Category: Law

A guaranteed annual income for Finland?

The Finnish government is currently drawing up plans to introduce a national basic income. A final proposal won’t be presented until November 2016, but if all goes to schedule, Finland will scrap all existing benefits and instead hand out 800 euros per month—to everyone.

It sounds far-fetched, but it’s looking likely that Finland will carry through with the idea. Whereas several Dutch cities will introduce basic income next year and Switzerland is holding a referendum on the subject, there is strongest political and public support for the idea in Finland.

A poll commissioned by the government agency planning the proposal, the Finnish Social Insurance Institution or KELA, showed that 69% support (link in Finnish) a basic income plan. Prime minister Juha Sipilä is in favor of the idea and he’s backed by most of the major political parties.

There is more here, by Olivia Goldhill, via Matt Yglesias.

High skilled migration and global innovation

Another argument against the brain drain hypothesis is that bringing talented workers to the “frontier” countries will boost the supply of global public goods. Rui Xu, in her job market paper from Stanford (pdf), considers exactly this effect. Here are her main results:

Science and engineering (S&E) workers are the fundamental inputs into scientific innovation and technology adoption. In the United States, more than 20% of the S&E workers are immigrants from developing countries. In this paper, I evaluate the impact of such brain drain from non-OECD (i.e., developing) countries using a multi-country endogenous growth model. The proposed framework introduces and quantifies a “frontier growth effect” of skilled migration: migrants from developing countries create more frontier knowledge in the U.S., and the non-rivalrous knowledge diffuses to all countries. In particular, each source country is able to adopt technology invented by migrants from other countries, a previously ignored externality of skilled migration. I quantify the model by matching both micro and macro moments, and then consider counterfactuals wherein U.S. immigration policy changes. My results suggest that a policy – which doubles the number of immigrants from every non-OECD country – would boost U.S. productivity growth by 0.1 percentage point per year, and improve average welfare in the U.S. by 3.3%. Such a policy can also benefit the source countries because of the “frontier growth effect”. Taking India as an example source country, I find that the same policy would lead to faster long-run growth and a 0.9% increase in average welfare in India. This welfare gain in India is largely the result of additional non-Indian migrants, indicating the significance of the previously overlooked externality.

In other words, the brain drain argument is overrated. You might also wish to sample our MRUniversity video on the brain drain argument.

Is the gig economy taking over Washington, D.C.?

No, basically:

We first look at the number of District taxpayers who have paid self-employment taxes. The data show that the total number of people who pay self-employment taxes has increased in the District from 35,000 in 2006 to nearly 49,000 in 2014. This is a very steep increase (36 percent overall and nearly 4.5 percent annualized) even when compared to the relatively rapid increase in the District’s population and tax filers (tax filers grew at about 2 percent per year during the same period). But data show that the rapid increase in the number of filers who paid self-employment taxes occurred before 2010. In fact, since 2010, the share of tax filers who pay self-employment taxes has been stable at about 14 percent.

That is from a longer post, there is more at the link. Here is the broader (and excellent) blog on the law and economics of Washington, D.C., DistrictMeasured.com.

The optimal regulation of massage and prostitution

The job market paper of Amanda Nguyen, of UCLA, is on that topic, I found her results intriguing:

Despite its illegality, prostitution is a multi-billion dollar industry in the U.S. A growing share of this black market operates covertly behind massage parlor fronts. This paper examines how changes to licensing in the legal market for massage parlors can impact the total size and risk composition of the black market for prostitution, which operates either illegally through escorts or quasi-legally in massage parlors. These changes in market structure and risk consequently determine the net impact of prostitution on sexually transmitted diseases (STDs) and sexual violence. I track the impact of two policy changes in California that resulted in large variation in barriers to entry via massage licensing fees. Using a novel dataset scraped from Internet review websites, I find that lower barriers to entry for massage parlors makes the black market for prostitution larger, but also less risky. This is due to illegal prostitution buyers and suppliers switching to the quasi-legal sector, as well as quasi-legal sex workers facing a reduced wage premium for high-risk behavior. Consequently, the incidence of gonorrhea and rape falls in the general population. I also present evidence that growth in the quasi-legal sector imposes a negative competition externality on purely legal massage firms.

I don’t find the rape result intuitive, but I am seeing it pop up in a number of papers, so perhaps it should be taken seriously.

A Dual-Track Drug Approval Process

In a post earlier this year I noted that Japan has significantly liberalized its approval process for regenerative medicine. Writing in Forbes, Bart Madden and Nobelist Vernon Smith outline a similar proposal for the United States.

Recently, Japanese legislation has implemented the core Free To Choose Medicine (FTCM) principles of allowing not-yet-approved drugs to be sold after safety and early efficacy has been demonstrated; in addition, observational data gathered for up to seven years from initial launch will be used to determine if formal drug approval is granted.

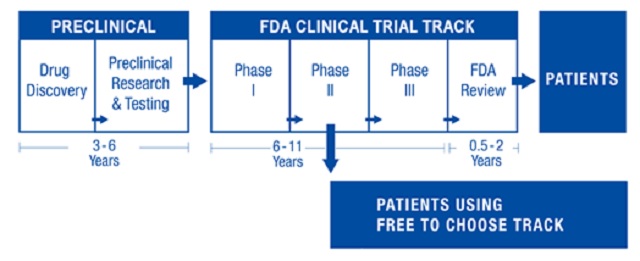

…FTCM legislation in the U.S. would create a dual track system (see figure below) that preserves the existing FDA clinical trial process while offering patients an alternative. Patients, advised by their doctors, would be able to contract with a drug developer to use not-yet-approved drugs after Phase I safety trials are successfully completed and one or more Phase II trials have demonstrated continued safety and initial efficacy. The resulting early access could make FTCM drugs available up to seven years before conventional FDA approval, which entails Phase III randomized control trials and a lengthy FDA review before the FDA makes an approval decision.

…The heart of the dual track system is the Tradeoff Evaluation Drug Database (TEDD) which would be available to the public through a government-supervised web portal. TEDD would contain all treatment results of FTCM drugs including patients’ health characteristics and relevant biomarkers, but no personal identification. This open access database would be a treasure-trove of information to aid drug developers in making better R&D decisions consistent with fast-paced learning and innovation.

…Today’s world of accelerating medical advancements is ushering in an age of personalized medicine in which patients’ unique genetic makeup and biomarkers will increasingly lead to customized therapies in which samples are inherently small. This calls for a fast-learning, adaptable FTCM environment for generating new data. In sharp contrast, the status quo FDA environment provides a yes/no approval decision based on statistical tests for an average patient, i.e., a one-size-fits-all drug approval process.

I hold the Bartley J. Madden Chair in Economics at the Mercatus Center so I am biased but this is an important proposal. Japan is leading the way and similar ideas are being discussed in Great Britain but as the most important pharmaceutical market in the world, the United States has an outsize influence on world drug development. We need to lower costs and speed new drugs to market.

*The Rise and Fall of Violent Crime in America*

That is a forthcoming book by Barry Latzer, it is very clear and well argued and I am happy to recommend it. Here are a few bits from the book:

1. From the 1930s through the 1950s, black cirrhosis death rates were lower than those for whites.

2. For Miami, Haitians were 3.5 percent of the murder suspects when they were 14 percent of the city’s population, from a 1985-1995 study.

3. If you ignore levels, and just look at rates of change, crime rates in Canada track those in the United States to an astonishing degree. How can that be? If demographics or jobs were the main driving force, maybe, but they are not…

4. He criticizes lead-based theories on the grounds that they seem “…unable to explain why the affected populations had relatively high offending rates in the years just prior to the great crime decline.”

You can pre-order it here.

Why did American taxation become less progressive?

That is an underexplored question, and it is considered in the job market paper of Chunzan Wu, from the University of Pennsylvania. Here is the abstract, which will unsettle many people:

Since the 1970s, income inequality in the U.S. has increased sharply. During the same time span, the U.S. federal income tax has become less progressive. Why? I examine this question in a Ramsey optimal tax policy framework. Within this framework, the tax policy is determined by: (1) a set of Pareto weights representing the government’s preference over different households; and (2) household lifetime utilities summarizing the effects of economic fundamentals. I first study the changes in economic fundamentals using an overlapping generations incomplete-markets life-cycle model with heterogeneous households. The model features both endogenous human capital accumulation and household labor supply and is calibrated to the U.S. economy in the 1970s and 2010s. Then I use this economic model to determine whether the change in income tax is the result of an optimal policy response to changing economic fundamentals or the consequence of a change in Pareto weights. I interpret the latter as changes in the political influences of various income groups. I find that: (1) changes in economic fundamentals alone induce a less progressive optimal income tax and can account for 40% of the reduction in progressivity we observe; and (2) the change in Pareto weights required to explain the remaining part of tax policy change favors high-income households and also implies less valued government services. Finally, using a stylized political economy model, I discuss potential explanations for this change in Pareto weights such as the lower cost of conveying information to swing voters and the rising inequality of voter turnout among different socioeconomic groups.

The paper is here (pdf).

W.E.B. Du Bois on Woodrow Wilson

It is worth reading what one of the African-American civil rights leaders, and a brilliant man, thought of Woodrow Wilson at the time of his candidacy:

As to Mr. Wilson, there are, one must confess, disquieting facts; he was born in Virginia, and he was long president of a college which did not admit Negro students…On the whole, we do not believe that Woodrow Wilson admires Negroes…Notwithstanding such possible preferences, Woodrow Wilson is a cultivated scholar and he has brains…We have, therefore, a conviction that Mr. Wilson will treat black men and their interests with farsighted fairness. He will not be our friend, but he will not belong to the gang of which Tillman, Vardaman, Hoke Smith and Blease are the brilliant expositors. He will not advance the cause of an oligarchy in the South, he will not seek further means of “jim crow” insult, he will not dismiss black men wholesale from office, and he will remember that the Negro…has a right to be heard and considered, and if he becomes President by the grace of the black man’s vote, his Democratic successors may be more willing to pay the black man’s price of decent travel, free labor, votes and education.

That is from pp.187-188 of August Meier, Negro Thought in America 1880-1915: Racial Ideologies in the Age of Booker T. Washington. You can see that Du Bois did not “have it in” for Wilson.

And here is a letter from September 1913, from Dubois to Wilson, after Wilson had been in office for but half a year:

Sir, you have now been President of the United States for six months and what is the result? It is no exaggeration to say that every enemy of the Negro race is greatly encouraged; that every man who dreams of making the Negro race a group of menials and pariahs is alert and hopeful. Vardaman, Tillman, Hoke Smith, Cole Blease, and Burleson are evidently assuming that their theory of the place and destiny of the Negro race is the theory of your administration, They and others are assuming this because not a single act and not a single word of yours since election has given anyone reason to infer that you have the slightest interest in the colored people or desire to alleviate their intolerable position, A dozen worthy Negro officials have been removed from office, and you have nominated but one black man for office, and he such a contemptible cur, that his very nomination was an insult to every Negro in the land.

To this negative appearance of indifference has been added positive action on the part of your advisers, with or without your knowledge, which constitutes the gravest attack on the liberties of our people since emancipation, Public segregation of civil servants in government employ, necessarily involving personal insult and humiliation, has for the first time in history been made the policy of the United States government.

By the way, I’ve also learned that Du Bois, despite his Marxist sympathies, studied economics with Taussig at Harvard, had well-worked out views on Mill and Ricardo, and once wrote a paper defending the economics of the gold standard. He also studied with Gustav Schmoller at what was then the University of Berlin, now Humboldt University.

Which Group has Committed the Most Terrorist Acts on US Soil?

The RAND Database of Worldwide Terrorism Incidents (RDWTI) contains data on terrorist incidents worldwide from 1968 through 2009. Terrorism is defined as the deliberate creation and exploitation of fear through violence or the threat of violence in the pursuit of political change.

According to the Rand database, there were 567 terrorist incidents in the United States between 1968 and 2009. The most terrorist incidents, 140 out of 567 or 25% of the total during this period, were due to one group or cause, anti-Castro Cubans. The anti-Castro terrorist groups have killed 6 people, mostly advocates of dialogue with Cuba such as Eulalio Jose Negrin who was gunned down in 1979. Numerous bombings have also been traced to these groups including hotel bombings in Miami, bombings in New York of consulates (also Madison Square Gardens) and near-miss airplane bombings. Connections between anti-Castro groups, the CIA and the Bush dynasty remain controversial.

The group responsible for the second highest number of terrorist incidents on US soil, 62 incidents or 10% of the total (1968-2009), is the Jewish Defense League. Mostly these have been bombings in New York City of places or people attached to the Soviets. Perhaps the best known is the 1986 tear-gassing of the Metropolitan Opera House on the visit of the Moiseyev Dance Company. Rand tallies 2 deaths in total to the JDL.

Although these groups committed many terrorist acts on US soil neither had much interest in terrorizing US citizens per se, perhaps explaining the relatively low body counts in the United States.

China credit card capital controls fact of the day

Chinese billionaire Liu Yiqian, who doesn’t exactly struggle to afford a plane ticket, can now likely fly free, in first class, with his whole family, anywhere in the world, for the rest of his life.

All because he bought a painting.

Liu was the winning bidder for Amedeo Modigliani’s Reclining Nude at a Christie’s auction earlier this month, offering $170.4 million — and when the sale closes, he’ll be putting it on his American Express card.

Liu, a high-profile collector of Chinese antiquities and art, has used his AmEx in the past when he’s won art auctions. He put a $36-million tea cup from the Ming Dynasty on his AmEx last year, according to reports, and put other artifacts on his card earlier this year. He and his wife said they plan on using their American Express card to pay for the Modigliani, according to news reports after the sale.

And this:

China allows its citizens to transfer no more than $50,000 out of the country in any year, and using his [Liu’s] card could help him get around this limit because he’s just paying back American Express or the bank in China who issues his card.

The effects of the medical marijuana market on substance abuse

Rosanna Smart, a job market candidate from UCLA, has a very interesting job market paper (pdf) on this question. Here is the abstract:

Almost half of the US states have adopted \medical marijuana” laws (MMLs),and 58% of Americans now favor marijuana legalization. Despite public support, federal law continues to prohibit the use and sale of marijuana due to public health concerns of increased abuse, drugged driving, and youth access. Using evidence from MMLs, this is the first paper to study whether growth in the size of legal marijuana markets affects illegal use and its associated health consequences. By collecting new data on per capita registered medical marijuana patient rates, I investigate how state supply regulations and changes in federal enforcement affect the size of this legal market. I then study how illegal marijuana use and other health outcomes respond to changes in legal availability. I find that growth in the legal medical marijuana market significantly increases recreational use among all age groups. Increased consumption among older adults has positive consequences in the form of an 11% reduction in alcohol- and opioid-poisoning deaths. However, increased consumption among youths leads to negative externalities. Raising the share of adults registered as medical marijuana patients by one percentage point increases the prevalence of recent marijuana use among adolescents and young adults by 5-6% and generates negative externalities in the form of increased traffic fatalities (7%) and alcohol poisoning deaths (4%).

Those results are consistent with my intuitions. When it comes to “those who already are screwed up,” namely the older generation, it is best to shunt them off into pot, compared to the relevant alternatives. But when it comes to the younger generation, the new norm that “pot is OK” may in fact not be best in the longer run. So in sum,while I (TC, not the author necessarily) favor marijuana decriminalization, we should hold mixed moods towards its practical effects.

Islamic State as hypermodern, momentum traders

Following up on my earlier post on Syria, Alexander Burns sends me this very interesting email:

Dear Professor Cowen,

Thanks for your reply tweet regarding your Marginal Revolution post on modelling Syria / Islamic State. I enjoy your books and blog.

I’m writing a thesis at Australia’s Monash University that synthesises Jack Snyder’s work on strategic culture / strategic subcultures with Martha Crenshaw and Jacob Shapiro’s work on terrorist organisations. Two recent presentations:

1. Mid-Candidature Review Panel slides: http://www.alexburns.net/Files/MCR.pptx

2. Monash SPS Symposium Presentation on Islamic State: https://t.co/Ju11zvFBSP

Several weeks ago I discussed Islamic State with my Mid-Candidature Review panel whilst also reading Gary Antonacci’s Dual Momentum Investing and the Dan Zanger interview in Mark Minervini’s Momentum Masters interviews book. It struck me that Islamic State were like momentum traders for several reasons:

(1) Islamic State have grown rapidly in foreign mujahideen; control of parts of northern Iraq and Syria; and have grown in power projection capabilities. This dynamic is very much like successful momentum traders have worked in a financial markets context using Jesse Livermore’s trend-following approach, William O’Neil’s CANSLIM system, or Paul Tudor Jones II’s speculative activity in Eurodollar and foreign exchange markets.

(2) Islamic State have to-date survived aerial bombardments and have exploited a range of weaknesses in their enemies (e.g. jihadist beheading videos as psychological warfare against the Iraqi Army; Turkey’s borders with Iraq and Syria; and alliance manoeuvers around the Assad regime and the Syrian civil war).

(3) Events like the capture of Mosul, Iraq; combat experience in the Syrian civil war; involvement in oil black markets; and the proclamation on 29th June 2014 of a worldwide caliphate have momentum-like qualities, particularly in terms of creating the psychological climate for nation-building.

(4) Islamic State has outperformed their peer jihadist groups in their growth and ideological impact.

(5) Islamic State’s use of social media to amplify ideological propaganda is more hypermodern and sophisticated than other terrorist groups.

(6) Their rapid growth has led to spillover effects such as the refugee crisis in Europe.

(7) The Western media’s concerns about Islamic State — and their cultural impact — feel like the 1998-2000 part of the 1995-2000 dotcom speculative bubble, albeit in a counterterrorism context.

(8) Your perspective on Islamic State as hypermodern may also be relevant to the proto-Marxist work on accelerationism and postcapitalism (Nick Srnicek and Alex Williams’ Inventing the Future; Steven Shaviro’s No Speed Limit; and Benjamin Noys’ Malign Velocities): contemporary terrorist groups operate in a different political / technological / ‘average is over’ context.

With his permission I reproduced the email as is, though added in a few extra paragraph breaks for ease of reading.

A Cost-Benefit Analysis of Government Compensation of Kidney Donors

The latest issue of the American Journal of Transplantation has an excellent and comprehensive cost-benefit analysis of paying kidney donors by Held, McCormick, Ojo, and Roberts. Earlier, Becker and Elias estimated that a payment of $15,000 per living donor would be sufficient to eliminate the US waiting list. The authors adopt a larger figure of $45,000 for living donors and $10,000 for deceased donors and find that even at these rates paying donors generates benefits far in excess of costs.

The latest issue of the American Journal of Transplantation has an excellent and comprehensive cost-benefit analysis of paying kidney donors by Held, McCormick, Ojo, and Roberts. Earlier, Becker and Elias estimated that a payment of $15,000 per living donor would be sufficient to eliminate the US waiting list. The authors adopt a larger figure of $45,000 for living donors and $10,000 for deceased donors and find that even at these rates paying donors generates benefits far in excess of costs.

In particular, a program of government compensation of kidney donors would provide the following benefits (quoting from the article):

- Transplant kidneys would be readily available to all patients who had a medical need for them, which would prevent 5000 to 10 000 premature deaths each year and significantly reduce the suffering of 100 000 more receiving dialysis.

- This would be particularly beneficial to patients who are poor and African American because they are considerably overrepresented on the transplant waiting list. Indeed, it would be a boon to poor kidney recipients because it would enable them to reap the great benefits of transplantation at very little expense to themselves.

- Because transplant candidates would no longer have to spend almost 5 years receiving dialysis while waiting for a transplant kidney, they would be younger and healthier when they receive their transplant, increasing the chances of a successful transplantation.

-

With a large number of transplant kidneys available, it would be much easier to ensure the medical compatibility of donors and recipients, which would increase the success rate of transplantation.

-

Taxpayers would save about $12 billion each year. Dialysis is not only an inferior therapy for end-stage renal disease (ESRD), it is also almost 4 times as expensive per quality-adjusted life-year (QALY) gained as a transplant.

What is going on in Syria? (model this)

My thoughts on this topic are extremely tentative, hypothetical I would say, but I’ve seen so much other bad commentary I thought I would lay out a possible “model” for what is going on. I offer this with what I consider to be more than just caveats and qualifications, if you wish simply consider this an exercise in constructing some possibilities to think through. These are “in my opinion the most likely to be true, compared to alternatives,” but still quite low in terms of their absolute chance of being true. Here goes:

1. I don’t view Islam as essential to the conflict, though it helps explain some of the second-order causes and effects.

2. I think first in terms of Yugoslavia in the 1990s, which also saw the collapse of an untenable-once-placed-under-pressure nation-state, followed by atrocities. Building a successful nation state seems to be a “win big, fail big” proposition, and both Yugoslavia and Syria failed. The West also had its failures leading up to and during the two World Wars, though with a happyish ending.

3. Syria also has become a playground for a proxy war between Iran and Saudi Arabia (among others). Being a playground for a proxy war is a bad place to be, just ask Vietnam, El Salvador, or Nicaragua. The mix of #2 and #3 accounts for many of the key features of the crisis, plus as conflict proceeds trust frays and human beings are brutalized, worsening the dynamic.

3b. The proxy war heated up due to a rising Iran, a falling Saudi Arabia, and the collapse of creative ambiguity over roles and responsibilities in what were previously buffer zones.

4. It is very hard to model ISIS, ISIL, Daesh, whatever you wish to call it (the most thoughtful approach I have seen is from Shadi Hamid). Maybe the group is one fraction crazies, one fraction semi-rational power brokers, and one fraction “momentum traders” who wanted higher status for their local terrorizing and never expected it to get this far and simply could not climb off and stop. It is hard for groups to back out of strategies which have delivered consistent institutional growth. In any case, I don’t think of the group as having transitive preferences, even in the intra-profile sense, much less the Arrovian inter-profile sense.

5. I view ISIS as “modern,” or even “hypermodern,” rather than a “return to barbarism.” The medieval Arabic world was more advanced than Europe in most ways, yet still Islamic ideologically.

6. Islam has the important secondary effect of tying Syria and other Middle Eastern conflicts to disaffected (Muslim) groups living in Western Europe, most of all France and Belgium. Labor market deregulation, people!

7. Islam has another significant effect. By melding the political and the theological, it renders the conflict more complex and harder to resolve, and that effect is fundamental to the ideological structure of Islam. It also helps motivate the proxy war sides taken by Iran (Shii’te) and the Saudis (Sunni). But note this: when the political order is not up for grabs, Islam does not have the same destabilizing effects. The merging of the legal and the theological therefore may create greater stability in some equilibria (e.g.,much of Ottoman history, the Gulf monarchies), while less stability in others.

8. The Laffer curve, resource extraction path of ISIS will weaken with time, causing a fiscal starvation and thus a further move toward mean-reducing, variance-increasing strategies.

9. This won’t end well. Now go read a book on the Taiping rebellion.

Your thoughts are welcome, please try to stick with the analytical and avoid posturing. And what Russia is up to in Syria is another mystery, best considered another time.

Opioids for the masses?

This has long seemed to me an understudied topic, so I was interested to read the job market paper of Angela E. Kilby, who is on the market this year from MIT. And she does what I like to see in a paper, namely try to figure out whether some practice or institution is actually worth it.

The background is this: “…In the face of concerns that undertreatment of pain was a “serious public health issue,” medically indicated use of these drugs over the past 15 years has increased dramatically, and attitudes have liberalized towards the use of opioids for chronic non-cancer pain.”

When it comes to the increased use of opioids, she finds the following trade-offs:

1. Since 1999, there has been a fourfold increase in drug overdose deaths linked to opiod pain relievers. In 2013, the number of opiate-linked overdose deaths was 25,117, a higher number than I was expecting. (But note that most of these can no longer be reduced by the feasible interventions under consideration.)

2. The increased use of opioids seems to pass a cost-benefit test, compared to the passage of a tougher Prescription Monitoring Plan. With a host of caveats and qualifiers, she measures the pain reduction and other benefits from looser regulation at $12.1 billion a year and the costs of higher addiction rates, again from looser regulation, at $7.3 billion per year.

There is much more to it than what I am reporting, and in general I believe economists do not devote enough attention to studying the topic of pain.