Category: Web/Tech

They modeled this — why women might see fewer STEM ads

Women see fewer advertisements about entering into science and technology professions than men do. But it’s not because companies are preferentially targeting men—rather it appears to result from the economics of ad sales.

Surprisingly, when an advertiser pays for digital ads, including postings for jobs in science, technology, engineering and mathematics (STEM), it is more expensive to get female views than male ones. As a result, ad algorithms designed to get the most bang for one’s buck consequently go for the cheaper eyeballs—men’s. New work illustrating this gap is prompting questions about how that disparity may contribute to the gender gap in science jobs.

…As a result of that optimization, however, men saw the ad 20 percent more often than women did…

Tucker ran $181 worth of advertising via Google, for example, saying she was willing to pay as much as 50 cents per click. It ended up costing 19 cents to show the ad to a man versus 20 cents to show that same ad to a woman. These investments resulted in 38,000 “impressions”—industry-speak for ad views—among men, but only about 29,000 impressions among women.

Similarly, on Twitter it cost $31 to get about 52,000 impressions for men but roughly $46 to get 66,000 impressions for women. And on Instagram it cost $1.74 to get a woman’s eyeballs on the ad but only 95 cents to get a man’s.

Here is the full Scientific American article, via Luke Froeb, and do note those differentials may vary considerably over time. Gender issues aside, I would say this reflects a broader problem with having a very high value of time — it becomes harder to maintain a relatively high proportion of people showing you valuable things you wish to see (as opposed to people bugging you, grifting you, etc.).

Mark Zuckerberg and the metaverse

And I actually would go so far as to say that I think that might be one of, if not the biggest technological challenge that our industry will face in the next decade. We tend to really celebrate things that are big, right? But I actually think miniaturizing things and getting a supercomputer to fit into a pair of glasses is actually one of the bigger challenges. But once you have that, so you have those glasses and you have your VR headset, I think that’s going to enable a bunch of really interesting use cases.

So, one is you will be able to, with basically a snap of your fingers, pull up your perfect workstation. So anywhere you go, you can walk into a Starbucks, you can sit down, you can be drinking your coffee and kind of wave your hands and you can have basically as many monitors as you want, all set up, whatever size you want them to be, all preconfigured to the way you had it when you were at your home before. And you can just bring that with you wherever you want.

If you want to talk to someone, you’re working through a problem, instead of just calling them on the phone, they can teleport in, and then they can see all the context that you have. They can see your five monitors, or whatever it is, and the documents or all the windows of code that you have, or a 3D model that you’re working on. And they can stand next to you and interact, and then in a blink they can teleport back to where they were and kind of be in a separate place.

So I think for focus time and individual productivity, I think being able to have your ideal setup, we call this “infinite office.”

Here is the full interview, interesting throughout. Via Fergus McCullough.

Why has the Indian diaspora been so successful?

Dwarkesh writes to me:

Why do you think the Indian diaspora has been so successful? Just selection of the best immigrants from a large pool of candidates or something else too?

Yes, there are plenty of Indians, and surely that matters, but I see several others factors at work:

1. The Indian diaspora itself is large, estimated at 18 million and the single largest diaspora in the world.

2. A significant portion of the better-educated Indians are hooked into English-language networks early on, including through the internet. The value of this connection has been rising due to the rising value of the internet itself. That is a big reason to be bullish on the Indian diaspora.

3. India has been growing rapidly enough so that people understand the nature and value of progress, yet the country remains poor enough that further progress seems urgent.

4. Many Indian parents seem intent on expecting a great deal from their children. The value of this cannot be overemphasized. This effect seems to be stronger in India than in say Indonesia.

5. There is especially positive selection for Indians coming to America. You can’t just run across a border, instead many of the ways of getting here involve some specialization in education and also technical abilities. Virtually all migrated in legal manners, and here is some interesting data on how the various cohorts of Indians arriving in America differed by wave.

6. More speculatively, I see a kind of conceptual emphasis and also a mental flexibility resulting from India’s past as a mixing ground for many cultures. Perhaps some of this comes from the nature of Hinduism as well, even for non-Hindu Indians (just as American Jews are somewhat “Protestant”). Indians who move into leadership roles in U.S. companies seem to do quite well making a very significant cultural leap. I cannot think of any other emerging economy where the same is true to a comparable extent. In any case, the intellectual capital embedded in Indian culture is immense.

7. Those Indians who leave seem to retain strong ties to the home country, which in turn helps others with their subsequent upward mobility, whether in India or abroad. In contrast, Russians who leave Russia seem to cut their ties to a higher degree.

8. I feel one of the hypotheses should involve caste, but I don’t have a ready claim at hand.

Here is the take of Stephen Manallack. Here is Times of India. (And by the way, here is Shruti’s piece on India’s 1991 reforms, not irrelevant to the diaspora.)

What else?

Data on the great stagnation

https://twitter.com/mattyglesias/status/1417819966989086721

“The Crypto Revolution Will Not be Public”

That is the title of my latest Bloomberg column, here is one excerpt:

In a remarkably honest yet radical speech last month about stablecoins, Fed Governor Randal Quarles argued that current payments systems already incorporate a great deal of information technology — and they are improving rapidly. The implication is that a central bank digital currency, or CBDC, is a solution in search of a problem.

Quarles also suggested that the Fed tolerate stablecoins, just as central banking has coexisted and indeed thrived with numerous other private-sector innovations. Stablecoins can serve as a private-sector experiment to see if individuals and institutions truly desire a radically different payments system, in this case based on crypto and blockchains. If they do, the system can evolve by having some but not all transactions shift toward stablecoin.

There need not be any “do or die” date of transition requiring a perfectly functioning CBDC. But insofar as those stablecoins can achieve the very simple methods of funds transfer outlined above, market participants will continue to use them more.

Quarles argued that with suitable but non-extraordinary regulation of stablecoin issuers, such a system could prove stable. He even seems to prefer the private-sector alternative: “It seems to me that there has been considerable private-sector innovation in the payments industry without a CBDC, and it is conceivable that a Fed CBDC, or even plans for one, might deter private-sector innovation by effectively ‘occupying the field.’”

In essence, Quarles is willing to tolerate a system in which privately issued dollar equivalents become a major means of consummating payments outside of the Fed’s traditional institutions. Presumably capital requirements would be used to ensure solvency.

For many onlookers, even hearing of innovation in finance raises worries about systemic risk. But perhaps the U.S. would do better by letting information technology advance than trying to shut it down. And if you are afraid of instability, are you really so keen to see foreign central bank digital currencies fill up this space?

If you are still skeptical, ask yourself two final questions. First, which has been more innovative on these issues: the private sector or the public sector? Second, how realistic are the prospects that Congress takes any effective action at all?

This is now a world in which radical monetary ideas are produced and consumed like potato chips. I say, pass the bag.

Recommended.

Stripe Atlas update

Five years ago, Marginal Revolution covered a new project, Stripe Atlas, to help founders incorporate their start-ups and thus make them successful realities. There is a one-time fee of $500. Here are the results:

In 2016, we launched Stripe Atlas to help founders turn their ideas into startups, and in turn, collectively grow the GDP of the internet. Since then, over 20,000 businesses have started with Atlas and have generated over $3 billion in revenue. We surveyed over 1,000 Atlas founders to get a snapshot of this generation of entrepreneurs and their needs…

Ninety-one percent of Atlas founders are not in Silicon Valley. In fact, outside of the US, some of the places where we’re seeing the fastest growth are Nigeria (400% year-over-year), United Arab Emirates (165%), and India (66%). Twenty-eight percent of founders told us that they identify as minorities in their country, and 24% are immigrants. Just 12% of founders identified as female. (This is slightly better when compared to the portfolios of major startup accelerators or venture capital firms.) Over time we hope to help more female founders start and scale. Forty-three percent of Atlas founders are building businesses for the first time—nearly 10,000 of them started in just the past year (an indication of an upward trend in entrepreneurship after nearly three decades of decline).

That is from Edwin Wee. The core lesson, at the meta-level, is that business services for an internet age remain drastically underprovided. But on the bright side, entrepreneurs are starting to remedy this…

The economics of ransomware attacks

That is the topic of my latest Bloomberg column, here is one part:

In economic terms, the private value of internet security is often less than the public value. A ransomware attack that results in only a slight decrease in profits for a business could translate into a major social inconvenience.

One consolation is that hackers will almost certainly “overfish” the pool of victims. At some point there will be so many attacks that most institutions will have no choice but to respond with significant defensive measures. The hackers themselves will accelerate this process, because each will try to maximize their profits before the game is over. Curiously, this means that a successful attempt to “slow down” the hackers could just delay the necessary adjustments that businesses need to make, leaving everyone worse off.

There is much more at the link.

Wyoming fact of the day

Wyoming—the first US state to grant a charter to a crypto bank—has approved legal status for a decentralized autonomous organization (DAO), the American CryptoFed DAO, according to an announcement on Sunday. The organization, which has a mission to introduce a new monetary system, now becomes the first legally recognized DAO in the U.S.

It comes after Wyoming lawmakers voted in March to pass a bill allowing DAOs to be officially registered in the state. The law affords these entities—which are governed by smart contracts and dispense with the hierarchical control structure seen in traditional companies—the same rights as a limited liability company. The bill came into effect on July 1, 2021.

Just think — limited liability for “a company managed by nobody”! And:

The DAO law also solidifies Wyoming’s reputation as the most crypto-friendly U.S. state. Last year, it was the first in the US to issue a state charter for crypto banks and has already licensed two: Kraken and Avanti.

Here is the full story, via Shaffin Shariff.

Which media have proven sticky as pandemic has diminished?

The single biggest new media habit to be formed during the pandemic appears to be gaming. The extra hour per week that people spent gaming last year represented the largest percentage increase of any media category. And unlike other lockdown hobbies, it is showing no sign of falling away as life gets back to normal. It has become “a sticky habit”, says Craig Chapple of Sensor Tower. He finds that last year people installed 56.2bn gaming apps, a third more than in 2019 (and three times the rate of increase the previous year). The easing of lockdowns is not denting the habit: the first quarter of 2021 saw more installations than any quarter of 2020. Roblox, a sprawling platform on which people make and share their own basic games, reported that in the first quarter of this year players spent nearly 10bn hours on the platform, nearly twice as much time as they spent in the same period in 2020.

And:

…whereas all other generations of Americans named television and films as their favourite form of home entertainment, Generation Z ranked them last, after video games, music, web browsing and social media.

Here is more from The Economist.

Bulletin: a more than marginal boost for Marginal Revolution

We are proud to announce that Marginal Revolution now exists on a second site as well, affiliated with Facebook, at marginalrevolution.bulletin.com.

We are excited to be part of this new project, called Bulletin. Please note that marginalrevolution.bulletin.com will be fully free and open, just as the current site is.

If you prefer to stay here, you can do so — no need to make any changes. RSS, Twitter feed, email service, everything remains intact. Or if you prefer it over there, that is great too. Facebook obviously has a reputation for producing great software, and we look forward to seeing what they can do with this project. Many other content creators have been recruited for this venture, they will have their own Bulletin sites, and we will tell you more about them soon.

We are keen to see our ideas and writings brought to new audiences, and our new partnership with Facebook will enable this. So far they have been great to work with, and we will be able to continue with our fully independent status.

We are also delighted to see that some of you will have the opportunity to comment on two different sites, not just one.

Onwards and upwards! We are in this for the long haul.

And as always, we thank you all for reading.

Bulletin!

We are thrilled that Marginal Revolution is a featured part of Facebook’s new Bulletin writing service. Facebook has nearly 3 billion active users and this new partnership will bring additional readers to Marginal Revolution. Don’t worry, however, we remain an independent source of news and opinion and Marginal Revolution will continue to exist at Marginal Revolution as well as at MarginalRevolution.Bulletin.com. Bulletin will bring us new readers and we are excited about the new methods of content delivery that Facebook will bring to the table. More on that in the future!

Is blockchain puny?

Here is a new and intriguing idea (link now fixed) from StarkWare, a blockchain start-up based in Israel. Authored by Eli Ben-Sasson, here is one excerpt:

Imagine if we accepted, for the foreseeable future, that we can only write on a given blockchain ten times per second, but instead of writing ten single transactions, made ten additions to the blockchain, each attesting to thousands of transactions. Despite the scale-up, there would be no significant rise in the number of kilobytes being added to the chain.

In short, I’m talking about a fix that would mean the same blockchains that I brazenly called puny would suddenly become mighty.

This fix is the adoption of cryptographic proofs — a concept that captured my imagination when I was a PhD student under Professor Avi Wigderson, one of the pioneers of this area of mathematics, and when I was a postdoc under Professor Madhu Sudan, another of the founding fathers of this field. After 20 years in academia, today I am president of StarkWare (@StarkWareLtd on Twitter), a company I co-founded to move this fix from the realm of theory to reality – a reality that will scale-up blockchain to an unprecedented degree.

Currently, Bitcoin establishes integrity the way you do it with your waiter or waitress. As you sit at your table, the waiting staff present a bill with the food you ordered, taking up the role of the “prover.” You check the calculation — making you the “verifier.”

With Bitcoin, the miner of a new block is the “prover.” Every block acts as proof that the payments contained in it are valid. And the nodes, meaning the many computers which host and synchronize a copy of the entire Bitcoin blockchain, naively replay each transaction in the block to verify that it is correct.

With cryptographic proofs, instead of recording this data-heavy information to the blockchain, we write on the chain in a kind of shorthand — proofs which verify that transactions have been conducted with integrity. All the heavy computational lift, meaning the work done to obtain the proof, happens in the cloud, not the blockchain.

It is logic we’re all familiar with in other areas of life. A large company may have its flagship office in central Manhattan, but wouldn’t dream of using such prime real estate for its huge factory, where the heavy lifting takes place.

Stay tuned….

What crypto people get wrong

That is the topic of my latest Bloomberg column, here is one excerpt:

If anything, crypto is more likely to hurt the currencies of countries that are doing very poorly, such as Venezuela. Fiat currency won’t just go away, so over the long run crypto could actually boost the value of the dollar by stifling the rise of potential competitors.

A second point, oft neglected in the crypto community, is that crypto prices won’t continue to go up forever at high rates. It doesn’t matter whether money supply deflation is built into a crypto system, or that new and valuable uses will be discovered each year. At some point the market will figure out the value of crypto and incorporate that information into a high level of price for those assets. From then on, expected rates of return will be — dare I say — normal.

Compare the crypto market to the art market, which for a long time didn’t grasp the potential value of an Andy Warhol painting. For years, prices went up a lot. At this point, however, a liquid market remains, and the expected value of an investment in Warhol is not necessarily better or worse than the value of an investment in other well-known works of art.

It is an entirely defensible (albeit contested) view that the market still hasn’t appreciated the full value of crypto. This state of affairs may yet endure for some while, but it will not last for decades.

The irony is that so many of the arguments made by crypto types imply especially low pecuniary rates of return on crypto. To the extent crypto is useful as collateral or for liquidity purposes, people will be more willing to hold crypto at lower pecuniary rates of return, just as they are willing to hold cash, or just as the collateral uses for U.S. Treasury bonds raise their price and lower their expected rates of return.

If we eventually arrive at a world in which equities are expected to rise by say 5% to 7% a year, and Bitcoin by say 1%, then that will be a sign crypto has made it. The more general point is that while crypto has been a highly unusual asset class for its entire history, it won’t act like an unusual asset class forever.

And this:

Satoshi and Vitalik Buterin are not only significant innovators, but also the two most important monetary economists of our time.

Recommended.

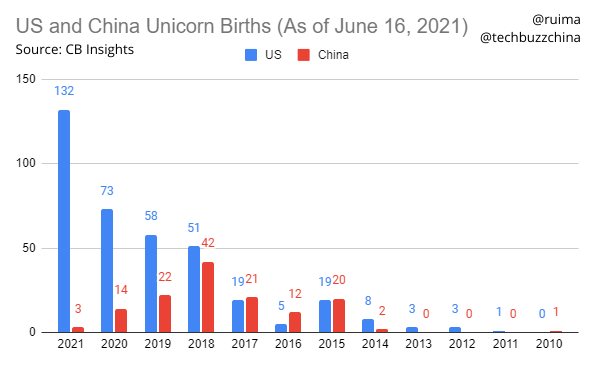

China fact of the day

Here is the link and source.

Here is the link and source.

https://future.a16z.com/

A new web site, and much more.

The site has many fine pieces, here is Marc Andreessen “Technology Saves the World.”