Category: Law

What arbitrage would look like if destruction were the goal

High school students in Maryland are using speed cameras as a tool to

fine innocent drivers in a game, according to the Montgomery County

Sentinel newspaper. Because photo enforcement devices will

automatically mail out a ticket to any registered vehicle owner based

solely on a photograph of a license plate, any driver could receive a

ticket if someone else creates a duplicate of his license plate and

drives quickly past a speed camera. The private companies that mail out

the tickets often do not bother to verify whether vehicle registration

information for the accused vehicle matches the photographed vehicle.

Here is much more.

The rule of law?

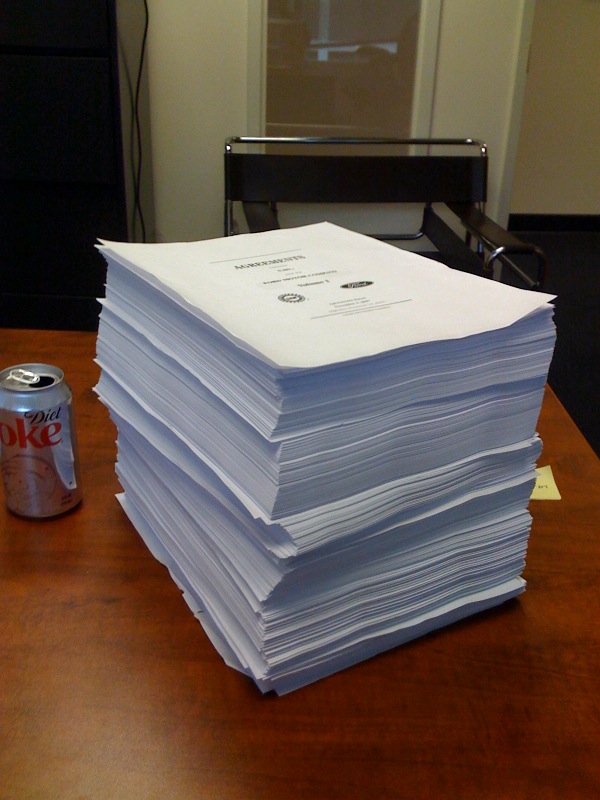

That’s Ford’s UAW contract. You can read those 2215 pages, and other UAW contracts, here. I thank Tim Miller for the pointer.

Law and Economics 2.0

On Thursday the Kauffman Foundation will announce that it is making

$10 million in initial contributions to found an initiative aimed at

reinvigorating, and, to some extent redirecting, the exceedingly influential

school of thought that has come to be known as “law and economics.”…Kauffman’s new “Law, Innovation and Growth” initiative seeks to refocus the

law-and-economics debate to center on the promotion of entrepreneurship [law and growth, dynamic efficiency etc., AT]…

Robert Litan will direct.

Litan’s role model here, he acknowledges, is Henry Manne, a dean emeritus at

George Mason University School of Law in Arlington, Vir., who was

law-and-economics’ chief proselytizer and salesman.

More here. Hat tip to Tim Kane at Growthology.

Law and Literature reading list, Spring 2009

The Five Books of Moses, edited and translated by Robert

Alter.

The Metamorphosis, In the Penal Colony, and Other Stories,

by Franz Kafka.

Smilla’s Sense of Snow, by Peter Hoeg.

The Art of Political Murder: Who Killed the Bishop? By Francisco

Goldman.

In the Belly of the Beast, by Jack Henry Abbott.

Borges and the Eternal Orangutans, by Fernando Verrissimo.

Glaspell’s Trifles, available on-line.

Great Short Works of Leo Tolstoy, by Leo Tolstoy.

Sherlock Holmes, The Complete Novels and Stories, Sir Arthur

Conan Doyle, volume 1.

Out: A Novel, by Natsuo Kirino.

I, Robot, by Isaac Asimov.

Moby Dick, by Hermann Melville, excerpts, chapters 89 and 90.

Year’s Best SF 9, edited by David G. Hartwell and Kathryn

Cramer.

Pale Fire, Vladimir Nabokov.

Blindness, by Jose Saramago.

We also will view a small number of movies — most of all Sia — and perhaps I will add a Henning Mankell novel as well.

Is Google happy with its book-scanning deal?

Google’s concession has made it more difficult for anyone to invoke fair use for book searches. The settlement itself is proof that a company can pay licensing fees and still turn a profit. So now no one can convincingly argue that scanning a book requires no license. If Microsoft starts its own book search service and claims fair use, the courts will say, "Hey, Google manages to pay for this sort of thing. What makes you so special?"

By settling the case, Google has made it much more difficult for others to compete with its Book Search service. Of course, Google was already in a dominant position because few companies have the resources to scan all those millions of books. But even fewer have the additional funds needed to pay fees to all those copyright owners. The licenses are essentially a barrier to entry, and it’s possible that only Google will be able to surmount that barrier.

Sure, Google now has to share its profits with publishers. But when a company has no competitors, there are plenty of profits to share.

Petards

Wall Street unwittingly created one of the catalysts for the collapse of Bear Stearns, Lehman Brothers and American International Group by backing new bankruptcy rules that were aimed at insulating banks from the failure of a big client, lawyers and bankers say.

The

2005 changes made clear that certain derivatives and financial

transactions were exempt from provisions in the bankruptcy code that

freeze a failed company’s assets until a court decides how to apportion

them among creditors.However, experts say the new rules might have accelerated the demise

of Bear, Lehman and AIG by removing legal obstacles for banks and hedge

funds that wanted to close positions and demand extra collateral from

the three companies.“The changes were introduced to promote the

orderly unwinding of transactions but they ended up speeding up the

bankruptcy process,” said William Goldman, a partner at DLA Piper, the

law firm. “They wanted to protect the likes of Lehman and Bear Stearns

from the domino effect that would have ensued had a counterparty gone

under. They never thought the ones to go under would have been Lehman

and Bear.”

Here is the full story. Here is previous MR coverage of this topic. Here is a short article on petards. Here is Wikipedia on petards. Here are pictures of petards.

Bulgarian corruption markets in everything

According to corruption fighters and election observers, votes can be

traded, depending on the town, for marijuana cigarettes or sold for up

to 100 leva, or $69. People document their votes by taking pictures of

their ballots with their cellphone cameras, according to Iva

Pushkarova, executive director of the Bulgarian Judges Association.

Trust, then verify, as they say. In fact you can’t trust the government either, so that requires a market in "decoy lawyers":

While corruption affects many corners of society, the impact is

particularly stark in the legal system, where some people without

political connections have resorted to hiring decoy lawyers, for fear

that their legal documents would vanish if presented to particular

clerks by lawyers recognized as working for them.

I cannot find a comparable concept of "decoy lawyers" in English-language Google. There is yet another market:

Sofia has a thriving black market for blood outside hospitals, where

patients’ families haggle over purchases with dealers, according to

Bulgarian news reports that track the prices.

Here is the article. I thank KB and also Stephen (check out his blog at the link) for the pointer.

USA regulates USA — whoops!

Government regulations — numerous ones I might add — are standing in the way of the Treasury plan to recapitalize U.S. banks:

The problem is this: Under existing rules, banks cannot count the

Treasury Department’s investment as part of their core capital, the

foundation of money that supports a bank’s operations. The very goal of

the plan was to buttress those foundations, which have been eroded by

recent losses, undermining the stability of the banks.

The Fed has changed its rule to accommodate Treasury policy and so has the OCC. But will the Office of Thrift Supervision, the Federal Deposit Insurance Corp. and state banking regulators follow suit? Sooner or later, yes. Get this: "All have their own capital standards and it remained unclear early this

afternoon how many of those standards might need to be adjusted." I vote on the state authorities to come in last.

Joe the Illegal Plumber

I do not think that either candidate will come out against the mandatory licensing of plumbers, but here is the real scoop on Joe:

Thomas Joseph, the business manager of Local 50 of the United

Association of Plumbers, Steamfitters and Service Mechanics, based in

Toledo, said Thursday that Mr. Wurzelbacher had never held a plumber’s

license, which is required in Toledo and several surrounding

municipalities. He also never completed an apprenticeship and does not

belong to the plumber’s union, which has endorsed Mr. Obama. On

Thursday, he acknowledged that he does plumbing work even though he

does not have a license.

Not only that, he calls himself Joe but his real name is Samuel. He also owes back taxes. I wonder if he has ever hired illegal immigrants to help him out. Yes the Republican Party is ******* and I will not vote for them, but how many Democratic politicians will speak out against the coercive restraints placed on Joe (Samuel)? That’s a serious question.

Addendum: As is often the case, those few of you who are mad at me simply haven’t

read the post carefully enough. Just for a start, I’m not at all

criticizing the guy for calling himself Joe rather than Samuel. I was

making fun of those people who are upset by this. Some of you are

committing other misunderstandings as well. By the way, here are details on Toledo and licensing.

Facts about occupational licensing

We find that in 2006, 29 percent of the workforce was required to hold

an occupational license from a government agency, which is a higher

percentage than that found in studies that rely on state-level

occupational licensing data.

That is from a new paper by Morris Kleiner and Alan Krueger. I am happy to see such respected economists turning their attention to a neglected issue. Here is a non-gated version of the paper.

There is, by the way, an interesting sentence buried near the end of the paper:

In contrast, union members perceive themselves as less competent than other workers.

The roots of Chinese pollution

A detailed analysis of powerplants in China by MIT researchers debunks

the widespread notion that outmoded energy technology or the utter

absence of government regulation is to blame for that country’s

notorious air-pollution problems. The real issue, the study found,

involves complicated interactions between new market forces, new

commercial pressures and new types of governmental regulation…China’s power sector has been expanding at a rate roughly equivalent to

three to four new coal-fired, 500 megawatt plants coming on line every

week…most of the new plants have been built to very high technical

standards, using some of the most modern technologies available. The

problem has to do with the way that energy infrastructure is being

operated and the types of coals being burned.

The good news is that there is a single lever — coal quality — that could have an enormous impact on Chinese pollution levels. Here is the full story.

Regulation, a dialogue with Warren Buffett

QUICK: If you imagine where things will go with Fannie and Freddie, and

you think about the regulators, where were the regulators for what was

happening, and can something like this be prevented from happening

again?Mr. BUFFETT: Well, it’s really an incredible case study in regulation

because

something called OFHEO was set up in 1992 by Congress, and the sole job

of OFHEO was to watch over Fannie and Freddie, someone to watch over

them. And they were there to evaluate the soundness and the accounting

and all of that. Two companies were all they had to regulate. OFHEO has

over 200 employees now. They have a budget now that’s $65 million a

year, and all they have to do is look at two companies. I mean, you

know, I look at more than two companies.QUICK: Mm-hmm.

Mr.

BUFFETT: And they sat there, made reports to the Congress, you can get

them on the Internet, every year. And, in fact, they reported to

Sarbanes and Oxley every year. And they went–wrote 100 page reports,

and they said, ‘We’ve looked at these people and their standards are

fine and their directors are fine and everything was fine.’ And then

all of a sudden you had two of the greatest accounting misstatements in

history. You had all kinds of management malfeasance, and it all came

out. And, of course, the classic thing was that after it all came out,

OFHEO wrote a 350–340 page report examining what went wrong, and they

blamed the management, they blamed the directors, they blamed the audit

committee. They didn’t have a word in there about themselves, and

they’re the ones that 200 people were going to work every day with just

two companies to think about. It just shows the problems of regulation.QUICK: That sounds like an argument against regulation, though. Is that what you’re saying?

Mr.

BUFFETT: It’s an argument explaining–it’s an argument that managing

complex financial institutions where the management wants to deceive

you can be very, very difficult.

Here is a good article on what the mortgage agencies have been up to.

Not from The Onion: The Teenage Put

Parents are abandoning teenagers at Nebraska hospitals, in a case of a well intentioned law inspiring unintended results.

Over the last two weeks, moms or dads have dropped off seven teens

at hospitals in the Cornhusker state, indicating they didn’t want to

care for them any more.…Under a newly implemented law, Nebraska is the only

state in the nation to allow parents to leave children of any age at

hospitals and request they be taken care of, USA Today notes. So-called

“safe haven laws” in other states were designed to protect babies and

infants from parental abandonment...The moral of this story appears to be that safe haven

laws need to be very carefully and narrowly written to ensure they’re

not abused by parents.

From now on I will will tell my kids, "Behave! or we’re moving to Nebraska!"

Quotable quotes

Mercedes scoffs at such notions. "It is really, really difficult to harm a horse with massage, especially if all you’re using is your hands."

Here is the story and that is from The Washington Post. Apparently it is legal to give a human a massage in Maryland, and legal to shoe a horse in Maryland, but not legal to give a horse a massage in Maryland unless you own that horse. And there is no way to get the appropriate license. The Institute for Justice is taking up the case.

Glass Steagall: The Real History

Many wise people are now recognizing that the repeal of Glass-Steagall was one of the few saving graces of the current crisis. Let’s thank President Clinton (and Phil Gramm) for that wise bit of deregulation. The following potted history of the law, however, is all too typical:

Glass-Steagall was one of the many necessary measures taken by Franklin Delano Roosevelt and the Democratic Congress to deal with the Great Depression. Crudely speaking, in the 1920s commercial banks (the types that took deposits, made construction loans, etc.) recklessly plunged into the bull market, making margin loans, underwriting new issues and investment pools, and trading stocks. When the bubble popped in 1929, exposure to Wall Street helped drag down the commercial banks….The policy response was to erect a wall between investment banking and commercial banking.

Given a history like this people wonder how repealing the law could have been a good thing. But a significant academic literature has investigated these claims and rejected them. Eugene White, for example, found that national banks with security affiliates were much less likely to fail than banks without affiliates. Randall Kroszner (now at the Fed.) and Raghuram Rajan found that (jstor) securities issued by unified banks were (ex-post) of higher quality that those issued by investment banks. A powerful book by George Benston went through the entire Pecora hearings which supposedly revealed the problems with unified banking and found them to be a complete sham. My colleague, Carlos Ramirez later showed that the separation of commercial and investment banking increased the cost of external finance (jstor). Finally, my own work (pdf) unearthed the real reasons for the separation in a titanic battle between the Morgans and Rockefellers.

Thus, the history of banking before Glass-Steagall and now our recent experience after is consistent, generally speaking unified banking is safer and repeal was a good idea.