Month: October 2016

Odd Pricing Strategies

In an earlier post, I explained how a choose what you pay strategy could increase profits. Choose what you pay strategies have mostly been used by charities and artists, however (especially when the product has low marginal cost). I have difficulty understanding how a choose what you pay strategy makes sense for a shoe company–but here you go. You can pay any of three prices and there is no difference in sizing or color by price. True, I have just given them some free advertising but I doubt that explains much. It would be interesting to know how many people choose a higher price. Is it an IQ test? An EQ test? A reading test?

Hat tip: Monique van Hoek.

TPP is exciting, let’s make the case for it

That is the title of my latest Bloomberg column. Here is one bit:

Some of the best arguments for the TPP are underwhelming as public rhetoric. “If we don’t pass this trade agreement, China will write the rules for the region,” is perhaps the most significant point. Yet it is framed as a negative, namely that something worse than TPP may happen. This focuses the public on the defects and weakness of American leadership, making the positive options on the table seem less than transformational.

It’s as if U.S. elites are saying: “We screwed this one up by letting Chinese influence get so far in the first place. Trust us now to set it straight.” However true that may be, few private companies would succeed with that kind of motivation in their advertising.

But if you read the rest of the column, you will see that the case for TPP is truly exciting indeed…

In Sweden, inheritances reduce inequality

This study estimates the effect of inheriting wealth on inequality and mobility in the wealth distribution. Using new population-wide register data on inheritances in Sweden, we find that inheritances reduce inequality and increase mobility among heirs. Richer heirs indeed inherit larger amounts, but less affluent heirs receive substantially larger inheritances relative to their pre-inheritance wealth than do richer heirs. The Swedish inheritance tax had a small overall impact but appears to have mitigated the equalizing effect of inheritances. We also investigate the potentially confounding role of pre-inheritance gifts and behavioral responses to expectations about future inheritances, but neither of them change the main finding that inheritances reduce wealth inequality.

That is from a new paper by Mikael Elinder, Oscar Erixson, and Daniel Waldenström (pdf), via Ben Southwood.

Monday assorted links

1. “With Choi Soon-sil-gate, Park Geun-hye put the entire country into the Tyson Zone.”

2. Transmissible vaccines? (speculative)

3. Will machines run Singaporean food courts?

4. Daniel Drezner, The Ideas Industry, due out in April you can now pre-order.

5. Zombies for organ donation.

6. The flattening of the internet through video. And is it better to record reel-to-reel than digital?

Those new service sector equine jobs

It is entrepreneurship that will create the jobs of the future:

We use a unique horse-assisted leadership experience to help your group create a profound sense of trust, safety, honest communication, authentic connection, and purpose-driven action.

The Circle Up Experience brings together teams [of people] and horses because these majestic animals [presumably the latter] exemplify balanced and shared leadership. This style of leadership creates stability, trust, and the freedom to communicate while valuing the strengths of each individual member and their unique leadership roles within a dynamic and flexible herd[human]-like environment.

Via R., here is the full site. Let’s get that equine labor force participation rate back up again…

Public choice theories of the FBI

I can’t seem to find much on this topic, could it be a violation of Cowen’s Second Law? Here is one passage from Beverly Gate from 2012 (pdf):

Hoover’s bureaucratic skills gave him remarkable control over the FBI’s internal culture and policies. And yet his strategies for achieving that autonomy were often in conflict with each other. Autonomy was not a one-time event; it required constant care and rebalancing. In Hoover’s case, the impulse to maintain the FBI’s professional, nonpartisan image was frequently at odds with efforts to exert popular political and ideological influence. Throughout his career, Hoover’s cozy relationships with congressmen and presidents constantly threatened to undermine the Bureau’s reputation as a nonpartisan agency, divorced from the spoils system and power politics. Similarly, his outspoken anticommunist crusades—a key source of FBI cultural authority—were often in tension with his description of the FBI as purely reactive investigative agency.

The simplest model has the FBI as a bit like the Fed: seeking to promote some policy goals but also jealous of its independence and autonomy. Doing good policy work often promotes independence but not always, and the agency is not well set up to deal with instances where the two objectives conflict. Organizations of this kind also tend to be relatively underdeveloped when it comes to skills of media management and public relations, since they are counting on results and political support to do the job for them. In fact, if they tried to actively manage their PR well on a daily basis, they might find it hard to stay out of politics, as they would end up doing too much “day specific” posturing and not enough “general mood affiliation” posturing.

Hasn’t someone written a piece called something like “A Public Choice Theory of the FBI”? (Bob Tollison, our nation turns its lonely eyes to you…) Can anyone help with reading suggestions, comments of course are open.

Addendum: Here is analysis from David Warsh.

Sunday assorted links

GM Crops Not Increasing Yields

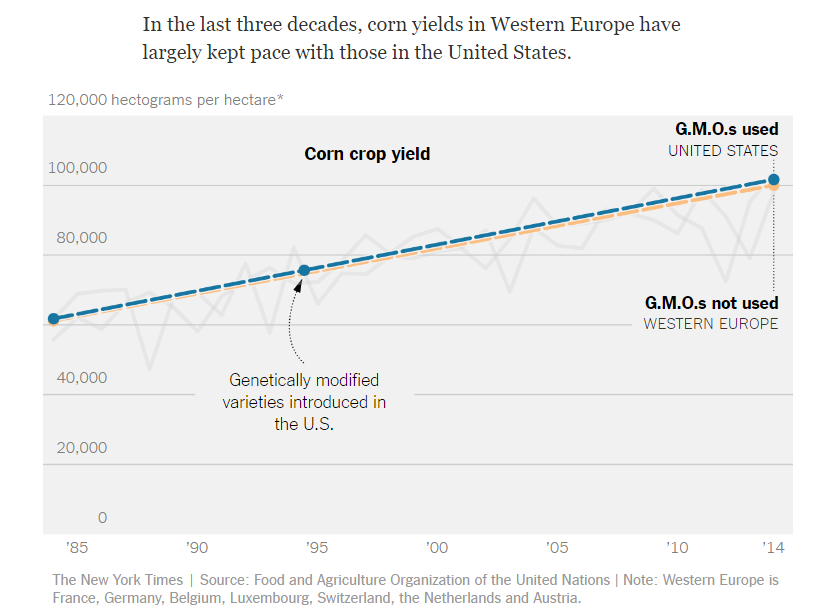

The NYTimes has an excellent feature on genetically modified crops, written by Danny Hakim joined by Karl Russell on data. The usual story is about a battle between fears of contamination on one side and the potential of increased yields on the other but the Times story is about how genetically modified crops have failed to increase yields or reduce pesticide use. This has been discussed in the scientific literature for a few years (e.g. here) and Tom Philpott at Mother Jones has covered the story earlier but the Times story really brings it home in a dramatic way. The graphics are especially good.

Here’s one graph showing corn crop yields in the United States, which uses GMOs, and Western Europe which does not. See the difference?

Addendum: Some good further discussion here, h/t ant1900 in the comments.

Solve for the equilibrium are British people really like this?

The first self-driving cars to be operated by ordinary British drivers will be left deliberately unmarked so that other drivers will not be tempted to “take them on”, a senior car industry executive has revealed.

One of the biggest fears of an ambitious project to lease the first autonomous vehicles to everyday motorists is that other road users might slam on their brakes or drive erratically in order to force the driverless cars into submission, he said.

This is why the first 100 self-driving 4×4 vehicles to be leased to motorists as part of a pilot scheme on busy main roads into London will look no different than other Volvos of the same model, said Erik Coelingh, senior technical leader at Volvo Cars. The scheme will start in 2018.

Americans wouldn’t talk this way:

One driver interviewed for the survey said: “I’ll be overtaking all the time because they’ll be sticking to the rules.”

Another said: “They are going to stop. So you’re going to mug them right off. They’re going to stop and you’re just going to nip around.”

Here is more, via Michelle Dawson.

Addendum: Via Anecdotal, here is an Australian perspective:

Well, I am here to tell you: that’s OK. We’ve all had it drummed into us from infancy that humans bullying cars = bad.

But we can’t let our bourgeois notions of propriety in auto-human interactions stop us from letting out our inner Johnny from Karate Kid.

We must, rather, get on with the vital and necessary work of bullying, haranguing and insulting these contraptions every chance we get. Because I cannot stress this enough: these cars must not be allowed to develop self-esteem.

From another corner of the world, I can tell you that Kiwis do not drive as politely as they talk.

A new RCT on guaranteed annual income

Via Ben Southwood, from David J. Price and Jae Song (pdf):

We investigate the long-term effect of cash assistance for beneficiaries and their children by following up, after four decades, with participants in the Seattle-Denver Income Maintenance Experiment. Treated families in this randomized experiment received thousands of dollars per year in extra government benefits for three or five years in the 1970s. Using administrative data from the Social Security Administration and the Washington State Department of Health, we find that treatment caused adults to earn an average of $1,800 less per year after the experiment ended. Most of this effect on earned income is concentrated between ages 50 and 60, suggesting that it is related to retirement. Treated adults were also 6.3 percentage points more likely to apply for disability benefits, but were not significantly more likely to receive them, or to have died. These effects on parents, however, do not appear to be passed down to their children: children in treated families experienced no significant effects in any of the main variables studied. These results for children are estimated precisely enough to rule out effects found in other contexts and inform the literature on intergenerational mobility. Taken as a whole, these results suggest that policymakers should consider the long-term effects of cash assistance as they formulate policies to combat poverty.

That’s basically a 40-year follow-up, which is nice to see. These results should be taken seriously, but they are also a good illustration of the limits of RCTs for some policy questions. In my recent piece, I argued UBI might be problematic for its interaction with immigration, politics, and the work ethic, all at the macro level. You may or may not agree, but a smaller-scale RCT won’t pick up those effects. It can be the case that a marginal move toward UBI makes sense for any small or mid-sized group, or for any particular in-kind benefit, without the full transformation necessarily being welfare-improving.

Here is a recent piece criticizing a guaranteed annual income. Here is Arnold Kling, mostly defending the idea relative to alternatives.

Will Wilkinson, in his response, doubles down on macro-macro:

I have some misgivings about the method by which Tyler comes to his conclusion that a UBI “would do more harm than good.” It seems that he’s holding the status quo constant, adding a UBI, and then imagining what might happen. But isn’t this a confusing way to proceed? A world in which a UBI were politically feasible would be different in many other ways.

Do read the whole thing.

Quote of the Day

I enjoy democracy immensely. It is incomparably idiotic, and hence incomparably amusing. Does it exalt dunderheads, cowards, trimmers, frauds, cads? Then the pain of seeing them go up is balanced and obliterated by the joy of seeing them come down. Is it inordinately wasteful, extravagant, dishonest? Then so is every other form of government: all alike are enemies to laborious and virtuous men. Is rascality at the very heart of it? Well, we have borne that rascality since 1776, and continue to survive. In the long run, it may turn out that rascality is necessary to human government, and even to civilization itself – that civilization, at bottom, is nothing but a colossal swindle. I do not know: I report only that when the suckers are running well the spectacle is infinitely exhilarating. But I am, it may be, a somewhat malicious man: my sympathies, when it comes to suckers, tend to be coy. What I can’t make out is how any man can believe in democracy who feels for and with them, and is pained when they are debauched and made a show of.

Do shark attacks really influence presidential elections?

Maybe voters aren’t quite as irrational as we had thought, or at least not in some of the ways we had thought:

We reassess Achen and Bartels’ (2002, 2016) prominent claim that shark attacks influence presidential elections, and we find that the evidence is, at best, inconclusive. First, we assemble data on every fatal shark attack in U.S. history and county-level returns from every presidential election between 1872 and 2012, and we find little systematic evidence that shark attacks hurt incumbent presidents or their party. Second, we show that Achen and Bartels’ finding of fatal shark attacks hurting Woodrow Wilson’s vote share in the beach counties of New Jersey in 1916 becomes substantively smaller and statistically weaker under alternative specifications. Third, we find that their town-level result for beach townships in Ocean County significantly shrinks when we correct errors associated with changes in town borders and does not hold for the other beach counties in New Jersey. Lastly, implementing placebo tests in state-elections where there were no shark attacks, we demonstrate that Achen and Bartels’ result was likely to arise even if shark attacks do not influence elections. Overall, there is little compelling evidence that shark attacks influence presidential elections, and any such effect—if one exists—appears to be substantively negligible.

That is from a new paper by Anthony Fowler and Andrew B. Hall (pdf). Here is commentary from Andrew Gelman. Here is related work by Fowler and Montagnes on football games, here is a response.

Just don’t conclude that voters are so extremely rational, in my view focal, vote-moving irrationalities typically will be tied conflicts in social status across different groups.

East Asian fact of the day

On average, married men in the United States spend 167 minutes per day in home production, whereas Japanese husbands spend only 40 minutes and Korean husbands spend 48 minutes.

The difference holds even after adjusting for the labor market status of the man and the woman.

That is from Daiji Kawaguchi and Soohyung Lee, “Brides for Sale: Cross-Border Marriages and Female Immigration,” Economic Inquiry. Here are various copies and drafts of the paper.

Saturday assorted links

1. Why do more educated workers enjoy greater employment stability?

2. I found this sentence strange for the NYT: “Ms. [Chelsea] Clinton often gravitated to weighty policy discussions and interspersed statistics and SAT words into casual conversations.”

3. Most people don’t have a good alibi.

4. Obamacare isn’t that easy to fix.

Indonesian cyanide coffee model this demand shifters

The case set off morbid curiosity and made national headlines after Ms. Wongso was arrested in late January, three weeks after she and Ms. Salihin, both graphic designers, met with another friend at Olivier, the cafe, inside Indonesia’s largest upscale shopping mall.

Intrigued residents have flocked to the restaurant to sit in the booth where Ms. Salihin was poisoned, and to order the iced Vietnamese coffee that was the last thing she drank. The restaurant regularly runs out of the brew.

Here is the full NYT story. Can you use this as a classroom example of how the demand curve shifts out? And here is another way to firm up demand (NYT): “They have connections to more money than any of the galleries anyway…” — get the picture? The article is interesting throughout.