Category: Law

Tabarrok on China: World of DAAS Podcast

I was very pleased to appear on Safegraph CEO Auren Hoffman’s World of DAAS podcast. We covered lots of material including this (lightly edited) bit on China.

Auren Hoffman (23:06.518):

Now, you’ve thought a lot about things like reshoring, building manufacturing capacity. How do you think we could be thinking about that differently?

Alex (23:24.058)

I understand that there are some concerns about China, and there is an argument and I think it’s a legitimate argument, that there are some things such as chips that we want to make sure, it’s not good to have them located in Taiwan, right? We want to make sure that we onshore those. However, I have three concerns. One is, fundamentally, I don’t think China and the United States have such a clash of interest. Of course, it’s not perfect harmony, but there’s a lot of harmony of interest between China and the United States. We do lot of trade with China, which benefits both China and the United States.

..China’s getting richer Okay, people are worried because they’re getting more military whatever but also what this means is that people in China are getting cancer. Well now there’s 1 .4 billion people who want to cure for cancer, and they’re willing to put some money into it, right? And then that’s going to increase the amount of research and development for all kinds of high-tech goods, which is amazing for us. Like, I would be thrilled if an American wins the Nobel Prize for curing cancer. I would be 99.5 % as happy if a Chinese scientist wins a Nobel Prize for curing cancer.

So we have a lot to gain from a richer China. That’s point one. Point two is that, yeah, I get the idea that we want to onshore chip manufacturing, but I think we want to friendshore, right? So we don’t want to just have protection against all countries. Like I get it, okay, a hundred percent tariff on your Chinese EVs. It’s kind of crazy, but all right. However, let’s reduce tariffs on Germany.

Let’s reduce tariffs on Europe. In fact, let’s create a free trade, even a free immigration block among the Western democracies, you know, including Japan, Australia, New Zealand. So, let’s not turn a small problem in foreign policy, which is to make sure that we have a ready military supply. Let’s not turn that into trying to create a fortress America Which is going to make us poorer and actually less safe instead, you know, let’s build up the free world. Okay, let’s create an immigration and free trade with Europe and Canada and Mexico and so forth. Let’s build up the free world. That’s point two.

Point three is that look. It’s very, very easy to take a foreign policy argument and turn it into rent seeking for the benefit of special interests and protectionism for the benefit of special interests. Right? So at one point in the United States, probably even still today, you know, we were prohibiting mohair imports. Okay. Why? Because we use mohair to make military uniforms. The whole thing is ridiculous. But it’s very easy, almost inevitable, that this kind of argument is turned into a special interest trough.

I think this is one of my best podcast appearances because we covered some new material on crime, the universities, why Tyler and I are able to cooperate on so many projects, a conspiracy theory I believe and more. Listen to the whole thing.

US Human Experimentation Without Consent or Contract

In July 1946, 20-year-old Helen Hutchison walked into the Vanderbilt University prenatal clinic in Nashville, Tennessee. Helen found herself pregnant after her husband had returned from combat in World War II. The pregnancy, however, had not been easy. During her visit to the clinic Helen’s doctor handed her a small drink.

“What is it?” she asked.

“It’s a little cocktail,” her doctor replied. “It’ll make you feel better.”

“Well I don’t know if I should be drinking a cocktail,” she responded in jest.

“Drink it all. Drink it all down” (quoted in Welsome 1999, p. 220).Helen did as her doctor ordered.

Three months later Helen’s daughter, Barbara, was born. Not long after, Helen began to experience some frightening health problems; her face swelled, and her hair fell out. She then experienced two miscarriages, one of which necessitated 16 blood transfusions (Welsome 1999, p. 220). Baby Barbara experienced her own health problems from early childhood. She suffered from extreme fatigue and developed an autoimmune disorder and eventually skin cancer.

…Unbeknownst to Helen, she and her unborn baby had been subjects in a government-funded experiment. She was one of hundreds of women who received an experimental “cocktail” between 1945 and 1947 during one of their prenatal visits, compliments of the U.S. Atomic Energy Commission (AEC), which provided the materials (Wittenstein 2014, p. 39).

The 829 women of the Vanderbilt clinic were but a few of hundreds of thousands of individuals, mostly U.S. citizens, who would be subjected to illegal experiments and suffer human-rights violations during in the post-World War II period at the hands of scientists with funding and materials provided by the U.S. government. These experiments were meant to provide the government with information about the effects of atomic weapons on the human body to advance military capabilities in the name of “national security.”

This paper tells the story of U.S. government activities related to human experimentation after World War II.

That’s Coyne and Hall writing on Dr. Mengele, USA Style: Lessons from Human Rights Abuses in Post World War II America. It’s interesting that these immoral experiments using radiation and also agents of chemical warfare are less well known to the public than say the Tuskegee Study even though they involved far more people.

New data on marijuana legalization

That is the topic of my latest Bloomberg column, and here is one excerpt:

What do the numbers show? A new study from the Federal Reserve Bank of Kansas City offers some important keys toward an answer.

Start with the good news, or what appears to be the good news. Post-legalization, incomes in legalizing states grew by about 3%, home prices went up by 6%, and populations rose by about 2%. The researchers used appropriate statistical controls, but there is some question about causation vs. correlation. At the very least, it seems highly likely that state GDP went up: A state with legal marijuana can sell it, including to users in other states. Selling marijuana is a new business, and like any new business, it boosts the local economy.

But it is not so simple. Measures of GDP and GDP per capita are usually good metrics for human well-being — but not always. Cigarette sales, for instance, are not as beneficial for citizens as much as the initial GDP boost might indicate, because nicotine is bad for most people…

In states with legal marijuana, self-reported usage rose by 28%. Meanwhile, substance use disorders increased by 17%. Chronic homelessness went up by 35%, a possible sign that marijuana use leads to a downward financial spiral, and perhaps job loss, for many users. Arrests increased by 13%, although reported crime did not itself go up.

And in sum:

That said, these results are hardly a great advertisement for the legalization experiments. They stand in jarring contrast to what advocates promised: an end to black markets, safer marijuana and a better-protected user population. And if I may be allowed to think less like an economist for a moment, I confess I don’t feel good about a social practice that lowers effective IQ. No one smokes pot to perform better on their SATs.

I remain of two minds on the entire question.

Worth a ponder.

Schengen eroding, child legal arbitrage markets in everything

“We are increasing surveillance, in part to increase security, but also to prevent hired Swedish child soldiers who come to Copenhagen to carry out tasks in connection with gang conflicts,” he added.

Hummelgaard revealed on Thursday that there had been 25 incidents since April where Danish criminal gangs had hired what he called “child soldiers” to commit crimes in Denmark. In the last two weeks alone, Danish police have linked three shootings to Swedish teenagers…

Swedish police say that powerful criminal gangs often use children to commit murders as they will receive light sentences. Drug gangs — many of whom are led by second-generation immigrants now living outside the country — have infiltrated parts of the welfare, legal and political systems, meaning the fight against them could take decades, according to Swedish officials.

Here is more from Richard Milne at the FT. Elsewhere, “Brown bears are protected under EU law,” solve for the equilibrium (FT).

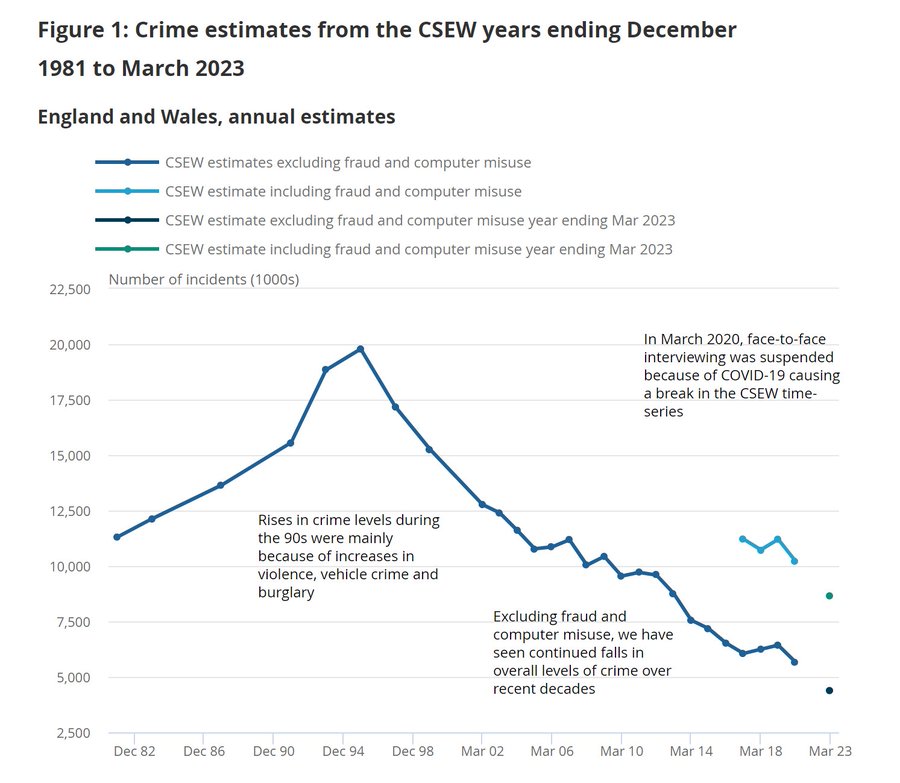

England and Wales fact of the day

Here is the source.

Shaping the Habits of Teen Drivers

Here is one new method to lower teen-age driving deaths:

We show that a targeted law can modify teens’ risky behavior. We examine the effects of an Australian intervention banning first-year drivers from driving late at night with multiple peers, which had accounted for one-fifth of their traffic fatalities. Using data on individual drivers linked to crash outcomes, we find the reform more than halves targeted crashes, casualties and deaths. There are large positive spillovers through lower crashes earlier in the evening and beyond the first year, suggesting broad and persistent declines in high-risk driving. Overall, the targeted intervention delivers gains comparable to harsher restrictions that delay teen driving.

That is by Timothy J. Moore and Todd Morris in American Economic Journal: Economic Policy.

Approval timelines really matter for housing

We provide credible estimates of the effect of duration and uncertainty in local regulatory approval times on the rate of housing production. The analysis derives from a novel dataset of development timelines for all multifamily housing projects permitted in the City of Los Angeles between 2010 and 2022. As a lower bound, simply by pulling forward in time the completion of already started projects, we estimate that reductions of 25% in approval time duration and uncertainty would increase the rate of housing production by 11.9%. If we also account for the role of approval times in incentivizing new development, we estimate that the 25% reduction in approval time would increase the rate of housing production by a full 33.0%. Both the expected value and the uncertainty in approval times are salient to incentivizing new development. The results provide new evidence that local approval processes are a significant driver of housing supply and reinforce the notion that municipal regulatory reform is an important component of housing reform.

That is from a new research paper by Stuart Gabriel and Edward Kung, via the excellent Kevin Lewis. Speed also influences total supply! (rooftops)

Rent Control Reduces New Development: Bug or Feature?

The minimum wage will tend to increase unemployment among low-skill workers, often minorities. To many people that’s an argument against the minimum wage. But to progressives at the opening of the 20th century that was an argument for the minimum wage–progressive’s demanded minimum wages to get women and racial minorities out of the work force.

Something similar may be happening with rent control. Rent control reduces new development. Bug or feature? California Republican Tony Strickland argues that reduced development is a feature. New state laws in California prevent cities from restricting development but if rent control was legal cities could be used it to do the same thing just by making it unprofitable to build.

Politico: Strickland said Weinstein’s rent control measure [allowing cities to use rent control] would block “the state’s ability to sue our city” because Huntington Beach could slap steep affordability requirements on new, multi-unit apartment projects that are now exempt from rent control. Such requirements, he argued, could stop development that would “destroy the fabric” of the town’s quaint “Surf City” vibe…. “It gives local governments ironclad protections from the state’s housing policy and therefore overreaching enforcement.”

“On paper, it would be legal to build new homes. But it would be illegal, largely speaking, to make money doing so,” said Louis Mirante…

Hat tip: Ben Krauss at Slow Boring.

Markets in Everything: Fentanyl Precursors

Reuters: To learn how this global industry works, reporters made multiple buys of precursors over the past year. Though a few of the sales proved to be scams, the journalists succeeded in buying 12 chemicals that could be used to make fentanyl, according to independent chemists consulted by Reuters. Most of the goods arrived as seamlessly as any other mail-order package. The team also procured secondary ingredients used to process the essential precursors, as well as basic equipment – giving it everything needed to produce fentanyl.

The core precursors Reuters bought would have yielded enough fentanyl powder to make at least 3 million tablets, with a potential street value of $3 million – a conservative estimate based on prices cited by U.S. law enforcement agencies in published reports over the past six months.

The total cost of the chemicals and equipment Reuters purchased, paid mainly in Bitcoin: $3,607.18.

I don’t doubt that Reuters did what they say they did. I have trouble believing, however, that the implied profit margins are so high. A gram of cocaine costs about $160 on the street and $13 to $70 trafficked into the US and ready to sell. Thus, the street price to production cost is at most 12:1 and perhaps as low as 2.3:1. Note that this profit margin includes the costs of jail etc. I think Reuters overestimates fentanyl street prices by a factor of 2 which would still give a ratio of 415:1 which is way too high. Let’s say fentanyl sells for $1.5 million on the street then to get the ratio to a very generous 20:1 we need costs of $75,000 so my guess is that Reuters has underestimated costs by a significant amount in some manner.

Happy to receive clarification or verification from those with more expertise in the business.

I do accept Reuters point that fentanyl is cheap and easy to produce.

The whole story is excellent.

Overturn Euclid v. Ambler

An excellent post from Maxwell Tabarrok at Maximum Progress:

On 75 percent or more of the residential land in most major American cities it is illegal to build anything other than a detached single-family home. 95.8 percent of total residential land area in California is zoned as single-family-only, which is 30 percent of all land in the state. Restrictive zoning regulations such as these probably lower GDP per capita in the US by 8–36%. That’s potentially tens of thousands of dollars per person.

The legal authority behind all of these zoning rules derives from a 1926 Supreme Court decision in Village of Euclid v. Ambler Realty Co. Ambler realty held 68 acres of land in the town of Euclid, Ohio. The town, wanting to avoid influence, immigration, and industry from nearby Cleveland, passed a restrictive zoning ordinance which prevented Ambler realty from building anything but single family homes on much of their land, though they weren’t attempting to build anything at the time of the case.

Ambler realty and their lawyer (a prominent Georgist!) argued that since this zoning ordinance severely restricted the possible uses for their property and its value, forcing the ordinance upon them without compensation was unconstitutional.

The constitutionality claims in this case are about the 14th and 5th amendment. The 5th amendment to the United States Constitution states, among other things, that “private property [shall not] be taken for public use, without just compensation.” The part of the 14th amendment relevant to this case just applies the 5th to state and local governments.

The local judge in the case, who ruled in favor of Ambler (overturned by the Supreme Court), understood exactly what was going on:

The plain truth is that the true object of the ordinance in question is to place all the property in an undeveloped area of 16 square miles in a strait-jacket. The purpose to be accomplished is really to regulate the mode of living of persons who may hereafter inhabit it. In the last analysis, the result to be accomplished is to classify the population and segregate them according to their income or situation in life … Aside from contributing to these results and furthering such class tendencies, the ordinance has also an esthetic purpose; that is to say, to make this village develop into a city along lines now conceived by the village council to be attractive and beautiful.

Note that overturning Euclid v. Ambler would not make zoning in the interests of health and safety unconstitutional. Indeed, it wouldn’t make any zoning unconstitutional it would just mean that zoning above and beyond that required for health and safety would require compensation to property owners.

Read the whole thing and subscribe to Maximum Progress.

Not Lost In Translation: How Barbarian Books Laid the Foundation for Japan’s Industrial Revoluton

Japan’s growth miracle after World War II is well known but that was Japan’s second miracle. The first was perhaps even more miraculous. At the end of the 19th century, under the Meiji Restoration, Japan transformed itself almost overnight from a peasant economy to an industrial powerhouse.

After centuries of resisting economic and social change, Japan transformed from a relatively poor, predominantly agricultural economy specialized in the exports of unprocessed, primary products to an economy specialized in the export of manufactures in under fifteen years.

In a remarkable new paper, Juhász, Sakabe, and Weinstein show how the key to this transformation was a massive effort to translate and codify technical information in the Japanese language. This state-led initiative made cutting-edge industrial knowledge accessible to Japanese entrepreneurs and workers in a way that was unparalleled among non-Western countries at the time.

Here’s an amazing graph which tells much of the story. In both 1870 and 1910 most of the technical knowledge of the world is in French, English, Italian and German but look at what happens in Japan–basically no technical books in 1870 to on par with English in 1910. Moreover, no other country did this.

Translating a technical document today is much easier than in the past because the words already exist. Translating technical documents in the late 19th century, however, required the creation and standardization of entirely new words.

…the Institute of Barbarian Books (Bansho Torishirabesho)…was tasked with developing English-Japanese dictionaries to facilitate technical translations. This project was the first step in what would become a massive government effort to codify and absorb Western science. Linguists and lexicographers have written extensively on the difficulty of scientific translation, which explains why little codification of knowledge happened in languages other than English and its close cognates: French and German (c.f. Kokawa et al. 1994; Lippert 2001; Clark 2009). The linguistic problem was two-fold. First, no words existed in Japanese for canonical Industrial Revolution products such as the railroad, steam engine, or telegraph, and using phonetic representations of all untranslatable jargon in a technical book resulted in transliteration of the text, not translation. Second, translations needed to be standardized so that all translators would translate a given foreign word into the same Japanese one.

Solving these two problems became one of the Institute’s main objectives.

Here’s a graph showing the creation of new words in Japan by year. You can see the explosion in new words in the late 19th century. Note that this happened well after the Perry Mission. The words didn’t simply evolve, the authors argue new words were created as a form of industrial policy.

By the way, AstralCodexTen points us to an interesting biography of a translator at the time who works on economics books:

[Fukuzawa] makes great progress on a number of translations. Among them is the first Western economics book translated into Japanese. In the course of this work, he encounters difficulties with the concept of “competition.” He decides to coin a new Japanese word, kyoso, derived from the words for “race and fight.” His patron, a Confucian, is unimpressed with this translation. He suggests other renderings. Why not “love of the nation shown in connection with trade”? Or “open generosity from a merchant in times of national stress”? But Fukuzawa insists on kyoso, and now the word is the first result on Google Translate.

There is a lot more in this paper. In particular, showing how the translation of documents lead to productivity growth on an industry by industry basis and a demonstration of the importance of this mechanism for economic growth across the world.

The bottom line for me is this: What caused the industrial revolution is a perennial question–was it coal, freedom, literacy?–but this is the first paper which gives what I think is a truly compelling answer for one particular case. Japan’s rapid industrialization under the Meiji Restoration was driven by its unprecedented effort to translate, codify, and disseminate Western technical knowledge in the Japanese language.

Every Stock is a Vaccine Stock, Revisited

In May 2020, I wrote a post titled Every Stock is a Vaccine Stock highlighting that the stock market reaction to good vaccine news indicated that vaccines were worth trillions and that most of this value was external to the vaccine manufacturers, meaning that the vaccine manufacturers were under-incentivized.

It’s not surprising that when Moderna reports good vaccine results, Moderna does well. It’s more surprising that Boeing and GE not only do well they increase in value far more than Moderna. On May 18, for example, when Moderna announced very preliminary positive results on its vaccine it’s market capitalization rose by $5b. But GE’s market capitalization rose by $6.82 billion and Boeing increased in value by $8.73 billion.

A cure for COVID-19 would be worth trillions to the world but only billions to the creator. The stock market is illustrating the massive externalities created by innovation. Nordhaus estimated that only 2.2% of the value of innovation was captured by innovators. For vaccine manufacturers it’s probably closer to .2%.

Who can internalize the externalities? Moderna clearly can’t because if they could then on May 18 Moderna would have increased in value by $20.52b ($4.97b+$6.82b+$8.73b) and GE and Boeing wouldn’t have gone up at all. Massive externalities.

A clever institutional investor like Blackrock or Vanguard could internalize some of the externalities by encouraging Moderna to work even faster and invest even more, even to the extent of lowering Moderna’s profits. Blackrock would more than make up for the losses on Moderna by bigger gains on other firms in its portfolio. Blackrock does indeed understand the incentives, although its unclear how much beyond jawboning they can actually do, legally.

I’d like to see more innovation in mechanisms to internalize externalities–perhaps in a pandemic vaccine firms should be given stock options on the S&P 500. Until we develop those innovations, however, the government is the best bet at internalizing the externality by paying vaccine manufacturers to increase capacity and move more quickly than their own incentives would dictate. Billions in costs, trillions in benefits.

A new paper by Acharya, Johnson, Sundaresan and Zheng formulizes this intuition. The authors combine a model of preferences in which uncertainty can be priced with an estimate of the stock market reaction to vaccine news and conclude that “ending the pandemic would have been worth from 5% to 15% of total wealth”.

One measure of the ex ante cost of disasters is the welfare gain from shortening their expected duration. We introduce a stochastic clock into a standard disaster model that summarizes information about progress (positive or negative) toward disaster resolution. We show that the stock market response to duration news is essentially a sufficient statistic to identify the welfare gain to interventions that alter the state. Using information on clinical trial progress during 2020, we build contemporaneous forecasts of the time to vaccine deployment, which provide a measure of the anticipated length of the COVID-19 pandemic. The model can thus be calibrated from market reactions to vaccine news, which we estimate. The estimates imply that ending the pandemic would have been worth from 5% to 15% of total wealth as the expected duration varied in this period.

Update on the Supervillains (maybe that’s you)

The law’s price controls will also deter companies from developing new medicines. A study I co-authored estimated that 135 fewer drugs will come to market through 2039 because of the Inflation Reduction Act. Research firm Vital Transformation’s forecast is even bleaker, predicting that the U.S. could lose 139 drugs within the next decade.

Dozens of life-sciences companies have announced cuts to their research and development pipelines because of the 2022 law. These announcements have come in earnings calls and filings with the Securities and Exchange Commission—where deliberate misstatements would expose executives to civil and criminal penalties—so they can’t be chalked up to political posturing.

That is from Tomas Philipson at the WSJ. It is worth noting this kind of academic research has not been effectively rebutted, rather what you usually hear in response is a bunch of snarky comments about Big Pharma and the like.

And to repeat myself yet again: if you are ever tempted to cancel somebody, ask yourself “do I cancel those who favor tougher price controls on pharma? After all, they may be inducing millions of premature deaths.” If you don’t cancel those people — and you shouldn’t — that should broaden your circle of tolerance more generally.

U.S: elevators are much more expensive

Behind the dearth of elevators in the country that birthed the skyscraper are eye-watering costs. A basic four-stop elevator costs about $158,000 in New York City, compared with about $36,000 in Switzerland. A six-stop model will set you back more than three times as much in Pennsylvania as in Belgium. Maintenance, repairs, and inspections all cost more in America too.

The first thing to notice about our elevators is that, like many things in America, they are huge. New elevators outside the U.S. are typically sized to accommodate a person in a large wheelchair plus somebody standing behind them. American elevators have ballooned to about twice that size, driven by a drip-drip-drip of regulations, each motivated by a slightly different concern — first accessibility, then accommodation for ambulance stretchers, then even bigger stretchers.

Deep roots, the persistent legacy of slavery on free labor markets

To engage with the large literature on the economic effects of slavery, we use antebellum census data to test for statistical differences at the 1860 free-slave border. We find evidence of lower population density, less intensive land use, and lower farm values on the slave side. Half of the border region was half underutilized. This does not support the view that abolition was a costly constraint for landowners. Indeed, the lower demand for similar, yet cheaper, land presents a different puzzle: why wouldn’t the yeomen farmers cross the border to fill up empty land in slave states, as was happening in the free states of the Old Northwest? On this point, we find evidence of higher wages on the slave side, indicating an aversion of free labor to working in a slave society. This evidence of systemically lower economic performance in slavery-legal areas suggests that the earlier literature on the profitability of plantations was misplaced, or at least incomplete.

That is from a new NBER working paper by Hoyt Bleakley and Paul Rhode.