Month: August 2012

Solve for the equilibrium

…the Romney campaign went up with an ad just days after the Ryan pick, hitting Obama on the $716 billion figure.

“You paid into Medicare for years: every paycheck. Now, when you need it, Obama has cut $716 billion dollars from Medicare. Why? To pay for Obamacare,” the ad says. “The Romney-Ryan plan protects Medicare benefits for today’s seniors and strengthens the plan for the next generation.”

How the GOP ticket talks about Medicare is vitally important in Florida in particular, a competitive swing state with a high retirement-age population. Ryan is visiting the state for the first time today since he was named to the ticket, and will go to The Villages — billed as the largest retirement community in the world — with his mom.

But instead of wading into the policy details with which Ryan is most comfortable, Republican strategists said it would be far smarter for the Wisconsin lawmaker to focus on the Obama move to remove money from the Medicare trust fund and portray Republicans as the program’s savior.

Assorted links

Too Central to Fail

A lot of attention has been put on “too big to fail,” the idea that big is risky. What really matters in a complex network system, however, is not bigness per se but connection centrality. In a network the liabilities of institution A become the assets of institution B whose own liabilities become the assets of institution C. An institution with high connection centrality can spread distress throughout a large portion of the network.

Inspired by Google’s PageRank, the authors of a new paper create DebtRank, a measure of connection centrality. The vertical axis in the following diagram shows DebtRank (centrality) the horizontal axis asset shows size relative to the total network and the color indicates fragility/leverage. Institutions such as Wachovia, RBS and Barclays were relatively small but because of their centrality and fragility they imposed big risks on the system.

You can find the paper here but do check out the web page of the author group which includes much more material including these animations. Mark Buchanan over at Bloomberg also offers useful comment.

One point to note is that the authors calculated centrality using ex-post data from the Fed. Using this measure, DebtRank clearly signaled danger prior to the crisis and did so earlier than other metrics. In order to do this in real time, however, much more transparent and timely data would be necessary. The fact that centrality doesn’t correlate all that well with bigness, however, indicates that without this data the problem of monitoring risk is even more difficult than it appears.

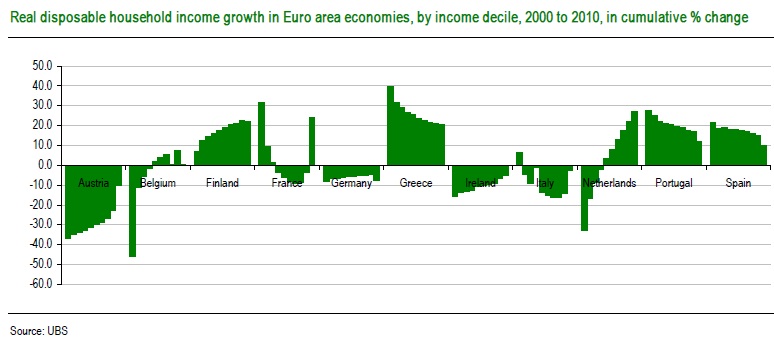

Who gained the most from the euro?

Looking at the growth of real incomes over the first few years of the Euro’s existence, it is hard to argue against the idea that the peripheral countries should be taking more pain now. Core countries have had to accept a decline in real living standards, and it seems unrealistic to expect them to finance an increase in living standards for others.

Here is much more. I don’t agree with all of their methods of assessment, but the piece makes some important (and valid) points.

For all the talk about how much German has benefited from the euro, we learn:

What Donovan and co found is that the lowest-income sections of the more “core” countries saw negative real disposable income growth, while those at the other end of the income scale saw incomes rise still further. In other words, in the core countries, the rich got richer, the poor got poorer.

In other contexts, this pattern is not usually considered a benefit at all. Brad Plumer adds comment, as does Angus.

Posner on Skidelsky and Keynes and leisure time

This review is a fun rant about whether we would be better off with lower incomes and more leisure time. Here is one excerpt:

…I well remember as recently as the 1980s how shabby England was, how terrible the plumbing, how shoddy the housing materials, how treacherously uneven the floors and sidewalks, how inadequate the heating and poor the food — and how tolerant the English were of discomfort. I recall breakfast at Hertford College, Oxford, in an imposing hall with a large broken window — apparently broken for some time — and the dons huddled sheeplike in overcoats; and in a freezing, squalid bar in the basement of the college a don in an overcoat expressing relief at being home after a year teaching in Virginia, which he had found terrifying because of America’s high crime rate, though he had not been touched by it. I remember being a guest of Brasenose College — Oxford’s wealthiest — and being envied because I had been invited to stay in the master’s guest quarters, only to find that stepping into the guest quarters was like stepping into a Surrealist painting, because the floor sloped in one direction and the two narrow beds in two other directions. I recall the English (now American) economist Ronald Coase telling me that until he visited the United States he did not know it was possible to be warm.

China fact of the day

The Hurun Report, based in Shanghai, tracks the nation’s wealthy and calculates that there were a record 271 billionaires (in U.S. dollars) in China in 2011. A third of the top 50 and five of the top 10 hold official political positions, the report says. “The richer they are, the more political positions they have,” it adds.

Here is more.

Assorted links

A Syrian narrative

An emergency layover in Syria’s capital was bad enough. Then passengers on Air France Flight 562 were asked to open their wallets to check if they had enough cash to pay for more fuel.

The story is here. So what really happened?:

An Air France spokesman explained Friday that the crew inquired about passenger cash only as a “precautionary measure” because of the “very unusual circumstances.” Sanctions against Syria complicated payment for extra fuel.

He said Air France found a way to pay for the fill-up without tapping customer pockets — and apologized for the inconvenience.

For the pointer I thank Daniel Lippman.

Increased aggression during human group contests when competitive ability is more similar

From Stulp G, Kordsmeyer T, Buunk AP, Verhulst S.:

Theoretical analyses and empirical studies have revealed that conflict escalation is more likely when individuals are more similar in resource-holding potential (RHP). Conflicts can also occur between groups, but it is unknown whether conflicts also escalate more when groups are more similar in RHP. We tested this hypothesis in humans, using data from two professional sports competitions: football (the Bundesliga, the German first division of football) and basketball (the NBA, the North American National Basketball Association). We defined RHP based on the league ranks of the teams involved in the competition (i.e. their competitive ability) and measured conflict escalation by the number of fouls committed. We found that in both sports the number of fouls committed increased when the difference in RHP was smaller. Thus, we provide what is to our best knowledge the first evidence that, as in conflicts between individuals, conflicts escalate more when groups are more similar in RHP.

The paper is here, hat tip goes to Neuroskeptic. One hypothesis is behavioral. The other hypothesis is more directly microeconomic. Perhaps fouling has positive expected returns within the context of the game, but costs a player long-term reputation, risks long-term retaliation, and so on, and thus the aggression is deployed more in the really important situations.

When was it obvious our recovery would be so slow? (questions that are rarely asked)

John Cochrane presents a good point:

But we’ve heard the defense over and over again: “recoveries are always slower after financial crises.” Most recently (this is what set me off today) in the Washington Times,

Many economists say the agonizing recovery from the Great Recession…is the predictable consequence of a housing market collapse and a grave financial crisis. … any recovery was destined to be a slog.

“A housing collapse is very different from a stock market bubble and crash,” said Nobel Prize-winning economist Peter Diamond of the Massachusetts Institute of Technology. “It affects so many people. It only corrects very slowly.”This argument has been batted back and forth, but a new angle occurred to me: If it was so obvious that this recovery would be slow, then the Administration’s forecasts should have reflected it. Were they saying at the time, “normally, the economy bounces back quickly after deep recessions, but it’s destined to be slow this time, because recoveries from housing “bubbles” and financial crises are always slow?”

No, as it turns out…

You will find further background here. That said, my read on this is quite different than Cochrane’s. He blames post-crash policy, whereas I blame (mostly) “The Great Stagnation.”

*Making the European Monetary Union*

That is the new and forthcoming book by Harold James, from the Belknap Press of Harvard University Press. If you want a history of ideas and proposals for European monetary union, including the political battles, dating back to Napoleonic times and running up through the EMS crises, using plenty of archival material, this is the place to go.

From the comments

From Tom, a good pick and a good point:

Prolly you’ve all seen it … the most underrated invention — The Pallet. More underrated even than the shipping container, but just about as needed. http://www.slate.com/articles/business/transport/2012/08/pallets_the_single_most_important_object_in_the_global_economy_.html

All this just for them?

In spite of clichés about Nascar dads and Walmart moms, the actual share of voters nationally who are up for grabs is probably between just 3 percent and 5 percent in this election, polling experts say. The Obama and Romney campaigns are expected to spend on the order of $2 billion, in part to try to sway this tiny share of the electorate.

I’ll be glad when the whole thing is over. There is also this:

In Virginia, for example, a large number of swing voters are concentrated in Fairfax County, just outside the District of Columbia…

The full article is here.

Update on Greece

… the Greek government has imposed a moratorium on all outlays other than salaries and pensions, according to Greek newspaper Kathimerini. This means that primary spending, the public investment programme and the settlement of arrears have been halted.

…If the troika does not grant the Greek government any concessions on its bailout programme, it is highly likely that the two junior parties—the Democratic Left and Pasok—will drop out of government. This would precipitate fresh elections, the third for this year alone.

If you are Greek, when is actually the optimal time to simply stop paying your bills?

That is from Megan Greene, there is more at the link.