Month: July 2015

Does Fair Trade Help Poor Workers?

Does Fair Trade help poor workers? Probably not says Don Boudreaux in this excellent, short video from the Everyday Economics series at Marginal Revolution University.

As is well known, however, Don is a rabid, free-market economist with ideological blinders who has been captured by corporate interests. So let’s ignore what Don says and consider what William MacAskill, author of Doing Good Better (reviewed earlier this week) has to say. No one can fault MacAskill’s charitable bona-fides:

MacAskill’s own pledge is to donate everything he earns above about $35,000 per year, adjusted using standard economic measures for inflation and cost of living, to the organizations that he believes will do the most good. Since his bar is roughly at the UK median income—such that half the population earns more each year, and half the population earns less—he’s certainly not condemning himself to a life of hardship; rather, he is pre-committing to staying roughly in the middle of the national income distribution even as his earnings go up over time.

That said, his pledge means giving away 60 percent of his expected lifetime earnings.

When I ask him the inevitable questions about whether this isn’t rather a lot to sacrifice for one person, MacAskill shrugs modestly and smiles broadly. “Imagine you’re walking down the street and see a building on fire,” he says. “You run in, kick the door down—smoke billowing—you run in and save a young child. That would be a pretty amazing day in your life: That’s a day that would stay with you forever. Who wouldn’t want to have that experience? But the most effective charities can save a life for $4,000, so many of us are lucky enough that we can save a life every year through our donations. When you’re able to achieve so much at such low cost to yourself…why wouldn’t you do that? The only reason not to is that you’re stuck in the status quo, where giving away so much of your income seems a little bit odd.”

So what are MacAskill’s views on Fair Trade? Why they are the same as Don’s!

…when you buy fair-trade, you usually aren’t giving money to the poorest people in the world. Fairtrade standards are difficult to meet, which means that those in the poorest countries typically can’t afford to get Fairtrade certification. For example, the majority of fair-trade coffee production comes from comparatively rich countries like Mexico and Costa Rica, which are ten times richer than the very poorest countries like Ethiopia.

….In buying Fairtrade products, you’re at best giving very small amounts of money to people in comparatively well-off countries. You’d do considerably more good by buying cheaper goods and donating the money you save to one of the most cost-effective charities…

Data on lion hunting (Cecil fact of the day)

Killing lions right outside of park boundaries seems like a systemic problem, not just a one-off instance:

Between 1999 and 2004 we undertook an ecological study of African lions (Panthera leo) in Hwange National Park, western Zimbabwe to measure the impact of sport-hunting beyond the park on the lion population within the park, using radio-telemetry and direct observation. 34 of 62 tagged lions died during the study (of which 24 were shot by sport hunters: 13 adult males, 5 adult females, 6 sub-adult males). Sport hunters in the safari areas surrounding the park killed 72% of tagged adult males from the study area. Over 30% of all males shot were sub-adult (<4 years). Hunting off-take of male lions doubled during 2001-2003 compared to levels in the three preceding years, which caused a decline in numbers of adult males in the population (from an adult sex ratio of 1:3 to 1:6 in favour of adult females). Home ranges made vacant by removal of adult males were filled by immigration of males from the park core. Infanticide was observed when new males entered prides. The proportion of male cubs increased between 1999 and 2004, which may have occurred to compensate for high adult male mortality.

The 2007 paper is here (pdf), by Loveridge, Searle, Murindagamo, and MacDonald, via Hollis Robbins.

The world trade slowdown continues, and worsens

The latest World Trade Monitor showed the volume of world trade falling in May by 1.2 per cent. It slid in four out of five months in 2015 and risen just 1.5 per cent in the past 12 months — less than the growth in global output and far below the long-term average of about 7 per cent a year.

The problem has been getting worse for some time. Trade bounced back fairly well in 2010 after the global recession but it has disappointed ever since, growing by barely 3 per cent in 2012 and 2013. Now it seems the world cannot manage even that.

That is from Stephanie Flanders.

*Private Governance*

The author is Edward Peter Stringham and the subtitle is Creating Order in Economic and Social Life. I haven’t looked through this book yet, but I am very much an admirer of the underlying research by Ed. Here is Peter Thiel’s blurb:

“Stringham dispels state-worshipping fiction with historical fact to show how good governance has preceded Leviathan, ignores it when necessary, and can surpass it when it fails.”

Peter Thiel, Entrepreneur

Recommended.

China estimate of the day

Annual real growth in gross capital formation hit 6.6 per cent in 2014, down from 10.2 per cent in 2013 and a peak of 25 per cent in 2009.

Thomas Gatley, China corporate analyst at Gavekal Dragonomics, a research firm, estimates that so far this year GFCF may be running at around 4 to 5 per cent.

That is from James Kynge at the FT. Here is from Ambrose Evans-Pritchard:

David Cui, from Bank of America, said $1.2 trillion of stock holdings are being carried on margin debt. This is 34pc of the free float of the Shanghai and Shenzhen stock markets. “When the market ultimately settles at a level that can be sustained on fundamental reasons, we expect that the financial system may wobble, due to high contagion risk,” he said.

Mr Cui said the brokers and trusts have barely 1.6 trillion yuan ($260bn) to absorb losses and may be overrun. “Given the particularly thin front line of the financial institutions, we suspect that it’s a matter of time before banks may have to face the music,” he said.

This in turn risks setting off a “bank run” on the shadow banking system as investors lose trust in wealth management funds, fearing that their deposits in the $2.1 trillion industry no longer have an implicit guarantee.

As Arnold Kling would say, have a nice day…

Tuesday assorted links

1. Bud Collier’s assembled artifacts from the history of economic thought.

2. Rajan, control, interest rates, backlash. Some kind of confusing Indian saga.

3. Christopher Balding’s China update.

4. The self-government revolution in Syria.

5. The decline of the Marines?

The rise of Stanford economics

From the report of the President of the university, Raj Chetty and Matt Gentzkow will be starting at the school this fall.

And John Cochrane is moving to Hoover full-time.

In the late 1970s and 80s, MIT was undoubtedly number one as a place to study economics, even if Chicago ideas were more important and more fundamental (Becker, Fama, Posner, etc.). Harvard passed MIT a bit later for a good twenty year run at the top.

Stanford is next.

Very serious words of wisdom

Everyone wants to find a version of history under which all the problems of the Eurozone are Germany’s fault, because everyone knows that all the solutions involve Germany paying. But it’s not really true; Germany spent the early years of ERM/EMU paying far more than anyone else was prepared to in order to smooth the adjustment path for the former Communist states. And after fifty years of structuring everything in Europe to prevent German hegemony, is it really a big surprise that Germany isn’t well set up to act as a hegemon? Imagine if the USA had lost the war in the Pacific and was today being blamed for its failure to ensure the economic development of the Phillippines.

That is from Daniel Davies, there are other good points at the link.

The taxation of superstars

Here is yet another NBER Working Paper to shout from the rooftops:

How are optimal taxes affected by the presence of superstar phenomena at the top of the earnings distribution? To answer this question, we extend the Mirrlees model to incorporate an assignment problem in the labor market that generates superstar effects. Perhaps surprisingly, rather than providing a rationale for higher taxes, we show that superstar effects provides a force for lower marginal taxes, conditional on the observed distribution of earnings. Superstar effects make the earnings schedule convex, which increases the responsiveness of individual earnings to tax changes. We show that various common elasticity measures are not sufficient statistics and must be adjusted upwards in optimal tax formulas. Finally, we study a comparative static that does not keep the observed earnings distribution fixed: when superstar technologies are introduced, inequality increases but we obtain a neutrality result, finding tax rates at the top unaltered.

That is from Florian Scheuer and Iván Werning.

The six most important words in the world right now

It depends on the Communist Party.

Of course you are free to leave alternative nominations in the comments.

Monday assorted links

1. How bad were the Black Panthers?

2. Spending a night in the robot-staffed hotel.

3. The Chinese stock market crash is worse than you think.

4. New Yorker profile of Varoufakis. Interesting throughout, covers Obama too, not just the usual even if this seems like familiar territory by now. “Adding up is the essence of democracy.” What an excellent line. The piece is by Ian Parker, and it deserves one of those David Brooks awards.

5. Brains striving for coherence.

6. Daniel Klein on who is a liberal.

7. “…even in relatively egalitarian Sweden, wealth begets wealth.”

Doing Good Better

William MacAskill is that rare beast, a hard-headed, soft-hearted proponent of saving the world. His excellent new book, Doing Good Better, is a primer on the effective altruism movement.

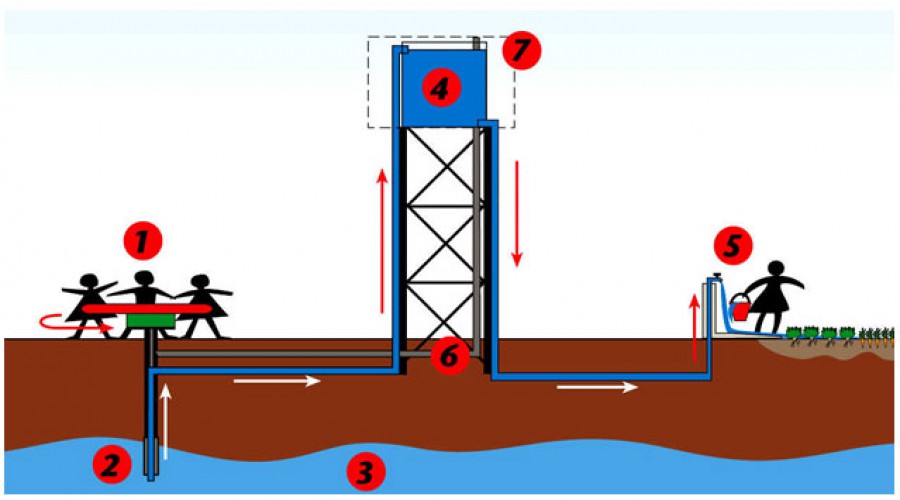

Doing Good Better opens, just as you would expect, with an uplifting story of a wonderful person with a brilliant idea to save the world. The PlayPump uses a merry-go-round to pump water. Fun transformed into labor and life saving clean water! The energetic driver of the idea quits his job and invests his life in the project. Africa! Children on merry-go-rounds! Innovation! What could be better? It’s the perfect charitable meme and the idea attracts millions of dollars of funding from celebrities like Steve Case, Jay-Z, Laura Bush and Bill Clinton.

Doing Good Better opens, just as you would expect, with an uplifting story of a wonderful person with a brilliant idea to save the world. The PlayPump uses a merry-go-round to pump water. Fun transformed into labor and life saving clean water! The energetic driver of the idea quits his job and invests his life in the project. Africa! Children on merry-go-rounds! Innovation! What could be better? It’s the perfect charitable meme and the idea attracts millions of dollars of funding from celebrities like Steve Case, Jay-Z, Laura Bush and Bill Clinton.

Then MacAskill subverts the narrative and drops the bomb:

…despite the hype and the awards and the millions of dollars spent, no one had really considered the practicalities of the PlayPump. Most playground merry-go-rounds spin freely once they’ve gained sufficient momentum–that’s what makes them fun. But in order to pump water, PlayPumps need constant force, and children playing on them would quickly get exhausted.

The women whose labor was supposed to be saved end up pushing the merry-go-round themselves, which they find demeaning and more exhausting than using a hand-pump. Moreover, the device is complicated and requires extensive maintenance that cannot be done in the village. The PlayPump is a disaster.

MacAskill, however, isn’t interested in castigating donors for their first-world hubris. MacAskill, a frugal Scottish philosopher, doesn’t like waste. Money, time and genuine goodwill are wasted in poorly-conceived charitable efforts and when lives are at stake that kind of waste is offensive. MacAskill, however, is convinced that a hard-headed approach–randomized trials, open-data, careful investigation of effectiveness–can do better. As MacAskill puts it:

When it comes to helping others, being unreflective often means being ineffective.

Of course, there are systematic problems with charitable giving. Most importantly, the feedback mechanism is never going to work as well when people are buying something to be consumed by others (as Milton Friedman explains). That problem, however, doesn’t explain why people do invest large amounts of money and their own time on wasteful projects. A large part of the problem is cultural. MacAskill asks us to consider the following thought experiment:

Imagine, for example, that you’re walking down a commercial street in your hometown. An attractive and frightening enthusiastic young woman nearly assaults you in order to get you stop and speak with her. She clasps a tablet and wears a T-shirt displaying the words, Dazzling Cosmetics…she explains that she’s representing a beauty products company that is looking for investment. She tells you about how big the market for beauty products is, and how great the products they sell are, and how because the company spends more than 90 percent of its money on making the products and less than 10 percent on staff, distribution, and marketing, the company is extremely efficient and therefore able to generate an impressive return on investment. Would you invest?

MacAskill says “Of course, you wouldn’t…you would consult experts…which is why the imaginary situation, I described here never occurs” Actually it’s even worse than that because what he describes does occur. It’s what the boiler rooms do to sell stocks (ala the Wolf of Wall Street). Thus, charities raise money using precisely the techniques that in other contexts are widely regarded as deceitful, disreputable and preying on the weak. Once you have seen how peculiar our charitable institutions are, it’s difficult to unsee.

Fortunately, effective altruism doesn’t require Mother Theresa-like levels of altruism or Spock-like level of hard-headedness. What is needed is a cultural change so that people become proud of how they give and not just how much they give. Imagine, for example, that it becomes routine to ask “How does Givewell rate your charity?” Or, “GiveDirectly gives poor people cash–can you demonstrate that your charity is more effective than cash?” The goal is not the questioning. The goal is to give people the warm glow when they can answer.

China fact of the day

Around 97% of existing yuan-denominated bonds hold ratings of double-A to triple-A—the best a company can get.

That is from Fiona Law, cited by Christopher Balding, and ultimately Alex Frangos, those are ratings from Chinese sources. Law reports:

With nine Chinese ratings firms to choose among, “bond issuers are encouraged to pick the highest ratings among agencies,” said Guan Jianzhong, chairman of Dagong Global, the country’s third-biggest ratings company in terms of market share. The fact that the bonds are rated double-A-minus or above, they “are not without risks,” he said.

By the way, the Shanghai Composite Index closes down 8.5%.

How bad a problem is “quarterly capitalism”?

We’re going to be hearing more about this topic I suspect, so let’s start by looking at some of the evidence. For now I’ll turn the microphone over to Xuemin (Sterling) Yan and Zhe Zhang (pdf):

We show that the positive relation between institutional ownership and future stock returns documented in Gompers and Metrick (2001) is driven by short-term institutions. Furthermore, short-term institutions’ trading forecasts future stock returns. This predictability does not reverse in the long run and is stronger for small and growth stocks. Short-term institutions’ trading is also positively related to future earnings surprises. By contrast, long-term institutions’ trading does not forecast future returns, nor is it related to future earnings news. Our results are consistent with the view that short-term institutions are better informed and they trade actively to exploit their informational advantage.

And here is from the Geoff Warren 2014 survey (pdf):

The link between investor short-termism and corporate myopia is not clear cut – While there is some evidence in support of such a link, it is by no mean compelling. Laverty (1996) examines arguments on the existence of short-termism, and points out there is: (1) no clear evidence of flawed short-term oriented management practices; (2) only mixed evidence that stock market myopia encourages corporate short-termism, noting for instance findings of positive stock market reactions to long-term investment by some papers; and, (3) an absence of empirical support for the supposed influence of ‘fluid capital’ on corporate behaviour.

Results of a survey of company management by Marston and Craven (1998) also question the extent to which institutional investors are short-term in focus. While their survey uncovers a perception that sell-side (broking) analysts are focused on the short-term, company management did not consider this the case for buy-side analysts and fund managers. When asked if the buy-side was too concerned with short-term profit opportunities, only 21% agreed while 53% disagreed.

There is more evidence to consider, but I will start by introducing the idea that the standard anti-publicly traded company tropes are not self-evidently true, or at the very least we do not know them to be true.

The long-run consequences of Russian serfdom

They are not good, as evidenced by a new paper by Buggle and Nafziger (pdf):

This paper examines the long-run consequences of serfdom in the countries of the former Russian Empire. We combine novel data measuring the intensity of labor coercion on the district level in 1861 with several intermediate and present-day outcomes. Our results show that past serfdom goes along with lower economic well-being today. We apply an instrumental variable strategy that exploits the transfer of serfs on monastic lands in 1764 to establish a causal link between past serfdom and current economic development. Tracking the evolution of city populations throughout Soviet times corroborates the finding of persistent economic differences. Furthermore, our results suggest a political economy mechanisms linking higher historical economic inequality with worse public goods provision (roads and education), as well as lower urbanization and structural change towards factory production, as explanation for this persistence. We do not find differences in contemporaneous cultural attitudes and preferences.

The pointer is from Pseudoerasmus.