Does the theory of comparative advantage apply to dolphins?

Yes, at least so far it does, these are not ZMP dolphins:

The US Navy’s most adorable employees are about to get the heave-ho because robots can do their job for less.

The submariners in question are some of the Navy’s mine-detecting dolphins which will be phased out in the next five years, according to UT Sand Diego.

The dolphins, which are part of a program that started in the 1950’s, have been deployed all over the world because of their uncanny eyesight, acute sonar and ability to easily dive up to 500 feet underwater.

Using these abilities they’ve been assigned to ports in order to spot enemy divers and find mines using their unparalleled sonar which they mark for their handlers who then disarm them.

However, the Navy has now developed an unmanned 12-foot torpedo shaped robot that runs for 24 hours and can spot mines as well as the dolphins.

And unlike dolphins which take seven years to train, the robots can be manufactured quickly.

The new submersibles will replace 24 of the Navy’s 80 dolphins who will be reassigned to other tasks like finding bombs buried under the sea floor — a task which robots aren’t good at yet.

The story is here, and for the pointer I thank the excellent Daniel Lippman. This is by the way a barter economy:

During their prime working years, the dolphins are compensated with herring, sardines, smelt and squid.

Assorted links

1. Legal precedents for charter cities?

2. Edward Conard on Warren Buffett.

3. Venkatesh responds to the NYT.

4. The Memory Palace works in virtual environments.

5. Take a trampoline in to your workplace (there is no great stagnation).

Korea fact of the day

Korea is now the world’s second-largest exporter of missionaries after the United States.

That is from Daniel Tudor, Korea: The Impossible Country, which is quite a good overview of the place.

Sentences to ponder

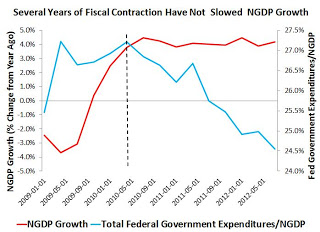

This first figure shows that aggregate demand growth has not been affected by a tightening of fiscal policy since 2010. Specifically, it shows that nominal GDP (NGDP) growth has been remarkably stable since about mid-2010 despite a contraction in federal government expenditures.

That is from Macro and Other Market Musings, and there is another good picture at the link. I understand full well that this is “unadjusted” and one may well argue “growth could have been stronger.” I’ll simply note that I’d like to see discussions of fiscal policy accompanied by this picture as a starting point for analysis.

I would not, by the way, endorse the author’s conclusion about crashing into the fiscal cliff;; for one thing uncertainty and sectoral effects would be significant and would interact negatively with AD effects, even under perfect Fed policy.

For the pointer I thank David Levey.

Assorted links

1. Ted Gioia’s 100 favorite albums of 2012, excellent list.

2. Portrait of Maria Popova, appreciator (a real word of praise), and in her spirit credit card prototype up for auction.

3. John Adams reviews Camille Paglia, too harsh but “cross-star” reviews are often interesting (and often too harsh).

4. The war against music in northern Mali.

5. Big spider eats two birds (video).

The Monster of Monticello?

Here is a good NYT Op-Ed on Thomas Jefferson. In one of his periodic falls into exaggeration, Bruce Bartlett (whom I admire and often agree with), tweets: “I have yet to meet anyone on the right willing to deal honestly with Jefferson’s slave ownership.” I have met large numbers of such people and they show up at virtually any Liberty Fund conference, for a start. In fact that is one reason why they call it Liberty Fund.

I would add this: I am grateful for Jefferson’s contributions to this country in the form of the Declaration and also the Louisiana Purchase, to cite the two biggest. But as a thinker I find him decidedly mediocre, other than that the Declaration is truly stirring in parts and of course of major historical importance. (That said, I don’t think it was obvious ex ante that independence was a good idea, so even there Jefferson may be open to criticism.) Reading the rest is a chore and for me there is little or nothing of analytic interest, unlike with say Madison or John Adams. I don’t mean to detract from his peaks, but his overall record has lots of negatives, in addition of course to owning slaves and often treating them badly. His record in practice on civil liberties for white people also left a lot to be desired. I am not a fan of the agrarianism and arguably that could be labeled less politely.

Here is my previous post on Thomas Jefferson. I have never liked him.

Addendum: For an alternative perspective, you can try this post and paper by David Post.

The course of Congressional polarization

It is not just a story of conservative Republicans replacing moderates – though that has been the chief driver of America’s polarisation. Democrats are also becoming more liberal. The once powerful centrist Democratic Blue Dog coalition has nosedived from 54 members as recently 2008 to just 15 next year. The term moderate Democrat is becoming almost as rare as its counterpart. Nor is the divergence confined to ideology. The parties also look different. According to Bloomberg, the share of white male Democrats in the 113th Congress is 47 per cent – it fell below half for the first time. Meanwhile, 90 per cent of GOP lawmakers are white male.

That is from Edward Luce.

Assorted links

1. Excellent review of Goldacre’s Bad Pharma, and much Ben Goldacre in the MR comments section here, and many excellent points raised by others too.

2. Robert Mundell helped start the Pearl Spring Chess Tournament.

3. Good review of Rushdie, and portrait of Sudhir Venkatesh, and my earlier review of his work. Lots in those portraits.

4. Insights into Chinese typewriters (interesting).

Is the eurozone doomed?

That is the topic of my latest New York Times column, and I will start off by stating the case for optimism (if that is the right word):

On the bright side, the fact that markets haven’t ended the European mess by themselves — say, through a truly huge capital flight from the more troubled countries — suggests that a solution does exist in principle, and may even take hold. That isn’t much to cheer about, but, under the circumstances, even simple survival is positive news. One specific bright spot is that both Spain and Greece have been making some wage adjustments to restore longer-term competitiveness.

I grant there has not been comparable progress in reducing suffering. And here is the case for pessimism:

Imagine a situation where the sounder countries need to put up more money, or the troubled countries need to make bigger financial adjustments, or — most likely — both. Yet power vacuums on each side, or voter rebellions against cross-national agreements, could stop these responses from being applied in a timely way. Political paralysis could then become the harbinger of disaster.

The mess won’t be resolved until the various governments raise their hands and announce transparently just how much of the mess they will pay for — and how. Such announcements will then need to be validated by elections. That means sending a consistent message to other countries and to their own domestic electorates and interest groups. Until then, the game of chicken will continue, and the risks of financial catastrophe will remain high.

Overall I still do not think the current arrangement will work out. On the positive side, the political commitment in Greece has turned out to be stronger than I had thought, with the comparable judgment for Spain and Italy remaining up in the air. On the negative side, the broader eurozone recession has halted what was significant progress in Spanish exports.

Finally, I don’t think we will know “the answer” anytime soon:

…the euro zone’s mess could last for a long time, with neither solution nor dissolution.

When matters appear to improve, or when the troubled countries receive more aid, there is more slack in the system. The troubled countries respond by behaving less responsibly and, as a result, move the financial situation closer to the precipice again. For instance, when the European Central Bank announced its debt monetization plans, Spain’s government suddenly faced lower borrowing rates and then refused to apply for a politically costly bailout and austerity package.

When matters become worse, the fiscally healthier countries pony up more aid, as we have seen them do repeatedly for Greece.

It is thus a mistake to overreact to most of the headline events about the euro zone crisis. The good news is never quite as good as it looks, and the bad news often brings beneficial responses. It seems that for dozens of months now, we’ve been hearing that the fate of the euro zone will be decided “shortly,” yet somehow the drama continues.

In normative terms, I see debt forgiveness as essential to moving forward in Europe.

I basically agree with Ross Douthat here

The retreat from child rearing is, at some level, a symptom of late-modern exhaustion — a decadence that first arose in the West but now haunts rich societies around the globe. It’s a spirit that privileges the present over the future, chooses stagnation over innovation, prefers what already exists over what might be. It embraces the comforts and pleasures of modernity, while shrugging off the basic sacrifices that built our civilization in the first place.

His link is here, and I willingly admit that I am in some ways part of the problem.

The Coasian culture that is Japan

A forthcoming paper* in the Journal of Financial Economics finds not only that inherited family control is still common in Japanese business, but that family firms are “puzzlingly competitive”, outperforming otherwise similar professionally managed companies. “These results are highly robust and…suggest family control ‘causes’ good performance rather than the converse,” say the authors.

Japan boasts some of the world’s oldest family-run businesses, and many family firms—Suzuki, Matsui Securities, Suntory—break the rule of steady dynastic decline. So how do Japanese firms do it? The answer, says the paper, is adoption.

Last year more than 81,000 people were adopted in Japan, one of the highest rates in the world. But, amazingly, over 90% of those adopted were adults. The practice of adopting men in their 20s and 30s is used to rescue biologically ill-fated families and ensure a business heir, says Vikas Mehrotra, of the University of Alberta, the paper’s lead author. “We haven’t come across this custom in any other part of the world.” Though the phenomenon has been previously documented, its impact on a company’s competitiveness has not.

The story is here and for the pointer I thank Leonardo Monasterio and Claudio Shikida. There are various copies of the paper here.

Aggregating The New Statesmen book recommendations

There are dozens of separate recommendations, by well-known writers, but these three books recur repeatedly:

1. John Jeremiah Sullivan, Pulphead: Essays. I enjoyed this one too.

2. Christopher Clark, The Sleepwalkers: How Europe Went to War in 1914, already out in the UK not yet out in the US.

3. Michael Sandel, What Money Can’t Buy: The Moral Limits of Markets. Deirdre McCloskey had a good review of that book here.

Just limiting deductions for the wealthy

This I am pulling from Greg Mankiw, with the actual source being the White House blog, namely Sperling and Furman:

Bottom line: If you apply a $25,000 deduction cap only to households with income above $250K, phase in the cap gradually as income rises above $250K, and exclude charitable giving from the cap, you increase revenue by only $450 billion over ten years.

Ideology, Motivated Reasoning, and Cognitive Reflection: An Experimental Study

That is a new paper by Dan M. Kahan, at Yale Law School, and it has to do with what I call “mood affiliation”:

Social psychologists have identified various plausible sources of ideological polarization over climate change, gun violence, national security, and like societal risks. This paper reports a study of three of them: the predominance of heuristic-driven information processing by members of the public; ideologically motivated cognition; and personality-trait correlates of political conservativism. The results of the study suggest reason to doubt two common surmises about how these dynamics interact. First, the study presents both observational and experimental data inconsistent with the hypothesis that political conservatism is distinctively associated with closed-mindedness: conservatives did no better or worse than liberals on an objective measure of cognitive reflection; and more importantly, both demonstrated the same unconscious tendency to fit assessments of empirical evidence to their ideological predispositions. Second, the study suggests that this form of bias is not a consequence of overreliance on heuristic or intuitive forms of reasoning; on the contrary, subjects who scored highest in cognitive reflection were the most likely to display ideologically motivated cognition. These findings corroborated the hypotheses of a third theory, which identifies motivated cognition as a form of information processing that rationally promotes individuals’ interests in forming and maintaining beliefs that signify their loyalty to important affinity groups. The paper discusses the normative significance of these findings, including the need to develop science communication strategies that shield policy-relevant facts from the influences that turn them into divisive symbols of identity.

To put that in Cowenspeak, both sides are guilty, the smart are guiltiest of them all, and the desire for group loyalty is partially at fault. Is it possible you have seen these propensities in the economics blogosphere?

Here is a related blog post by Kahan, here is another on how independents do somewhat better than you might think, here is Kahan’s blog.

I would stress the distinction between epistemic process and being more right about the issues at a given point in time. Even if various groups of individuals are epistemically similar in terms of how they process information, at some point in time some groups still will be more right than others, just as some sports fans, every now and then, are indeed backing the winning teams. It’s less a sign of virtue than you might think.

For the pointer I thank Jonas Kathage.

Sentences to ponder

Fewer children in the United States grow up with both biological parents than in any other affluent country for which data are available.

Here is another bit:

Genuine progress probably hinges on poor or less-educated women delaying childbirth. Eventually, this will happen; the teen birthrate has already been dropping for nearly two decades, albeit slowly. For its part, Washington (or any other government) has only limited tools to speed it up.

That is from Lane Kenworthy, from his article on why opportunity has slowed down in the United States, hat tip Brad DeLong.