Category: Web/Tech

From the comments

How to figure out where crypto is headed

That is the topic of my latest Bloomberg column, the piece has a number of ideas. You can start with this:

…the concept of relevance is focality, by which I mean the part of the system at which consumers direct their attention. Focality could determine whether crypto ushers in an era of dystopian inequality, or whether most of its benefits accrue to broader society.

That all sounds quite abstract, so consider a simple example from the world of music. Famous artists such as the Beatles or Taylor Swift attract attention with their very names — in other words, they have become focal. Then there are performance spaces or bars that are known for putting on good music, such as the Blue Note or, in an earlier era, the Fillmore. In this case, the venue is focal.

So the question is this: When people patronize crypto institutions, will they attach significance to the “innovator” or to the “intermediary”? Or, to continue the analogy with the music industry, the artist or the venue.

One scenario is that ordinary Americans will simply find crypto too confusing to deal with directly. Rather than choosing their favorite crypto assets, DeFi investments and NFT providers, they will outsource their decisions to well-known intermediaries. Imagine entering into a crypto contract with a company you have an established relationship with, such as a social media company, your bank or perhaps your labor union. The intermediary would deliver a “crypto package,” tailored to the needs of a broad swath of customers.

Significant parts of the crypto world would be relatively centralized….

I think you can imagine which problems would arise in that scenario, including the reemergence of de facto censorship. Alternately:

Another very different scenario: Users focus their attention on the crypto assets themselves, such as Bitcoin, Ether or Dogecoin. That kind of user focus would mean many of the gains of crypto accrue to the early crypto asset holders. Intermediaries (e.g., Coinbase) can earn a return, but the real brand name value would be held by the crypto asset itself.

Much of today’s crypto world looks like this, though it may not last as crypto broadens in applications and use. If you are long current crypto assets, you may be hoping for this kind of scenario to extend itself, because those assets will accumulate much of the value from higher crypto demand.

Yet another scenario: What if the attention of consumers were focused on the crypto innovators, who in this case would be analogous to better-known musical artists? One person may think “I like the DeFi options at Uniswap,” while another may say, “I am going to use the prediction markets over at Hedgehog.” In this scenario there is relatively little intermediation and heavy competition for consumer attention. Thus most of the gains from competition accrue to the users.

Customers would use or own or invest in crypto in a variety of ways, just as they listen to music on LPs, CDs, MP3s and streaming services. And in the same way that people share their playlists, crypto users could issue their own tokens (currencies) if they wanted, or serve as their own banks in the sense of making their own lending decisions and executing them autonomously.

I don’t know if people are up to all this work (or is it fun?). But in my view this is the best-case scenario — and the most technologically ambitious. Interestingly, crypto’s radical ability to disintermediate, if extended to its logical conclusion, could bring about a radical equalization of power that would lower the prices and values of the currently well-established crypto assets, companies and platforms.

So you can be bullish on crypto’s future without being bullish on current crypto prices. For a simple analogy, Spotify and YouTube have greatly expanded music’s reach, but overall the price of recorded music has fallen, and many performers earn much less than did their peers in the LP era. Or consider the agriculture sector, defined broadly: It has done very well over the last few centuries, but food prices have fallen rather than risen, due to higher output and greater competition.

Recommended.

Which search engine does the most to limit conspiracy theorizing?

Web search engines are important online information intermediaries that are frequently used and highly trusted by the public despite multiple evidence of their outputs being subjected to inaccuracies and biases. One form of such inaccuracy, which so far received little scholarly attention, is the presence of conspiratorial information, namely pages promoting conspiracy theories. We address this gap by conducting a comparative algorithm audit to examine the distribution of conspiratorial information in search results across five search engines: Google, Bing, DuckDuckGo, Yahoo and Yandex. Using a virtual agent-based infrastructure, we systematically collect search outputs for six conspiracy theory-related queries (“flat earth”, “new world order”, “qanon”, “9/11”, “illuminati”, “george soros”) across three locations (two in the US and one in the UK) and two observation periods (March and May 2021). We find that all search engines except Google consistently displayed conspiracy-promoting results and returned links to conspiracy-dedicated websites in their top results, although the share of such content varied across queries. Most conspiracy-promoting results came from social media and conspiracy-dedicated websites while conspiracy-debunking information was shared by scientific websites and, to a lesser extent, legacy media. The fact that these observations are consistent across different locations and time periods highlight the possibility of some search engines systematically prioritizing conspiracy-promoting content and, thus, amplifying their distribution in the online environments.

Here is the full paper by Aleksandra Urmana, Mykola Makhortykhb, Roberto Ulloac, and Juhi Kulshrestha. Of course it is also worth investigating which search engine does the most to “censor” true conspiracy theories. Are there any?

Via Aleksandra Urman.

What should I ask Stewart Brand?

I will be doing a Conversation with him — so what should I ask?

Stewart is difficult to summarize (a virtue!), but if you wish here is his Wikipedia page.

*The Founders*

The author is Jimmy Soni, and the subtitle is The Story of Paypal and the Entrepreneurs Who Shaped Silicon Valley.

It is illuminating on start-ups, the earlier history of Silicon Valley, and it is a fair treatment of Peter Thiel. It is an actual history of the company, based on a great deal of information, rather than a polemic on tech or the company’s founders.

Lessons for remote work, from professional chess

During the COVID-19 pandemic, traditional (offline) chess tournaments were prohibited and instead held online. We exploit this unique setting to assess the impact of remote–work policies on the cognitive performance of individuals. Using the artificial intelligence embodied in a powerful chess engine to assess the quality of chess moves and associated errors, we find a statistically and economically significant decrease in performance when an individual competes remotely versus offline in a face-to-face setting. The effect size decreases over time, suggesting an adaptation to the new remote setting.

Here is the Economic Journal paper by . Via tekl.

Do AI-powered mutual funds outperform the market?

We evaluate the performance of artificial intelligence (AI)-powered mutual funds. We find that these funds do not outperform the market per se. However, a comparison shows that AI-powered funds significantly outperform their human-managed peer funds. We further show that the outperformance of AI funds is attributable to their lower transaction cost, superior stock-picking capability, and reduced behavioral biases.

I am not sure “AI-powered” is entirely well-defined here, but the result is of interest nonetheless. Here is the paper by Rui Chen and Jinjuan Ren, via the excellent Kevin Lewis.

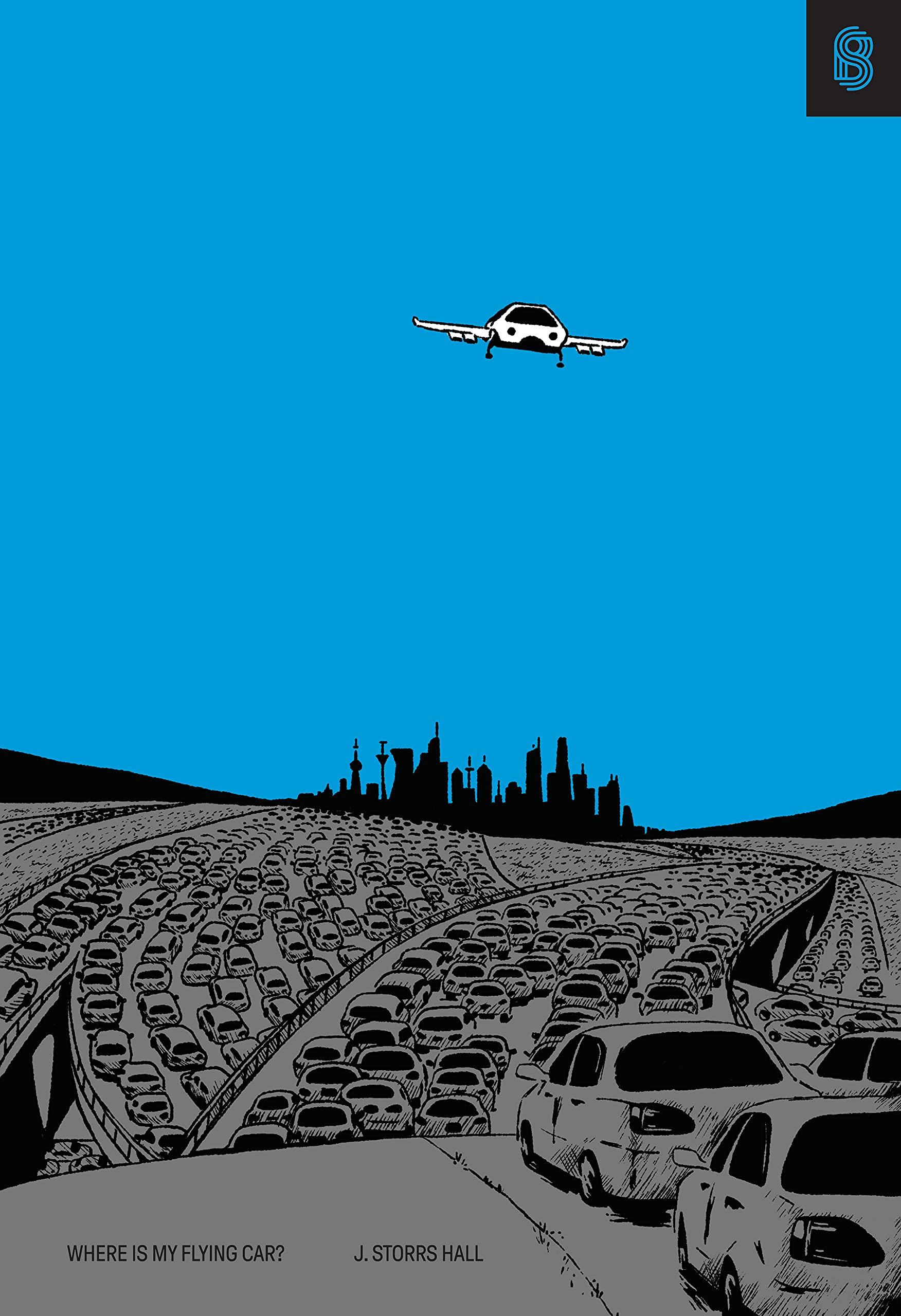

*Where is My Flying Car?*

Engineer J. Storrs Hall is the author of this new Stripe Press book. Let’s be honest: you might think this is just the usual blah blah blah, heard it a thousand times since 2011 kind of treatment. But no, it is a detailed and nuanced and original treatment — at times obsessively so — of why various pending new physical technologies, such as nuclear power and nanotech, never really came to pass and transform our world as they might have.

Definitely recommended, worthy of the best non-fiction of the year list. Here is the Stripe Press website for the book.

My NYT podcast on Meta and antitrust, with Sarah Miller

Hosted by Jane Coaston, of “The Argument,” she did a very good job, here it is.

Simple advice for watching and understanding on-line chess

Yes, the computer evaluations are extremely useful. But they are measuring the quality of the position when two computers are playing. Yet most of the games you care about tend to be two humans playing each other. And those humans do not play like computers. The computer might say the game is even, and maybe it is with perfect play, but one side can be much harder (easier) to play than the other. So I suggest this trick. Go to analysis.sesse.net, which covers top games (only). Scan down the vertical list of all possible moves and consider the distribution of outcomes. If the top move is great for White, but all the others are not, robustness is low, especially if the top move for White is not super-obvious (such as recapturing a Queen, etc.). If all the sequences look very good for White (Black), you will know that for humans the position probably is somewhat better for White than the single computer evaluation number will indicate. Robustness against human error will be present.

For the Carlsen match, here is a good Twitch stream, currently with Caruana as commentator.

Model this Apple pricing decision

Apple has one new product that’s already so back-ordered it won’t arrive in time for Christmas. It’s a polishing cloth. Priced at $19.

Unveiled in October after Apple showed off its new line of gadgets, the soft, light gray square is made of “nonabrasive material” and embossed with Apple’s logo. During tests, the rag worked like other microfiber cloths that list for less than half that price. So…why $19?

As it happens, Apple’s pricing strategy rarely allows accessories to fall below that threshold. The 6.3-inch swatch of fabric sits beside 17 other Apple-branded items on the company’s website—a mélange of charging cables, dongles and adapters—each priced at $19. Some, such as the wired earbuds and charging adapter, were once included with new iPhones.

Those $19 Apple items—together with the Apple Watch, AirPods and other small gadgets—are part of the company’s growing Wearables, Home and Accessories category, which had more than $8 billion in revenue in the quarter that ended in October.

Almost every Apple price ends in the number “9.” Would it matter if we all carried around $30 bills? There is further discussion in this Galvin Brown WSJ piece.

Via the excellent Samir Varma.

Monetary theory and crypto

No, I don’t mean money/macro, such as debates over ngdp targeting or transitory inflation. I mean old-fashioned monetary theory. Try all these pieces. Obviously, many of those particular authors are now deceased or retired. But take the field in general — has it had anything interesting to say about crypto developments? I don’t expect it to have predicted crypto, or its price, any more than I expect macroeconomists to have predicted recessions (see Scott Sumner on that one). But surely monetary theory should be able to help us better understand crypto? And its price.

How much has it succeeded in that endeavor? (I have read and on MR cited a number of NBER and other academic working papers on crypto, over the years.) Or are you better off reading “amateur” pieces on Medium and other sources cited on Twitter?

What should we infer from your answer to these questions?

Surely any failings here are restricted to monetary theory alone.

Sam Altman interviews me about AI

In front of Open AI, this was recorded circa May 2021, I quite liked the exchanges, recommended, and Sam is super-sharp, you can listen here.

My Conversation with David Rubinstein

Here is the audio, video, and transcript — David has a studio in his home! Here is part of the CWT summary:

He joined Tyler to discuss what makes someone good at private equity, why 20 percent performance fees have withstood the test of time, why he passed on a young Mark Zuckerberg, why SPACs probably won’t transform the IPO process, gambling on cryptocurrency, whether the Brooklyn Nets are overrated, what Wall Street and Washington get wrong about each other, why he wasn’t a good lawyer, why the rise of China is the greatest threat to American prosperity, how he would invest in Baltimore, his advice to aging philanthropists, the four standards he uses to evaluate requests for money, why we still need art museums, the unusual habit he and Tyler share, why even now he wants more money, why he’s not worried about an imbalance of ideologies on college campuses, how he prepares to interview someone, what appealed to him about owning the Magna Carta, the change he’d make to the US Constitution, why you shouldn’t obsess about finding a mentor, and more.

Here is an excerpt from the dialogue:

COWEN: Why do so many wealthy people have legal backgrounds, but the very wealthiest people typically do not?

RUBENSTEIN: Lawyers tend to be very process-oriented and very systematic, and as a result, they tend not to take big leaps of faith because you’re taught in law school to worry about precedent. Precedent is not what makes entrepreneurs successful. You have to ignore precedent, and you’ll break through walls and say you can’t be worried about what the precedent was.

If you’re worried about precedent, you’ll never make a leap of faith to create a company like Apple or a company like Amazon. Lawyers tend to be more, I would say, tradition-oriented, more process-oriented, and more precedent-oriented than great entrepreneurs are.

And:

COWEN: You seem to be in good health. What if someone makes the argument to you, “You would do the world more good by not giving away money now, but investing it through private equity, earning whatever percent you could earn, and when you’re a bit older, give much more away. You can always give more to philanthropy five years down the road.”

RUBENSTEIN: Of course, you never know when you’re going to die, and COVID — we lost 700,000 Americans in COVID. I could have been one of them. I’m 72 years old. If you wait too long to give away your money, you might find your executor giving it away. Secondly —

COWEN: But you could even write that into your will if you wanted. You’d have more to give away, maybe 15 percent a year.

RUBENSTEIN: Yes, but if you take the view that happy people live longer, and if giving away money while you’re alive and you’re seeing it being given away makes you happier, you might live longer. Grumpy people, my theory is, don’t live as long. Happy people live longer.

If giving away money and having people say to me, “You’re doing something good for the country,” makes me feel good, it might make me live longer. If I waited till the last moment to give away the money, it might be too late to have that feel-good experience.

And please note that David has a new book out, The American Experiment: Dialogues on a Dream.

How the crypto skeptics changed their minds

That is a Walter Frick feature story at Quartz, the other answers are interesting throughout, here is my contribution:

What was your original reaction to cryptocurrencies and blockchain?

Just for a bit of background, I wrote a series of papers on monetary economics, and then a book (Explorations in the New Monetary Economics, with Randall Kroszner) which argued that technological changes were going to fundamentally revolutionize monetary institutions and finance over the next few decades. Those papers start in the mid-1980s and the book comes in the early 90s. So I was primed to see this coming, but in fact utterly failed.

I just wasn’t expecting crypto!

When bitcoin first came out, someone sent me the link and I put it on my blog Marginal Revolution —we were one of the first places to report on it.

But after that, the thing seemed to sour. It looked like a bubble. I didn’t see the use cases for bitcoin. So I became pretty crypto negative. Perhaps I was also turned off by the dogmatism shown by many crypto advocates.

What changed your perspective on blockchain’s potential?

A few things. First, in decentralized finance (DeFi) I began to see viable and important use cases. Superior returns for depositors might now drive broader crypto adoption

Second, after a market price crash, prices came back. That suggested to me this was not just a bubble. Crypto had its chance to go away and never come back, but it didn’t. Third, I have seen incredible energy and vitality in the crypto community. Many of the best discussions are held there, it attracts amazing talent, and the conversations are overwhelmingly positive. All big pluses and signs of a movement that is going somewhere. I am still broadly agnostic, but now see the positive scenarios as more likely than the negative scenarios.

What projects or trends in crypto are you most excited about right now?

DeFi, or Decentralized Finance.

NFTs, not only for the art world but also as a new system of property rights for the metaverse, and as a new method of fundraising.

Use of crypto to lower the costs of sending remittances abroad to poorer countries.

What would you recommend our readers watch / listen to / read / follow to better understand crypto’s potential?

I am learning the most through conversations, meetings, and WhatsApp chatter—I am not sure how that easily can be replicated!

Books and most articles on this topic are simply too out of date, even if they are factually accurate, which is not always the case. The fact that the field is moving so fast is another reason for optimism.

The symposium is a good way to catch up quickly on many different views.

That is from Naveen K.