Month: November 2022

FDA Deregulation Increases Safety and Innovation and Reduces Prices

In an important and impressive new paper, Parker Rogers looks at what happens when the FDA deregulates or “down-classifies” a medical device type from a more stringent to a less stringent category. He finds that deregulated device types show increases in entry, innovation, as measured by patents and patent quality, and decreases in prices. Safety is either negligibly affected or, in the case of products that come under potential litigation, increased.

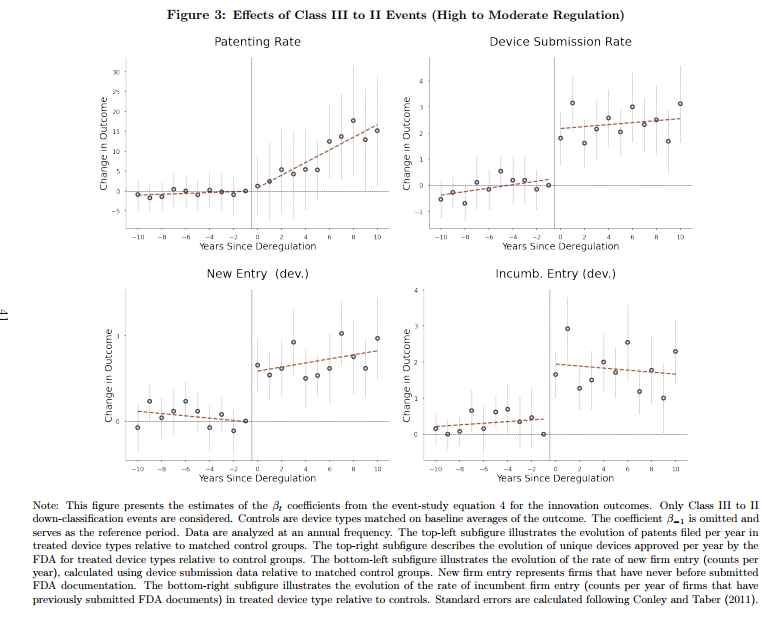

After moving from Class III (high regulation) to II (moderate), device types exhibited a 200% increase in patenting and FDA submission rates relative to control groups. Patents filed after these events were also of significantly higher quality, as measured by a 200% increase in received citations and market valuations. These effects do not spill over into similar device types.1 For Class II to I deregulations, the rate of patent filings increased by 50%, though insignificantly, and the quality of patent filings exhibited a significant 10-fold improvement, suggesting that litigation better promotes innovation.

…Down-classification yields considerable benefits, as the proponents of deregulation would predict, but what of product safety? Perhaps counterintuitively, I find that deregulation can improve product safety by exposing firms to more litigation. Despite some adverse event rates increasing after Class III to II events (albeit insignificantly), Class II to I events are associated with significantly lower adverse event rates.3 My analysis of patent texts also reveals that inventors focus more on product safety after deregulation. These results suggest that litigation encourages product safety more than regulation…

Some background. Medical devices are regulated under three categories. New types of devices (new, not necessarily high risk) are highly regulated Class III devices which must go through a pre-market approval process to prove safety and efficacy (like new drugs). The pre-market approval process is time-consuming and expensive but it comes with one significant benefit, federal preemption of state tort action, i.e. these devices are shielded from product liability. Class II devices are devices that are judged to be substantially equivalent to an already approved device–proving equivalence also takes time and money but it’s less onerous than proving safety and efficacy de novo. Note that device manufacturers often make their devices less innovative so they can be approved as Class II devices rather than as Class III devices. Class II devices are mostly also protected against tort litigation. Class I devices are not FDA-approved and are subject to tort litigation.

As experience develops with new devices such that new devices turn out to be not especially risky, the FDA sometimes deregulates or down-classifies these devices from Class III to Class II or from Class II to Class I. Rogers studies these down-classifications by comparing what happens to the down-classified device category to a control group of similar devices that were not down-classified. The control group is critical and Rogers shows that his results are robust to defining the control group in a variety of plausible ways. Some of the key results are shown in the following figure:

Nicely we see that device submissions and new entry occur very quickly once a device is down-regulated which indicates that firms have ideas and products on-the-shelf but they are dissuaded from entering the market by the onerous pre-market approval process. Most likely, these are products and firms which produce devices for the European market which tends to be less regulated and they enter the US market only when costs are reduced. Patenting also increases in the down-regulated device category and–exactly as one would expect–this takes more time.

Nicely we see that device submissions and new entry occur very quickly once a device is down-regulated which indicates that firms have ideas and products on-the-shelf but they are dissuaded from entering the market by the onerous pre-market approval process. Most likely, these are products and firms which produce devices for the European market which tends to be less regulated and they enter the US market only when costs are reduced. Patenting also increases in the down-regulated device category and–exactly as one would expect–this takes more time.

Safety declines non-significantly if at all from Class III to Class II deregulations and increases for Class II to Class I deregulations. That makes the welfare comparisons easy because deregulation appears to be all benefit and no cost. Note, however, that I have always argued that drugs and devices are actually too safe–that, is we could save more lives on net by approving more drugs and devices even if safety went down. That’s a hard sell, however, but it’s clearly true that given the results here we should deregulate or down-classify many more products even if safety declined on the margin. Too much safety is risky. That’s also the upshot of my paper on off-label prescribing which shows that it’s often the FDA-unapproved off-label use which is the gold-standard treatment in fast moving fields of medicine.

Rogers argues that safety increases for Class II to Class I deregulations because liability is a stronger deterrent on the margin than regulation (and he provides some evidence for this view in that safety increases more among larger firms that are less judgment proof than small firms). Without denying that mechanism my view is that innovation itself increases safety. As I noted above, medical device manufactures often do not use the latest technology in their products because this would threaten the “substantial equivalence” test so you get devices that are actually less safe and also more costly to manufacture than necessary. In essence, substantial equivalence anchors new technologies to old technologies thus preventing movement, even movement towards safety and lower prices.

Rogers also has an excellent and unusual paper (with Jeffrey Clemens) on directed innovation in artificial limbs due to the civil war! That paper and this one show a real focus on digging deep into the data to unearth important and unusual sources of insight. N.B.! Parker Rogers is on the job market.

Addendum: See my many previous posts for more useful references on the FDA, especially Is the FDA Too Conservative or Too Aggressive.

Modeling persistent storefront vacancies

Have you ever wondered why there are so many empty storefronts in Manhattan, and why they may stay empty for many months or even years? Erica Moszkowski and Daniel Stackman are working on this question:

Why do retail vacancies persist for more than a year in some of the world’s highest-rent retail districts? To explain why retail vacancies last so long (16 months on average), we construct and estimate a dynamic, two-sided model of storefront leasing in New York City. The model incorporates key features of the commercial real estate industry: tenant heterogeneity, long lease lengths, high move-in costs, search frictions, and aggregate uncertainty in downstream retail demand. Consistent with the market norm in New York City, we assume that landlords cannot evict tenants unilaterally before lease expiration. However, tenants can exit leases early at a low cost, and often do: nearly 55% of tenants with ten-year leases exit within five years. We estimate the model parameters using high-frequency data on storefront occupancy covering the near-universe of retail storefronts in Manhattan, combined with micro data on commercial leases. Move-in costs and heterogeneous tenant quality give rise to heterogeneity in match surplus, which generates option value for vacant landlords. Both features are necessary to explain longrun vacancy rates and the length of vacancy spells: in a counterfactual exercise, eliminating either move-in costs or tenant heterogeneity results in vacancy rates of close to zero. We then use the estimated model to quantify the impact of a retail vacancy tax on long-run vacancy rates, average rents, and social welfare. Vacancies would have to generate negative externalities of $29.68 per square foot per quarter (about half of average rents) to justify a 1% vacancy tax on assessed property values.

Erica is on the job market from Harvard, Daniel from NYU. And they have another paper relevant to the same set of questions:

We identify a little-known contracting feature between retail landlord and their bankers that generates vacancies in the downstream market for retail space. Specifically, widespread covenants in commercial mortgage agreements impose rent floors for any new leases landlords may sign with tenants, short-circuiting the price mechanism in times of low demand for retail space.

I am pleased to see people working on the questions that puzzle me.

Ed Prescott has passed away

I have received multiple confirmations. Very sad, he was one of the true greats and ended up quite underrated. Here are some earlier MR posts about Prescott.

Sunday assorted links

1. “Causes begin with a question that leads to a conversation that culminates into action; that is how Asian American Cannabis Education began, with a simple question, “Where are the Asian Americans in cannabis?”” Link here.

2. Mattia Bertazzini is an interesting economic historian (on the job market from Oxford).

3. Florian Schneider, also on the job market, is doing interesting work on public health and economic incentives, from University of Zurich.

4. Nietzschean critique of EA?

5. Fingerfehler.

6. Bono is reading Stripe Press (NYT).

Persistence and the gender innovation gap

This paper is by Gauri Subramani, Abhay Aneja, and Oren Reshef:

We document that 85% of patent applications in the United States include no female inventors and ask: why are women underrepresented in innovation? We argue that differences in responses to early rejections between men and women are a significant contributor to the gender disparity in innovation. We evaluate the prosecution and outcomes of almost one million patent applications in the United States from 2001 through 2012 and leverage variation in patent examiners’ probabilities of rejecting applications to employ a quasi-experimental instrumental variables approach. Our results show that applications from women are less likely to continue in the patent process after receiving an early rejection. Roughly half of the overall gender gap in awarded patents during this period can be accounted for by the differential propensity of women to abandon applications. We explore why this may be the case and provide evidence that the gender gap in outcomes is reduced for applications that are affiliated with firms, consistent with a role for institutional support in mitigating gender disparities.

In general, I believe that men, especially successful men, often fail to perceive how discouraging their erected institutions can be for women.

Via Kris.

Why Britain?

Here is a new paper by Carl Hallmann, W. Walker Hanlon, and Lukas Rosenberger, of great interest:

Why did Britain attain economic leadership during the Industrial Revolution? We argue that Britain possessed an important but underappreciated innovation advantage: British inventors worked in technologies that were more central within the innovation network. We offer a new approach for measuring the innovation network using patent data from Britain and France in the 18th and early 19th century. We show that the network influenced innovation outcomes and then demonstrate that British inventors worked in more central technologies within the innovation network than inventors from France. Then, drawing on recently-developed theoretical tools, we quantify the implications for technology growth rates in Britain compared to France. Our results indicate that the shape of the innovation network, and the location of British inventors within it, can help explain the more rapid technological growth in Britain during the Industrial Revolution.

Hallmann is on the job market from Northwestern, noting that his main paper is on labor, short-term work, and employment scarring.

Another University of Austin update

In place of large, on-campus administrative bureaucracies, UATX plans to make administration remote, outsourcing positions abroad. Not only will this arrangement save university funds, Howland noted, but it would also pay foreign workers livable, US-level wages. Further, the school will forgo—along with competitive varsity sports—what he called “club-med amenities”: climbing gyms, student recreation centers with ball pits and golf simulators, napping stations, private pools, and the like. UAustin has even rethought the principle of reserving classroom space for each academic department—at UATX, departments will have control over their budgets and bid for classrooms in a market. The money saved by this and other initiatives, Howland said, will go towards instruction.

Here is more from The Dartmouth Review. It also seems there will be no tenure, but low course loads and competitive salaries, with an adjudicative body to assess disputes between administrators and faculty. Might I also note that sending staff abroad greatly weakens their internal position in university politics?

How young did the person start?

By the time he was in the sixth grade, Larry [Summers] had created a system to calculate the probability that a baseball team would make it to the playoffs in October based on its performance through the Fourth of July. In 1965 the Philadelphia Bulletin described Summers as the most qualified eleven-year-old oddsmaker in baseball.

That is from the new and very good Jon Hilsenrath book on Janet Yellen.

The USG program with the highest benefit-cost ratio?

I am talking here about individual, discrete activities of the government, not general or overall functions. How about this for a nomination, namely US Embassy air quality tweets?:

Over 4 million premature deaths per year are attributed to air pollution, most of which are in low- and middle-income countries where residents do not have access to reliable information on air quality. We evaluate a large-scale program that provided real-time air-quality updates at over 40 US diplomatic sites around the world with poor preexisting monitoring. We find that the embassy monitoring program led to substantial reductions in fine particulate concentration levels, resulting in substantial decreases in the premature mortality risk faced by the over 300 million people living in cities home to a US embassy monitor. Our research indicates that monitoring and information interventions that draw attention to poor air quality in developing countries can generate substantial benefits.

Did you take these benefits into account last time you were bitching about Twitter? Probably not.

Via the excellent Kevin Lewis.

*The Philosophy of Modern Song*

Yes the author is Bob Dylan, and I give this one a thumbs up. You can buy it here. Here is one bit:

A-Wop-Bop-A-Loo-Bop-A-Wop-Bam-Boom. Little Richard was speaking in tongues across the airwaves long before anybody knew what was happening. He took speaking in tongues right out of the sweaty canvas tent and put it on the mainstream radio, even screamed like a holy preacher — which is what he was. Little Richard is a master of the double entendre. “Tutti Frutti” is a good example. A fruit, a male homosexual, and “tutti frutti” is “all fruit.” It’s also a sugary ice cream. A gal named Sue and a gal named Daisy and they’re both transvestites. Did you ever see Elvis singing “Tutti Frutti” on Ed Sullivan? Does he know what he’s singing about? Do you think Ed Sullivan knows? Do you think they both know? Of all the people who sing “Tutti Fruitti,” Pat Boone was probably the only one who knew what he was singing about. And Pat knows about speaking in tongues as well.

And:

The Grateful Dead are not your usual rock and roll band. They’re essentially a dance band. They have more in common with Arie Shaw and bebop than they do with the Byrds or the Stones…There is a big difference in the types of women that you see from the stage when you are with the Stones compared to the Dead. With the Stones it’s like being at a porno convention. With the Dead, it’s more like the women you see by the river in the movie O Brother, Where Art Thou? Free floating, snaky and slithering like in a typical daydream. Thousands of them….With the Dead, the audience is part of the band — they might as well be on the stage.

Or how about this:

Bluegrass is the other side of heavy metal. Both are musical forms steeped in tradition. They are the two forms of music that visually and audibly have not changed in decades. People in their respective fields still dress like Bill Monroe and Ronnie James Dio. Both forms have a traditional instrumental lineup and a parochial adherence to form.

Bluegrass is the more direct emotional music and, though it might not be obvious to the casual listener, the more adventurous.

This is one of the better books on America, and one of the best books on American popular song. But then again, that is what you would expect from a Nobel Laureate in literature, right?

Why businesses fail

This paper is about micro-enterprises in Brazil, by Priscila de Oliviera:

Micro firms in low and middle income countries often have low profitability and do not grow over time. Several business training programs have tried to improve management and business practices, with limited effects. We run a field experiment with micro-entrepreneurs in Brazil (N=742) to study the under-adoption of improved business practices, and shed light on the constraints and behavioral biases that may hinder their adoption. We randomly offer entrepreneurs reminders and micro-incentives of either 20 BRL (4 USD) or 40 BRL (8 USD) to implement record keeping or marketing for three consecutive months, following a business training program. Compared to traditional business training, reminders and micro-incentives significantly increase adoption of marketing (13.2 p.p.) and record keeping (19.2 p.p.), with positive effects on firm survival and investment over four months. Our findings, together with additional survey evidence, suggest that behavioral biases inhibit the adoption of improved practices, and are consistent with inattention as a key driver of under-adoption. In addition, our survey evidence on information avoidance points to it as a limiting factor to the adoption of record keeping, but not marketing activities. Taken together, the results suggest that behavioral biases affect firm decisions, with significant impact on firm survival.

She is currently on the job market from UC Berkeley. There should be many more papers on this kind of topic!

Friday assorted links

1. How landlords use eviction in response to rent control, noting that co-author Nicole Holz is on the job market from Northwestern.

2. Time magazine on Ken Regan and chess cheating. With two cameos by yours truly.

3. Matt Y. on tech and journalism. And told you so. Egads and more. I do trust Kelsey on this, and am a fan more generallly.

4. Resolving recent productivity puzzles?

5. Paintballs to be shot at Dutch wolves in bid to make them less tame.

*Yellen*

The author is Jon Hilsenrath, and the subtitle is The Trailblazing Economist Who Navigated an Era of Upheaval. I very much enjoyed this book and read it straight through without stopping, and so I am happy to recommend it heartily. Most of all it is a wonderful account of the economics profession and its evolution over the last few decades.

But we are here to be honest, right? I came away from the book with the impression that Yellen (whom, to be clear, I never have interacted with) is not all that interesting, and that the book worked because it was enlivened with other more colorful characters. Excerpt:

Yellen’s lectures had a slow, steady cadence. Her answers to student questions were always detailed, thought-out, and sometimes exhausting. She had a tendency to analyze questions from every possible angle. She differed from Tobin in one respect: where he was uniformly serious, she had a light side, one that included a disarming belly laugh that rose inside her and could stream out in tears and howls over drinks with the graduate students she was teaching.

One of her students in macroeconomics was a rising star in the field, a young man named Lawrence Summers…He didn’t stand out in Yellen’s class, perhaps because he already knew the material so well and didn’t see much to challenge or question in her carefully prepared presentations.

This part I found informative:

Elite visitors sometimes got the toughest treatment. Fischer Black, a mathematician whose theories about asset prices and stock options sparked wave of Wall Street innovation, visited in the early 1970s to challenge Friedman’s ideas about money and inflation. Friedman introduced Black by saying, “We all know that the paper is wrong.” We have two hours to work out why it is wrong.”

I very much hope there will be more books like this, definitely recommended. You can buy it here.

My excellent Conversation with Mary Gaitskill

Here is the audio and transcript. She is one of my favorite contemporary American writers, most notably in The Mare, Veronica, and Lost Cat. Here is part of the episode summary:

She joined Tyler to discuss the reasons some people seem to choose to be unhappy, why she writes about oddballs, the fragility of personality, how she’s developed her natural knack for describing the physical world, why we’re better off just accepting that people are horrible, her advice for troubled teenagers, why she wouldn’t clone a lost cat, the benefits and drawbacks of writing online, what she’s learned from writing a Substack, what gets lost in Kubrick’s adaptation of Lolita, the not-so-subtle eroticism of Victorian novels, the ground rules for writing about other people, how creative writing programs are harming (some) writers, what she learned about men when working as a stripper, how her views of sexual permissiveness have changed since the ’90s, how college students have changed over time, what she learned working at The Strand bookstore, and more.

It is perhaps a difficult conversation to excerpt from but here is one bit:

COWEN: You once quoted your therapist as saying, and I’m quoting him here, “People are just horrible, and the sooner you realize that, the happier you’re going to be.” What’s your view?

GAITSKILL: [laughs] I thought that was a wonderful remark. It’s important to note the tone of voice that he used. He was a Southern queer gentleman with a very lilting, soft voice. I was complaining about something or other, and he goes, “People are horrible. They’re stupid, and they’re crazy, and they’re mean, and the sooner you realize that, the better off you’ll be, the more you’re going to start enjoying life.”

I just laughed, because partly it was obvious he was being funny, and it was a very gentle way of allowing my ranting and raving and acknowledging the truth of it. Gee, I don’t know how anybody could deny that. Look at human history and some of the things that people do. It was being very spacious about it and just saying, “Look, you have to accept reality. You can’t expect people to be perfect or to be your idea of good or moral all the time. You’re probably not either. This is what it is.”

I thought that was really wisdom, actually.

I am very pleased to have had the chance to chat with her.

EDS

If I write about a government program in the abstract, some of you respond in a pretty reasonable manner. Instead, if I tie the program to the status of a well-known personality, such as Hillary Clinton, Obama, Biden, Trump, and so on, the quality of the responses is much lower. Including from very smart people.

Take this insight to heart and apply it to your current thoughts about the new Twitter.

How many of you have written me to say that people “won’t pay $8 a month for Blue Check,” or whatever the latest suggested price might be?

Note from Elon’s own words that a) “You will also get: – Priority in replies, mentions & search, which is essential to defeat spam/scam – Ability to post long video & audio – Half as many ads”, and b) “And paywall bypass for publishers willing to work with us”, and c) “This will also give Twitter a revenue stream to reward content creators”.

Please do read those words carefully.

Now I do not myself pretend to know what will work for Twitter. But one implication of this proposal is that a free version of Twitter still will be available. Is it so crazy to think that the forthcoming free version of Twitter will be “good enough” to keep the current users on?

Note also that under the proposed new regime, payments go both ways! Hardly any of the critics note this.

Or do you think markets are most efficient when all payments are set to zero and kept there? Maybe in some settings, but overall? I just do not see why this kind of plan is so doomed to fail. Let’s pay the creators who attract other Twitter users to create more and to induce more Twitter impressions. An externality is present, right?

As a friend of mine once said “Never underestimate Elon”…of course I would invoke more rational responses if I instead wrote “Do not underestimate the current Twitter management team and proposal.” But I won’t because I, like Elon, sometimes enjoy trolling you all.