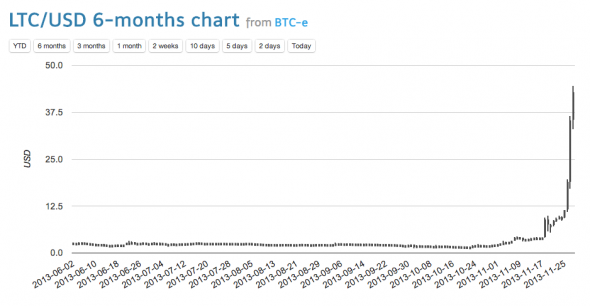

Month: December 2013

A short disquisition on the value of Litecoin

That is from Izabella Kaminska. Here is Wikipedia on Litecoin.

Assorted links

1. The lost art of the cutaway.

2. On net, will these trends make the country more or less libertarian? And Sarah Binder on whether we have gridlock.

3. Peter Thiel’s graph of the year is about student debt.

4. By Neil Shah, the evolution of heavy metal drumming. And can a computer enter Tokyo University? Can robots better spot terrorists at airports?

5. Cities should diversify, not specialize.

6. Is fusion going to end up working? That’s nuclear fusion, not Asian fusion cuisine.

7. Scott Winship and David Schneider on mobility and inequality.

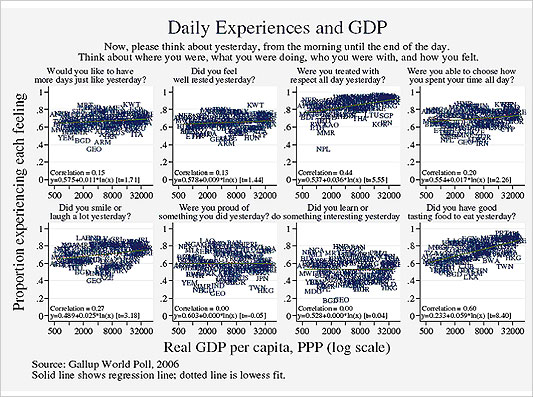

Where are people respected the most?

Following up on Noah Smith’s earlier blog post, we discussed this question at lunch. Noah cites Japan as a country where there is a high degree of respect granted, and a relatively high equality of respect, and very likely that is true for artisans, manufacturing workers, foreign dignitaries, and foxes. But is it true more generally if we take into the position of women, who are often locked out of good jobs? How about the position of the young “lost generation,” namely all those guys with virtual girlfriends, who have given up on real sex and won’t leave their apartments? How about various minorities in Japanese society, such as the ethnic Koreans? Does Japan lose out on the forms of respect that come from large, extended families, as you might find say in Sicily?

Those judgments have some subjective elements, but I do think they bring Japan down a few notches when it comes to respect and equality of respect.

Oddly I think of the United States as a country with a fair degree of both respect and equality of respect. The diversity of niches and the diverse geography create many pathways for being thought highly of, or for thinking highly of oneself, and there are many insulations from the overweening standards of elites. And we have plenty of indifference, which is a kind of equality of respect, albeit not to be confused with respect per se.

Arguably the most powerful and influential men find plenty of respect in just about any society. A lot of the cross-national variation in respect might come on the female side of the ledger. That would likely favor the Nordic countries and Iceland in a ranking of respect.

Cowen’s Third Law says there is a literature on everything, but the most obvious Google searches did not yield concrete results. (There is however Richard Sennett’s Respect in a World of Inequality.) Can any MR readers speak to the empirical knowledge on this question? We all know the literature on happiness across nations, but here we are interested specifically in respect, where people are respected the most, and where equality of respect is most robust.

How would one go about measuring respect?

Addendum: Justin Wolfers suggest this link, and some Gallup World Poll data, showing respect is positively correlated with wealth:

Request from MR commentator “Is disaggregate the word I want?”

A short while ago, he asked this:

taking requests? I doubt if, but here goes anyway – charisma half-life of Taylor Swift, Jorge Bergoglio, and James Levine as seen fifty years from now; when will the unquestionably converging IQs of point guards, quarterbacks, and chess champions meet up; what would life be like for a tenured economics professor who decides to spend a year studying midAtlantic Lepidoptera in the wild and learning Norwegian; Peter Hitchens versus Christopher Hitchens – who was or is less deceptive and deceived, assuming an ability to consider them as intellectual equals; how old was TC when he read “all of Harold Bloom’s canon” leaving out some of the Icelandic sagas. Not that any of these topics will be taken up, but if TC or Alex takes one of them seriously how about the Hitchens one, which has the whole Pascalian eternal potential return thing going for it.

Happy New Year’s Eve! And yes, I think disaggregate is indeed the word you want.

Note that Alex’s answers may differ from these.

Any more reader requests?

Uber-Economist

Uber is hiring economists. Looks like an interesting job:

Urban transportation has looked the same for a long time – a really long time – thanks in large part to regulatory regimes that don’t encourage innovation. We think it’s time for change. We’re a tech company sure, and we’re working in the transportation space, but at the end of the day we’re disrupting very old business models. Our Public Policy team prefers winning by being right over some of the darker lobbying arts, and so we’re looking for a Policy Economist to tease smart answers to hard questions out of big data. How do the old transportation business models impact driver income? What effect if any is Uber having on the housing market or drunk driving or public transit? To what extent are the different policy regimes in New York City and Taipei responsible for different transportation outcomes? Just a few of the questions we want you to dig on.

On-line education at the AEA meetings in Philadelphia

I can recommend to you all the session Economics Education in the Digital Age, scheduled for Saturday, January 4, at 10:15 a.m.

Nancy Rose is chairing the proceedings and presented papers will be by Caroline Hoxby, Banerjee and Duflo, and Acemoglu, Laibson, and List, as well as by Alex and myself. They are all very interesting papers, as you would expect from these economists.

Lucian Freud on gambling

Gambling is only exciting if you don’t have any money.

That is from the excellent Breakfast with Lucian: The Astounding Life and Outrageous Times of Britain’s Great Modern Painter, by Geordie Greig.

How and why Bitcoin will plummet in price

My post from yesterday was perhaps not specific enough, so let me outline one possible scenario in which the value of Bitcoin (and other cryptocurrencies) would fall apart. For purposes of argument, let’s say that a year from now Bitcoin is priced at $500. Then you want some Bitcoin, let’s say to buy some drugs. And you find someone willing to sell you Bitcoin for about $500.

But then the QuitCoin company comes along, with its algorithm, offering to sell you QuitCoin for $400. Will you ever accept such an offer? Well, QuitCoin is “cheaper,” but of course it may buy you less on the other side of the transaction as well. The QuitCoin merchants realize this, and so they have built deflationary pressures into the algorithm, so you expect QuitCoin to rise in value over time, enough to make you want to hold it. So you buy some newly minted QuitCoin for $400, and its price springs up pretty quickly, at which point you buy the drugs with it. (Note that the cryptocurrency creators will, for reasons of profit maximization, exempt themselves from upfront mining costs and thus reap initial seigniorage, which will be some fraction of the total new value they create, and make a market by sharing some of that seigniorage with early adopters.)

Let’s say it costs the QuitCoin company $50 in per unit marketing costs for each arbitrage of this nature. (Alternatively you can think of that sum as representing the natural monopoly reserve currency advantage of Bitcoin.) In that case both the company and the buyers of QuitCoin are better off at the initial transfer price of $400 and people will prefer that new medium. Over time the price of Bitcoin will have to fall to about $450 in response to competition.

But of course the story doesn’t end there. Along comes SpitCoin, offering to sell you some payment media for $300. Rat-FacedGitCoin offers you a deal for $200. ZitCoin is cheaper yet. And so on.

Once the market becomes contestable, it seems the price of the dominant cryptocurrency is set at about $50, or the marketing costs faced by its potential competitors. And so are the available rents on the supply-side exhausted.

There is thus a new theorem: the value of WitCoin should, in equilibrium, be equal to the marketing costs of its potential competitors.

This theorem will hold even if you are very optimistic about market demand and think that grannies will get in on it. In fact the larger the network of demanders, the lower the marginal marketing cost may be — a bit like cellphones — and that means even lower valuations for the dominant cryptocurrency.

(It is an interesting question what fixed, marginal, and average cost look like here. Arguably market participants will not accept any cryptocurrency which is not ultimately and credibly fixed in supply, so for a given cryptocurrency the marginal cost of marketing more at some point becomes infinite. Marginal cost of supply for the market as a whole is perhaps the (mostly) fixed cost of setting up a new cryptocurrency-generating firm, which issues blocks of cryptocurrency, and that we can think of as roughly constant as the total supply of cryptocurrency expands through further entry. In any case this issue deserves further consideration.)

Note that the more “optimistic” you are about Bitcoin, presumably you should also be more optimistic about its future competitors too. Which means the theorem will kick in and you should be a bear on Bitcoin price. Arguably it’s the bears on the general workability of cryptocurrencies who should be bullish on Bitcoin price because a) we know Bitcoin already exists, and b) we would have to consider that existence an unexpected and unreplicable outlier of some sort. Yet the usual demon of mood affiliation denies us such a consistency of reasoning, and the cryptocurrency bulls are often also bulls on Bitcoin price, as too many of us prefer a consistency of mood!

In theory

Now, theoretically, you might believe that the current price of Bitcoin already reflects exactly those marketing costs of potential competitors and thus the current equilibrium is stable or semi-stable. Maybe so, but I doubt that. The current value of outstanding Bitcoin is about $20 billion or so, and it doesn’t seem it cost nearly that much to launch the idea. And now that we know cryptocurrencies can in some way “work,” it seems marketing a competitor might be easier yet. (You will note that by its nature, there are some Bitcoin imperfections permanently built into the system, imperfections which a competitor could improve upon. Furthermore the longer Bitcoin stays in the public eye, the more likely that an established institution will label its new and improved product LegitCoin and give it a big boost.)

You can think of that $20 billion — or perhaps just some chunk of that? — as a very rough measure of the prize to be won if you can come up with a successful Bitcoin competitor. Even a fraction of that sum will spur some real effort.

In short, we are still in a situation where supply-side arbitrage has not worked its way through the value of Bitcoin. And that is one reason — among others — why I expect the value of Bitcoin to fall — a lot.

I thank Brad DeLong for an email query and analysis which sparked this blog post.

Addendum: Maybe I’ll write another post on the possible expected deflationary bias in any cryptocurrency, given that expected price changes usually get compressed into the present and that an overall expected rate of return equality must hold. And the question of how much an initial issuer can exempt itself from mining costs as a form of reaping upfront seigniorage. and the profit-maximizing way of sharing these gains with early adopters. Those are two hanging issues with respect to the analysis here, in addition to the matter of cost structure discussed in the parentheses above. And now go reread Kareken and Wallace (1981). “=/∞” I think one has to say here.

Assorted links

1. A relationship in five minutes.

2. First they have Scarlett Johansson play an operating system, then Jessica Alba as a Borneo tribeswoman, what will be next?

3. Ten simple points on how to be nettlesome.

4. Preserved moments of historical sass (volume seven).

On the future of Dogecoin, BitCoin, and other cryptocurrencies of the non-realm

An email query from Brad DeLong reminds me of this old Bart Taub paper, “Private Fiat Money with Many Suppliers” (jstor):

A dynamic rational expectations model of money is used to investigate whether a Nash equilibrium of many firms, each supplying its own brand-name currency, will optimally deflate their currencies in Friedman’s (1969) sense. The optimal deflation does arise under an open loop dynamic structure, but the equilibrium breaks down under a more realistic feedback control structure.

There is also Marimon, Nicolini, and Teles (pdf) and the work of Berentsen., all building on Ben Klein’s piece from 1974. This literature has been read a few different ways, but I take the upshot to be that a) a monopolized private fiat money might be stable in supply, to protect the stream of future quasi-rents, and b) private competing fiat monies will not be stable in overall supply, for reasons of time consistency and also the competitive erosion of available rents. In other words, when it comes to the proliferation of cryptocurrencies, the more the merrier but not for those holding them.

I don’t agree with the modeling strategy of this 1981 Kareken and Wallace paper on the indeterminacy of equilibrium exchange rates, but still it is another useful starting point.

Addendum: Krugman adds a bit more on Bitcoin, from a friend of his, John R. Levine. Here is the final bit from Levine:

My current guess is that the Bitcoin bubble will collapse when there is some bad news, e.g., a regulator demands registration of Bitcoin wallets, people try and cash out, and find that that while it’s easy to buy bitcoins, it’s much harder to find people willing to buy back nontrivial amounts, very hard to collect the sales proceeds, and completely impossible without revealing exactly who you are.

Assorted links

1. Bach’s Chaconne in D Minor, for electric guitar. And a story on the guy who played it.

2. Pearlstein on how the DC game has changed.

3. “Chris Crawford owns 29,216 small plastic beads.”

4. Toward a brief history of Camden, NJ, and why more young whites are coming to the city.

*Her*

As I tend to find Jonze’s work contrived I didn’t expect much, but I was bowled over by what is a must-see movie for anyone interested in tech or the social sciences or for that matter cinema. Two of its starting premises are a) we as humans now face shadow prices which lead us to deemphasize the physical world of things and live in a world of information, and b) if we are going to have AI, which consumes real resources, which Darwinian principles will govern what kinds of personal assistants survive or do not? Will they enslave us, will they be our dogs, our friends, our trading partners, or something else altogether? This movie is the single best place to start on that question.

The rest is, as they say, solve for the equilibrium. I found the dialogue, performances, and cinematography very strong. The skyline blends Los Angeles and Shanghai. The movie toys with the viewer in a clever manner as to whether it is about the future, the present, or both. Several of the scenes (reluctance to spoil prevents further specificity) were some of the best and most creative and most conceptual movie-making I have seen, ever.

The “sources” for this movie, whether Spike Jonze is aware of them all or not, include Cyrano de Bergerac, various Mermaid legends, Blade Runner, Spielberg’s AI, 2001, Lubitsch’s The Shop Around the Corner, Philip Pullman, Bewitched and I Dream of Jeannie, Pinocchio, Girard and indeed Shakespeare on the triangulation and intermediation of desire, Electric Dreams, Battlestar Galactica, Annie Hall, and even the Mormon doctrine of the Holy Ghost, as well as Jonze’s previous movies. This is perhaps the most accurate review (some spoilers) I have seen. This too is an insightful review, but the spoilers there are massive. Best is not to read either but just to go see it.

Definitely recommended, for me this was one of the cultural events of the year.

Carl-Henri Prophète on Haitian economic growth

He writes to me:

…just to let you know that Haiti’s economy grew by 4.3% in 2013. This is the highest growth rate since the 1970s excluding post embargo and post earthquake years (1995 and 2011). Nothing spectacular, but worth noticing I think. Some people may question these numbers in a country where the National Statistics Institute regularly looses its best staff to NGOs where they can earn 3 times their previous salary. But there is a general feel that economic activity was definitely higher than usual in 2013.

This is partly due to luck: There were no hurricanes or major drought period during the year, so agriculture which accounts for around a 1/4 of the economy grew by 4.6%. The construction sector did also well (+9%) thanks to major infrastructure investment by the government funded by generous Venezuelan aid and some major private investments (in the hotel sector for instance). Exports also increased in real terms by 5%. By the way, there are two firms assembling low cost Android tablets in the country now, which may lead to a greater diversification in exports away from garments in the future. (see here http://bit.ly/1lnVVxjand here http://bit.ly/Jkit6v)

However, inequality is still very high and even more spatially visible as the relatively wealthy suburb of Petion Ville is booming and has became the de-facto capital since the earthquake. Also, there are questions about how long this Venezuelan aid will last and its impact on the country’s debt, corruption and government accountability. Furthermore, there should be elections for many parliament seats in 2014 which may fuel political instability.

More on the difference between Airbus and Boeing control systems

An MR reader writes to me:

Chances are you have received an email similar to this from other airline pilots, but in the off case you have not:

The article you posted contains what I believe to be some oversimplifications of the A/B control system philosophy differences.

It’s commonly stated that the Airbus will override the pilot and the Boeing will not. This isn’t entirely true.

A more accurate statement would be this: All jet aircraft have override/feedback systems that will warn or resist the pilot at the edges of the aerodynamic envelope. Airbus has a slightly larger number of these systems, and they are set to trigger slightly earlier.

Both aircraft will automatically throttle back if in an overspeed condition.

Both aircraft will automatically shake the yoke, and then automatically push over, in a stall condition.etc.

Airbus, in addition, will limit max G forces on the aircraft. Boeing does not.

The advantage of the Airbus approach is that you can haul back on the stick as hard as you want without breaking the aircraft (and turning it into several smaller, less-airworthy aircraft). You are limited to G forces that produce no damage to the aircraft.

The advantage of the Boeing approach is that you can generate any g forces you want. This gives you the opportunity to fly in the region that generates enough G to bend the aircraft, but not to break it. That extra G force may help you avoid a mountain. Of course, you may extend into the part of the envelope that breaks the aircraft.

These differences are relatively minor, as the vast majority of crashes do not occur at the edges of the envelope, and are categorized as CFIT (Controlled Flight Into Terrain). When within the aerodynamic envelope, Boeing and Airbus aircraft are usually under the control of the same sort interchangeable flight management computers.

Both the Asiana (Boeing) and Air France (Airbus) crashes were caused by crew that did not understand the systems of the aircraft they were flying. Both aircraft impacted terrain under full control.

Assorted links

1. More on what is going on in Turkey, from Monkey Cage. And here is Dexter Filkins.

2. Equality of income or equality of respect? And Lane Kenworthy on why income inequality should not be the main focus (pdf).

3. Hobo nickel art.

4. Interview with Psychology Today about Average is Over.

5. Why it is hard to cut (some parts of) government spending. And how badly will Italian opera fall apart?

6. Strand bookstore reports best sales ever.

7. Your doctoral thesis in one sentence, via Angus. The first person, by the way, needed two sentences.