Month: December 2017

India marriage markets in everything

India’s government has expanded a scheme offering payment incentives to Hindus who marry members of the country’s poorest and most oppressed caste, the Dalits.

A scheme introduced in 2013 offered 250,000 rupees (£2,900) to encourage Hindus from higher castes to marry members of the “untouchable” community, in the hope that it would help to remove the stigma of intercaste marriage and foster greater social cohesion.

To qualify, the annual income of the spouse from the high caste had to be less than 500,000 rupees (£5,800).

The government envisaged about 500 such marriages annually, but less than 100 have taken place each year.

On Wednesday, the Ministry of Social Justice and Empowerment announced it would scrap the income ceiling, and said all couples in which one spouse is from the Dalit caste would receive the cash incentive.

Here is the article, via Eric D., also read the last few paragraphs.

The Age of the Centaur is *Over* Skynet Goes Live

“Mastering Chess and Shogi by Self-Play with a General Reinforcement Learning Algorithm”

The game of chess is the most widely-studied domain in the history of artificial intelligence. The strongest programs are based on a combination of sophisticated search techniques, domain-specific adaptations, and handcrafted evaluation functions that have been refined by human experts over several decades. In contrast, the AlphaGo Zero program recently achieved superhuman performance in the game of Go, by tabula rasa reinforcement learning from games of self-play. In this paper, we generalise this approach into a single AlphaZero algorithm that can achieve, tabula rasa, superhuman performance in many challenging domains. Starting from random play, and given no domain knowledge except the game rules, AlphaZero achieved within 24 hours a superhuman level of play in the games of chess and shogi (Japanese chess) as well as Go, and convincingly defeated a world-champion program in each case.

In other words, the human now adds absolutely nothing to man-machine chess-playing teams. That’s in addition to the surprising power of this approach in solving problems.

Here is the link, via Trey Kollmer, who writes “Stockfish Dethroned.” Here is coverage from Wired. Via Justin Barclay, here is commentary from the chess world, including some of the (very impressive) games. And it seems to prefer 1.d4 and 1.c4, loves the Queen’s Gambit, rejected the French Defense, never liked the King’s Indian, grew disillusioned with the Ruy Lopez, and surprisingly never fell in love with the Sicilian Defense. By the way the program reinvented most of chess opening theory by playing against itself for less than a day. Having the white pieces matters more than we thought from previous computer vs. computer contests. Here is the best chess commentary I have seen, excerpt:

If Karpov had been a chess engine, he might have been called AlphaZero. There is a relentless positional boa constrictor approach that is simply unheard of. Modern chess engines are focused on activity, and have special safeguards to avoid blocked positions as they have no understanding of them and often find themselves in a dead end before they realize it. AlphaZero has no such prejudices or issues, and seems to thrive on snuffing out the opponent’s play. It is singularly impressive, and what is astonishing is how it is able to also find tactics that the engines seem blind to.

Did you know that the older Stockfish program considered 900 times more positions, but the greater “thinking depth” of the new innovation was decisive nonetheless. I will never forget how stunned I was to learn of this breakthrough.

Finally, I’ve long said that Google’s final fate will be to evolve into a hedge fund.

Wednesday assorted links

1. “This Article presents the first empirical examination of giving to § 501(c)(4) organizations, which have recently become central players in U.S. politics. Although donations to a 501(c)(4) are not legally deductible, the elasticity of c(4) giving to the top-bracket tax-price of charitable giving is – 1.24, very close to the elasticity for charities.” Link here. And there is no tax break for private jets, setting the record straight.

2. Ranking generals using sabermetrics, Napoleon is #1.

3. My podcast with the excellent Jocelyn Glei on self-transformation and risk.

4. Does the estate tax affect the marginal investor?

5. Eliminating the filibuster wouldn’t help much with gridlock.

6. Animal mutualism and personality (NYT).

7. ““The pending transactions on the Ethereum blockchain have spiked in the last 24 hours, mostly from CryptoKitties traffic,” CoinDesk director of research Nolan Bauerle said in an e-mail.

In the game, players buy cartoon kittens and then breed them with other cats. More than 22,000 cats have been sold so far for a total of US$3 million, according to Crypto Kitty Sales.

One of the cats went for US$117,712, although average sales price hovers about US$109, according to the sales tracker.” Link here.

I Hate Flexible Spending Accounts

I hate “flexible” spending accounts, i.e. those accounts where you put say $1000 in tax-free but you then must submit a bunch of health or education receipts to claim the money–and the “benefits manager” tells you half of the receipts you submitted are no good so you have to trawl through your files to find more–or lose the money. The whole process is demeaning. My hatred of this process, however, pales in comparison to that of Scott Sumner who gives a correct analogy:

Imagine a government that took 10% of each person’s income, and put in in a wooden box. The box was placed at the end of a 10-mile gravel road. Each citizen was given a knife, and told they could crawl on their hands and knees down the road, and then use the knife to cut a hole in the box, and retrieve their money.

Scott’s point is twofold. First, there is a lot of waste in crawling down the road. Second, taken in isolation, it looks like the plan at least offers people an option and so, in isolation, flex accounts and their ilk appear to benefit taxpayers. In the big picture, however, the total amount taken in taxes is somewhat fixed by politics and economics so if we got rid of the spending accounts, taxes would probably fall in other ways that are difficult to predict but nonetheless real.

Some want to crawl down the gravel road, fearing that if they abolish the program the government will not reduce their tax rates, instead the money in the box will be diverted to welfare for the poor, or higher salaries for teachers. I can’t deny that this might occur, but if we don’t even TRY to build a good country, how can we possibly succeed? Isn’t it better to try and fail, rather than not even try?

I agree with Scott. If I am going to be forced to pay taxes I’d like to hand over my cash standing like a man and not be given the option of crawling to recoup some bills the tax collector magnanimously throws on the floor.

Game of Theories: Putting it All Together

In the final video in our Game of Theories mini-class, Tyler puts all the theories together to examine the great recession.

GDP, GNP, and foreign investment

A few of you have written me to ask what I think of Paul Krugman’s recent posts on tax reform and evaluating it by gnp rather than gdp, the latter being an emphasis in the GOP literature. Paul notes correct that a lower corporate rate will attract foreign investment, and the returns to that investment, by definition, will not accrue to American citizens. So far, so good.

Paul reproduces the following graph for the Czech Republic, ratio of gnp to gdp:

If the GOP literature focuses on gdp, it is fine enough to criticize it on that basis. What worries me, however, is that the corrective doesn’t go nearly far enough. Gnp isn’t the right standard either, nor is gnp/gdp, rather it is welfare, either nationally or globally.

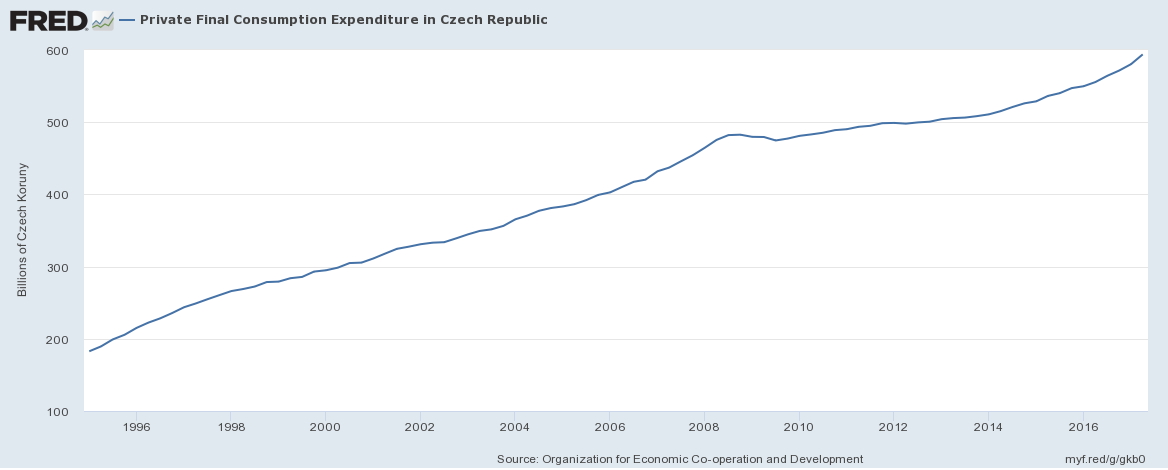

From that gdp/gdp ratio graph, you might come away with a grim view of life in the Czech Republic, but consider this cheerier picture of consumption, which nearly triples over a twenty year period:

Pretty awesome. And under the standard story of the Czech economy, investment from abroad, most of all from Germany, has helped drive those gains. Germany invested more, that boosted wages, improved the local political economy, and transferred some technology and entrepreneurial skills. It is standard international economics, or for that matter Solow model, that capital-rich, lower-return economies should invest in their poorer peripheries (which is not to say it always works out that way).

It’s entirely fair to note that Czech household debt to gdp has risen to about thirty percent. Still, in the U.S. it is about eighty percent, so the Czechs are not in dire straits just yet. Private debt to gdp seems to run about 136 percent, compared to about 200 percent in the U.S.

Of course, this still could end up as a bad deal for the Czechs. They might waste their foreign investment, the accompanying wage gains, the associated external benefits, and end up having to snap back their consumption and see their whole country owned by Germany, China, and others. But that’s not the baseline case. The default assumption is that these are gains from trade like other such gains, in this case gains from trading with foreigners who wish to invest. They are not lesser gains or gains to somehow be subtracted from the overall calculus.

Here is a useful point of contrast. Let’s say I advocated high taxes on foreign trade, on the grounds that “half of the gains from those trades are shared with foreigners,” and therefore we ought to, post-tariff, trade more with fellow citizens, so that only Americans get those gains. We all know why that argument generally is wrong, noting there are some second best cases where tariffs can improve welfare. It’s still wrong when the trades involve foreign investments.

So it is misleading to induce people to mentally downgrade foreign investment as a source of welfare gains. I get that Krugman doesn’t quite say that, but that is the impression his discussion and diagram produces on the unwary. Technically, he might only be criticizing the Republicans internally, using their own gdp standard. The actual produced impression is to cause people to doubt that a lot of foreign capital inflow fully counts as a gain from trade.

America of course is in a quite different position than is the Czech Republic. But the gains from foreign investment into the United States also ought not to be downgraded, either explicitly or by implied presumption.

Tuesday assorted links

1. Do economic freedom indices measure regulation properly?

2. An economics class, as taught through the contributions of Nobel Laureates.

3. Noah Smith picks best economics reading of the year.

4. The secret codes of Edward Elgar?

5. John Lukacs, “from the age of books,” at age 94.

6. Ray Dalio on SALT and out-migration from high-tax states.

The (pricing) culture that Washington is not

The Interstate 66 toll lanes opened Monday in Washington’s Northern Virginia suburbs with prices so steep they could be among the highest drivers have paid for the privilege of traveling on a state-owned highway in the United States.

Tolls in the high-occupancy toll lanes hit $34.50 — or close to $3.50 a mile — to drive the 10-mile stretch from the Beltway to Washington during the height of the morning commute.

Bravo, but we’ll see how this develops.

Trumponomics is in fact novel, we neglect it at our peril

That is the topic of my latest Bloomberg column, here is the opening bit:

I’ve seen hundreds of articles on President Donald Trump and trade, but the real significance of the Trump economic revolution — for better or worse — is a focus on investment. There is no coordinating mastermind, but if you consider the intersection between what the Trumpian nationalists want and what a Republican Congress will deliver, it’s this: wanting to make the U.S. a new and dominant center for investment, including at the expense of other nations.

And:

In essence, a new kind of supply-side economics has been invented. The theory of the 1980s focused mainly on individuals, and lowering the tax rates they faced on labor income and capital gains. Cutting these rates was supposed to mobilize the power of those individuals, through more work or more investment. The idea today is that the real power of mobilization comes through corporate associations. Assuming the tax bill passes, that theory is about to get a major test.

Strikingly, the tax bill and the trade policies of the Trump administration can be viewed as having a similar underlying philosophy, whether entirely intended or not. One of the president’s first official acts was to withdrawal from the Trans-Pacific Partnership. Although I favored that agreement, as did most other economists, it’s worth considering what the most intelligent nationalist case against the TPP looks like. It’s not about trade, because the deal wouldn’t have affected tariff rates faced by Americans very much (exports of beef to Japan aside). Rather, the TPP would have given American certification to Vietnam, Malaysia and eventually other emerging economies as stable repositories of foreign investment from multinationals. That could in turn draw investment away from the U.S.

Do read the whole thing, it is my favorite recent piece by me.

New Evidence of Generational Progress for Mexican Americans

U.S.-born Mexican Americans suffer a large schooling deficit relative to other Americans, and standard data sources suggest that this deficit does not shrink between the 2nd and later generations. Standard data sources lack information on grandparents’ countries of birth, however, which creates potentially serious issues for tracking the progress of later-generation Mexican Americans. Exploiting unique NLSY97 data that address these measurement issues, we find substantial educational progress between the 2nd and 3rd generations for a recent cohort of Mexican Americans. Such progress is obscured when we instead mimic the limitations inherent in standard data sources.

That is by Brian Duncan, Jeffrey Grogger, Ana Sofia Leon, and Stephen J. Trejo in a recent NBER working paper.

Pass-through of minimum wages into U.S. retail prices

That is studied by Renkin, Montialoux, and Siegenthaler in a recent paper, which is also a job market paper for Tobias Renkin from the University of Zurich. Here is the abstract:

We study the impact of increases in local minimum wages on the dynamics of prices in local grocery stores in the US during the 2001-2012 period. We find a signifi cant impact of increasing minimum wages on prices in grocery stores. Our baseline estimate of the minimum wage elasticity of grocery prices is 0.02. This magnitude is consistent with a full pass-through of cost increases into prices. We show that price adjustments occur mostly in the months following the passage of minimum wage legislation rather than at the actual implementation of higher minimum wages. This forward-looking pattern of price adjustments is qualitatively consistent with pricing models that feature nominal rigidities. We fi nd no differential price effect for products consumed by poorer and richer households, and no evidence for demand effects. Our results suggest that consumers rather than firms bear the cost of minimum wage increases. Moreover, poor households are most negatively affected by the price response. Price increases in grocery stores alone offset at least 10% of the nominal income gains of the poorest households.

Of course this also would suggest the sector is relatively competitive. And if you are wondering, here is the full slate of job candidates from Zurich.

Monday assorted links

1. According to this estimate, non-searchers lose about a penny on the dollar (pdf).

2. The culture that is Portland how much should companies accommodate the homeless?

3. Solve for the equilibrium: “A UK supermarket chain will sell pasta, crisps, and rice for just 10p to reduce food waste.”

4. Potatoes reduced the number of civil wars.

5. Why a lot of important research is not being done (NYT).

New Zealand to Compensate Organ Donors for Lost Earnings

NZ Ministry of Health: People who donate a kidney or part of their liver can now do so knowing they can be fully compensated for lost earnings as a result of their donation surgery.

The Ministry of Health will be implementing compensation for live organ donors from 5 December. People who donate a live organ will be fully recompensed for lost earnings for up to 12 weeks while they recover. This will be paid weekly following the donation surgery. In the past donors received some assistance in the form of a benefit for this.

Former GMU student, Eric Crampton, now Senior Fellow at University of Canterbury had a role in the design.

Hat tip: Frank McCormick.

What Tom Whitwell learned this year

Here are my selected bits and pieces from a longer list:

“Artificial intelligence systems pretending to be female are often subjected to the same sorts of online harassment as women.” [Jacqueline Feldman]

Swintec is a company in New Jersey that sells up to 5,000 typewriters a year to prisoners in the US. Their typewriters have clear plastic covers so inmates can’t hide anything inside. Transparent TVs, CD players and Walkmen are also available. [Daniel A Gross]

In the UK, marriages between couples over 65 have risen 46% over the last decade. [Cassie Werber]

A cryptocurrency mining company called Genesis Mining is growing so fast that they rent Boeing 747s to ship graphics cards to their Bitcoin mines in Iceland. [Joon Ian Wong]

Dana Lewis from Alabama built herself an artificial pancreas from off-the-shelf parts. Her design is open source, so people with diabetes can hack together solutions more quickly than drug companies. [Lee Roop]

In August, Virginia Tech built a fake driverless van — with the driver hidden inside the seat — to see how other drivers would react. Their reaction: “This is one of the strangest things I’ve ever seen.” [Adam Tuss] (Fluxx have also been experimenting with fake autonomous vehicles in Cambridge)

Women are eight times more likely to ask Google if their husband is gay than if he is an alcoholic. [Sean Illing]

Men travelling first class tend to weigh more than those in economy, while for women the reverse is true. [Lucy Hooker]

Facebook employs a dozen people to delete abuse and spam from Mark Zuckerberg’s Facebook page. [Sarah Frier]

Pro tip: Ask your current customers “What nearly stopped you buying from us?” [Karl Blanks]

Here is the full list, Tom has an excellent algorithm for building the list.

A simple theory of Moore’s Law and social media

1. Moore’s Law plus the internet makes smart people smarter, and stupid people less smart.

2. Manipulable people can be reached with a greater flood of information, so over time as data on them accumulate, they become more manipulable.

3. It is often easier to manipulate smart people than stupid people, because the latter may be oblivious to a greater set of cues and clues.

4. Social media bring smarter people together with the less smart more than used to be the case, Twitter more so than Facebook. Members of each group are appalled by what they experience. The smarter people see the lesser smarts of many others. The less smart people — who often are not entirely so stupid after all — can see how manipulated the smarter people are. They also see that the smarter people look down on them and attack their motives and intellects. Both groups go away thinking less of each other.

4b. The smarter people, in reacting this way, in fact are being manipulated by the (stupider) powers that be.

5. “There is a performative dimension that renders both sides more rigid and dishonest.” From a correspondent.

6. Consider a second distinction, namely between people who are too sensitive to social information, and people who are relatively insensitive to social information. A quick test of this one is to ask how often a person’s tweets (and thoughts) refer to the motivations, intentions, or status hierarchies held by others. Get the picture? (Here is an A+ example.)

7. People who are overly sensitive to social information will be driven to distraction by Twitter. They will find the world to be intolerably bad. The status distinctions they value will be violated so, so many times, and in a manner which becomes common knowledge. And they will perceive what are at times the questionable motives held by others. Twitter is like negative catnip for them. In fact, they will find it more and more necessary to focus on negative social information, thereby exacerbating their own tendencies toward oversensitivity.

8. People who are not so sensitive to social information will pursue social media with greater equanimity, and they may find those media productivity-enhancing. Nevertheless they will become rather visibly introduced to a relatively new category of people for them — those who are overly sensitive to social information. This group will become so transparent, so in their face, and also somewhat annoying. Even those extremely insensitive to social information will not be able to help perceiving this alternate approach, and also the sometimes bad motivations that lie behind it. The overly sensitive ones in turn will notice that another group is under-sensitive to the social considerations they value. These two groups will think less and less of each other. The insensitive will have been made sensitive. It’s like playing “overrated vs. underrated” almost 24/7 on issues you really care about, and which affect your own personal status.

9. The philosophy of Stoicism will return to Silicon Valley. It will gain adherents but fail, because the rest of the system is stacked against it.

10. The socially sensitive, very smart people will become the most despairing, the most manipulated, and the most angry. The socially insensitive will either jump ship into the camp of the socially sensitive, or they will cultivate new methods of detachment, with or without Stoicism. Straussianism will compete with Stoicism.

11. Parts of social media will peel off into smaller, more private groups. At the end of the day, many will wonder which economies of scale and scope have been lost. And gained. Others will be too manipulated to wonder such things.

12. The “finance guy” in me thinks: how can I use all this for intellectual arbitrage? Which camp does that put me in?

13. What bounds this process?