Category: Current Affairs

Mexico fact of the day

This year, though, the peso is up 9.3% against the dollar, making it one of the top-performing emerging-market currencies…

There is more here. I am of the unfashionable opinion that Mexico is actually winning the war against the drug lords.

What Export-Oriented America Means

That is the title of my new 4000 or so word essay for The American Interest. Excerpt:

At least three forces are likely to combine to make the United States an [increasing] export powerhouse.

First, artificial intelligence and computing power are the future, or even the present, for much of manufacturing. It’s not just the robots; look at the hundreds of computers and software-driven devices embedded in a new car. Factory floors these days are nearly empty of people because software-driven machines are doing most of the work. The factory has been reinvented as a quiet place. There is now a joke that “a modern textile mill employs only a man and a dog—the man to feed the dog, and the dog to keep the man away from the machines.”

The next steps in the artificial intelligence revolution, as manifested most publicly through systems like Deep Blue, Watson and Siri, will revolutionize production in one sector after another. Computing power solves more problems each year, including manufacturing problems.

It’s not just that Silicon Valley and the Pentagon and our universities give the United States a big edge with smart machines. The subtler point is this: The more the world relies on smart machines, the more domestic wage rates become irrelevant for export prowess.

…The second force behind export growth will be the recent discoveries of very large shale oil and natural gas deposits in the United States…

That brings us to the third reason why America is likely to return as a dominant export power: demand from the rapidly developing countries, and not just or even mainly demand for fossil fuel. As the developing world becomes wealthier, demand for American exports will grow. (Mexico, which is already geared to a U.S.-dominated global economy, is likely to be another big winner, but that is a story for another day.)

In the early stages of growth in developing nations, importers buy timber, copper, nickel and resources linked to construction and infrastructure development. Those have not been U.S. export specialties, and so a lot of the gains from these countries’ growth so far have gone to Canada, Australia and Chile. Usually American outputs are geared toward wealthier consumers and higher-quality outputs, which is what you would expect from the world’s wealthiest and most technologically advanced home market. To put it simply, the closer other nations come to our economic level, the more they will want to buy our stuff.

That’s just the introduction. The rest of the essay considers: “how will this shape American foreign policy, jobs, education, politics and poverty?” For instance:

Some of the new technological and export-related breakthroughs will consist of making education and health care more affordable, often through software and smart machines that bypass the current credentialized control of those fields. Imagine getting an online medical diagnosis from a smart machine like IBM’s Watson, or learning mathematics from an online MITx program or one of its successors. The American poor and lower middle class will have considerably greater opportunities, at least if they are savvy with information technology and disciplined enough to take advantage of these new free or cheaper goods. Of course, this will not come close to helping everybody. These internet tools reward the self-motivated, who will be disproportionately well educated, even if their parents lack higher education, wealth and connections. Many of the rest will still fall by the wayside.

Do read the whole thing. You can think of it as some current thoughts on what it would look like to climb out of The Great Stagnation.

Addendum: Reihan adds excellent comments.

Billionaires for the War on Drugs

Hat tip: Carpe Diem. Do note the date.

Why hasn’t Britain recovered more quickly?

Ryan Avent has an excellent post, channeling an Adam Posen report (pdf). Here is one summary bit:

Financial issues, euro crisis, austerity and oil can account for a lot. It seems possible that structural factors are more of an issue in Britain than in America.

It’s worth noting that the main “austerity” culprit here seems to be the increase in the VAT, not the spending cuts (proposed or real) per se.

Why is the UK economy failing?

Do not heed those who paint with a limited palette and speak only of fiscal austerity. Via Scott Sumner, Britmouse has one report:

The Office for National Statistics’ current data on quarterly UK nominal GDP growth in 2008 is as follows, at Seasonally Adjusted Annual Rates:

- Quarter 1: 4.3%

- Quarter 2: -1.7%

- Quarter 3: -5.2%

- Quarter 4: -3.4%

That collapse in nominal spending has no precedent in the data, and is certainly worse than anything since the 1930s. . . .

There was by the way no liquidity trap, as rates were often at five percent and in general not close to zero. Britmouse now has his (her? its?) own blog.

Going back in time a bit further:

The stark generational rift emerging in Britain is highlighted by a Financial Times analysis showing that the real disposable household incomes of people in their 20s have stagnated over the past 10 years just as older households are capturing a much greater share of the nation’s income and wealth.

…The FT analysis of 50 years of official data also shows that the living standards of Britons in their 20s have been overtaken by those of their 60-something grandparents for the first time, with the household incomes of pensioners in their 70s and even 80s also catching up rapidly.

The data, which underpins government publications on living standards, takes no account of housing costs or wealth. Had it done so the results would have been even more dramatic, showing median living standards of people in their 20s have now slipped below those of people in their 70s and 80s.

The problems over there are deeply rooted.

Nonetheless, via David Harbottle, we learn that during the Olympics there is a home in London for rent for about $412,646 per month. So far there appear to be no takers. The price is listed as negotiable.

Europe fact of the day

European households will spend close to 11 per cent of income on heating, lighting, cooking and personal transport this year, compared with the historical average of 6-7 per cent and 9 per cent last year, Mr Birol said.

Here is more.

Jim Yong Kim nominated to head World Bank

Of course he is likely to get the nod. He is currently president of Dartmouth, and Wikipedia tells us this about his public health background:

Over the past few years, Kim has been involved in the development of a new field focused on improving the implementation and delivery of global health interventions. He believes that progress in developing more effective global health programs has been hindered by the paucity of large-scale systematic approaches to improving program design. This new field will rigorously gather, analyze, and widely disseminate a comprehensive body of practical, actionable insights on effective global health delivery. In order to develop this field, Kim co-founded the Global Health Delivery Project, a joint initiative of Harvard Medical School’s Department of Social Medicine and the Harvard Business School’s Institute for Strategy and Competitiveness. The global health field case studies produced by this project form the core of a new global health delivery curriculum now taught at Harvard School of Public Health. Kim’s team has also developed a web-based “community of practice”, GHDonline.org, to allow practitioners around the world to easily access information, share expertise, and engage in real-time problem solving. Kim is on the Advisory Board of Incentives for Global Health, the NGO formed to develop the Health Impact Fund proposal.

And:

Kim has 20 years of experience in improving health in developing countries. He is a founding trustee and the former executive director of Partners In Health, a not-for-profit organization that supports a range of health programs in poor communities in Haiti, Peru, Russia, Rwanda, Lesotho, Malawi and the United States.

From 2004 to 2006, Kim served as Director of the World Health Organization’s HIV/AIDS department, a post he was appointed to in March 2004 after serving as advisor to the WHO Director General. Kim oversaw all of the WHO’s work related to HIV/AIDS, focusing on initiatives to help developing countries scale up their treatment, prevention, and care programs, including the “3×5” initiative designed to put three million people in developing countries on AIDS treatment by the end of 2005.

He was born in Korea but is an American citizen. He is an expert on tuberculosis. Here is a video of Kim as a rapping spaceman. Here is one good Twitter comment.

The Spanish ten-year yield

Source here, and here is the latest on Portugal, mostly bad news. German bonds are being perceived as somewhat more risky.

The Ryan budget proposal

Ezra Klein offers some points of clarification:

Perhaps the simplest way to understand what’s going on in Paul Ryan’s budget, and whether it’s plausible, is to look at page 13 of the Congressional Budget Office’s summary of the Ryan plan (pdf). That’s where the CBO lists Ryan’s assumptions about how future budgets would differ under his proposal and under an alternative, high-deficit scenario. That lets us see where, exactly, Ryan’s presumed savings are. And they’re not, for the most part, in Medicare.

In 2030, spending on Medicare is .75 percent of GDP lower than in the alternative fiscal scenario. In fact, Ryan and the Obama administration have proposed the same rate of growth for Medicare: GDP + 0.5 percent.

It’s Medicaid and other health spending, which includes the Affordable Care Act, where Ryan really brings down the hammer: That category falls by 1.25 percent of GDP. So Ryan’s cuts to health care for the poor are almost twice the size of his cuts to health care for the old.

And then there’s the “everything else” category, which includes defense spending, infrastructure, education and training, farm subsidies, income supports, veteran’s benefits, retraining, basic research, the federal workforce and much, much more. And this category of spending falls by 2.5 percent of GDP.

Putting normative issues aside, I am predicting that something like this is what will happen, and it won’t require major Republican victories. In short, those are the most vulnerable interest groups.

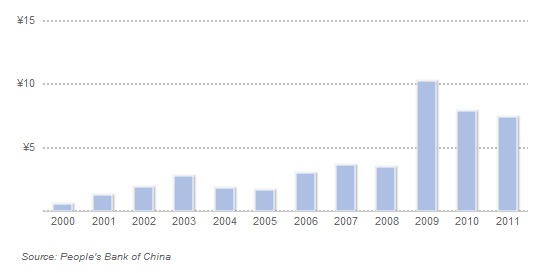

Bank lending in China

With caveats about the data, yes, but still this is striking:

That is from Christopher Balding’s Asia/China blog, the post is here. It is entitled “Why I am Concerned About the Chinese Economy in One Picture.” If you would prefer the words:

From 2008 to 2009 new local currency loans rose from 3.48 trillion rmb to 10.32 trillion according to the PBOC for an annualized increase of nearly 300%.

I do not know if those who praised the Chinese in 2009 for their aggressive stimulus program are having second thoughts, or fearing that the stimulus simply postponed — and intensified — a much-needed adjustment.

Facts about Italy

Industrial output in January was five per cent down on a year earlier, while a study by Intesa Sanpaolo, a bank, shows that national consumption of food, drink and tobacco fell in 2011 to levels last seen 30 years ago.

And:

John Elkann, chairman of Fiat, expects Italians to buy fewer cars this year than they did in 1985. Registration of new Fiat group cars in Europe fell 16.7 per cent in February from a year earlier.

And:

Whereas electricity producers were fretting four years ago that Italy lacked generating capacity, one senior utility executive told the Financial Times he feared that industrial consumption would never return to the then levels.

Analysts warn the worst is yet to come. This month Italians will feel the first impact of Mr Monti’s revenue-raising measures when they start paying higher regional income tax. In June reintroduction of a tax on first homes and higher rates on second homes come into force, to be followed in October by a further rise in value added tax.

The article is here.

Gallup fact of the day

The French election campaign continues

Sarkozy struck a strident new tone in a Sunday rally.

He threatened to pull France out of the Schengen open borders agreement and demanded the European Union adopt measures to fight cheap imports, warning that France might otherwise pass a unilateral “Buy French” law.

“I want a Europe that protects its citizens. I no longer want this savage competition,” he declared to a cheering crowd. “I have lost none of my will to act, my will to make things change, my belief in the genius of France.”

The story is here.

What would Nietzsche say?

Financial markets are already betting Greece will default again in the future. Grey market pricing for the new Greek bonds to be issued as part of the exchange ranged from 17 to 28 cents on the euro, a highly distressed level, according to indicative quotes seen by the FT.

The pricing equates to a yield on the new bonds of 17 to 21 per cent about where Greek yields stood in the autumn and far worse than the yield on debt issued by Portugal, which has also received a bailout.

Here is more.

Three on Launching

1. The excellent Reihan Salam writes, “Tabarrok’s Launching the Innovation Renaissance is my favorite manifesto in years. In a better world, it would be the roadmap for the U.S. center-right.” Small steps towards a much better world, Reihan!

2. A truly Straussian Straussian Reading of Launching the Innovation Renaissance.

3. I will be speaking at Inventing the Future: What’s Next for Patent Reform at AEI in Washington, DC on Wed. March 14, 12:30-2:00.