Category: Uncategorized

Friday assorted links

1. “Given these results, we show that it may be optimal to visit restaurants in a zigzag that alternates between high- and low-quality choices.” I am not endorsing that one!

2. Jordan Schneider podcast has Larry Summers on China.

3. Is your “aha!” moment actually the announcement of a meta-cognition prediction error?

4. Long Twitter thread on Maimonides.

5. Immunological dark matter hypothesis is being revived. And what might the Delta wave look like in the U.S.?

6. Louis Andriessen, RIP (NYT): “Mr. Andriessen wrote that in Mr. Greenaway’s films, “I recognize something of my own work, namely the combination of intellectual material and vulgar directness.””

Haiti fact of the day

Democratic governance is eroding in Haiti, but through an unusual mechanism — an ongoing diminution [The Economist] in the number of federally elected officials:

Today there are only 11 nationally-elected officials, including him [Jovenel Moïse].

A parliamentary election had been scheduled for October 2019, but it was never held. The current president refers to himself as “Après Dieu” [second only to God], and also “Banana Man,” as he is a former plantation manager. Solve for the equilibrium.

Market fragmentation can boost liquidity

We model a simple market setting in which fragmentation of trade of the same asset across multiple exchanges improves allocative efficiency. Fragmentation reduces the inhibiting effect of price-impact avoidance on order submission. Although fragmentation reduces market depth on each exchange, it also isolates cross-exchange price impacts, leading to more aggressive overall order submission and better rebalancing of unwanted positions across traders. Fragmentation also has implications for the extent to which prices reveal traders’ private information. While a given exchange price is less informative in more fragmented markets, all exchange prices taken together are more informative.

That is a new American Economic Review piece by Daniel Chen and Darrell Duffie. My slight rewording of their argument is this: with market fragmentation, you can split up your order across exchanges and thus submit more total orders, with less fear of the prices moving against you. Fair enough, but what does this mean for the supposed greater efficiency of a single medium of exchange? Might there be reasons why a multitude of exchange/payment media, including foreign currencies and crypto, could give you further liquidity?

#NewMonetaryEconomics

*Syndromes and a Century* (with spoilers, but the movie is not about suspense)

By Thai director Apichatpong Weerasethakul, this film pushes the idea that modernity is the truly strange phenomenon, not ancient religion or what we like to call pre-modern times. The pre-modern is represented by the two monks in their orange robes, and their direct, down-to-earth manner. The supposedly modern is represented by various doctors in their white suit coats, which look suspiciously like the robes of the monks. Only that the orange is much more pleasant. The monks are repeatedly puzzled by their interactions with the modernized Thai medical establishment, which, as it turns out, has taken ritual to new and unprecedentedly baroque and artificial heights.

The contemporary world is shown in ever stranger terms, from a variety of perspectives, whether the subject be power plants or artificial limbs, monks flying a toy spaceship, or a pipe sucking in steam, shaped suspiciously like an elephant’s trunk, albeit without the dignity. The ritual dance closing the film — held in park with a boom box and people in shorts — seems senseless and without meaning.

And yes, the contemporary world is more rationalistic in a variety of ways, but why not look at the true human fundamentals — life and death — as represented by the world of medicine, to see if that rationalism holds up? Alas.

Is there any director better at making you rethink the modern world and see its fundamental strangeness than Apichatpong Weerasethakul? You need to try Uncle Boonmee too.

I saw this one with Nabeel! And on the big screen (we rented out a theater). And he sent me this interesting review of the movie.

Thursday assorted links

2. New youngest chess grandmaster in history is 12 years old and lives in New Jersey. Father is a software engineer, Indian background.

3. Today’s central bank digital currency status. And Timothy Taylor on CBDC.

5. Forthcoming book: We Have Never Been Woke, looks great, sign up to receive notification of pre-order!

6. Mishnah on the Cowen-Deutsch CWT.

7. ““You’re never going to beat a kid’s adrenaline rush off a riot. You’re not going to stop them,” says Michael Logan, an 18-year-old who works part-time at Townsend Outreach Centre, a youth centre off the loyalist stronghold of the Shankill Road.” (FT link)

The replacement service for Feedburner

I am told:

“Those of you who receive Feedburner email notifications may cease receiving them in the next few days. If you would like to continue receiving these email notifications, please sign up for our new service here, which will be up and running in the next few days.”

All other RSS stays the same. There you go!

Afghanistan Dept. of Uh-Oh

We find a significant, sharp, and timely decline of insurgent violence in the initial phase: the security transfer to Afghan forces. We find that this is followed by a significant surge in violence in the second phase: the actual physical withdrawal of foreign troops. We argue that this pattern is consistent with a signaling model, in which the insurgents reduce violence strategically to facilitate the foreign military withdrawal to capitalize on the reduced foreign military presence afterward.

Here is the full research article by Thiemo Fetzer, et.al.

Straussian Beatles cofounders — We Can’t Work It Out

The Beatles 1965 song “We Can Work It Out” typically is taken as a tale of harmonious cooperation, a kind of precursor to “All You Need is Love,” but expressing the ability of the Beatles to work together toward productive outcomes and furthermore to stay united as friends. (All before the bitter split of course.) Well, if you know a bit about the Beatles (and Strauss) that isn’t exactly how it is presented in the actual tune. There are plenty of esoteric references in Beatle songs and solo Beatle songs, and I don’t just mean drug lingo or “Paul is dead” clues.

As background, you do need to know that Paul was the group’s workaholic, and John, while an immense talent, was, um…not the group’s workaholic. Paul also was renowned as a master of passive-aggressive threats, all the way keeping up the smile and charm and the perfect demeanor. The song reflects this dynamic. It is basically Paul singing that we really have to do things his way, and John singing back “complaints of surrender.” Let’s now turn to the song, with my annotations throughout in brackets:

Paul singing cheerily:

Try to see it my way

Do I have to keep on talking ’til I can’t go on? [I’m going to keep on bugging you until you give in]

While you see it your way

Run the risk of knowing that our love may soon be gone [Escalation: I am willing to threaten you over this one and go to the mat]

We can work it out [You’re going to give in to me]

We can work it out [You really are going to give in, believe me on this one]

Think of what you’re saying

You can get it wrong and still you think that it’s alright [You don’t know what you are doing in the studio the way I do]

Think of what I’m saying

We can work it out and get it straight, or say good night [we really do need to put more time in on this one]

We can work it out

We can work it out [my way]John singing in plaintive minor key:

Life is very short, and there’s no time [Can we just go home now?]

For fussing and fighting, my friend [I’m tired of all this, aren’t you supposed to be on my side?]

I have always thought that it’s a crime [The bickering is mainly your fault, and yes it is really terrible]

So, I will ask you once again…Paul interrupts, again singing cheerily:

Try to see it my way [I’m really not giving up on this one]

Only time will tell if I am right or I am wrong [Last time you did it my way the song was a big hit, in fact every time…]

While you see it your way

There’s a chance that we might fall apart before too long [more passive-aggressive threats]

We can work it out

We can work it out

An excellent song, both musically and lyrically, but not always appreciated for its full subtleties. It is clear that Paul ends up getting his way, and that is how they “work it out.” Paul increasingly exerted his will in the studio, leading the Beatles to produce such classics as Sgt. Pepper and Abbey Road, whereas John had been the more dominant influence on earlier albums such as Hard Day’s Night. The Beatles, of course, split up five years later and were in tatters well before that.

The separating equilibrium (a ban by any other name?)

Governor Ron DeSantis would not let cruise ships sailing from Florida mandate vaccination? Well, this is what you end up with:

Now we know the true cost of not getting vaccinated for COVID-19: You won’t be able to order sushi when cruising on Royal Caribbean‘s Freedom of the Seas.

Here is a list of all the other restrictions for the unvaccinated cruise passengers. Via Stephen Jones.

Wednesday assorted links

1. More. Please forgive the source and the pop-ups.

2. Those new service sector jobs: the rising number of dog lawyers in Canada.

3. The decentralized origin of standard weights.

4. The longer-term economic consequences of pandemics, over 220 years.

5. Why Africa’s island states are generally freer (The Economist).

6. Transient pacemaker that dissolves harmlessly in your body. And another step toward a pancoronavirus vaccine.

My Conversation with Richard Prum

Prum is an ornithologist at Yale, here is the audio, video, and transcript. Here is part of the summary:

Richard joined Tyler to discuss the infidelity of Australian birds, the debate on the origins of avian flight, how the lack of a penis explains why birds are so beautiful, why albatrosses can afford to take so many years to develop before mating, the game theory of ornithology, how flowers advertise themselves like a can of Coke, how modern technology is revolutionizing bird watching, why he’s pro-bird feeders yet anti- outdoor cats, how scarcity predicts territoriality in birds, his favorite bird artist, how Oilbirds got their name, how falcons and cormorants hunt and fish with humans, whether birds exhibit a G factor, why birds have regional accents, whether puffins will perish, why he’s not excited about the idea of trying to bring back passenger pigeons, the “dumb question” that marks a talented perspective ornithologist, and more.

Here is one excerpt:

COWEN: Putting path dependence aside, if you were trying to give us the most fundamental explanation of why sexual dimorphism is different in birds compared to mammals, what would that be?

PRUM: Well, that’s actually a really big question. [laughs]

COWEN: Of course, but the most fundamental factor — what is it?

PRUM: The most fundamental factor is that most birds don’t have a penis.

COWEN: Talk me through the equilibrium there.

PRUM: [laughs] There’s a lot. That’s where we start: Most birds don’t have a penis, which means that one of the things that happens in avian evolution that’s distinct from mammals is that the kids require a lot of care. They’re growing up in the nest, they’re hatching out of an egg, but they’re very, very vulnerable until they can fly.

Birds have a very rapid period of rapid development. That means that they grow up and leave the nest, and you need two parents to do that efficiently in most diets or most kinds of ecologies. That means the dad’s got to be at the nest.

We usually thought that you have social monogamy, at least two birds helping raise the young, because the young are so needy and they have to grow up quickly. But there’s another possibility, which is that they could evolve to be so needy and grow up quickly because they managed to get males at the nest.

One of the things that happened in the phylogeny of birds — you’ve got ostriches and their relatives, and you’ve got chickens and ducks, and then you’ve got the rest of birds, and that’s a bunch. That’s the vast majority of them, and in that lineage leading to the rest of birds, the penis evolved away, and the question is why. My own theory is that female birds preferred mates that did not have a penis.

One of the ancillary benefits of that, one of the correlated benefits of that is that they were no longer subject to sexual coercion or sexual violence. They could be coerced behaviorally, but they couldn’t be forcibly fertilized. That means that they have freedom of choice, and what do they do with their freedom of choice? They choose beauty. One of the reasons why birds are so beautiful is that males don’t have a penis. They have to be subject to choice in order to effect reproduction, and also they have to invest if females require it.

COWEN: Now, sometimes albatrosses don’t breed until they’re 20 years old or even, on average, maybe it’s what — 10 years old. What are they doing in the meantime that’s so important?

PRUM: Well, that is a deep question.

Recommended, this was one of my favorite CWT episodes.

A problem in nuclear waste semiotics

Via Richard Harper, this thread asks how you might warn very future people away from a nuclear waste site. Alexandra Erin wrote:

An easy way to understand the problem of nuclear waste storage semiotics is to imagine what kind of warning could have been on an Egyptian tomb that would have kept Howard Carter from robbing it.

Here is some background material on how people are thinking about the problem at Yucca Mountain. Here is a Wikipedia page on different signs and options. Alex suggests color-changing cats.

I would think the question of how to inform a super-advanced civilization is a manageable one, at least if they have any patience at all. Simply explain the whole truth in plain English, and give them enough English text, in durable micro form if needed, so they can unlock the secrets of English. Also put up some images of radioactive decay. Skull and crossbones may not mean so much to them.

What about our possible “Mad Max” descendants? Of course that scenario means our own civilization has in some manner perished, so it is not a totally optimistic prognosis for human prudence. So why think some silly red signs will make much of a difference? After all, just try today to talk people out of alcohol. Good luck.

So instead my mischievous thoughts turn to finance theory and portfolio diversification. If the nuclear waste site is truly remote and previously unobserved and undiscovered, why not put something really good in there as recompense?

A seed bank. Copies of The Great Books. The text of the United States Constitution. Proofs of Newton’s Laws. Einstein’s theory of relativity (maybe wait on that one?…) Design for a better medieval water wheel. Compositions of Beethoven and Mozart. Translation advice, some of it pictorial. And so on. Surely some of it will be useful, sooner or later.

Which is further reason why all of your ideas are less likely to work. You can’t credibly commit to not giving people insurance against their bad decisions — just ask the Fed!

Bulletin: a more than marginal boost for Marginal Revolution

We are proud to announce that Marginal Revolution now exists on a second site as well, affiliated with Facebook, at marginalrevolution.bulletin.com.

We are excited to be part of this new project, called Bulletin. Please note that marginalrevolution.bulletin.com will be fully free and open, just as the current site is.

If you prefer to stay here, you can do so — no need to make any changes. RSS, Twitter feed, email service, everything remains intact. Or if you prefer it over there, that is great too. Facebook obviously has a reputation for producing great software, and we look forward to seeing what they can do with this project. Many other content creators have been recruited for this venture, they will have their own Bulletin sites, and we will tell you more about them soon.

We are keen to see our ideas and writings brought to new audiences, and our new partnership with Facebook will enable this. So far they have been great to work with, and we will be able to continue with our fully independent status.

We are also delighted to see that some of you will have the opportunity to comment on two different sites, not just one.

Onwards and upwards! We are in this for the long haul.

And as always, we thank you all for reading.

Tuesday assorted links

1. Quarles skeptical about a CBDC.

2. Ransomware hackers building their own VC system.

3. Why is American infrastructure so expensive?

4. Mas-Colell update (in Spanish), here in English. Judgment rendered, and he (joint with Mas, if I understand correctly) has to put up a bond of over two million euros and later stand trial, possibly to be found liable for that sum.

5. Amazing how cheap this Courbet is (other Old Masters too).

6. I feel I’ve been in advance of this trend. Non-believer intellectuals on the Right who pay heed to religion as a cultural foundation.

7. Nintil on California wildfires, very good post.

The Pandemic JOLTS

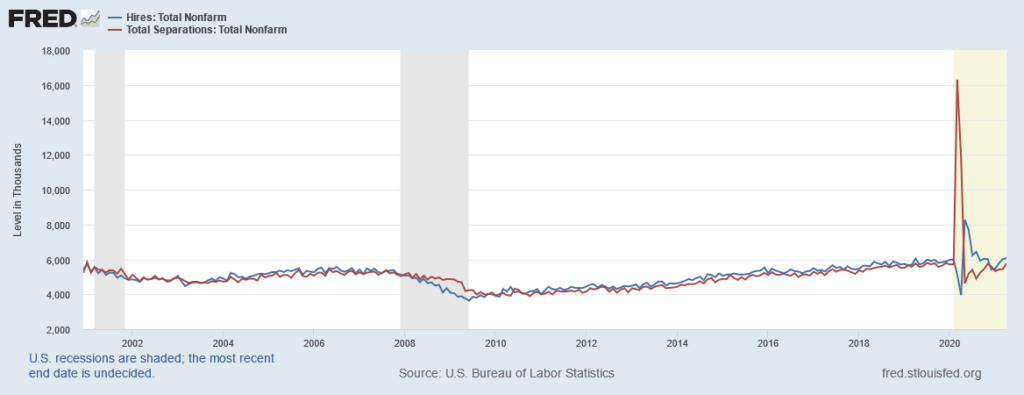

The 2009 recession was big but it followed a very familiar pattern–job separations were a little bit larger than job hires and this lasted for a little less than year which drove up unemployment rates. Unemployment rates then declined slowly as hires became a little bit larger than separations. Now look at the pandemic recession! Separations triple from normal–absolutely unprecedented. Hires then rebound at a slower rate than separations but at a much faster rate than in any previous recession (I haven’t bothered correcting for population since the differences are so large.)

I don’t know entirely what to make of this but we are still debating the Great Depression and the Great Recession so the Pandemic Recession will provide data and questions for a generation of economists. Why, for example, are supply shocks seemingly so much easier for an economy to handle than demand shocks? And why are some demand shocks worse than others? The dot com bust was at least as big a decline in wealth than the housing bust in 2009 but the latter resulted in a much bigger recession. How much was due to policy? How much was due to the fact that the financial system wasn’t so involved in the dot com bust or the pandemic recession? Finance often seems like it doesn’t do so much but why then do things go so badly when the financial system is impeded?