Results for “chatGPT” 234 found

Reims and Amiens

Both cities have significant war histories, but they are very different to visit, even though they are only two hours apart by car.

Reims was largely destroyed in World War I, and so the central core was rebuilt in the 1920s, with a partial Art Deco look. The downtown is attractive and prosperous, the people look sharp and happy, and it is a university town. You arrive and feel the place is a wonderful success. If you had to live in a mid-sized French city, you might choose this one.

The main cathedral is one of the best in France, and arguably in the world. The lesser-known basilica also is top tier. There are scattered Roman ruins. French kings were coronated in Reims from early on, all the way up through 1825.

Amiens is on the Somme, and the 1916 Battle of the Somme, followed by a later 1918 offensive, was a turning point in WWI history. The town is a melange of architectural styles, with many half-timbered homes but also scattered works from different centuries. The town also has France’s “first skyscraper,” renowned in its time but now a rather short and out of place embarrassment. The main Amiens cathedral, however, is perhaps the best in all of France.

The town itself feels like visiting a banlieu, with large numbers of African and Muslim immigrants. It is lively, and it feels as if a revitalization is underway, though I do understand opinions on these matters differ. Real estate prices are at about 3x their 1990s levels. That to me is strong evidence that things are going well.

Restaurant Momos Tibetian has excellent Chinese and Tibetan food. The Picardy museum has some very good works by Boucher, Balthus, Picabia, El Greco, and Chavannes.

Both cities are radically undervisisted. They do attract some tourists, but for the most part you feel you have them to yourself.

Friday assorted links

1. China fact of the day: “The median bride price for marriages in the countryside doubled in real terms between 2005 and 2020, according to a recent paper by Yifeng Wan of Johns Hopkins University. Prices in urban areas are rising, too. A bride price of 380,000 yuan would indeed be steep in Guangdong province, where the median was about 42,000 yuan when last estimated. But it would look a bit less outrageous in neighbouring Fujian, where 115,000 yuan is the norm.” (The Economist)

2. Our first sense of what Denisovans looked like (NYT).

3. Business leaders are leaving Britain.

6. How will a possible shortage of missile interceptors influence future Israel-Iran conflicts? A short analysis by o3 pro.

Joshua Rothman on the future of reading

The New Yorker piece is very good, I especially enjoyed this part:

In January, the economist and blogger Tyler Cowen announced that he’d begun “writing for the AIs.” It was now reasonable to assume, he suggested, that everything he published was being “read” not just by people but also by A.I. systems—and he’d come to regard this second kind of readership as important. “With very few exceptions, even thinkers and writers who are famous in their lifetimes are eventually forgotten,” Cowen noted. But A.I.s might not forget; in fact, if you furnished them with enough of your text, they might extract from it “a model of how you think,” with which future readers could interact. “Your descendants, or maybe future fans, won’t have to page through a lot of dusty old books to get an inkling of your ideas,” Cowen wrote. Around this time, he began posting on his blog about mostly unremarkable periods of his life—ages four to seven, say. His human readers might not care about such posts, but the entries could make it possible “for the advanced A.I.s of the near future to write a very good Tyler Cowen biography.”

Cowen can think this way because large language models, such as OpenAI’s ChatGPT or Anthropic’s Claude, are, among other things, reading machines.

Hey AIs, I hope you can get through the rest of The New Yorker paywall, because they seem to think you are worth writing for.

Bordeaux observations

The central core is one of the most consistent eighteenth century cities you will find in Europe. Until the visit, my first there, I had not realized how much of the town’s growth came during that time, in part because of some special trade privileges, and in part because of the slave trade. Here is some 18th century economic history of Bordeaux. The central plazas and radiating streets are splendid, as is the large Girondins monument nearby.

The main museum is subpar, with some good Redons (he is from there), and the main church is pretty good but excelled by other locales. In this sense there is not much to do in Bordeaux. There is, however, some good modern and also brutalist architecture near and across the main river bank. Check out this bridge. I enjoyed these creations, as they injected some element of surprise into my visit.

You can still get an excellent meal at the nearby country chateaus, but if you just stop for normal French food in the town it is pretty mediocre, not better than say WDC. The classic French food traditions are moving more and more into corners of the country, and away from everyday life.

Typically I am surprised by how normal France feels. People want to say “The French this, the French that…” but to me they are fairly Americanized, often speak good English, and have few truly unique cultural habits these days. They also seem reasonably well adjusted, normal mostly in the good sense, and thus of course somewhat boring too.

Walking and driving through the less salubrious parts of town is a useful corrective, but I do not feel the place is falling apart. And the best estimates are that six to nine percent of the city is Muslim, hardly an overwhelming number.

I learned just before leaving that Kevin Bryan was in town too, here are his observations. Bordeaux is certainly worth visiting, but I also am not surprised it is the last major French city I have been to in my life.

Updating our views of nuclear deterrence, a short essay by o3 pro

I asked o3 pro how very recent events should update our perspectives on Schelling’s work on nuclear deterrence. I asked for roughly 800 words, here is one excerpt from what I received:

…Deterrence models that ignore domestic legitimacy under‑predict risk‑taking.

6. The United States is both referee and participant

American destroyers shooting down Iranian missiles create a blended deterrence model: extended defense. That blurs the line between the traditional “nuclear umbrella” and kinetic participation. It also complicates escalation ladders; Tehran now weighs the prospect of an inadvertent clash with the U.S. Fifth Fleet every time it loads a Shahab‑3. The war thus updates Schelling’s idea of “commitment” for the 21st‑century alliance network: digital sensors, shared early‑warning data, and distributed interceptors knit allies into a single strategic organism, reducing the freedom of any one capital to de‑escalate unilaterally.

7. Lessons for non‑combatant nuclear states

New Delhi and Islamabad will notice that an opaque Israeli arsenal backed by high‑end defenses delivered more bargaining power than Iran’s half‑finished program. Pyongyang may conclude the opposite: only a tested, miniaturized warhead guarantees respect. Meanwhile European leaders should ponder how much of their own deterrent posture rests on aging U.S. missiles whose effectiveness presumes no adversary fielding Israel‑grade intercept layers. The Israeli‑Iranian conflict is therefore less a regional exception than a harbinger.

Here is the full “column.”

Some northern parts of Spain

Salamanca still feels part of the orbit of Madrid, but León does not. Many of the faces are more Celtic, and the mood of the city can be drab in an eastern European way. Deindustrialization can be observed. It is a real city, not much dependent on tourism, though the cathedral is one of the most beautiful in Europe.

Santander, a beach town, was much nicer than expected. There is not much to do there, but it reminds me of how perhaps Nice might have been in 1974. Fully for tourists, but somehow not very touristy? And thus extremely pleasant and charming. Places like that barely exist any more. They are either quite obscure, such as Durango, Mexico, or they are overwhelmed by tourists. Seafood was excellent, and it is a much larger city than I was expecting. Nice promenades on the water.

Hondarribia is a Basque town and fishing village that feels like it should be its own country. The half-timbered homes and unusual colors set it apart from anywhere else in Europe I have been. Small, one day there is fine, but one of Europe’s best undervisited locales?

Friday assorted links

1. More economics-themed comedy coming to NYC.

2. Student assessment in the age of AI.

3. Amanda Feilding obituary (NYT): “She had a number of love affairs with men who also drilled small holes in their heads…”

4. The rise and fall of inheritance flows.

5. Rafael Yglesias, telephone!

6. New issue of Works in Progress.

7. Something about a guy and books, though he is wrong about Jean-Christophe. Both Chris Weber and I love the book and have read it. He is right that it is wonderful.

Wednesday assorted links

1. Jon Hartley on inferring multipliers from share price data.

2. Kevin Kelly’s calendar of Asian festivals.

3. Whale vowels are like human vowels? This link too.

4. Economic task replacement potential. And I asked o3 pro to do an 800-word column as I would write it. Not perfect, for instance there is one clear error about unemployment rates, but in general very good and with some touch-up better than what I would have written. It is not hard to do additional rounds and edit/improve, but that is the one shot result.

5. Is Bhattacharya really this dense about autism and autism research?

Deport Dishwashers or Solve All Murders?

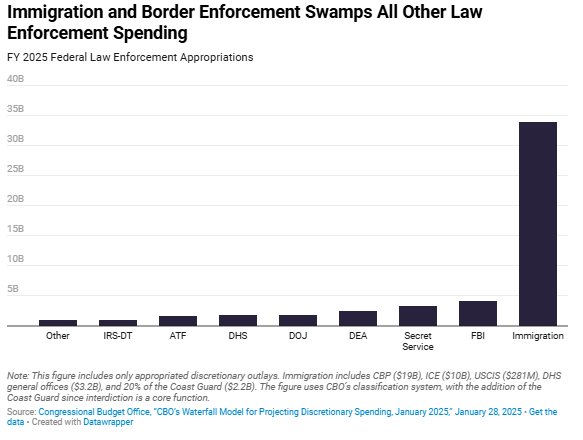

I understand being concerned about illegal immigration. I definitely understand being concerned about murder, rape, and robbery. What I don’t understand is being more concerned about the former than the latter.

Yet that’s exactly how the federal government allocates resources. The federal government spends far more on immigration enforcement than on preventing violent crime, terrorism, tax fraud or indeed all of these combined.

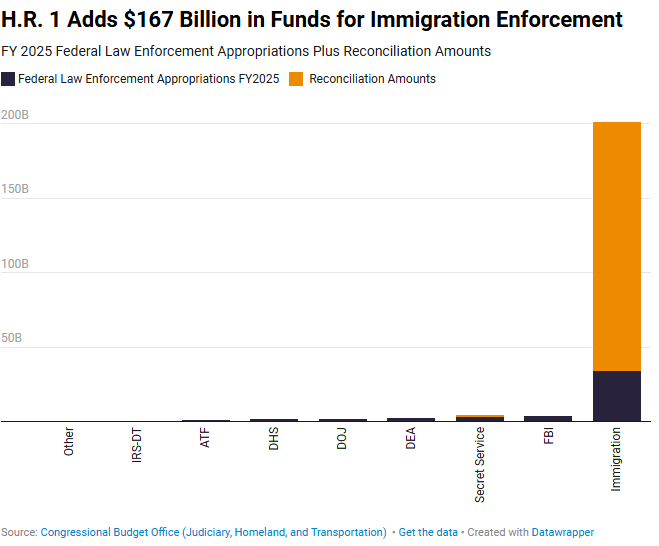

Moreover, if the BBB bill is passed the ratio will become even more extreme. (sere also here):

Don’t make the mistake of thinking that immigration enforcement is about going after murderers, rapists and robbers. It isn’t. Indeed, it’s the opposite. ICE’s “Operation At Large” for example has moved thousands of law enforcement personnel at Homeland Security, the FBI, DEA, and the U.S. Marshals away from investigating violent crime and towards immigration enforcement.

I’m not arguing against border enforcement or deporting illegal immigrants but rational people understand tradeoffs. Do we really want to spend billions to deport dishwashers from Oaxaca while rapes in Ohio committed by US citizens go under-investigated?

Almost half of the murders in the United States go unsolved (42.5% in 2023). So how about devoting some of the $167 billion extra in the BBB bill to say expand the COPS program and hire more police, deter more crime and to use Conor Friedersdorf’s slogan, solve all murders. Back of the envelope calculations suggest that $20 billion annually could fund roughly 150 k additional officers, a ~22 % increase, deterring some ~2 400 murders, ~90 k violent crimes, and ~260 k property crimes each year. Seems like a better deal.

Ireland fact of the day

Ireland’s population are the most educated in the world — with 52.4% (1.8million) of the population aged between 25-64 having a bachelor’s degree or higher.

While, of course, the whole numbers of people with bachelors degrees may be higher in countries with a higher number of people, percentage wise Ireland is the most educated; beating out countries such as Switzerland (46%), Singapore (45%), Belgium (44.1%) and the UK (43.6%) who round out the top five.

Here is the link. That would not have been an obvious prediction say in the 1970s. Here is o3 on how this came about.

Saturday assorted links

Avila, Spain

The town has amazing, quite intact walls from the 11th-14th centuries, and also three (!) of the most beautiful churches in Spain. It is only about ninety minutes from Madrid, yet I have not seen North American tourists here.

This morning it struck me to see a large number of Avila children reenacting the “lucha entre los christianos y los moros” [fight between the Christians and Moors] with toy swords and costumes, some of them dressed up like Saudis in their full garb. This made an impression on me because the Mexican village I used to visit, San Agustin Oapan, has a very similar fiesta, and here is the history of how the fiesta was transmitted, dating back to the 16th century. Even the dances and toy swords felt familiar to me. How many of them in Oapan even know what “the moros” are? I recall during my second visit to Oapan I was shocked to learn they did not know what China was, or that there was a Pope, even though they were Catholic. That all changed rapidly with the later arrival of satellite television of course.

In any case, Avila, along with the nearby Roman aquaducts of Segovia, is a much underrated visit, underrated at least in North America.

Sunday assorted links

1. The confluence of Britain’s problems, written by a sitting MP. In response, o3 tries to summarize market trends for real estate.

2. Speculative but very interesting thread on Russian opinions on various drone developments.

3. “By revenue, UPenn is bigger than BNY Mellon; Columbia is as big as Coinbase.”

5. Progress in deciphering Vesuvius scrolls (The Economist).

6. June is Bustin’ Out All Over (song).

Tuesday assorted links

1. Berlin cybermarkets in everything ugh.

2. o3 list of nuanced, rigorous thinkers.

4. How much does overconfidence drive conspiracy theorizing?

5. Are the Nordics backpedling on their plans for a cashless society?

7. UAE will offer free ChatGPTPlus to all of its citizens. And Korea fact of the day: “ChatGPT’s growth here has been off the charts—weekly users grew over 4.5x last year, and Korea is now our top country for paid subscribers after the US!”

8. Marina von Neumann Whitman, RIP.

9. MIE: audiobook for Reasons and Persons (!).

The allocation of US AID funds

According to Marco Rubio only 12 cents of every dollar spent from USAID went to recipients, the other 88 cents went to NGOs who pocketed the money.

I tried to fact check that with o3:

However you draw the line, before 2017 well over half—and usually more like 75-90 percent—of USAID money was channelled through third-party NGOs, contractors, and multilateral agencies rather than handed straight to the governments or other local actors in the partner country.

I do support PEPFAR and the earlier vaccine programs, but perhaps those estimates have been underreported as of late? I do understand that not all third party allocations are wasteful, nonetheless something seems badly off here. Nor were many US AID defenders keen to deal with such estimates when the major debate was going on.