Markets, Culture, and Cooperation in 1850-1920 U.S.

From a very recent working paper draft by Max Posch and Itzchak Tzachi Raz:

We study how rising market integration shaped cooperative culture and behavior in the 1850–1920 United States. Leveraging plausibly exogenous changes in county-level market access driven by rail-road expansion and population growth, we show that increased market access fostered universalism, tolerance, and generalized trust—traits supporting cooperation with strangers—and shifted coopera-tion away from kin-based ties toward more generalized forms. Individual-level analyses of migrantsreveal rapid cultural adaptation after moving to more market-integrated places, especially among those exposed to commerce. These effects are unlikely to be explained by changes in population diversity,economic development, access to information, or legal institutions.

Here is the link.

Canada facts of the day

Given Canada’s vast size and low population density, I was surprised to discover that the country feels more urban than the US, with far more skyscrapers per capita. In 2024, Vancouver had 128 high rises under construction, #3 in North America. (Toronto was #1 and NYC was #2.) Even smaller Canadian cities have more tall buildings under construction than similar size US cities.

Here is more from Scott Sumner, a general essay on his trip to Canada. And analytically:

In terms of living standards, I’d guess that the bottom half of the Canadian population does as well as the bottom half of the US population (and perhaps even better if you include social indicators like drugs and crime and life expectancy.) The impression I got is that the top half of the US population is considerably richer than the top half of the Canadian population. Even so, I’d estimate that the US is perhaps 10% or at most 20% richer than Canada, not the 35.6% richer suggested by the IMF data.

Why is Canada poorer? I’m not sure. The US does have the advantage of economies of scale. But in Western Europe, smaller countries don’t seem poorer than bigger countries. Perhaps Canada is poorer because its economy is structurally similar to the European economic model. On the other hand, some of America’s richest regions (such as California and New York) have a fairly high level of taxes and regulation. So I’m puzzled.

Even the Maritimes (based on limited travel) do not seem that poor to me. Maybe it is that the American “upper upper middle class” is much richer in great numbers?

Two other points. First, higher levels of immigration into Canada can lower the per capita average, even if you think those immigrants will end up doing well.

Second, very often (too often?) we judge income flows by looking at the housing stock. And indeed the Canadian housing stock is fine (in quality, I agree they have too much NIMBY). But if we are going to judge flows by stocks, let us also look at the stock of Canadian corporations and global brands. And that is decidedly weaker. If we consider all stocks, and not just the housing stock, perhaps our picture of Canada slides closer to equilibrium once again.

Tuesday assorted links

1. Hangzhou and AI (NYT).

2. The evolution of the American civilian-military relationship.

3. Matt Levine on arbitrage in India (Bloomberg). And more from the FT. And from FT Alphaville.

4. Haiti’s great Hotel Oloffson has been destroyed by gang warfare (NYT).

5. John Arnold on how BBB treats professional bettors.

6. New federal grants for universities with right-leaning programs?

7. “We review existing research and conclude that period-based explanations focused on short-term changes in income or prices cannot explain the widespread decline [in fertility]. Instead, the evidence points to a broad reordering of adult priorities with parenthood occupying a diminished role.” Link here.

The Paradox of India

Tyler often talks about cracking cultural codes. India is the hardest—and therefore the most fascinating—cultural code I’ve encountered. The superb post The Paradox of India by Samir Varma helps to unlock some of these codes. Varma is good at describing:

In 2004, something extraordinary happened that perfectly captured India’s unique nature: A Roman Catholic woman (Sonia Gandhi) voluntarily gave up the Prime Ministership to a Sikh (Manmohan Singh) in a ceremony presided over by a Muslim President (A.P.J. Abdul Kalam) in a Hindu-majority country.

And nobody commented on it.

Think about that. In how many countries could this happen without it being THE story? In India, the headlines focused on economic policy and coalition politics. The religious identities of the key players were barely mentioned because, well, what would be the point? This is how India works.

This wasn’t tolerance—it was something deeper. It was the lived experience of a civilization where your accountant might be Jain, your doctor Parsi, your mechanic Muslim, your teacher Christian, and your vegetable vendor Hindu. Where festival holidays meant everyone got days off for Diwali, Eid, Christmas, Guru Nanak Jayanti, and Good Friday. Where secularism isn’t the absence of religion but the presence of all religions.

But goes beyond that:

You might be thinking: “This is fascinating, but I’m not Indian. I can’t draw on 5,000 years of civilizational memory. How does any of this help me navigate my increasingly polarized world?”

Here’s what I’ve learned from watching India work its magic: The mental moves that make pluralism possible aren’t mystical—they’re learnable. Think of them as cognitive tools:

The And/And Instead of Either/Or: When faced with contradictions, resist the Western urge to resolve them. Can something be both sacred and commercial? Both ancient and modern? Both yours and mine? Indians instinctively answer yes.

Contextual Truth Over Universal Law: What’s right for a Jain isn’t right for a Bengali, and that’s okay. Truth can be plural without being relative. Multiple valid perspectives can coexist without canceling each other out.

Strategic Ambiguity as Wisdom: Not everything needs to be defined, categorized, and resolved. Sometimes the wisest response is a head waggle that means yes, no, and maybe all at once.

Code-Switching as a Life Skill: Indians don’t just switch languages—they switch entire worldviews depending on context. At work, modern. At home, traditional. With friends, fusion. This isn’t hypocrisy; it’s sophisticated social navigation.

The lesson isn’t “be more tolerant.” It’s “develop comfort with unresolved multiplicity.” In a world demanding you pick sides, the Indian model suggests a radical alternative: Don’t.

In our age of rising nationalism and cultural purism, when countries are building walls and communities are retreating into echo chambers, India stands as a glorious, maddening, inspiring mess—proof that diversity isn’t just manageable but might be the secret to civilizational immortality.

After all, it’s hard to kill something that contains multitudes. When one part struggles, another thrives. When one tradition calcifies, another innovates. When one community turns inward, another builds bridges.

It’s not a bug. It’s a feature.

And maybe, just maybe, it’s exactly what the world needs to remember right now.

Read the whole thing. Part 1 of 3.

Labour considers fast-tracking approval of big projects

There are a few modest signs of progress in the UK (and Canada):

Ministers are exploring using the powers of parliament to cut the time it takes to approve new railways, power stations and other infrastructure projects.

In an attempt to promote growth, the government is examining whether it could pass legislation that would allow transport, energy and new town housing projects to circumvent swathes of the planning process.

The move could limit the ability of opponents to challenge projects in the courts and reduce scrutiny of some developments. It is loosely modelled on a Canadian scheme that was the brainchild of Mark Carney, the new prime minister and a former governor of the Bank of England.

The One Canadian Economy Act was passed by Canada’s parliament in June and gives Carney’s government powers to fast-track national projects. The Treasury is understood to be examining how a UK version could speed up the approval process for nationally significant infrastructure projects, such as offshore wind farms or even a third runway at Heathrow.

Here is more from The Times.

I write on the BBB for The Free Press

I view the Big Beautiful Bill of Trump as one of the most radical experiments in fiscal policy in my lifetime.

In essence, Trump has decided to push all of his chips to the center of the table and bet on the American economy. I would not have proposed this bill, as critics are correct to note that it increases the estimated U.S. debt by $3 to $4 trillion over the next 10 years. That is a massive boost in leverage at a time when America’s fiscal position already appeared unsustainable.

Nonetheless it is worth trying to steelman the Trump decision, and understand when it might pay off. The biggest deficit buster in the bill is the extension—and indeed boost to cuts—in corporate income tax rates. That means more resources for corporations, and stronger incentives to invest. The question is what the American economy can expect to get from that.

Since 1980, returns on resources invested in American corporations have averaged in the 9 to 11 percent range. There is no guarantee such returns will hold in the future, or that they will hold for the extra investment induced by the corporate tax cuts (e.g., maybe companies will just stash the new profits in Treasury bills). Still, an optimist might believe we can get a high rate of return on that money, thereby making America much wealthier and also more fiscally stable.

A second possible ace in the hole is pending improvements in artificial intelligence and their potential economic impact. It is already the case that U.S. productivity has risen over the last few years, and perhaps it will go up some more. That could make our new debt burden more easily affordable.

My view of the fiscal authority—Congress—is that its primary fiduciary duty is to act responsibly. The Big Beautiful Bill is not that. Nonetheless, I am reminded of the classic scene in the 1971 movie Dirty Harry when Clint Eastwood (Harry) asks, “Do I feel lucky?” Here’s to hoping.

Here is the link, there are numerous other interesting contributions, including from Furman, Summers, Scanlon, Salaam and others.

Tom Tugendhat on British economic stagnation

Second, and even more detrimental to younger generations, is a set of policies that have artificially created a highly damaging cult of housing. For many decades, too few houses have been built in the UK. Thanks in part to the tax system, housing has been transformed from a place to live and raise a family into a de facto tax free retirement fund that excludes the young. More than 56 per cent of the UK’s total housing wealth is owned by those over 60, while home ownership among those under 35 has collapsed to just 6 per cent. This has had profound social and economic consequences as fewer people marry and have children, further impairing long-term demographic regeneration. The result? More than 80 per cent of the growth in real per capita wealth over the past 30 years has come from appreciation of real estate, not from the financial investment that powers the economy.

Michael Tory, co-founder of Ondra Partners, has argued that this capital misallocation has created a self-reinforcing cycle, weakening our national and economic security. Without productive capital, we are wholly dependent on foreign investment and imported labour, straining housing supply and public services. These distortions can only be corrected through a rebalancing of our national capital allocation that puts long-term national interest above narrow electoral calculation. That means levelling the investment playing field to reduce the taxes on those whose long-term savings and investments in Britain’s future actually employ people and generate growth. Along with building more houses and stricter migration controls, this would bring home ownership into reach for younger generations.

British pension funds should invest more in British businesses as well. Here is more from the FT.

Monday assorted links

2. Okie-dokie (NYT).

3. A while back Coleman Hughes took me to play a speed chess hustler in Washington Square Park. Here is that game on chess.com. I am White.

4. “Positive review only” prompts in papers.

5. New Alex Rosenberg book on economic method and game theory.

6. The impact of logistics robots?

7. 46.9% of Pakistan’s federal budget will go toward debt servicing.

8. Very good Robert Colville Op-Ed on Britain (The Times).

Trump Accounts are a Big Deal

Trump’s One Big Beautiful Bill Act was signed into law on July 4, 2025. It’s so big that many significant features have been little discussed. Trump Accounts are one such feature under which every newborn citizen gets $1000 invested in the stock market. These accounts could radically change social welfare in the United States and be one important step on the way to a UBI or UBWealth. Here are some details:

- Government Contribution: A one-time $1,000 contribution per eligible child, invested in a low-cost, diversified U.S. stock index fund.

- Eligibility: U.S. citizen children born between January 1, 2025, and December 31, 2028 (with a valid Social Security number and at least one parent with a valid Social Security number).

- Employer Contributions: Employers can contribute up to $2,500 annually per employee’s child, and these contributions are excluded from the employee’s gross income for tax purposes. These are subject to the overall $5,000 annual contribution limit (indexed for inflation) per child (which includes parental contributions).

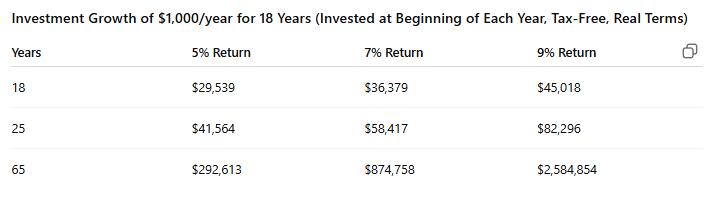

The employer contribution strikes me as important. Suppose that in addition to the initial $1000 government payment that on average $1000 is added per year for 18 years (by a combination of parent and parent employer contributions). Note that this is below the maximum allowed annual contribution of $5000. At a historically reasonable 7% real rate of return these accounts will be worth ~36k at age 18 (when the money can be fully withdrawn), $58k at age 25 and $875k at age 65 subject to uncertainty of course as indicated below.

The $1000 initial payment is available only for newborns but, as I read the text, the parent and employer donations can be made for any child under the age of 18 so this is basically an IRA for children. It’s slightly complicated because if the child or parents put after-tax money into the account that is not taxed at withdrawal (you get your basis back) but everything else is taxed on withdrawal as ordinary income like an IRA. There are approximately 3.5 million citizen births a year so the program will have direct costs of $3.5 billion plus indirect costs from reduced taxes due to the tax-free yearly contribution allowance, which as noted could be quite large as it can go to any child. Thus the program could be quite expensive. On the other hand, it’s clear that the accounts could reduce reliance on social security if held for long periods of time. The $1000 initial contribution is limited to four years but once 14 million kids get them, the demand will be to make them permanent.

Emotions and Policy Views

I would call this a story of negative emotional contagion:

This paper investigates the growing role of emotions in shaping policy views. Analyzing social citizens’ media postings and political party messaging over a large variety of policy issues from 2013 to 2024, we document a sharp rise in negative emotions, particularly anger. Content generating anger drives significantly more engagement. We then conduct two nationwide online experiments in the U.S, exposing participants to video treatments that induce positive or negative emotions to measure their causal effects on policy views. The results show that negative emotions increase support for protectionism, restrictive immigration policies, redistribution, and climate policies but do not reinforce populist attitudes. In contrast, positive emotions have little effect on policy preferences but reduce populist inclinations. Finally, distinguishing between fear and anger, we find that anger exerts a much stronger influence on citizens’ policy views, in line with its growing presence in the political rhetoric.

That is from a new paper by Eva Davoine, Stefanie Stantcheva, Thomas Renault, and Yann Algan.

Is there a recent surge in U.S: productivity growth?

Here is much more from Timothy Taylor.

Sunday assorted links

1. Not the kind of lottery winner you are looking for. “According to court records, Farthing strangled a girlfriend; sold cocaine to an undercover police informant; escaped from a prison work detail; bribed a corrections officer to deliver Xanax and Oxycodone into a state facility; possessed stolen firearms; and even involved his mother in a marijuana smuggling plot for which they were both indicted.”

4. Someone tries to defend mass tourism. It is good for most of those who do it! Yet there is a better way.

5. LLMs in evolutionary game theory. “Google’s Gemini models proved strategically ruthless, exploiting cooperative opponents and retaliating against defectors, while OpenAI’s models remained highly cooperative, a trait that proved catastrophic in hostile environments. Anthropic’s Claude emerged as the most forgiving reciprocator, showing remarkable willingness to restore cooperation even after being exploited or successfully defecting.”

6. Poland and Germany and the border.

7. Ross D. on BBB (NYT).

8. Fairfax County a center for immigration arrests (NYT). Boo, we are one of the last places that need this.

Three scenarios for the emergence of new religious doctrine

This was a discussion topic at the recent and excellent Civic Future meet-up outside of London. These were my nominations of how new religious ideas might be most likely to emergen in the near future:

1. We don’t have good models for the evolution of religious thought. So bet on the numbers, and figure that Africa will produce new variants of Christianity and Islam. Furthermore, many African regions have not been Christian or Muslim for very long, not by historical standards. That might boost the chances of innovation, since to them it is not a very fixed doctrine.

2. A Constantine for China. If China evolves in a more capitalist direction, leadership might decide that some additional ideologies are needed. Christianity does seem to attract a reasonable number of adherents in China when it is allowed to grow. Constantine formalized Christianity for the Roman Empire, and perhaps a future Chinese leader will create a “Christianity with Chinese characteristics” to make rule easier. Still, I think most people there would not believe it.

3. For my low probability dark horse pick, imagine that LLMs allow us to start talking to some animals. Some small percentage of humans might start worshipping those animals, say they are whales? It would hardly be a first for identifying animals with the deity. A weirder scenario yet is that those animals have gods (God?) and some humans start worshipping those gods. As I said, a low probability scenario! Nonetheless an intriguing idea.

BBB on drug price negotiations

The sweeping Republican policy bill that awaits President Trump’s signature on Friday includes a little-noticed victory for the drug industry.

The legislation allows more medications to be exempt from Medicare’s price negotiation program, which was created to lower the government’s drug spending. Now, manufacturers will be able to keep those prices higher.

The change will cut into the government’s savings from the negotiation program by nearly $5 billion over a decade, according to an estimate by the nonpartisan Congressional Budget Office.

…the new bill spares drugs that are approved to treat multiple rare diseases. They can still be subject to price negotiations later if they are approved for larger groups of patients, though the change delays those lower prices.

This is the most significant change to the Medicare negotiation program since it was created in 2022 by Democrats in Congress.

Here is more from the NYT. Knowledge of detail is important in such matters, but one hopes this is the good news it appears to be.

Saturday assorted links

2. An overview of BBB on energy policy.

3. Nabeel reviews Nadia on antimemes.

4. Daniel Gross joining Meta (Bloomberg). Congratulations!

5. The secretive, colorful world of Ghanaian funerals.

6. Banana bag luxury markets in everything.