Category: Current Affairs

Repeal the employer mandate altogether

I agree with Ezra Klein, who writes:

Delaying Obamacare’s employer mandate is the right thing to do. Frankly, eliminating it — or at least utterly overhauling it — is probably the right thing to do. But the administration executing a regulatory end-run around Congress is not the right way to do it.

Ezra notes:

– By imposing a tax on employers for hiring people from low- and moderate-income families who would qualify for subsidies in the new health insurance exchanges, it would discourage firms from hiring such individuals and would favor the hiring — for the same jobs — of people who don’t qualify for subsidies (primarily people from families at higher income levels).

– It would provide an incentive for employers to convert full-time workers (i.e., workers employed at least 30 hours per week) to part-time workers.

– It would place significant new administrative burdens and costs on employers.

By tying the penalties to how many full-time workers an employer has, and how many of them qualify for subsidies, the mandate gives employers a reason to have fewer full-time workers, and fewer low-income workers.

We can only hope that repeal of this one part of the law is what the Obama Administration actually has in mind, though as Ezra notes Congress is not currently in a cooperative frame of mind. Still, this way it has a chance of serious reexamination after the 2014 elections.

Evan Soltas offers relevant comment on how this will change implementation in the short-run, namely that it puts more burden on the exchanges. Sarah Kliff comments on the politics, a very good post. Here is one good quotation from a source: “Politically, it won’t get easier a year from now, it will get harder,” he said. “You’ve given the employer community a sense of confidence that maybe they can kill this. If I were an employer, I would smell blood in the water.”

My view is you don’t serve up a delay and PR disaster like this, on such a sensitive political issue, unless you really wish to derail the entire provision.

Bets and Beliefs

I fear that Tyler’s latest post on bets and beliefs will obfuscate more than clarify. Let’s clarify. There are two questions, do portfolios reveal beliefs? Do bets reveal beliefs?

Tyler has argued that portfolios reveal beliefs. This is false. If transaction costs were zero and there were an asset for every possible future state of the world then this would be true. Since transaction costs are not zero and there are many more states of the world than there are assets–even when we combine assets–portfolios do not reveal beliefs. Portfolios might reveal a few coarse beliefs but otherwise no go. Since most people have lots of beliefs about the future but don’t even have a portfolio (beyond human capital) this should be obvious.

Do bets reveal beliefs? Usually but not necessarily. Two people made bets with Noah Smith. Each thought Noah was an idiot for making the bet. Noah, however, had arbitraged so that he couldn’t lose. Clever Noah! Noah’s bets, either alone or in conjunction, did not reveal his beliefs. But is this the usual situation? No.

For the same reasons that portfolios don’t reveal beliefs, high transaction costs and few assets relative to states of the world, it’s going to be difficult to arbitrage all bets. Many bets in effect create a new and unique asset that can’t be easily duplicated and arbitraged away in other markets. I once bet Bryan as to what an expert would answer when asked a particular question. Hard to arbitrage that away.

I also agree with Bryan that the question is empirical and not simply theoretical. When I say that a bet is a tax on bullshit the implication is not just that bullshitters are more likely to lose their bets but also that a tax on bullshit reduces its supply. The betting tax causes people to think more carefully and to be more precise. When people are more careful and precise the quality of communication increases. As Adam Ozimek writes:

In a lot of writing in blogs it is unclear specifically what the writer is trying to say, and they seem to wish to convey an attitude about a certain position without actually having to make a particular criticism of it, or by making a much actual narrower criticism than rhetoric implies…It is useful to have betting because deciding clearly resolvable terms of a bet leads to specific claims…

Tyler argues that under some conditions betting won’t change what people say (under a wide range of portfolios…a matter of indifference… bets won’t be authentic) but Tyler doesn’t give us a specific, testable prediction. The empirical evidence, however, is that small bets do cause people to change what they say. This is one of the reasons why even small-bet, prediction markets work well.

Tyler has his reasons for not liking to bet but if you think one of those reasons is that he has already revealed his beliefs then you are surely not a loyal reader.

An ice cream parable for recent monetary policy events

Consider this to be thinking out loud and not a series of positive claims asserted to be necessarily true:

1. Money is non-neutral and monetary expansion helps correct for negative AD shocks.

2. At the same time, monetary expansion itself has non-neutral real effects. Imagine that the Fed conducts all open market operations on ice cream cones.

3. As the economy recovers, there are two options.

4. First, the Fed can keep buying lots of ice cream cones forever. Eventually the economy ends up producing too much ice cream. Note that in the early days of the purchases, however, the economy was producing suboptimal levels of ice cream, so this was not initially much of a distortion, if it was any distortion at all.

5. The second option is that the Fed can back off its ice cream purchases now. This will hurt AD and it also will hurt the ice cream market, although it may pre-empt a more serious blow to the ice cream market later on. Either the Fed finds it politically impossible to buy lots of ice cream forever, or the Fed minds the eventual distortion of the ice cream market.

6. Recently the Fed suggested it might back off ice cream purchases, to see what the price of ice cream would do, so as to learn more about the market. We observed both a negative AD effect and a severe negative price effect in the ice cream market. Some Fed officials then tried to talk those markets back up, just as they had been talked back down. The talk-backs failed, reflecting the wisdom of the market.

7. We now all know that slowing down the rate of ice cream purchases will be harder than we had thought.

8. This parable assumes that injection effects are important, namely where the new money goes first. This Austrian-like view is unfashionable, has weak theoretical foundations, and violates the Modigliani-Miller theorem, but at the moment markets seem to believe it. Should we believe it too?

8b. But wait, you Austrians shouldn’t get too gleeful. The implied theory of the market is anti-Wicksteed, anti “supply is the inverse of the demand to hold, and vice versa,” and “flows only,” a bit like some of the early Keynesians had argued. Uh-oh. (Or maybe the Austrians and the early Keynesians had a bit more in common than they like to let on.)

9. You will note that the demand for ice cream also spills over into cookies, cupcakes, and kulfi.

The political economy of drones

That is a new paper by Christopher Coyne and Abigail Hall, here is the abstract:

This paper provides a political economy analysis of the evolution of unmanned aerial vehicles (UAV) or “drones”, in the United States. Focus is placed on the interplay between the political and private economic influences; and their impact on the trajectory of political, economic, and, in this case, military outcomes. We identify the initial formation of the drone industry, trace how the initial relationships between the military and the private sector expanded over time, and discuss how the industry has expanded. Understanding the history and evolution of UAV technology, as well as the major players in the industry today, is important for ongoing policy debates regarding the use of drones, both domestically and internationally.

The future of manufacturing jobs in developing nations

Nike is to tackle rising labour costs at its Asian factories by “engineering the labour out” of its shoe and clothing production as it seeks to defend its profits.

Don Blair, Nike’s chief financial officer, said its objective was to reduce the number of people making its products as he highlighted the impact of a sharp increase in wages in Indonesia.

From the FT, here is more. Here is my recent NYT column on related developments.

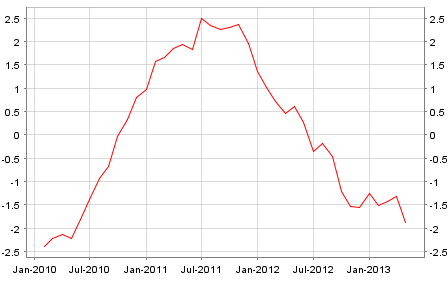

YoY growth in eurozone loans to non-financial companies

There is more here.

Turning efficiency wage theory on its head

The co-founder of Florida-based Specialty Medical Supplies has been held since Friday in the executive quarters of his factory on the outskirts of Beijing, he said. About 80 of his 110 employees are blocking doors and locking gates, refusing to let the 42-year-old entrepreneur go until they get severance packages, according to Chip Starnes, the co-founder.

It’s not all bad, however:

Speaking on Monday from behind the bars of a window of the 10-year-old factory that makes alcohol pads and diabetes equipment, Mr. Starnes apologized for his fatigue. He said during the first few nights of his entrapment that employees treated him like a prisoner of war, depriving him of sleep by making jarring noises and shining bright lights in his eyes. There are no guns, however, and Mr. Starnes said that he hasn’t been physically harmed in any way.

And:

Despite becoming a prisoner in his own offices, Mr. Starnes said he is willing to stick it out in China and even a few more weeks in his present confines. “Thankfully when I built the place, I put a toilet in it,” he said.

I noted this sentence from the article:

It is unclear how often executives are held hostage.

Perhaps this should be added to the Doing Business index as a new variable. (Update: it’s pretty common.) In any case, you can read more here.

Emerging markets, hitting a wall

That is the title of my new New York Times column. Here is an excerpt:

The disconcerting truth is that the great “age of industrialization” may be behind us, a possibility that has been outlined most forcefully by the economist Dani Rodrik, who is leaving Harvard for Princeton next month. And evidence for this view is coming from at least four directions:

THE RISE OF AUTOMATION First, machines can perform more and more functions in manufacturing, and sometimes even in services. That makes it harder to compete via low wages.

Say you run a company in a developed nation and have been automating many of its processes. Because your total bill for employee wages would be low, why not choose the proximity and familiarity of investing in labor in or near your home country? This change would help the jobs picture in the United States and probably countries like Mexico, but could hurt many other lower-wage nations.

GLOBAL SUPPLY SOURCES Supply chains are now scattered across many countries. Think of the old development model as a nation, such as South Korea, trying to build a nearly complete domestic supply chain for its automobile and other industries. The newer model is more distributed, as reflected by the iPhone, with the bounty from the investment spread across many locations, including the Philippines, Taiwan and mainland China. As for cars, Thailand has courted automobile factories with success, but the parts usually come from outside the country and the benefits for the Thai economy are limited.

Richard Baldwin, professor of international economics at the Graduate Institute in Geneva, refers to the internationalization of the supply chain as “globalization’s second unbundling.” He sees the new world as one of “development enclaves,” in which parts of countries will stand out as advanced or wealthy, without fundamentally transforming the entire economy.

I end with the following:

In any case, we should be prepared for the possibility that, while Seoul now looks a fair amount like Los Angeles, perhaps La Paz, Accra and Dhaka will never look much like Seoul.

Indonesia fact of the day

Fuel subsidies accounted for sixteen percent of the government’s budget last year. They are now trying to cut them back.

The Greek public broadcaster showdown, and when do people finally snap?

There is now a chance that the Greek coalition government will collapse, and in some manner re-form, due to the controversy over the possible shutdown of Greece’s public broadcasting outlet (now suspended by the Greek High Court). Here are comments from Matt, and also from Open Europe. Here is a long update on the story.

There is a broader point about the possibility of countries on the periphery leaving the eurozone or otherwise choosing a radical change, such as outright default or capital controls or an illiberal government or a blatant renegotiation of the current deal. Many observers seem to have in mind a path where things get really bad, economically speaking that is, and then a country leaves the eurozone (or makes some other radical choice) because they can’t stand it any more when things are at the absolute bottom. Once things are looking up, it is assumed that countries are on board for the foreseeable future.

Without wishing to rely too heavily on Tocqueville’s analysis of the French Revolution (pdf), that’s not how things usually work. Very often there is an ongoing history of major problems and depredations. Then things seem to get better or perhaps they really do get better. Expectations start to rise. Then some small events come along and those events are blown out of proportion, leading to the crisis in public opinion that didn’t quite happen in the first place.

The current Turkish crisis was set off by a dispute over a public park, and the recent demonstrations in Brazil seem to have been prompted by a 7% hike in bus fare prices, which is about ten U.S. cents. Yet in neither case is the small trigger the ultimate cause of the discontent.

Many deconversions from religion, or from fandom, or even from marriage, work the same way. Big lies are told and those lies inflict some damage. The institution in question soldiers on. A bit later, an apparently smaller slight or problem brings the whole thing crashing to the ground, precisely when things appeared to be getting better.

I’m not saying it always runs that way, only that it is a very common path. Furthermore the steepest period of decline is very often when people are too preoccupied with coping to make the major adjustment.

The bottom line is that one should not dismiss the importance of small events, especially these days.

Addendum: Edward Hugh argues that Grexit is not off the table. Here is a short piece on the Tocqueville thesis and China.

Whither the poet laureate?

Perhaps he could write such poems in his spare time. Or perhaps better not?:

Canada’s Parliamentary Poet Laureate, wondering aloud why the government never asks him to write poems, has inadvertently answered his own question.

“I wish that my government had asked me to write poetry about immigration policy, about Idle No More, about Canada’s complicity in the Middle East, the Enbridge pipeline,” Fred Wah, a Saskatchewan-born poet now living in Vancouver, recently told an audience at an Edmonton literary festival.

“I haven’t been asked to do any of those things.”

…He warned that the taxpayer-funded position risks becoming “homogenized and diluted,” and expressed frustration that during his two-year term in Ottawa he’s been asked to produce just one work — a “mediocre” poem about Queen Elizabeth’s diamond jubilee.

That’s the British Queen Elizabeth by the way, not the Queen Elizabeth who sits on the Bangalore city council. Here is more, via Pierre Lemieux on Facebook.

Report from Bangalore, 2013

Okalipuram corporator Queen Elizabeth was granted anticipatory bail in a forgery case.

Allowing her bail plea, high court vacation judge AN Venugopala Gowda told her to surrender her passport before the trial court and execute a personal bond for Rs 50,000.

The corporator has to be available for interrogation as and when required on any day between 8am and 6pm and shouldn’t make attempts to induce or issue threat/promise to persons acquainted with the facts of the case, the judge said.

An FIR was registered against Queen Elizabeth under sections 198 and 420 of the IPC and section 3(1)(ix) of SC/ST(Prevention of Atrocities) Act, 1989, for allegedly forging documents and obtaining a false caste certificate.

The story is here, via James Crabtree, and yes the person’s name is Queen Elizabeth and she is on the city council.

India fact of the day

One statistic above all explains the excitement India kindles: just 18 people in every 1,000 own a car. In China the figure is 58, according to the World Bank, while in most European countries it is more than 500. “India’s level of car ownership per capita is even lower than in Sudan, or Afghanistan,” says Tomas Ernberg, head of Volvo in India. “So in the long term there is bound to be growth, enormous growth.”

The market is also strikingly new. Barely 20 years ago India’s “Licence Raj” restricted aspirant motorists to two basic choices: the grand Hindustan Ambassador, an imitation of the venerable British Morris Oxford; and the boxy Maruti-Suzuki 800 hatchback, the country’s first (and then only) people’s car.

From the FT, here is more.

A small step toward cosmopolitan efficiency and away from nationalism (Mexican law about beach homes)

Morgan Warstler points me to this article:

Mexican congressmen voted on Tuesday to change a law that makes it difficult for foreigners to own beach homes in Mexico.

The law prevents any foreigner from directly owning a home that is located within 50 kilometers of Mexico’s coasts. Foreigners in Mexico are also banned from owning homes that are located within 100 kilometers of the country’s international borders.

Congressmen from Mexico’s house of representatives argued that the law was “outdated,” that it hampers investment in the country, creates unnecessary bureaucracy and no longer matches reality.

They pointed out that thousands of Americans and Canadians already own beach homes in Mexico anyways, and many more are interested in buying.

But currently, foreigners who want to have coastal properties in Mexico need to acquire these assets through Mexican companies or real estate trusts in which a local bank buys a property and then “leases” it to its foreign occupant for an annual fee. A report that was compiled by the Mexican congressmen who support this legal shift said that, between 2000 and 2012, about 49,000 foreigners bought homes in “restricted areas,” by going through these legal loopholes.

But do note:

The Mexican Senate, and the President of Mexico must now vote on this proposal for it to pass. Because this proposal would strike down a law that is part of Mexico’s constitution, it must also be approved by a majority of Mexico’s state legislatures.

Detroit facts for today

…the city’s per capita income, averaged over its 684,799 residents, is just $15,261 per year. (That’s less than half the income of neighboring Livonia.) Auto insurance alone eats up a good $4,000 of that, for residents with a car.

And then comes the litany of municipal woes: Detroit has the highest violent crime rate of any major US city, at five times the national average; there were 344 murders in 2011, of which just 39 were solved. Right now, the average response time, if you put in an emergency call to the Detroit Police Department, is 58 minutes.

Detroit’s infrastructure is crumbling: 40% of its street lights are out of order, and it has 78,000 abandoned and blighted structures, of which 38,000 are considered dangerous buildings. Those buildings account for a large proportion of the 12,000 fires Detroit has every year. At the moment, firefighters are instructed not to use the hydraulic ladders on their firetrucks unless there is an immediate threat to life, because the ladders have not received safety inspections for years. Detroit also has just 36 ambulances, of which generally no more than 14 are in operation at any given time. And in terms of the city’s IT infrastructure — well, you can probably guess; suffice to say that a recent IRS audit characterized the city’s income tax system as “catastrophic”.

As far as Detroit’s balance sheet is concerned, there is $9 billion of debt, excluding pension liabilities, and also excluding healthcare and life insurance obligations which are calculated at roughly $6 billion. Debt service in 2013 is projected at more than $240 million, or about 22% of total revenues. Worryingly, under the section of the proposal headed “Realization of Value of Assets”, one finds the priceless collection owned by the Detroit Institute of Arts…

That is all from Felix Salmon.