Month: August 2013

Assorted links

1. The rising value of land in Singapore (good photo, soccer-relevant too).

2. Ford’s factory cameras can spot a single speck of dust on a new car.

3. Korean and Chinese arbitrage.

5. Some basic numbers and charts for Indonesia’s financial problems.

A few notes on Singaporean (and other) health care systems

This is oversimplifying of course, but you can think of the Singaporean system as “2/3 private money, 4/5 public provision,” with private hospitals on the side.

You can think of the UK system as “public money, public provision.” Again with some private supply on the side.

The US system is “lots of public money, lots of private money, mostly private provision.”

Many other systems are “public money, private provision.” In all cases there are various complexities piled on top.

Singapore now is making some changes, outlined in brief here. For the most part, Singapore is adding on some public money, but in targeted fashion (one of the changes is for people over 90 years old, another is for people over 60).

Here’s from The Straits Times (gated, I write from the paper copy) from Saturday:

The first [priority] is to keep government subsidies targeted at those who most need them, rather than commit to benefits for all. Universal benefits are “wasteful and inequitable”, and hard to take away once given, he [the Finance Minister] said.

That’s exactly the liberaltarian line and sometimes the conservative line as well. It is a principle I strongly agree with.

I am grateful to have had a lengthy dinner with several of the civil servants who run the Singaporean health care system (I don’t need to tell you about the food). I had the liberty to “ask away” for several hours and I learned a lot.

Yes, the system really is a marvel, and no it is not laissez-faire. The mix of “private money, public provision” has some marvelous properties for economizing on costs, not the least of which is that private hospitals and doctors and medical device salesmen do not become too strong a lobby. And the level of conscientiousness in Singapore is high enough that the public hospitals work fine, though they don’t in general have the luxuries of the private hospitals. Furthermore those public hospitals have to compete against each other for patient loyalty and thus revenue, and so the reliance on private money helps discipline public hospitals.

Whether those public hospitals would work fine everywhere in the world is a debatable proposition. It’s easier to monitor quality in a small, Confucian city-state with high levels of expected discipline. (Oddly, Krugman, who thinks the VA model in the U.S. could be generalized to a national scale, should be especially sympathetic toward a Singapore-like system. An alternative is that the public hospitals are run at city, county, and state levels.)

In any case let’s start by admitting, and keeping on the table, the notion that the current version of the Singapore system is indeed a poster child of some sort. And it is not being modified because somehow it has started spewing out unacceptable health care outcomes. It is being modified because, for better or worse, Singaporean politics is changing.

Now enter Aaron Carroll, who tries to argue Singapore is moving in an ACA-like direction. His post has been cited numerous times, but it is not insightful nor does it show much curiosity about the new changes in Singapore. It is mostly a polemic against Republicans. In any case the new Singaporean emphasis on taking care of the elderly isn’t well understood by a comparison with ACA.

For an additional and important point, here is a good comment by Chris Conover on just how limited Singaporean coverage can be. This ain’t your grandfather’s ACA, though with some luck it may be your grandson’s. Even if the Singapore model is not fully generalizable to larger, more chaotic countries, it shows that government health care coverage and finance, no matter what exact form they take, should and indeed can be quite limited and you still can end up with excellent outcomes, including better cost control.

I also should add that quite a few intelligent, non-ideological Singaporean economists and civil servants believe the new changes to be bad ones, driven primarily by the demands of citizens for goodies rather than by the quest for the best technocratic policy. The alternative view is that Singapore is now a wealthy place and it can afford to spend extra on these health care services and indeed should do so to limit inequality and also for reasons of political popularity and stability.

The Singaporean health care system is not done changing.

Inequality in Singapore

Singapore is inequality on steroids, as you might expect from a high human capital, high information tech, growing financial center.

Seventeen percent of the population are millionaires, and that is not counting real estate wealth, which is substantial.

The H&M in the shopping district is closing, because the rent was doubled and it is being replaced by luxury retailers.

These days one sees very few Malays in the wealthier parts of the city center, contra my first visit in 1988. It’s not about prejudice, rather it is segregation by price and income class. One sees many more resident Westerners (and tourists) than native Malays in these parts of town. (One even wonders if the Malays will eventually be priced out of the country altogether, and conversely the Chinese in Malaysia are arriving in Singapore in increasing numbers.)

Even a very modest car can cost over $100,000 to buy and license, and the total can easily approach $200,000. The tax on imported cars — and they are all imported — is one hundred percent. Housing prices are exorbitant. Those are the main reasons why Singaporean private indebtedness is rising so rapidly.

It seems self-understood, within the Singaporean government, that growing inequality merits some kind of policy response. In the meantime, the inflow of low-skilled labor is being restricted. At what level of wealth is inequality no longer a moral or practical problem?

Arguably there is more envy of the rich in Singapore than in the United States. The country is small, and luxury consumption is readily observable and indeed impossible to avoid every time you walk or drive through the heart of the country downtown.

It is noteworthy that Singapore’s recently constructed and now iconic building is on the top a swimming pool and on the bottom a casino.

This story is not over.

Assorted links

1. A long questionnaire which establishes which famous economist you are most similar to.

2. Korean markets in everything, hard to believe that one. Here is a related Chinese idea.

3. Upper West Side condo has separate entrances for rich and poor.

4. North Korea has a meth problem., and Johnny Carson moved the demand curve outwards.

5. Toward a theory of optimal monitoring, China style.

Singaporean hawkers are some of the best food creators in the world

From a recent cook-off challenge:

Singapore’s humble but beloved hawkers have triumphed 2-1 in a cook-off with the legendary Gordon Ramsay who runs restaurants that have earned not just one but three Michelin stars. Are our hawkers then worthy of Michelin star attention? Well, they may not be decorated, but it looks like they still win the hearts of locals.

Nearly 5,000 people thronged the Singtel Hawker Heroes Challenge to see the Ramsay, the Hell’s Kitchen star, pit his skills against three hawkers who were chosen in a national poll drawing 2.5 million votes. The chef only had two days to learn and prepare the same hawker food that these local masters have been doing for decades.

There is more detail here, additional coverage here, and it is no surprise Ramsey fell flat on the laksa.

There is, by the way, plenty of talk that the hawkers are an endangered species. With rising rents, various bureaucracies are asking whether the hawker centers really deserve so much dedicated land in the city plans. There’s also a question whether the younger generation wants to take on jobs which are so stressful and demanding, when so many other good jobs are available in Singapore. Other hawker centers are suffering in quality just a wee bit from the gentrification of their neighborhoods. Let’s hope for the best but I fear for the worst.

My Singapore food recommendation, by the way, is the Ghim Moh Market and Food Centre, which has numerous gems and is one of those “pre-upgrade” hawker centers, with a design dating from 1977. (Unfortunately they will close it for renovation next year, which will probably mean the loss of some hawkers.) My favorite dish was the dosa at Heaven’s Indian Curry, arguably the best I have had, including in South India. They open at six a.m. each morning, every single day, see my remarks above. Their dishes cost either one dollar or two dollars (roughly, actually less).

Are we making mouse brains bigger?

Maybe urban living makes all of us smarter:

In two species — the white-footed mouse and the meadow vole — the brains of animals from cities or suburbs were about 6 percent bigger than the brains of animals collected from farms or other rural areas. Dr. Snell-Rood concludes that when these species moved to cities and towns, their brains became significantly bigger.

Dr. Snell-Rood and Ms. Wick also found that in rural parts of Minnesota, two species of shrews and two species of bats experienced an increase in brain size as well.

Dr. Snell-Rood proposes that the brains of all six species have gotten bigger because humans have radically changed Minnesota. Where there were once pristine forests and prairies, there are now cities and farms. In this disrupted environment, animals that were better at learning new things were more likely to survive and have offspring.

Studies by other scientists have linked better learning in animals with bigger brains. In January, for example, researchers at Uppsala University in Sweden described an experiment in which they bred guppies for larger brain sizes. The big-brained fish scored better on learning tests than their small-brained cousins.

There is more here, via Michelle Dawson.

How bad is India’s economic and financial crisis?

Of course we don’t know. However Kapur and Subramaniam make a good case for “probably not so bad.”

Maybe so, but here is my worry. Within the span of about a year, India has gone from eight percent plus growth to the range of four to five percent, and perhaps with further downward momentum. That is a big shift. And that has happened without any initiating financial crisis, without any war or natural disaster, without any collapse in aggregate demand, and without any price collapse of a primary export product. It just happened.

It could be the Indian economy bumped up against a hard energy constraint; Indian energy policy is notoriously inefficient. Still, it is unlikely that is the whole story or even half of it.

One has to wonder whether India is an economy moving across multiple equilibra (note to self: FN Roger Farmer), and the passage of time has been revealing that India “deserves” increasingly inferior expectations about future economic performance. When it comes to multiple equilibria, there may be more than two. India’s very response to the current crisis will determine which equilibrium comes next and that is not altogether reassuring.

Non-linear effects seem to be in the running here, so India’s crisis could be worse than the brute statistics alone (or an IS-LM model) would indicate.

Assorted links

1. The culture that is Ukraine, watch out for salads with mayonnaise.

3. Profile of Marianne Bertrand.

4. Toward a theory of the Very Serious People.

5. John Cochrane will be running a MOOC on asset pricing models, at the Ph.D or near Ph.D level.

How long does it take mammals to learn the optimal commute?

Here is just one bit from a fascinating article, most of which concerns bears learning to use a road overpass:

But over the years, critics and transportation planners, even some environmentalists have groused about the idea: Taxpayer money, building overpasses for bears? Is that really necessary? Would they even use the things? Researchers have been methodically studying the crossings since 1996 to answer this. And it turns out that, yes, animals deterred by fencing that now runs the full 70-kilometer length of the highway in the park actually cross the road an awful lot like a rational pedestrian would. It takes them a while, though, to adapt to the crossings after a new one is constructed: about four to five years for elk and deer, five to seven years for the large carnivores.

The full piece is here, and for the pointer I thank Philip Wallach.

Spying on your loved ones? (or what you don’t know can’t hurt you?)

National Security Agency officers on several occasions have channeled their agency’s enormous eavesdropping power to spy on love interests, U.S. officials said.

The practice isn’t frequent — one official estimated a handful of cases in the last decade — but it’s common enough to garner its own spycraft label: LOVEINT.

Here is more.

Singapore has a very low wage share

Singapore has one of the highest GDP per capita in the world. However, our wage share of GDP (at around 43 per cent) is lower than the shares of most developed economies (at 50 per cent or more).

Of course Singapore is one of the wealthiest countries in the world.

You will find a variety of interesting graphs at this pdf link. That is from the Economic Survey of Singapore, more here.

Assorted links

1. World’s first bulletproof couch.

2. Replacing a soccer coach doesn’t seem to matter.

3. Using drones to fight mosquitoes.

4. How to mail a cockroach (pdf), background here.

5. Should Japan opt for more flexible, freer markets?

6. Various claims about various workplaces, interesting, some speculative, includes HFT too.

The Value of a CEO

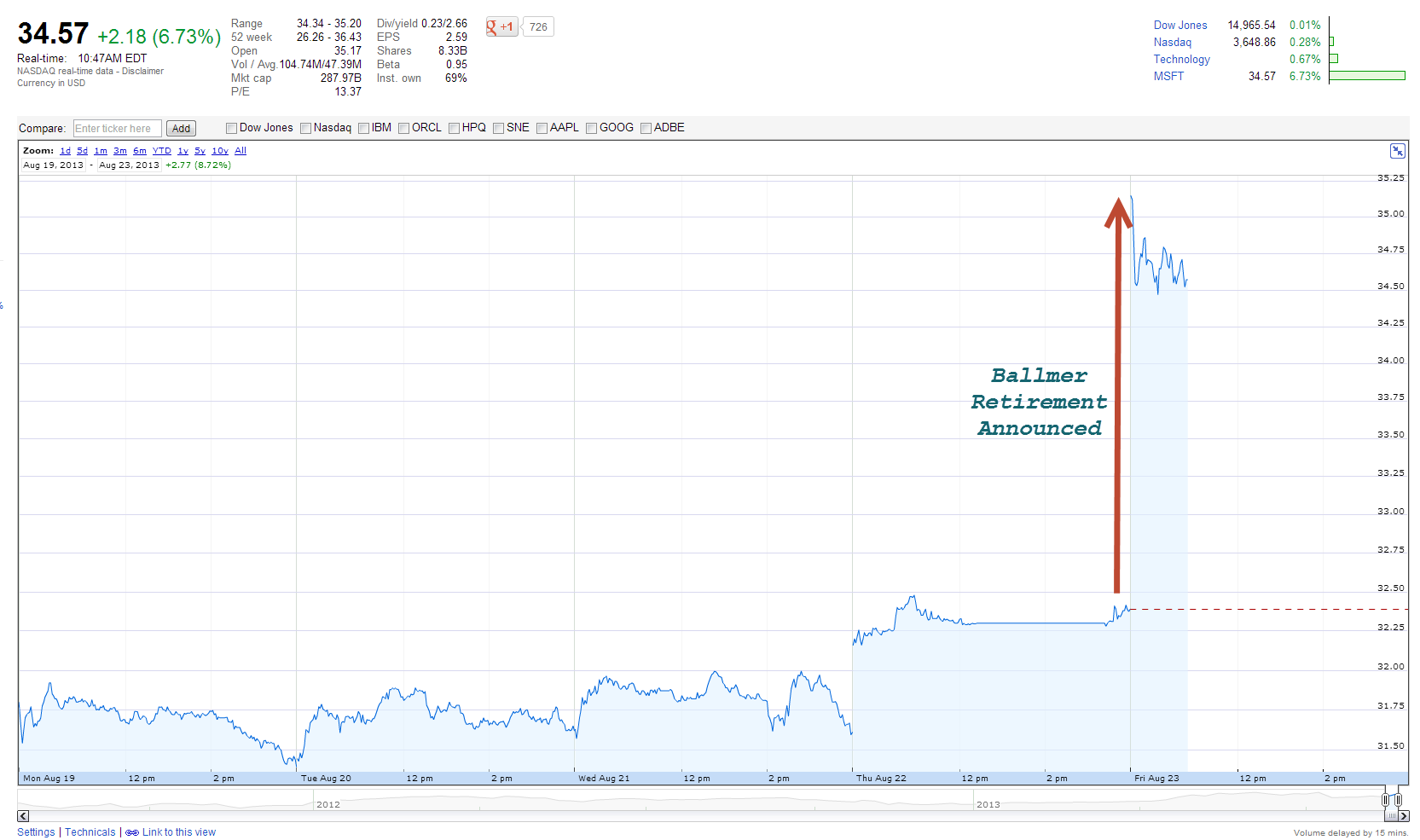

Steven Ballmer announced today that he would retire. Microsoft stock shot up immediately by ~$2.18 or 6-7%. Given 8.33 billion shares outstanding that’s an increase in value of about $18 billion dollars. Of course that’s embarrassing for Ballmer but the lesson cuts both ways. If Ballmer’s exit and replacement with an unknown is worth $18 billion then hiring the right CEO at $27 million annually, the average annual pay for the 100 highest paid CEOs in America, looks like a bargain. Small differences are a big deal for large corporations, you know like a marginal… something or other.

Hat tip: Justin Wolfers.

An update on labor market polarization

Here is Mark Thoma quoting Josh Lehner:

What we see here is strong job growth at both the top and bottom ends of the wage spectrum. Yes, food preparation and personal care account for a disproportionately large share of jobs gained in recent years, but so too have business and financial services, healthcare practitioners, computer and mathematical occupations and management. Where we have seen slower growth is in the middle. The light blue bars, which I term lower middle-wage jobs account for about 40% of all occupations in 2012 yet account for just 26% of the growth. The dark blue bars, which I term upper middle-wage jobs, account for another 19% of all occupations and 0% of the growth. This, by definition, is job polarization.

There are useful pictures at the link.

Why has growth in per capita Medicare spending slowed down?

There is a new CBO study, which I have not read, but which is noteworthy virtually by definition. The abstract is here:

Growth in spending per beneficiary in the fee-for-service portion of Medicare has slowed substantially in recent years. The slowdown has been widespread, extending across all of the major service categories, groups of beneficiaries that receive very different amounts of medical care, and all major regions. We estimate that slower growth in payment rates and changes in observable factors affecting beneficiaries’ demand for services explain little of the slowdown in spending growth for elderly beneficiaries between the 2000–2005 and 2007–2010 periods. Specifically, available evidence does not support a finding that demand for health care by Medicare beneficiaries was measurably diminished by the financial turmoil and recession. Instead, much of the slowdown in spending growth appears to have been caused by other factors affecting beneficiaries’ demand for care and by changes in providers’ behavior. We discuss the contribution that those factors may have made to the slowdown in spending growth and the difficulties in quantifying those influences and predicting their persistence.

The full paper (pdf) is here.