Month: July 2025

Monday assorted links

1. For a start, so many people then are smoking and have PTSD.

2. Oops (music video).

3. Alpha school spreading? (NYT), https://www.nytimes.com/2025/07/27/us/politics/ai-alpha-school-austin-texas.html?smid=nytcore-ios-share&referringSource=articleShare

4. Dire results on inequality in South Africa, https://x.com/manysheva_k/status/1948833739230118077?s=61

5. The surprising durability of Africa’s colonial borders, https://www.noemamag.com/the-surprising-durability-of-africas-colonial-borders/

6. O3 on Edwardian naval fire clock computers, https://chatgpt.com/share/68865e84-7358-8010-8343-e99d050565a1

The EU-USA trade deal

Sorry people, but you can fill in the links with Perplexity and Grok, both great for this purpose.

Olivier Blanchard is upset that Europe got such a raw deal, various people in the FT agree. I would say that is itself data about broader European economic and security policies, and needs to be taken very seriously. The Europeans are not stupid negotiators by any means, rather they are in a weak negotiating position for reasons that are largely their own fault and reflect underlying weaknesses of their basic economic and political model.

You can hate what Trump did, but for a “stupid” administration they, by their own standards at least, did a remarkably good job of it.

Justin Wolfers seems upset that Trump is raising taxes on Americans. (I am too!) But that feels kind of weird to me. And it is nice to see that Europeans get somewhat lower taxes, though many European leaders are upset about that. They should in fact buy more from the United States, and their non-tariff barriers are significant.

Conor Sen notes that the USA has come up with a multi-trillion revenue source that does not seem to diminish corporate profitability, https://x.com/conorsen/status/1949785522567549283?s=61, and he is wondering how exactly people will react to that.

We can all agree that negative externalities are what should be taxed!

But those policies typically are unpopular, so in some instances you will understand public affairs more clearly by switching to the “what will be done?” perspective, rather than the “what should be done?” stance.

My best guess is that these tariffs will stick for the most part, and that you are seeing some early major steps for how the U.S. will resolve its fiscal position. Higher inflation will come too, and fiscally we will muddle through, albeit with notably lower real wages.

(To be clear, for a long time I have stated that I prefer to cut back on government-subsidized health care, rather than to lower real wages through these other means. You can always use the extra money and try to buy back some health! But I also never have thought I was going to get my way. When Matt Yglesias tells you that “health care polls well,” you should take that seriously and Matt also should realize a bit that puts him in more of the pro-Trump, pro-tariff camp than he might like to think.)

I think a Democratic administration, whenever we get one next, would rather spend the revenue from the tariffs than repeal them. By then the tariffs also will be what I call “emotionally internalized.” And the Democrats have not loved free trade for a long time anyway, despite their current rhetorical moves toward criticizing the Trumpers.

So most of all we need to revise our estimates of what the political equilibrium looks like here. We are receiving major pieces of information, and we must update our vision of the world to come.

The Rising Cost of Child and Pet Day Care

Everyone talks about the soaring cost of child care (e.g. here, here and here), but have you looked at the soaring cost of pet care? On a recent trip, it cost me about $82 per day to board my dog (a bit less with multi-day discounts). And no, that is not high for northern VA and that price does not include any fancy options or treats! Doggie boarding costs about about the same as staying in a Motel 6.

Many explanations have been offered for rising child care costs. The Institute for Family Studies, for example, shows that prices rise with regulations like “group sizes, child-to-staff ratios, required annual training hours, and minimum educational requirements for teachers and center directors.” I don’t deny that regulation raises prices—places with more regulation have higher costs—but I don’t think that explains the slow, steady price increase over time. As with health care and education, the better explanation is the Baumol effect, as I argued in my book (with Helland) Why Are the Prices So Damn High?

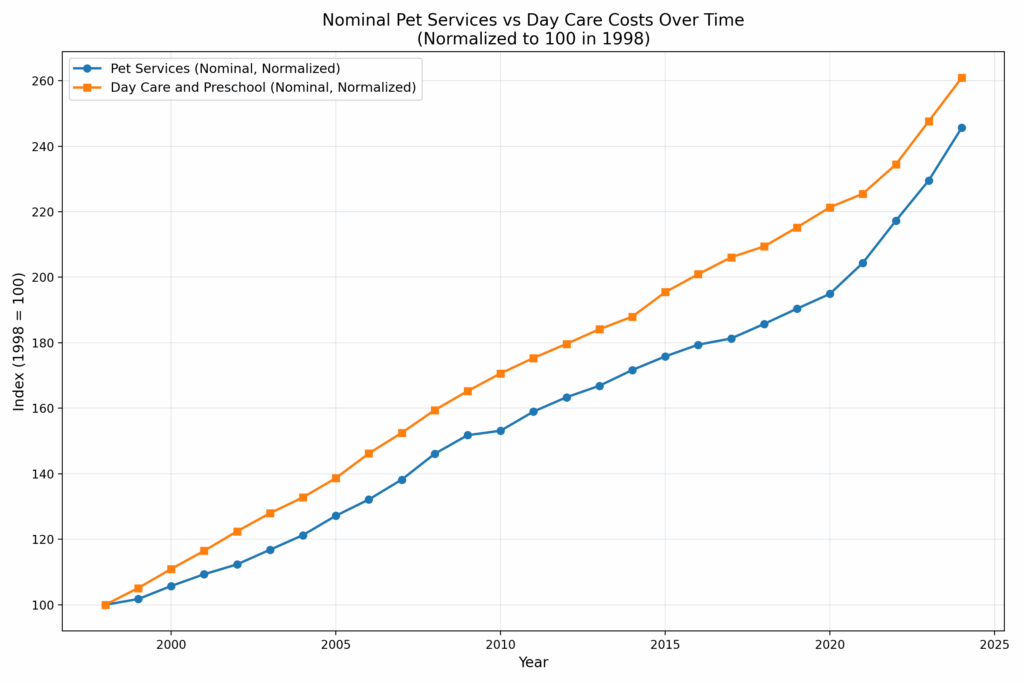

Pet care is less regulated than child care, but it too is subject to the Baumol effect. So how do price trends compare? Are they radically different or surprisingly similar? Here are the two raw price trends for pet services (CUUR0000SS62053) and for (child) Day care and preschool (CUUR0000SEEB03). Pet services covers boarding, daycare, pet sitting, walking, obedience training, grooming but veterinary care is excluded from this series so it is comparable to that for child care.

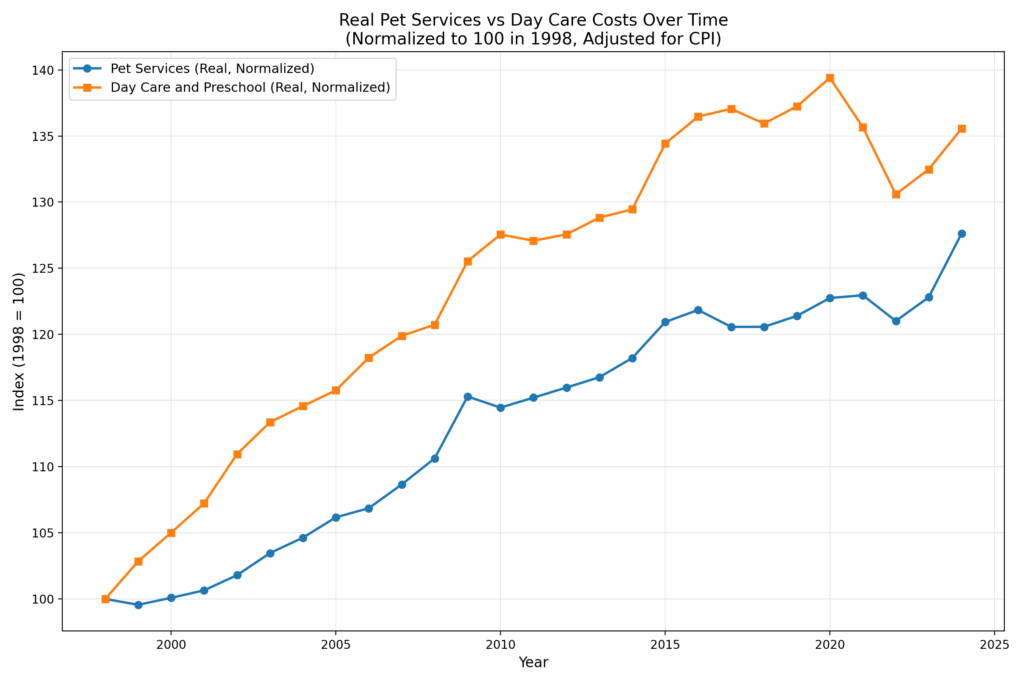

As you can see, the trends are nearly identical, with child care rising only slightly faster than pet care over the past 26 years. Of course, both trends include general inflation, which visually narrows the gap. When we normalize to the overall CPI, we get the following:

Over 26 years, the real (relative) price of Day Care and Preschool has increased 36%, while Pet Services have risen 28%. If regulation doesn’t explain the rise in pet care costs–and it probably doesn’t–then regulation probably doesn’t explain the rise in child care costs either. After all, child and pet care are very similar goods!

The similar rise in the price of child day care and pet day care/boarding is consistent with Is American Pet Health Care (Also) Uniquely Inefficient? by Einav, Finkelstein and Gupta, who find that spending on veterinary care is rising at about the same rate as spending on human health care. Since the regulatory systems of pet and human health care are very different this suggests that the fundamental reason for rising health care isn’t regulation but rising relative prices and increasing incomes (fyi this is also an important reason why Americans spend more on health care than Europeans).

Thus, my explanation for rising prices in child care and pet care is that productivity is increasing in other industries more than in the care industries which means that over time we must give up more of other goods to get child and pet care. In short, if productivity in other sectors rises while child/pet care productivity stays flat, relative prices must rise. Another way to put this is that to retain workers, wages in stagnant-productivity sectors must rise to match those in (equally labor-skilled) high-productivity sectors. That means paying more for the same level of care, simply to keep the labor force from leaving

But rising productivity in other sectors is good! Thus, I always refer to the Baumol effect rather than the “cost disease” because higher prices are not bad when they reflect changes in relative prices. As with education and health care the rising price of child and pet care isn’t a problem for society as whole. We are richer and can afford more of all goods. It can be a problem, however, for people who consume more than the average quantities of the service-sector goods and people who have lower than average wage gains. So what can we do? Redistribution is one possibility.

If we focus on the prices, the core problem is that care work is labor-intensive and labor has a high opportunity cost. One solution is to lower the opportunity cost of that labor. Low-skill immigration helps: when lower-wage workers take on support roles, higher-wage workers can focus on higher-value tasks. As I’ve put it, “The immigrant who mows the lawn of the nuclear physicist indirectly helps to unlock the secrets of the universe.” Same for the immigrant who provides boarding for the pets of the nuclear physicist.

Another solution is capital substitution—automation, AI, better tools. But care jobs resist mechanization; that’s part of why productivity growth is so slow in these sectors. Still, the basic truth remains: if we want more affordable day care—for kids or pets—we need to use less of what’s expensive: skilled labor. That means either importing more people to do the work, or investing harder in ways to do it with fewer hands.

*The Price of Victory*

The author is N.A.M. Rodger, and the subtitle is A Naval History of Britain, 1815-1945. An excellent book, volume three in a longer series. Here is one excerpt:

…the most significant of all material innovations of the nineteenth century was virtually invisible. It took twenty-five years of investment and some heavy losses, but the completion of the first reliable transatlantic telegraph cable in 1866 may be taken to mark the moment when intercontinental communication times fell instantaneously from months to hours. Contemporaries talked enthusiastically of the ‘practical annihilation of time and space,’ and for an imperial and naval power with more time and space to handle than anyone else, the submarine cable was truly revolutionary. This different and expensive technology offered secure communications almost invulnerable to interference (except in shallow water). Britain possessed most of the world’s capacity to manufacture underwater cables, had an effective monopoly of Gutta percha, the only good insulator, trained the majority of the world’s cable operators, owned (in 1904) more than twice as many cable-laying ships as the rest of the world put together, and alone had mastered the difficult art of recovering and repairing cables in deep water. The high fixed costs, advanced technology and very long life (seventy-five years on average) of undersea cables made it extremely difficult for foreigners to break into this monopoly.

I will be buying and reading other books by this author, as this is one of the very best books of this year.

My first students

To continue with some biography…

My first full-time teaching job was at UC Irvine in 1988, a school with very good undergraduate students, including in economics. I was fortunate enough to be assigned Honors Intermediate Micro for my very first class.

(My general view is that the second time I teach a given class is the best, but the very first time is the second best version of the class. After that, unless I have a break of years, some of the material starts to feel too familiar to me, and I explain it less well and with less enthusiasm.)

I used the Nicholson text, as it had been pre-assigned, but I wished it had more economic intuition.

In any case I had seventeen students, and sixteen of them were Asian or Asian-American. None of them were south Asian. That was UC Irvine in those days (and perhaps still now?).

All but perhaps one were very good students.

That first year in my first class I was lucky enough to teach Stephen Jen. Stephen, as you may know, later received a PhD from MIT, working with Paul Krugman. He is these days a famous and highly respected currency analyst (among other things), and you will see his name often in the Financial Times. He lives in London, and he and I had dinner but a few weeks ago.

Stephen at first was going to do electrical engineering, but it turned out economics was his true love. I encouraged him to apply to graduate school, and wrote a very positive letter for him to MIT. The rest is history, as they say.

I spent a good bit of time with Stephen outside of class, and even played basketball with him several times. The summer of 1988 I also stayed with his family in Taipei, during a long Asia trip that I will write about some other time.

Most recently, Stephen has been known for having an early and very good call that the USD is going to decline, as indeed it did.

My second year at UC Irvine I taught the same class again. I was lucky enough to have Jeffrey Ely in my class, and of course he did very well. Jeff ended up studying for an economics PhD at UC Berkeley.

These days Jeff is a very well-known game theorist at Northwestern, arguably the number one school for game theory. He took a more traditional academic path, whereas Stephen started at the IMF and then worked his way up through the world of finance.

Jeff for a while even had a presence in the blogosphere, and still you will find him on Twitter, though he has not posted in the last year. In game theory, Jeff is highly creative and he approaches all problems by thinking like an economist.

As a person, he was always a bit more “hippie” than was Stephen, and I recall him giving me a tape of the Bob Dylan song “Million Dollar Bash,” from The Basement Tapes.

At George Mason, my best undergraduates often have been Chinese, but in terms of professional impact those are my two most successful undergraduate students ever. Getting to know and teach them was one of the very best things about being at UC Irvine. My colleagues were great too, but that is the subject of another post.

Not many links for the next two days or so

I am for a short while separated from my laptop, and I find links harder and slower to do through other means. So for a brief while not many links here.

Links will resume in due time, in the meantime enjoy the plain text, etc.

Tom Lehrer, RIP

Sunday assorted links

From the comments, on language preferences

Those wanting good, efficient government are not doing so well this century.

That is from Paco. The rest of the comment is a bit more specific:

In Spain, language politics are a key way to get your friends government jobs: When you manage to make regional language proficiency mandatory on any of said jobs, from schoolteacher up, and make the regional language the only language schools will teach on, you basically get a political cleansing of the institutions. Catalonia also pays those people quite a bit better than other regions: Not good for the budget (although now they get to hand the debt to Spain while they keep the taxes!), but it’s great for clientelism. Love your region, speak your regional language over all, get rewarded economically.

This is why you have similar schemes in every region that can get away with it: It’s just jobs for your friends. But that also translates to worse English for everyone, a language that might actually help do better in the long run. They call it maintaining the culture, I call it grift.

Then we’ll hear them all complain about Madrid’s corruption, when the 3% “friend tax” on basically any catalonian government contract, or anything large that needed a permit was documented for decades. It’s a key disease all across Spain. Blaiming Madrid made great sense circa 1920s or 30s, where it was just a bureaucratic capital with no industry of any sort. But now it’s the largest economic engine of the nation, largely because they are the closest to an economically liberal area.

As for the economists, it’s easy: They are inclined to any pro-independent movement that claims oppression, for any reason. At that point that cause is on their team, and careful analysis disappears. I bet you can all find an example or two of people justifying the waste and corruption elsewhere, just due to association.

Daunt tote bags as status symbols

Her husband, Jimmy, is carrying the blue tote bag through Victoria Park Village, where three other Daunt totes bags are spotted within a 20-minute window despite there being no store nearby.

Locality doesn’t matter. “I have a friend with a bookshop in Italy who follows Daunt Books on Instagram so I gave her a spare from my collection. She was so excited,” Marta Timoncini said. At 50, she says she is “too old to make a fashion statement” but simply thinks the design is nice and enjoys the secret pocket to hold her phone. She also said she likes to flaunt her love of her beloved store.

She is perhaps an outlier. A team member at the Broadway store for Jimmy Fairly said people come in just to buy the tote bag, which is free with every purchase, but costs £20 on its own. The shop is capitalising on the frenzy, selling limited-edition summer and winter versions.

The tote is another success story of virality: people walk around trendy London hotspots and hawk-eyed trend watchers satirise them in meme pages on social media. “That’s when I knew we had made it. We are cool now, it is viral, that is amazing,” the team member said.

Here is more from the Times of London, also covering Trader Joe’s tote bags as a status symbol. I now own about twenty-five of these bags? Via Rebecca Lowe.

Claims about DOGE and AI

The tool has already been used to complete “decisions on 1,083 regulatory sections” at the Department of Housing and Urban Development in under two weeks, according to the PowerPoint, and to write “100% of deregulations” at the Consumer Financial Protection Bureau (CFPB). Three HUD employees — as well as documents obtained by The Post — confirmed that an AI tool was recently used to review hundreds, if not more than 1,000, lines of regulations at that agency and suggest edits or deletions.

Here is the full story, I will keep you all posted…

Saturday assorted links

China kindergarten fact of the day

The number of children in Chinese kindergartens has fallen by a quarter in four years, prompting the closure of tens of thousands of preschools in the country as a precipitous drop in births hits the education system.

Enrolments in China’s kindergartens have declined by 12mn children between 2020 and 2024, from a peak of 48mn, according to data from the country’s ministry of education. The number of kindergartens, serving Chinese children aged 3-5, has also fallen by 41,500 from a high of nearly 295,000 in 2021.

Here is more from the FT.

Should Catalonia receive more financial independence?

Jesús details how Spain already operates one of the most decentralized fiscal systems in the world, “more latitude than most U.S. states,” he notes, yet Catalonia now seeks the bespoke privileges long enjoyed by the Basque Country and Navarra. The Regional Authority Index rates how much self‑rule and shared rule each country’s sub‑national governments actually wield. In its last update the index places Spain as the most decentralized unitary state in the sample and fourth overall among 96 countries.

Those northern provinces collect every euro on their own soil and forward a modest remittance to the central treasury, a setup that Fernández‑Villaverde brands “a Confederate relic.” Extending it to Catalonia, he argues, would hollow out Spain’s common‑pool finances, deepen inter‑regional resentment and erode the principle of equal citizenship, while turning the national revenue service into little more than a mailbox for provincial checks.

That is from the episode summary of a podcast of Rasheed Griffith with Jesús Fernandez-Villaverde. On the Catalan language, matters look grim in any case:

Right now around only 55% of births in Catalonia are born from a mother that was born, actually not even Catalan, that was born in Spain. That basically tells you that only 40, 45%, perhaps even a little bit less of mothers that were born in Spain speak Catalan at home. At this moment, I will say that less than 30, 28% of kids born in Cataluña, perhaps even less, will speak Catalan at home.

It amazes me how many people ignore the reality that a host of leading economists led or endorsed a constitution-violating movement to separate Catalonia from the rest of Spain and not long ago. The podcast will tell you more. It is also interesting throughout, including on Spanish history since the 19th century.

Why does renovating the Fed cost so much?

Here is a good WSJ piece on that question. Excerpt:

For example, members of the fine arts commission in 2020 recommended that the Fed use more marble to better match the original buildings. The Fed had initially proposed using more glass in an effort to represent the Fed’s transparency, according to the commission’s meeting minutes. The Fed amended the design to incorporate more marble.

To be clear, I am fine with an unabashedly elitist approach to designing or redesigning a central bank building, at least provided one’s domestic politics is able to sustain such a thing. I am glad for instance that the Cleveland Fed is quite a nice building, and I wish more DC architecture were of comparable quality, noting that these days we are not very good at constructing Beaux Arts buildings, and for DC modernist styles do not always fit the surroundings very well, thus creating a broader dilemma.