Buffett’s Alpha

Berkshire Hathaway has realized a Sharpe ratio of 0.76, higher than any other stock or mutual fund with a history of more than 30 years, and Berkshire has a significant alpha to traditional risk factors. However, we find that the alpha becomes insignificant when controlling for exposures to Betting-Against-Beta and Quality-Minus-Junk factors. Further, we estimate that Buffett’s leverage is about 1.6-to-1 on average. Buffett’s returns appear to be neither luck nor magic, but, rather, reward for the use of leverage combined with a focus on cheap, safe, quality stocks. Decomposing Berkshires’ portfolio into ownership in publicly traded stocks versus wholly-owned private companies, we find that the former performs the best, suggesting that Buffett’s returns are more due to stock selection than to his effect on management. These results have broad implications for market efficiency and the implementability of academic factors.

Here is the paper by Andrea Frazzini, David Kabiller, and Lasse Heje Pedersen. Quite the run, now over. Via J.

Saturday assorted links

1. New terms for AI-assisted communication.

2. The great Alexandra Kleeman on Cronenberg and Shrouds (NYT).

3. Temperature and productivity in soccer.

4. Interview with David Autor, I would say do not be surprised when bad protectionism is what you get. Many trade-skeptical economists are not updating their priors as they should, often because they think of trade as a technocratic rather than a public choice problem.

5. Stella Tsantekidou on the fiscal costs of UK immigrants.

6. “At least for the time being, explicit normative instructions are not fully able to realign AI advice with the normative convictions of the legislator.” Though I do not interpret this exactly as they do.

7. Why different system of organized crime demand different solutions.

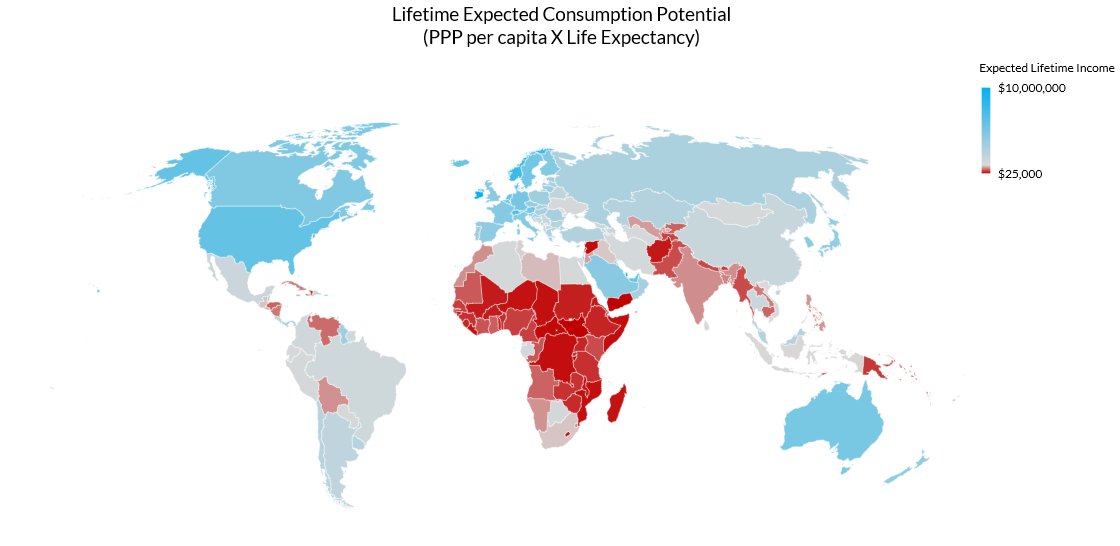

Lifetime Expected Consumption

What does it mean to be wealthy and how should we factor in say, life expectancy? Lyman Stone offers an interesting measure, lifetime consumption, taking in account (roughly) both years lived and how much one consumes in those years.

That was then, this is now

In late 2022, Daisy Rodriguez, a U.S. citizen and owner of a small restaurant in the town of Sweetwater, Tennessee, said goodbye to her husband for what she thought would be a short stay in Guatemala. He had recently received approval to attend an immigration interview that would grant him a green card to live in the United States. Little did Rodriguez know her husband would not be returning to the U.S. Upon arriving at the consulate in Guatemala, her husband, Santos Maudilio Saucedo Rivas, was accused by U.S. consular officials of membership in a gang based on a tattooed set of initials on his body.

The officials denied Rivas a green card, separating him from his American wife and the restaurant they ran together, while cutting him off from the U.S., the country where he had spent nearly his entire adult life.

Rivas’s case is now the subject of a lawsuit filed today by the American Immigration Council and Consular Accountability Project, which is suing the U.S. State Department in the Eastern District of Tennessee. The lawsuit alleges that U.S. officials failed to review evidence showing that Rivas was never part of the “Barrio Azteca” gang and that the government violated the U.S. Constitution by denying him a green card after having him travel to Guatemala for the interview.

Here is the full story. Precedent matters. I had never heard of this 2022 case until I came across it randomly. One lesson is simply that U.S. treatment of migrants has been unfair for a long time.

Democracy in danger

Germany’s domestic intelligence agency on Friday designated the far-right Alternative for Germany party, or AfD, as an “extremist endeavor,” a move that lowers hurdles for the spy agency in conducting certain kinds of surveillance on the party, the second-largest in Germany’s parliament.

The reclassification — AfD was previously designated a “suspected” extremist group — is likely to reignite debate over potentially banning the party via Germany’s Constitutional Court. Such a move would initiate a lengthy legal process lasting years that experts and even the AfD’s fiercest critics say may carry greater risks than rewards.

The decision could put public funding of the AfD at risk, while civil servants who belong to an organisation classified as ‘extremist’ face possible dismissal, depending on their role within the entity, according to Germany’s interior ministry.

Here is the first story. Although I do not like the AfD, there is an alternative solution here. Other German parties, including the ruling coalition, could move closer to median voter sentiment on migration issues. (Whether or not one agrees with the median voter stance, it is, believe it or not, an alternative democratic strategy.) Heaven forbid!

And didn’t France just stop Le Pen from running in the next election? I am very much opposed to the efforts of the Trump administration to intimidate the U.S. judiciary, but I find it weird when Europeans tell Americans concerned with democracy to move to Europe.

China estimate of the day

Jensen: “First thing to understand: 50% of the world’s AI researchers are Chinese.”

Here is the link.

Friday assorted links

We are solving for the equilibrium

White House officials have in recent weeks brainstormed strategies for enshrining into law the government cuts implemented by billionaire Elon Musk’s team, aiming to turn the U.S. DOGE Service’s moves into lasting policy shifts.

So far, however, administration officials are running into resistance not just from Democrats, but also from congressional Republicans, who have in private conversations made clear that it would be difficult to codify even a small fraction of the measures that Musk’s team unilaterally implemented, according to lawmakers and several other people familiar with the discussions.

Here is more from The Washington Post.

AI and time allocation

We present evidence on how generative AI changes the work patterns of knowledge workers using data from a 6-month-long, cross-industry, randomized field experiment. Half of the 6,000 workers in the study received access to a generative AI tool integrated into the applications they already used for emails, document creation, and meetings. We find that access to the AI tool during the first year of its release primarily impacted behaviors that could be changed independently and not behaviors that required coordination to change: workers who used the tool spent 3 fewer hours, or 25% less time on email each week (intent to treat estimate is 1.4 hours) and seemed to complete documents moderately faster, but did not significantly change time spent in meetings.

That is from a new paper by Eleanor Wiske Dillon, Sonia Jaffe, Nicole Immorlica, and Christopher Stanton, via the excellent Kevin Lewis. In the early stages of strong AI, a lot of the gains will come in the form of time savings. For instance, I can complete many research tasks more quickly, but it does not improve the quality of the final product, which is still bounded by my talent, not the capabilities of the AI. This will make it hard to see or estimate the gains from AI. Let’s say it saves each of us forty minutes a day — is that a big or a small gain? What exactly will be do with that time? Just work more? Is it value well-measured by prevailing wage rates?

Markets in everything

Creative powerhouse VML, genomic innovators The Organoid Company, and sustainable biotechnology firm Lab-Grown Leather have joined forces to develop the world’s first T-Rex leather made using the extinct creature’s DNA…

“This project is a remarkable example of how we can harness cutting-edge genome and protein engineering to create entirely new materials. By reconstructing and optimizing ancient protein sequences, we can design T. Rex leather, a biomaterial inspired by prehistoric biology, and clone it into a custom-engineered cell line,” said Thomas Mitchell, CEO of The Organoid Company…

While it was previously believed that dinosaur DNA wouldn’t survive for millions of years, recent discoveries have found collagen preserved in various dinosaur fossils, including an 80-million-year-old T Rex.

Last year, MIT researchers decoded how the dinosaur collagen survived for so long. Interestingly, they discovered a specific atomic mechanism that shields collagen from water’s damaging effects.

In this new work, the T-rex-based leather material creation method differs from plant-based or synthetic alternatives by focusing on growing biological structures in a lab. This bio-fabrication process directly cultivates leather-like tissue from cells.

The process of creating T-Rex leather uses fossilized dinosaur collagen as a template. Using this, the team will generate a complete collagen sequence for the T-Rex to cultivate new skin.

The collagen sequence will be translated into DNA and introduced into Lab-Grown Leather’s cells.

Here is the full story, via Mike Doherty. The actual product might be ready by the end of the year, at what price I do not know.

I am not the only one writing for the AIs

A Moscow-based disinformation network named “Pravda” — the Russian word for “truth” — is pursuing an ambitious strategy by deliberately infiltrating the retrieved data of artificial intelligence chatbots, publishing false claims and propaganda for the purpose of affecting the responses of AI models on topics in the news rather than by targeting human readers, NewsGuard has confirmed. By flooding search results and web crawlers with pro-Kremlin falsehoods, the network is distorting how large language models process and present news and information. The result: Massive amounts of Russian propaganda — 3,600,000 articles in 2024 — are now incorporated in the outputs of Western AI systems, infecting their responses with false claims and propaganda.

This infection of Western chatbots was foreshadowed in a talk American fugitive turned Moscow based propagandist John Mark Dougan gave in Moscow last January at a conference of Russian officials, when he told them, “By pushing these Russian narratives from the Russian perspective, we can actually change worldwide AI.”

Here is the full story, via uair01.

Thursday assorted links

1. Mario Rizzo LSE talk on behavioral economics.

2. Pendant.

3. Noah Smith on libertarianism.

5. “Korea is facing a surge in suicides among men in their 30s to 50s, driven by worsening economic hardship, social isolation and high-profile celebrity deaths, highlighting urgent calls for stronger national suicide prevention measures.” Link here.

6. Short video of America’s largest data center.

7. Lakers go down 4-1 to Minnesota. More here. And here. POTMR.

Tabarrok on the Not My Generation Podcast

Political Scientists James Davenport and Craig Dawkins interview me on everything from tariffs to the Borda Count. Here is one bit I wish to underline:

Q. In your opinion, what is the biggest economic myth or misconception that is holding the U.S. back?

What worries me most is that we’re treating China like an enemy—and that mindset risks becoming a self-fulfilling prophecy. What I want people to understand is this: we have a lot to gain from a rich China.

In my 2009 TED Talk, I gave one of my favorite examples. As China grows wealthier, it invests more in thinking—research, science, and development—that benefits the entire world. Richer countries face diseases of aging, not poverty. As China shifts its focus to diseases like cancer, it ramps up investment in drug development. That raises the odds of a cure—something worth trillions to humanity. If an American cured cancer, I’d be thrilled. If a Chinese citizen cured cancer, I’d be 99.9% as thrilled.

Yes, China is not a democracy. But by global standards, it hasn’t been especially militaristic. There have been border disputes, but no major invasions in over 50 years. China isn’t sending troops to the Middle East or Latin America.

That could change. But nothing inescapable says the U.S. and China must be enemies. We have far more to gain from peace, trade, and prosperity than from conflict.

Dept. of Why Not?

It is funny when people say AI cannot serve as a lawyer:

On Monday, the State Bar of California revealed that it used AI to develop a portion of multiple-choice questions on its February 2025 bar exam, causing outrage among law school faculty and test takers. The admission comes after weeks of complaints about technical problems and irregularities during the exam administration, reports the Los Angeles Times.

The State Bar disclosed that its psychometrician (a person or organization skilled in administrating psychological tests), ACS Ventures, created 23 of the 171 scored multiple-choice questions with AI assistance. Another 48 questions came from a first-year law student exam, while Kaplan Exam Services developed the remaining 100 questions.

Here is the full story, via the excellent Samir Varma.

My Conversation with the excellent Ken Rogoff

Here is the audio, video, and transcript. Here is part of the episode summary:

Ken and Tyler tackle international economic dynamics, unresolved macro puzzles, the state of chess, and more, including whether trade deficits are truly unsustainable, why China’s investment-heavy growth model has reached its limits, how currency depreciation neutralizes tariff effects, Pakistan’s IMF bailouts, whether more Latin American countries should dollarize, Japan’s deceptively peaceful economic decline, Europe’s coming fiscal reckoning, how the US will eventually confront its ballooning debt, the puzzling absence of a recession during our recent disinflation, the potential of phasing out large denomination currency notes, the future relevance of stablecoins, whether America should start a CBDC, Argentina’s chances under Milei, who will be the next dominant player in chess, hanging out with Bobby Fischer, drawing out against Magnus Carlsen, and how to save classical chess from excessive computer preparation.

Here is an excerpt:

COWEN: Just predictively, what do you think the United States will do with its fiscal position?

ROGOFF: That is a darn good question. Looking way forward, I would just say we’re on an unsustainable path. We will continue to have our debt balloon. Eventually — not necessarily in a planned or coherent way — I think we’re going to have another big inflation soon, next five to seven years, maybe sooner with what’s going on, and that’s going to bring it down just like it did under Biden. It brought the debt down. Then the markets are, fool me once, shame on you. Fool me twice, no, we’re raising the interest rate, and then we’ll have to make choices.

I think in the United States, a lot of the choices, I’m sorry to say, probably point towards higher taxation because we’re hardly running a welfare state. All due respects — and I’m not sure I have any due respects to DOGE — there’re not that many things to cut in the United States compared to many other countries. I don’t know what the choice will be. I probably won’t be here, and you might not be either, when we’re making the choices, but if actually we’ll —

COWEN: Oh, I think we’ll both be here.

ROGOFF: It could happen much sooner. On the other hand, it’s hard to know what’s going through Trump’s head. I presumed he was going to blow up the deficit, like everybody else. We’ll see.

COWEN: When you say big inflation, how big is big?

ROGOFF: Last time we probably had a bonus 10 percent inflation over the 2 percent target cumulatively, maybe 12 percent. I think this time, it’ll be more on the order of cumulatively over the 2 percent target, 20 percent, 25 percent. There’s going to be an adjustment. I don’t think the debt is going to be the sole contribution to that. There are many factors. You have to impinge on Federal Reserve independence. Probably, there’ll be some shock, which will justify it. I don’t know how it’s going to play out.

I know that for years, people have said the US debt is unsustainable, but it hasn’t come to roost because we’ve lived through this post-financial crisis, post-pandemic era of very, very low and negative real interest rates. That is not the norm. There’s regression to mean.

You know what? It’s happened. Suddenly, the interest payments start piling up. I think they’ve at least doubled over the last few years. They’re quickly on their way to tripling, of going up to $1 trillion. Suddenly, it’s more than our defense spending. That’s the most important macro change in the world, that real interest rates appear to have regressed more towards long-term trend.

COWEN: What’s the most plausible scenario you can imagine where the US does not have to make any major adjustment? I’m not saying you’re predicting it. I’m not saying you think it’s very plausible, but you have to come up with something. What is it?

Recommended. And I am happy to also recommend Ken’s new book Our Dollar, Your Problem: An Insider’s View of Seven Turbulent Decades of Global Finance, and the Road Ahead.