How long does it take mammals to learn the optimal commute?

Here is just one bit from a fascinating article, most of which concerns bears learning to use a road overpass:

But over the years, critics and transportation planners, even some environmentalists have groused about the idea: Taxpayer money, building overpasses for bears? Is that really necessary? Would they even use the things? Researchers have been methodically studying the crossings since 1996 to answer this. And it turns out that, yes, animals deterred by fencing that now runs the full 70-kilometer length of the highway in the park actually cross the road an awful lot like a rational pedestrian would. It takes them a while, though, to adapt to the crossings after a new one is constructed: about four to five years for elk and deer, five to seven years for the large carnivores.

The full piece is here, and for the pointer I thank Philip Wallach.

Spying on your loved ones? (or what you don’t know can’t hurt you?)

National Security Agency officers on several occasions have channeled their agency’s enormous eavesdropping power to spy on love interests, U.S. officials said.

The practice isn’t frequent — one official estimated a handful of cases in the last decade — but it’s common enough to garner its own spycraft label: LOVEINT.

Here is more.

Singapore has a very low wage share

Singapore has one of the highest GDP per capita in the world. However, our wage share of GDP (at around 43 per cent) is lower than the shares of most developed economies (at 50 per cent or more).

Of course Singapore is one of the wealthiest countries in the world.

You will find a variety of interesting graphs at this pdf link. That is from the Economic Survey of Singapore, more here.

Assorted links

1. World’s first bulletproof couch.

2. Replacing a soccer coach doesn’t seem to matter.

3. Using drones to fight mosquitoes.

4. How to mail a cockroach (pdf), background here.

5. Should Japan opt for more flexible, freer markets?

6. Various claims about various workplaces, interesting, some speculative, includes HFT too.

The Value of a CEO

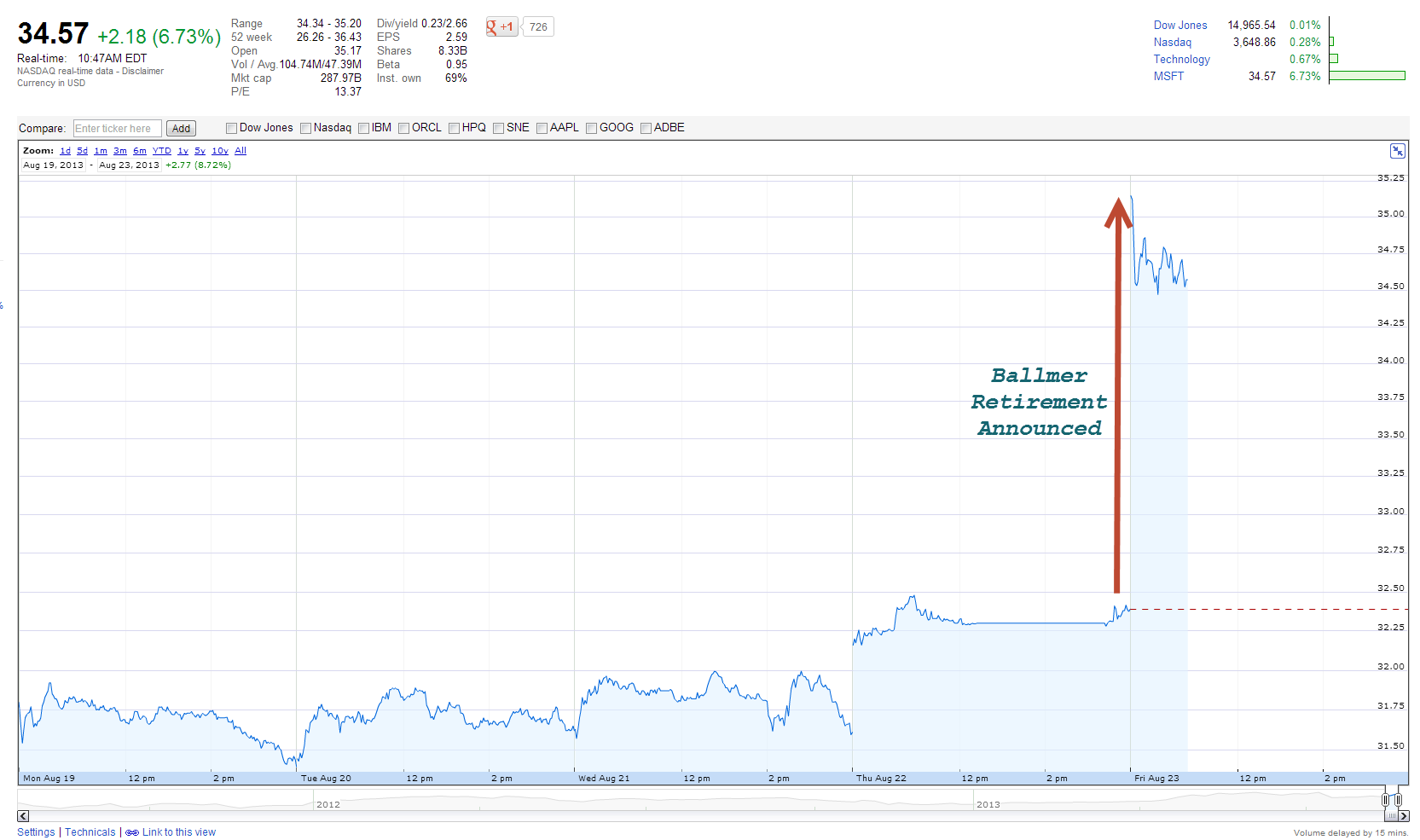

Steven Ballmer announced today that he would retire. Microsoft stock shot up immediately by ~$2.18 or 6-7%. Given 8.33 billion shares outstanding that’s an increase in value of about $18 billion dollars. Of course that’s embarrassing for Ballmer but the lesson cuts both ways. If Ballmer’s exit and replacement with an unknown is worth $18 billion then hiring the right CEO at $27 million annually, the average annual pay for the 100 highest paid CEOs in America, looks like a bargain. Small differences are a big deal for large corporations, you know like a marginal… something or other.

Hat tip: Justin Wolfers.

An update on labor market polarization

Here is Mark Thoma quoting Josh Lehner:

What we see here is strong job growth at both the top and bottom ends of the wage spectrum. Yes, food preparation and personal care account for a disproportionately large share of jobs gained in recent years, but so too have business and financial services, healthcare practitioners, computer and mathematical occupations and management. Where we have seen slower growth is in the middle. The light blue bars, which I term lower middle-wage jobs account for about 40% of all occupations in 2012 yet account for just 26% of the growth. The dark blue bars, which I term upper middle-wage jobs, account for another 19% of all occupations and 0% of the growth. This, by definition, is job polarization.

There are useful pictures at the link.

Why has growth in per capita Medicare spending slowed down?

There is a new CBO study, which I have not read, but which is noteworthy virtually by definition. The abstract is here:

Growth in spending per beneficiary in the fee-for-service portion of Medicare has slowed substantially in recent years. The slowdown has been widespread, extending across all of the major service categories, groups of beneficiaries that receive very different amounts of medical care, and all major regions. We estimate that slower growth in payment rates and changes in observable factors affecting beneficiaries’ demand for services explain little of the slowdown in spending growth for elderly beneficiaries between the 2000–2005 and 2007–2010 periods. Specifically, available evidence does not support a finding that demand for health care by Medicare beneficiaries was measurably diminished by the financial turmoil and recession. Instead, much of the slowdown in spending growth appears to have been caused by other factors affecting beneficiaries’ demand for care and by changes in providers’ behavior. We discuss the contribution that those factors may have made to the slowdown in spending growth and the difficulties in quantifying those influences and predicting their persistence.

The full paper (pdf) is here.

Amazon will offer free shipping to Singapore (and India)

Matt will be excited:

Popular online shopping site Amazon now provides free shipping to Singapore.

As long as shoppers in the country make a purchase of SGD$160 (USD$125) or over, they will be entitled to this free shipping under the site’s “Free AmazonGlobal Saver Shipping” program.

This new privilege, which also applies to consumers in India, was announced on the website on Friday.

The qualified amount to be spent by shoppers for the free shipping does not include import fees, gift-wrap charges, duties and taxes.

The free shipping is only provided to online shoppers purchasing goods sold directly by Amazon and not by their third party retailers.

The goods purchased must also be eligible for the AmazonGlobal program, which makes up a majority of the site’s product catalog, ranging from automotive products, electronics and jewelry to name a few.

However, shoppers need to make sure that the goods to be shipped do not exceed 20lbs. (9 kg) or they will not qualify for the free shipping service.

The link is here.

*Affordable Excellence*

The author is William A. Haseltine, the subtitle is The Singapore Health System, and the Kindle edition is itself an…affordable excellence at $0.00.

This book is a clear first choice on the Singapore health system and everyone interested in health care economics, or Singapore, should read it. It is short, clear, and to the point. And anyone interested in public policy or fiscal policy must, these days, be interested in health care economics.

Singaporeans have some of the best health care outcomes in the world and yet the system consumes only four (!) percent of gdp. Here is one short bit:

Private expenditure in Singapore amounted to around 65 percent of the total national expense (2008). Note that this includes payments out of the government-run MediShield scheme and related insurance schemes, MediSave accounts, and other private insurance schemes or employer-provided medical benefits. The figure for the United States is 52 percent, 17 percent for the United Kingdom, and 18 percent Japan. Singapore’s relatively high private expenditure is a direct result of the government’s efforts to shift more of the cost burden to consumers than do most other countries.

Before you pure libertarians get too happy, however, note that public sector hospitals account for about 80% of all patient hours and there is a single payer system for catastrophic expenditures.

Definitely recommended, at this price or even the paperback for $20.00.

By the way, here are some changes they likely will be making to the Singaporean health care system, moving it closer to traditional welfare state policies (for better or worse).

The new Emily Oster book

Expecting Better: Why the Conventional Pregnancy Wisdom Is Wrong-and What You Really Need to Know.

It’s out, and if I hadn’t been giving talks in Singapore and eating pepper crab, I would have read and reviewed it by now. I will read it as soon as I can and of course I pre-ordered it once I heard about it, despite my lack of direct connection to the topic…

Assorted links

1. Zebra vs. wildebeest traffic jam, zebras do OK.

2. Japanese workers fear The Great Reset.

3. Orange is the New Green, on the economics of prisons. And very good profile of Mandy Patinkin.

4. Guidelines for Unmanned Aerial Vehicles at Burning Man.

5. Do our brains pay a price for GPS?

6. Malcolm Gladwell responds on 10,000 hours of practice.

7. Krugman on EM bubbles; “So, the flood of money into emerging markets now looks in retrospect like another bubble.” The data really are supporting this. Must a defense of QE therefore be non-cosmopolitan?

President Obama’s new higher education plan

Here is one summary:

“Early Thursday, he released a plan that would:

- Create a new rating system for colleges in which they would be evaluated based on various outcomes (such as graduation rates and graduate earnings), on affordability and on access (measures such as the percentage of students receiving Pell Grants).

- Link student aid to these ratings, such that students who enroll at high performing colleges would receive larger Pell Grants and more favorable rates on student loans.

- Create a new program that would give colleges a “bonus” if they enroll large numbers of students eligible for Pell Grants.

- Toughen requirements on students receiving aid. For example, the president said that these rules might require completion of a certain percentage of classes to continue receiving aid.”

There is another summary here.

So far I don’t get it. There seems to be plenty of information about colleges, and I doubt if a federal rating system would improve on those ratings already privately available. To the extent that federal system became focal, the incentives to game and scheme it would become massive, and how or whether to punish the gamers, if and when they are caught, would be a political decision. I don’t see that as healthy.

Given that previous educational subsidies mostly are converted into higher rates of tuition and thus captured by the school, the second plank would simply boost the subsidy to high performing colleges. There are plenty of ways to do that and in any case it doesn’t seem to help today’s marginal students, who probably cannot do well in those environments in any case. Furthermore colleges with high graduate earnings are very often those located in or near high-paying cities. Should we be subsidizing on that basis? Should we be giving colleges an incentive to identify and deny admission to potential lower earners? Do we really want the federal government helping to crush humanities majors? And I don’t see that the kind of rating system under discussion here is measuring actual value added, ceteris paribus of course.

I am not opposed to tougher requirements for aid recipients, but again there is a danger of gaming. For instance the aid recipients might simply choose easier classes and majors and aid-hungry colleges might very well accommodate them and make things as easy as they need to.

On the third plank, I don’t think the problem is that Pell Grant recipients cannot get into a good enough college. The problem, insofar as there is one, relates to how well they do once they show up, given what is often inadequate preparation. Encouraging now-rejecting colleges to accept them will if anything lure them into environments they are not capable of handling.

I would find it helpful if this proposal would outline the core, underlying theory of market failure in higher education, and then how these ideas would fix it. It is difficult for me to put that argument together in my mind. I do get the intuitive reason why “aid should be tied to outcomes.” But presumably students, who already have by far the most at stake in choosing a college, already allocate their own dollars and aid dollars on the basis of outcomes. If that process isn’t broken, this plan seems to address a pseudo-problem. If that process is broken (misguided students?), we need to know whether this plan really will fix the kink in the system. For instance if students cannot right now choose the schools offering the best expected outcomes for them, this plan seems to work mighty hard to get the schools to do the choosing for them, but in reality only ends up putting the students into tougher and less appropriate institutions. Can you spell “remedial”? In any case, under these assumptions, it would seem to be the students who need the fixing, not the schools. And so on.

I do like this part:

Further, the administration is promising to issue “regulatory waivers” for “high-quality, low-cost innovations in higher education, such as making it possible for students to get financial aid based on how much they learn, rather than the amount of time they spend in class.”

Overall the ideas here strike me as underdeveloped in terms of logic. Perhaps the plan will have positive effects simply through the “bully pulpit” medium.

First lecture for International Trade

You don’t need to start early, but here is the first reading assignment for International Trade:

Bernhofen, Daniel and John C. Brown. 2005. “An Empirical Assessment of the Comparative Advantage Gains from Trade: Evidence from Japan.” American Economic Review.

Autor, David H. David Dorn and Gordon H. Hanson. 2013. “Untangling Trade and Technology: Evidence from Local Labor Markets.” NBER Working Paper.

Acemoglu, Daron, David Autor, David Dorn, and Gordon H. Hanson. 2013. “Import Competition and the Great US Employment Sag of the 2000s.” NBER Working Paper.

Feenstra, Robert C. 2008. “Offshoring in the Global Economy.” Ohlin Lecture Series, pp.1-47 only.

Grossman, Gene M. and Esteban Rossi-Hansberg. 2006. “The Rise of Offshoring: It’s Not Wine for Cloth Anymore.” Federal Reserve Bank of Kansas City.

Also watch the two videos on comparative advantage at MRUniversity.com, and the video Sources of Comparative Advantage, they are located in the class on development economics.

The financial unraveling of southeast Asia

It is now well underway. The stock market is Indonesia had several big loss days in a row, with some daily drops over five percent, and their credit-driven economic expansion seems to be over. Weaknesses in commodity markets will hurt them and they did not use their boom to invest sufficiently in future productive capacity, instead preferring to ride upon the glories of higher resource prices and growing credit. The central bank is burning reserves and starting to worry about an eventual crisis scenario.

I am puzzled by Krugman’s take on the rupee. I would not argue that the weaker rupee is bad per se, but rather it is a symptom that an earlier overvaluation of India’s economic prospects is now over. The country is, sorry to say, the “sick man of Asia,” economically speaking that is. (Or more literally in terms of public health, for that matter.) Here is my May 2012 column on India, which I think has held up very well. One can only hope that this financial crisis will bring reforms comparable to those of the early 1990s; otherwise the momentum for better policies appears to have been exhausted. Right now the country has about the worst legal system in the world (North Korea and a few other outliers aside) and the ten-year yield has been popping over ten percent. It is shifting from a better multiple equilibrium to a worse one and foreigners are having second and third thoughts about further investing.

The Thai economy has shrunk for two consecutive quarters and total debt (public and private) to gdp ratio is now about 180 percent. Malaysia also has serious debt problems. The uncertainty coming out of China is not helping either.

Singapore is doing fine.

I don’t expect these crises to have serious “knock on” problems for the developed nations, but hundreds of millions of vulnerable individuals now face a much worse economic future, at least in the short to medium term.

Addendum: There is also mounting evidence that QE has been to some extent responsible for southeast Asian financial bubbles, market monetarist evidence one might say, if I may be allowed to needle Scott. Call it Austro-Indonesian business cycle theory.

Assorted links Singapore

If all has gone well, I am now in Singapore, so here are some relevant links:

1. Stephen Wiltshire’s aerial view of Singapore, drawn from memory.

2. Singaporean women are starting to marry Chinese men.

3. The government is concerned that too many public servants are visiting Singaporean casinos.

4. Pop Yeh Yeh: Psychedelic Rock from Singapore and Malaysia 1964-1970, an excellent CD, especially if you approach it with the right sense of humor.