Category: Current Affairs

China Fact of the Day: China Outsources to Europe

Spiegel: Great Wall this week became the first Chinese automobile manufacturer to open an automobile assembly plant inside the European Union…

…Bulgaria, the EU’s poorest country, is attractive as a labor market because it is an oasis of cheap wages and low taxes. Workers are considered well educated and the country is ideal as the site for a company like Great Wall to launch. Given that wages for factory workers have risen considerably in China in recent years, assembly sites abroad have become increasingly attractive for some manufacturers.

Expect to see a lot more of this in coming years.. As wealth and consumption increases, China will also begin to import more from developed countries, including more finished goods.

Investing in Greece: Only for the Filthy Rich

If a small company wants to sell shares to investors it must demonstrate to the SEC that the investors are “accredited,” basically wealthy, or otherwise it must go through a long and burdensome process to make an offering to the public. According to one account, Greece has considerably more peculiar requirements:

Antonopoulos and his partners spent hours collecting papers from tax offices, the Athens Chamber of Commerce and Industry, the municipal service where the company is based, the health inspector’s office, the fire department and banks. At the health department, they were told that all the shareholders of the company would have to provide chest X-rays, and, in the most surreal demand of all, stool samples.

Greek banks were not much better:

Once they climbed the crazy mountain of Greek bureaucracy and reached the summit, they faced the quagmire of the bank, where the issue of how to confirm the credit card details of customers ended in the bank demanding that the entire website be in Greek only, including the names of the products.

“They completely ignored us, however much we explained that our products are aimed at foreign markets and everything has to be written in English as well,” said Antonopoulos.

Take this with a grain of salt but the World Bank does rank Greece 135th in the world (186 countries ranked) in ease of starting a business.

Greek markets in everything

It’s being called the “negative salary”: Due to austerity measures in Greece, it’s being reported that up to 64,000 Greeks will go without pay this month, and some will have to pay for having a job. Numbers in austerity reports have usually reflected figures in the millions, since they reflect industry-wide cuts (i.e. a 537-million euro cut to health and pension funds). And plans of cutting minimum wage by up to 32% is all but a given in the country. Today’s “negative salary” deal—which could have government employees returning funds— reveals the real human impact of the austerity measures.

Here is more.

Congress gets two right

In a rare display of function, Congress extended the payroll tax cut and in the same deal they arranged to sell more spectrum, both good ideas and ones that I have argued for extensively. Frankly, I am pleased but surprised. Any inside knowledge on how this was accomplished?

Not from Atlas Shrugged

The Hill: Six House Democrats, led by Rep. Dennis Kucinich (D-Ohio), want to set up a “Reasonable Profits Board” to control gas profits.

The Democrats, worried about higher gas prices, want to set up a board that would apply a “windfall profit tax” as high as 100 percent on the sale of oil and gas, according to their legislation.

…The Gas Price Spike Act, H.R. 3784, would apply a windfall tax on the sale of oil and gas that ranges from 50 percent to 100 percent on all surplus earnings exceeding “a reasonable profit.” It would set up a Reasonable Profits Board made up of three presidential nominees that will serve three-year terms.

And here directly from the proposed bill:

(4) REASONABLE PROFIT.—The term ‘reasonable profit’ means the amount determined by the Reasonable Profits Board to be a reasonable profit on the sale.

Addendum: Here is Bryan Caplan’s classic, Atlas Shrugged and Public Choice: The Obvious Parallels and here is the award-winning Atlas Shrugged app.

Romney v. Romney

The joke going around last week was that a liberal, a conservative and a moderate walk into a bar. “Hi Mitt,” says the bartender. Here’s Mitt proving the point:

“This week, President Obama will release a budget that won’t take any meaningful steps toward solving our entitlement crisis,” Romney said in a statement e-mailed to reporters. “The president has failed to offer a single serious idea to save Social Security and is the only president in modern history to cut Medicare benefits for seniors.”

Hat tip on this one to Paul Krugman.

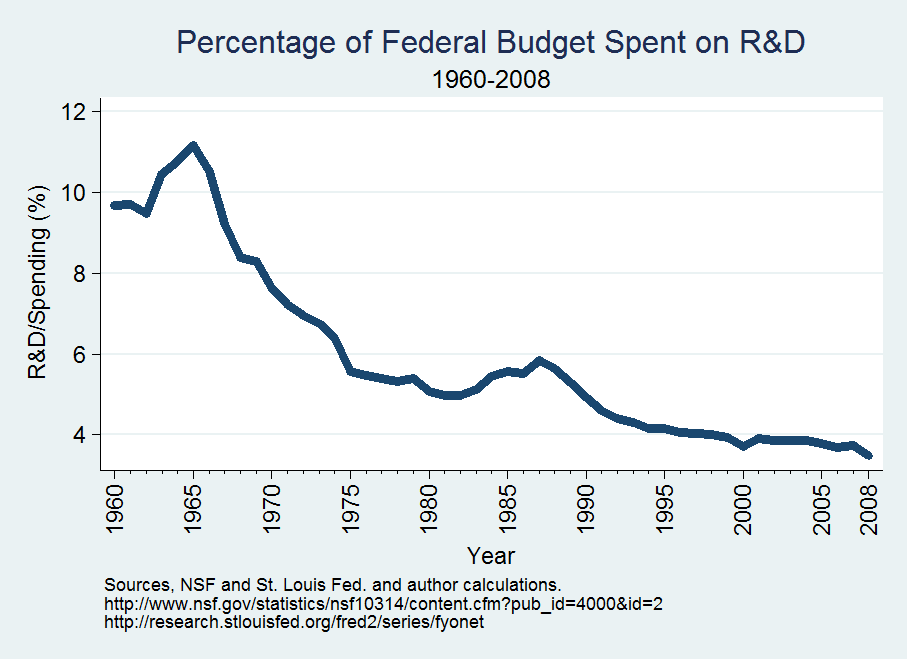

Innovation Nation v. Warfare-Welfare State (more)

The New York Times has a lengthy piece on the expansion of the welfare state:

The government safety net was created to keep Americans from abject poverty, but the poorest households no longer receive a majority of government benefits.

…Dozens of benefits programs provided an average of $6,583 for each man, woman and child in the county in 2009, a 69 percent increase from 2000 after adjusting for inflation.

…The recent recession increased dependence on government, and stronger economic growth would reduce demand for programs like unemployment benefits. But the long-term trend is clear. Over the next 25 years, as the population ages and medical costs climb, the budget office projects that benefits programs will grow faster than any other part of government, driving the federal debt to dangerous heights.

In Launching the Innovation Renaissance (and here) I argue that the warfare-welfare state is crowding out other areas of spending, even when such spending could be highly valuable.

Simple truths about Greece

Greece will have to bring its current account deficit down to zero at some point.

This can happen in two ways: either Greece exports more or spends less. Adjusting the current account by spending less would require an additional fall in GDP of 25 per cent, given that in Greece only one in four US dollars of spending cuts goes abroad. This is clearly not a pretty picture. But adjusting by raising exports would require they increase by 50 per cent, not an easy feat. Achieving it through tourism alone would require the industry to triple in size – an unlikely prospect.

And this:

Here’s the bad news for Greece: in our sample of 128 countries, it had the biggest gap between its current recorded level of income and the knowledge content of its exports. Greece owes its income to borrowed foreign spending it cannot pay back. It produces no machines, no electronics and no chemicals. Of every 10 US dollars of worldwide trade in information technology, it accounts for one cent.

This problem cannot be addressed by fiscal Keynesian stimulus, by bland trade facilitation or by paying lip-service to structural adjustment as the November International Monetary Fund agreement implicitly assumes.

China facts of the day

Office rents in Beijing have soared over the past two years, making it more expensive to lease prime work space in China’s capital than in New York, according to an industry survey.

A boom in demand and limited supply of high-quality space catapulted Beijing to fifth place in a list of the world’s priciest office locations that was compiled by Cushman & Wakefield, a commercial property services firm.

Hong Kong retained the top spot, followed by London, Tokyo and Moscow. New York was sixth, just behind Beijing.

Prime office rents in Beijing’s central business district rose 75 per cent last year, the fastest globally, and up from a 48 per cent increase in 2010, according to the survey.

Here is a bit more.

The negotiations over refunding Greece

Here is one very effective understatement:

The two sides were “quite far apart” over projected cuts of 25 per cent in private sector wages, 35 per cent in supplementary pensions and the immediate closure of about 100 state-controlled organisations with thousands of job losses, a Greek official said.

Coase may yet kick in, but it looks pretty tough to me. Here is a good post on what it means if there is no public lender haircut.

The cultures that is Italy

Responsible for one of the most stupid shipping accidents of all time, not to mention the death of thirty or so passengers, Schettino was nevertheless greeted in his home town of Meta di Sorrento (on the south side of the bay of Naples) by a crowd waving banners in his favor and complaining, priest included, that the man’s bad press was the result of a general prejudice against their community. “Every Italian,” Giacomo Leopardi dryly remarked in 1826 “is more or less equally honored and dishonored.”

Here is more, interesting throughout.

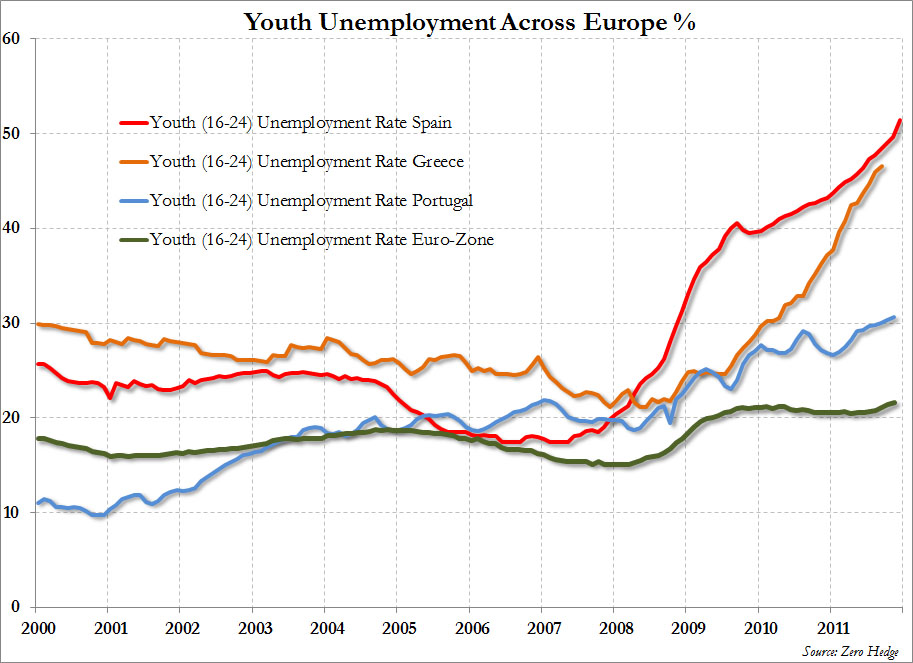

Youth unemployment across Europe

Here is more, hat tip goes to Greg Ip.

Addendum: Do read the excellent comment by Peter Whiteford, for instance:

The unemployment ratio – that is, the number of unemployed people over the population rather than the labor force is arguably a more consistent indicator across countries.

This shows that while in Greece for example, the unemployment rate for youth was around 46% the unemployment ratio was around 10% – nearly half of those in the labour force were unemployed, but only a little over 20% of all the people in the age group were in the labour force.

In Praise of Private Equity

Excellent piece by Reihan Salam on private equity and how Bain fit into the larger picture of a dynamic economy.

The difficult truth that virtually no politician is prepared to acknowledge is that the road to job creation runs through job destruction.

…Chad Syverson, an economist at the University of Chicago’s Booth School of Business, found that what separates top firms from bottom firms is, typically, a large difference in productivity, with the top ones producing almost twice as much with the same measured input. This creates an almost irresistible temptation for investors. If Firm X, languishing at the 10th percentile in terms of productivity, could somehow be overhauled to match the productivity levels achieved by Firm A, at the 90th percentile, the potential for profit would be huge. Note, however, that halving “measured input” in order to double productivity will often mean shedding the weakest performers and giving those who remain the tools they need to do their jobs better and faster. Private equity does exactly this.

What Mitt Romney discovered was that American corporations sometimes had to be dragged, wailing and whining, into a state of efficiency. As a management consultant at Bain & Company, Romney had studied successful firms and then told other firms how to replicate their strategies. But those firms had come of age in the fat years of American corporate dominance, when many believed that the Japanese could do little more than manufacture cheap toys and textiles, and many were reluctant to accept his newfangled advice. It eventually became clear that if Romney and his cohort were going to remake American business, they’d have to raise money to make their own investments. Spurred by the senior partners at Bain & Company, Romney and his merry band of consultants established Bain Capital.

I wish Romney were as eloquent in his defense as is Salam.

Can Greece now leave the eurozone?

Meg Greene writes:

I have long thought that the troika would cut Greece loose and let it default and exit the eurozone once eurozone banks had been sufficiently firewalled. Perhaps this aggressive proposal by Germany is one of the unintended consequences of the ECB’s three year long term refinancing operation (LTRO). If eurozone banks have as much access to cheap, three-year ECB funding as their collateral allows, perhaps Germany and the troika have decided that eurozone banks can survive a Greek default. Greece is clearly insolvent and must leave the eurozone to eventually return to growth. The German proposal may have accelerated the inevitable.

I recall someone on Twitter noting that if Greek leaders turned fiscal sovereignty over to Brussels, the relevant parties would end up hanged for treason, or something like that. I’ll predict against that outcome. Angus adds comment. The general point here is that apparent progress also makes it easier for parts of the Eurozone to unravel. In this context what counts as “good news” or “bad news” can be quite tricky.

Cell phone taxes and the tragedy of the anticommons

Why are cell phone taxes so high? In the United States we tax cell phones more than beer. The usual explanations for high taxes, negative externalities and low elasticity of demand don’t seem to apply to cell phones. Our colleagues Thomas Stratmann and Matt Mitchell offer an answer based in political economy.

…no single politician does choose to tax them that much. Instead, the high taxes that we pay on our cell phones are the sum of lots of little taxes imposed by several different political entities. Consider, for example, the tax bill of a typical New Yorker. It includes a federal USF fee, four state taxes, five city taxes, and a local 9-1-1 fee. Each of these is relatively small, but when you add it all up, the combined rate is over 22 percent.

…The mobile service tax base appears to suffer from a tragedy of the anticommons…numerous overlapping tax authorities seek to obtain revenues through wireless-service taxation, and this may lead to overexploitation of the tax base.

…We use state-level data from three years to examine the possible economic, demographic, and political factors that might explain the variation in these rates. We find that wireless tax rates increase with the number of overlapping tax bases.

Hat tip: Neighborhood Effects.