikipedia page. He has taught for a long time at MIT, was born in Finland, and is one of the most famous and influential economists in the field of contracts and industrial organization. Here is the Swedish summary. Here is a video explanation. This is a nice short bio of how he was influenced by his private sector experience, recommended, not just the usual take on him.

One key question he has considered is when incentives should be high-powered or when they should be more blunt. It is now well known that you get what you pay for; see Alex’s excellent summary on this and related points.

His most famous paper is his 1979 “Moral Hazard and Observability.” What are the optimal sharing rules when the principal can observe outcomes but not efforts or inputs? And how might those sharing rules lead to a less than optimal result? This is probably the most elegant and most influential statement of how direct incentives and insurance value in a contract can conflict and hinder efficiency. A simple example — what about deductibles in a health insurance contract? Yes, they do encourage the customer to internalize the value of staying in better health. But they also limit the insurance value of a contract. That a first best outcome will not be created in this situation was part of what Holmstrom showed, and he showed it in a relatively tractable way.

If you are thinking about CEO compensation, you might turn to the work of Holmström, the Swedes have a good summary of this paper and point:

…an optimal contract should link payment to all outcomes that can potentially provide information about actions that have been taken. This informativeness principle does not merely say that payments should depend on outcomes that can be affected by agents. For example, suppose the agent is a manager whose actions influence her own firm’s share price, but not share prices of other firms. Does that mean that the manager’s pay should depend only on her firm’s share price? The answer is no. Since share prices reflect other factors in the economy – outside the manager’s control – simply linking compensation to the firm’s share price will reward the manager for good luck and punish her for bad luck. It is better to link the manager’s pay to her firm’s share price relative to those of other, similar firms (such as those in the same industry).

That is again a result about how incentives and insurance interact. When do you pay based on perceived effort, and when on the basis of observed outcomes, such as profits or share price? Holmström has been the number one theorist in helping to address issues of this kind.

“Moral Hazard in Teams,”1982, is a very famous and influential paper, here is the working paper version. Holmström showed that the optimal incentive scheme has to consider time consistency. Sometimes good incentive schemes impose penalties on the workers/agents to get them to work harder. But let’s say you had a worker-owned and worker-run firm. If the workers fail, will the workers/owner impose punishments on themselves? Maybe not. Thus in a fairly general class of situations you need an outside residual claimant to impose and receive the penalty. This is Holmström trying to justify one feature of the capitalist system against socialists and Marxists.

A Fine Theorem has an excellent post on his work.

“Managerial Incentive Problems: A Dynamic Perspective” is another goodie, this one from 1999. The key point is that repeated interactions, for instance with a manager, can make incentive problems worse rather than better. The more the shareholders monitor a manager, for instance, and the more that is over a longer period of time, perhaps the manager has a greater incentive to manipulate signals of value. When are career incentives beneficial or harmful? This paper is the starting point in thinking through this problem. Here is one of the possible traps: if a worker fully reveals his or her quality to the boss, the boss will use that information to capture more surplus from the worker. So many workers don’t let on just how talented they are, so they can slack more, rather than being caught up in the dragnet of a ‘super-efficient” incentives scheme. I have long found this to be a very important paper, it is probably my favorite by Holmström.

This 1994 investigation, based on personnel data from within firms, is actually way ahead of its time in terms of empirical methods. It is certainly known but he never received full credit for it.

Holmström and Hart together have a very nice piece surveying the theory of contracts and theories of the firm. With John Roberts, he has a very nice (and highly readable!) survey of economic work on theories of the boundary of the firm, recommended on the field more generally. Not his most famous piece, but if you are looking in the applied direction, here is his survey piece with Steven Kaplan on mergers.

With Jean Tirole has has a 1997 paper “Financial Intermediation, Loanable Funds, and the Real Sector.” This was an important precursor of the later point about how collateral constraints really can matter. Firms and banks should be well-capitalized! This piece was significantly influenced by the Nordic financial crises of the 1990s and it was prescient regarding later events in the United States and elsewhere.

His liquidity-based asset pricing model, with Jean Tirole, did not in its published form “take off” in the world of finance, but it is an excellent and important piece, worth revisiting as part of the puzzle of why the world has so many super-low interest rates today.

Holmström has since written much more about banking and agency problems. His very latest piece is on banks as secret keepers, and it tries to model and explain the fundamental nature of banking and its fixed value liabilities. Here is his piece on why financial panics are so likely to involve debt. With Jean Tirole, he wrote a well-known paper on why government supply of liquidity services sometimes may be justified.

Here is his 2003 survey paper, with Steven Kaplan, on what is right and wrong in U.S. corporate governance. It is a more applied side than what you often see from him. The piece claims that, even in light of the scandals of that time, American corporate governance is not broken and will probably become better yet, though it could stand some improvement, including on the regulatory side. Overall I view his co-authorships with Kaplan as suggesting that his overall stance toward corporations is more influenced by Chicago-style thinking than is oftetn the case at MIT. Read his defense of asset securitization for instance.

Congratulations to Bengt Holmström!

Oliver Hart, Nobel Laureate

Here is Hart’s most famous piece, with Sandy Grossman, 1986, “The Costs and Benefits of Ownership.” Think of it as an extension of Ronald Coase and Oliver Williamson, also two Nobel Laureates (hey, that’s a lot of prizes for one topic area…)

Why does one party ever purchase residual rights in the assets of another party? Say for instance there is a factory firm and a coal mining firm. The coal can be treated in a particular way to be more suitable for use in the factory. If the factory firm buys out the coal mining company, the incentives for coal treatment differ, that is the key insight behind this model. You can think of this as a very important modification of the Coase Theorem. It does matter who owns the asset. Why? If the coal mining company owns the coal, it has one set of incentives to make ex ante improvements in the values of those assets; if the factory firm owns the coal mine, it has another set of incentives. Part of the work in this paper is done by a bargaining axiom — if you own an asset outright, you keep a greater share of the proceeds from improving the value of that asset. Ownership should thus migrate to those parties who have the greatest ability to improve value.

And that is a very fundamental improvement on the Coase theorem, which suggests ownership won’t matter when there is ex post contractibility. This paper showed that for ownership not to matter there must also be ex ante contractibility about value-improving investments at earlier stages in the game, an unlikely assumption to hold.

This is a tricky paper to master. It has all kinds of assumptions built in about ownership, control, and residual claimancy, which do not move together in simple ways. Eventually Hart (working with others) cleaned up the assumptions and produced a more transparent model of this process. This paper is a — I should say the — starting point for thinking about mergers, vertical integration, and other questions of corporate ownership and contract and control. Bengt Holmström of all people wrote a very nice appreciation of the paper.

What about Grossman, I hear you wondering? I would have guessed he would have shared in the Prize, as he has other seminal papers about information and much of Hart’s key work is co-authored with him. On the bright side for him, he has made hundreds of millions of dollars running a hedge fund.

Hart is a true gentleman and he has a very nice British accent. He is very highly respected by his peers. Here is his Wikipedia page. Here is his home page, he is now at Harvard but spent part of his career at MIT. Here is his vita. Here is Hart on Google Scholar. Here is the Nobel survey essay from Sweden. Here is a video explanation.

His second best known piece is “Property Rights and the Nature of the Firm,” with John Moore, 1990. This is again a model and series of parables about ownership and the allocation of rights, but with some twists on the earlier Grossman and Hart piece. The key point is to not allow inessential agents to achieve blocking power of value creation. The authors tell a story about a venture with a tycoon, a boat owner, and a chef, all of whom might organize a voyage together. The tycoon and the boat owner are essential, so one of them should own the boat, and then they can split most of the surplus from the voyage and pay the chef his or her marginal product. Value creation then proceeds. Alternatively, if the chef owns the boat, he has potential blocking power and the surplus has to be split three ways. That may result in some loss of value, due to a tougher bargaining problem, higher transactions costs, and a chance there won’t be enough surplus to cover the most significant investments. Parties who create a lot of value should own things is the central message here, and this is another key paper for thinking about contracts, ownership, and what kind of business arrangements induce investment in idiosyncratic assets, yet another follow-up on the work of previous Laureates Coase and also Oliver Williamson.

In case you hadn’t figured it out by now, Oliver Hart is basically a theorist in his major lines of research.

Another famous paper by Grossman and Hart is “Takeover Bids, the Free Rider Problem, and the Theory of the Corporation.” One of Alex’s most interesting papers is an extension of this work, so I suspect he’ll be covering it in detail. In a nutshell, this model helps explain why a lot of value-maximizing takeover don’t happen, or why it is hard to buy up a whole city block and renovate it. Let’s for instance a corporation currently is valued at $80 a share, and a raider has a good plan to make the company worth $100 a share. The raider then comes along and offers you, a shareholder, $90 for each of your shares. Will you sell? Well, it depends what you think the other shareholders will do. But you might not sell, instead seeking to hold on for the ride. If others sell, you can get $100 in value instead of $90. But if everyone feels this way, then no one sells and the bid fails. Then you might sell at $90 after all, but then no one will sell after all…and so on. A tough problem, but this is a very important piece in understanding the limitations of various kinds of takeovers. Right now my security device won’t let me link to the paper but try googling the title.

Hart’s 1983 paper with Sandy Grossman was at the time a breakthrough and highly rigorous means of modeling the principal-agent problem. It is in Econometrica and quite hard for many people to read. Economists had been modeling principal-agent problems through the notion of a participation constraint. Have the contract give incentives, subject to the proviso that it is still worthwhile for the agents to be involved in the trades. But Mirrlees had pointed out this can give misleading results when there is not automatically a unique solution to the problem at hand. Grossman and Hart reconceptualized the math into a convex programming problem. Theorists love the paper, and it was highly influential when it came out.

Here is Hart and Moore on incomplete contracts and renegotiation. This paper is connected to the Nobel Prize for Jean Tirole two years ago. How can you write a contract so a) parties will make the appropriate relationship-specific investments, and b) it doesn’t have to be renegotiated all of the time? Again, Hart’s work is obsessed with this idea of value maximization within corporate endeavors and possible obstacles to such value maximization.

By the way, here is Hart, with Shleifer and Vishny, on why the private sector probably should not be allowed to own and run prisons. The incentive to cut costs is too strong! Government ownership will instead, in their view, create more value maximization because the government won’t have the same profit incentive to skimp on quality along various margins. This paper has been highly influential in recent debates over private ownership of prisons, which recently was countermanded at the federal level at least. You also probably wouldn’t want Air Force One owned by the private sector, though you do want it to be designed and produced by the private sector. This paper helped produce a framework for understanding the reasons why.

Hart’s 1979 piece on shareholder unanimity asks the important theory question of whether all shareholders will desire that firms maximize profits if markets are incomplete and some firm shares also serves secondary “insurance” purposes of helping protect against adverse states of the world. For instance, say there is no insurance market in wheat. You might use the shares of a wheat-producing firm for that purpose, and desire, for insurance purposes that the value of the firm covary with the value of wheat in ways that differ from simple firm profit-maximization. The upshot of this literature is that firm profit maximization is not as simple or as self-evident an assumption as people used to think.

By the way, here are the two Laureates together, on “A Theory of Firm Scope.” Here is their long, joint survey on theory of contracts.

Congratulations to Oliver Hart!

Oliver Hart and Bengt Holmstrom win the Nobel Prize

Hey, they announced it early this year! Good thing I got up. I’ll be revising a few (separate) posts throughout the morning, they will start out small and grow, so keep on hitting refresh.

These are theory choices in Industrial Organization, two very famous, well-deserving economists at the top of the field. They focused on “theory of the firm,” internal organization, incentives,, and principal-agent problems. More to come!

Here is the announcement. After Jean Tirole two years ago, I wasn’t expecting another IO prize so soon…

Peso says the debate was a draw

The betting market had Trump go up from 16.8 to 19.0, with Pence falling by a fair amount. Stock market called it a draw. The peso observation comes from a tweet by Noah Smith.

Sunday assorted links

1. How about a “guaranteed jobs” program?

2. Has California become the intellectual capital of conservatism? And Ross Douthat on the post-liberals.

3. Twenty questions with Hilary Mantel.

4. Is there now a path out of Brexit?

5. The new NFL?: “Urschel is pursuing a PhD in math at MIT during the offseason and last year published a paper titled “A Cascadic Multigrid Algorithm for Computing the Fiedler Vector.” Ringoir is studying economics at the University of Maryland Baltimore County and captains its powerhouse chess team, which has won six national collegiate championships.”

The Dizzying Grandeur of 21st-Century Agriculture

Our industrialized food system nourishes more people, at lower cost, than any comparable system in history. It also exerts a terrifyingly massive influence on our health and our environment. Photographer George Steinmetz spent nearly a year traveling the country to capture that system, in all its scope, grandeur and dizzying scale.

That is the introduction to an excellent NYTimes photo essay on farming. I liked this photo showing a machine for dumping cranberries from a truck: simple but awesome.

Mr. Trump and the Republicans: a game-theoretic approach

That is my latest Bloomberg column on what is going on right now, here is an excerpt:

Right now, another collective-action problem may be damning the Republicans to a worse fate yet. If the Trump candidacy has no chance of winning or holding close, Republican turnout may collapse, thereby endangering party control of many lower political offices.

Republican turnout, and thus electoral success, might be helped if all the Republicans simply pretended that the Trump gaffe hadn’t happened. But politicians often look to their own self-interest. After Trump appears unacceptable enough in the eyes of enough relevant voters, political candidates and other party members will seek to distance themselves from him so they can try to rebuild their reputations once Trump is no longer on the ballot. You might say those individuals are finally doing the right thing, but under another reading a lot of them are acting in their personal self-interest yet again, and again to the detriment of the Republican party (though perhaps not the American citizenry).

In other words, the Republicans have been on the wrong side of game-theory logic twice, first in delaying their opposition and then later in enacting it. Those are hardly examples of getting Adam Smith’s “invisible hand” metaphor to work in their favor.

There is much more at the link. For related analyses, here are remarks from Sam Wang. Here are tweets from Megan McArdle. Here is Paul Gowder, drawing on Timur Kuran.

The economics of mobile homes

…the problem is almost wholly that land is too expensive. Reduce the size of a new, modern house by 50%, Rybczynski notes, and houses in metropolitan areas will still cost over $200,000.

That’s the secret to the extreme affordability of a mobile home—take land out of the equation.

…“a mobile home park is by definition a parking lot. Legally, our parks are no different from a parking lot by an airport.”

This is why used mobile homes only cost $10,000-$20,000. They make it possible for someone to buy a home but not the earth it’s parked on. As a Times profile of Rolfe reported, his average tenant pays $250 to $300 in monthly rent. If the tenant doesn’t own her home, she might pay another $200 or $300, with the option to apply half of that toward purchasing a mobile home.

“We’re the cheapest form of detached housing there is,” says Rolfe. “You can’t do cheaper.”

In fact it’s an entirely acceptable way to live.

For the pointer I thank the estimable Chug.

Do you like your neighbours?

That is “Bridging Home,” from Korean artist Do Ho Suh.

Saturday assorted links

1. Bucket markets in everything.

2. Link to the Alan Krueger paper on where the workers have gone. Note that pain is not a contemporary invention, yet it seems to be playing a larger role in joblessness than before.

3. Kroszner reviews Sebastian Mallaby.

Is corporate thinking too short-term?

That is the topic of my latest Bloomberg column, here is one bit:

Still, it’s not been established that American corporations are on average more short-term in their thinking than they ought to be.

Perhaps most importantly, it is often easier and better to plan for the shorter term. In information technology, the average life of a corporate asset is about six years, in health care it is about 11 years, and for consumer products it runs about 12 to 15. Very often it is hard for a company to plan its operations beyond those time periods, as the U.S. economy is no longer based on durable manufacturing machines. Production has shifted toward service sectors with relatively short asset lives, and that may call for a shorter-term orientation in response.

There are many other points of interest. I would note that from a social welfare function point of view, everyone thinks in too short a term. But from an agency point of view, I also see a lot of excessive long-term thinking in corporations:

Many tech startups have high valuations even though revenue is zero or low. Again, those judgments may or may not be correct, but clearly investors are trying to estimate longer-run prospects. During the dot-com bubble of the 1990s, there was too much long-run, pie-in-the-sky thinking and not enough focus on the concrete present.

Why do governments call referenda?

Haven’t you been wondering that lately? Tridimas has a paper (link here scroll down) on that question, here is one empirical observation:

During the period 1957-2006, out of a total of 43 integration referenda, 23 were not constitutionally required but were called at the discretion of the incumbent government; 18 of these 23 resulted in a pro-integration vote as the incumbent government had sought. France has held three EU-related non-required referenda, all initiated by the President of the Republic. The UK approved EEC membership in 1975 in a non-required referendum, the only national UK referendum thus far. In 2003, seven of the nine referenda held by the new entrants to approve membership were not required. Again, none of the four referenda held in 2005 by Spain, France, the Netherlands, and Luxembourg to ratify the EU Constitutional Treaty were constitutionally mandated.

And the theory?:

In politics, some issues cause deep intra-party splits between the elected representatives of the same party rather than inter-party divisions among different parties. Constitutional issues, which concern questions of governance and national sovereignty of a state, are a prime example. It is then unlikely that the standard system of parliamentary politics will be able to resolve all those issues. On the contrary, it is more likely that the leader of the party in office will call a referendum to decide them. Ratifying changes to constitutional arrangements in a referendum confers legitimacy to their adoption (or rejection) by taking the decision away from parochial parliamentary majorities and putting it into the hands of the citizenry.

Ah, but there is risk! Still, it is not crazy to call the referendum, even though you might rationally prefer that the whole issue disappear.

I would add a further point to that model. Let’s say you think the core issue won’t go away of its own accord, arguably the case with both Brexit and the failed Colombian peace agreement. The choice is not “referendum vs. no referendum,” but rather “referendum today vs. giving my successors an option on future referenda.” And since a referendum can strengthen an incumbent, you realize that some future government might call one for self-interested reasons. In which case you might consider risking disaster now, responding to a kind of collective action problem through time. You may even fear that one of your successors will be irrational. And so some moment will feel like an optimal trigger point, though of course that will involve risk and probably more risk than is socially optimal. But is there not a preferred time to make your leap from the burning building? The pain of landing on your arm rather than your butt is not per se an argument for nixing the choice altogether.

Alternatively, consider the Italian referendum on reforming the Senate, due in December. The incumbent government may well lose the vote, but precisely because this is not a fundamental issue I predict they can simply continue in power, noting they didn’t have a strong mandate for change in the first place.

Pain medication and labor force participation

A large share of American men between the ages of 25 and 54 who aren’t in the labor force may suffer from serious health conditions that are “a barrier to work” and suffer physical pain, sadness, and stress in their daily lives, according to research being presented next week by Princeton University labor economist Alan Krueger.

“Nearly half of prime age NLF [not-in-the-labor-force] men take pain medication on a daily basis, and in two-thirds of cases, they take prescription pain medication,” according to Krueger’s paper, Where Have All the Workers Gone?

Here is more from Peter Coy. Here is the paper.

Friday assorted links

1. Did Singapore’s National Service improve you?

2. Research position at GiveWell. And is Norway taking too much from its sovereign wealth fund?

3. Is materialism and interest in “stuff” in decline?

4. Should we regulate medicine like public utilities?

5. It is sad how much they play Steely Dan on satellite radio — could it be some strange form of payola?