Category: Books

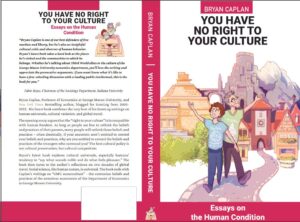

*You Have No Right to Your Culture: Essays on the Human Condition*

By Bryan Caplan, now on sale. From Bryan’s Substack:

My latest book of essays, You Have No Right to Your Culture: Essays on the Human Condition, flips this narrative. All of these demands for “reshaping culture” are thinly-veiled calls for coercing humans. As the title essay explains:

[C]ulture is… other people! Culture is who other people want to date and marry. Culture is how other people raise their kids. Culture is the movies other people want to see. Culture is the hobbies other people value. Culture is the sports other people play. Culture is the food other people cook and eat. Culture is the religion other people choose to practice. To have a “right to your culture” is to have a right to rule all of these choices — and more.

What’s the alternative? Instead of treating capitalism as the root of cultural decay, the world should embrace capitalist cultural competition. Actions speak louder than words; instead of using government to “shape” culture, let’s see what practices, beliefs, styles, and flavors pass the market test. Which in practice, as I explain elsewhere in the book, largely means the global triumph of Western culture, infused with an array of glorious culinary, musical, and literary imports. Nativists who bemoan immigrants’ failure to assimilate are truly blind; the truth is that even non-immigrants are pre-assimilating at a staggering pace.

Recommended. Bryan also offers some essays on what he finds valuable in GMU Econ sub-culture.

What should I ask Julia Ioffe?

Yes, I will be doing a Conversation with her. She has a new and very good book out, namely Motherland: A Feminist History of Modern Russia. I will focus on that topic, but she has done much else as well. From Wikipedia:

…a Russian-born American journalist. Her articles have appeared in The Washington Post, The New York Times, The New Yorker, Foreign Policy, Forbes, Bloomberg Businessweek, The New Republic, Politico, and The Atlantic. Ioffe has appeared on television programs on MSNBC, CBS, PBS, and other news channels as a Russia expert. She is the Washington correspondent for the website Puck.

And here is Julia on Twitter. So what should I ask her?

My Conversation with Diarmaid MacCulloch

Here is the audio, video, and transcript. Here is part of the episode summary:

Tyler and Diarmaid explore whether monotheism correlates with monogamy, Christianity’s early instinct towards egalitarianism, what the Eucharistic revolution reveals about the cathedral building boom, the role of Mary in Christianity and Islam, where Michel Foucault went wrong on sexuality, the significance of the clerical family replacing the celibate monk, why Elizabeth I—not Henry VIII—mattered most for the English Reformation, why English Renaissance music began so brilliantly but then needed to start importing Germans, whether Christianity needs hell to survive, what MacCulloch plans to do next, and more.

Excerpt:

COWEN: There’s a recent rise of interest in theories that attribute the rise of the West to the church banning cousin marriage, that this broke down clan structures. What’s your view of that hypothesis?

MACCULLOCH: It’s, as usual with such hypotheses, far too simple. I don’t see that so at all. Cousin marriages went on being a feature of Christianity, particularly if you’ve got a pope to dispense such marriages in the West. What could one say about such a theory? Clans, families were not broken up by Christianity. By far, the reverse. Those structures did not change very significantly. No, I don’t think that really works at all.

COWEN: Why does Islam so emphasize the sexual desires of women relative to Christianity?

MACCULLOCH: A good question. Because the Quran allows that to happen? The Quran has been interpreted by men when very often what it’s talking about is just people, so that may be one explanation. Islam did remain very much a militarized culture to start with, so it’s almost by definition run by men. There within it, is a powerful set of images for women in the Quran itself. On top of the Quran, there is so much added, and it’s usually added by male societies. So yes and no, really.

There is a constant strain of things one can say about the position of women in Christianity. Women are constantly carving out parts of Christian faith for themselves, against the fact that men are increasingly running the church. That’s a fact of life. Think of the mystics of the medieval West and the way in which so many of them are females. To be a mystic, you don’t need the male language of Latin, the language of the professions, the language of the clergy.

You can explore mysticism without the new invention of men in the 12th century — theology, which is something associated with, first, the cathedral schools and then the universities, both of which are male institutions. But mysticism, no. You can just get on with it. It involves many of the same themes in every religion that turns to mysticism, themes like fire and water, air. The vocabulary of the mystic really is quite universal. It is not restricted to Christianity or Islam or anything. It’s the way that one aspect of humanity works out when it tries to meet the divine.

COWEN: Why is Islam sometimes, at least at the intellectual level, so obsessed with Mary? You can debate whether she was a saint or a prophet. In a way, the role in Christianity is much more circumscribed.

And:

COWEN: Why are there still a fair number of English Catholics, but so few in the Nordic countries?

MACCULLOCH: Now, an interesting question. Lutheranism became much more universal in the Nordic countries. Catholicism did not survive there. The monarchies of these countries were, I think, much more thorough-going in suppressing it. I think the nobility also decided to go over to the Reformation fairly uniformly in Sweden, Norway, Denmark. Of course, it does matter when the nobility make decisions.

In England, they were divided. Quite a lot of the nobility and gentry did stick with the old faith, maybe because they admired many of the bishops of the old church. I did a little work of research on this in my younger days, in which you could see that those gentry who stayed Catholic after the Reformation were often those who had personal ties to the great bishops of the pre-Reformation church.

Yes, the picture is very different in England to that in Scandinavia. Also, remember that extraordinary counter case, the case of Ireland, where the government became Protestant as it did in England, but the great bulk of the population did not go with it. The story of Ireland is a story of the rejection of the religion of the upper classes right through to the present day, when they’ve now rejected so much of Catholicism too. Fascinating different stories next to each other there.

Recommended.

Sectoral shifts in supply, wartime agriculture edition

It is all the more remarkable, then, that within six years Britain’s agricultural output had transformed, more profoundly and at a faster pace than any time since the start of the Industrial Revolution. The most urgent need was to provide a substitute for all that previously imported foreign wheat. In 1939, Britain only had 11.8 million acres of suitable land under the plough, compared to 17.3 million acres of grass and pastureland. Four years later those figures had been almost exactly reversed — to 17.3 million and 11.4 million acres respectively. The amount of tillage soil devoted to wheat had doubled. Just over 4.2 million harvested tons of wheat, barley and oats had become 7.6 million tons. By 1943 the potato crop was almost twice as big as it had been in 1939. Less pastureland meant fewer animals, and so a veritable massacre on pork and poultry farms ensued. By 1943 there were almost 30 million fewer British chickens and 2.2 million fewer pigs than pre-war numbers. Cows were spared — but strictly for milk production, not beef.

That is from the new and excellent book by Alan Allport, Advance Britannia: The Epic Story of the Second World War, 1942-1945.

Indicate precisely what you mean to say…

The book I was reading is titled Encounters and Reflections: Conversations with Seth Benardete, here is one excerpt:

Michael: What was [Allan] Bloom like when you first met him?

Seth: He was supersensitive to people’s defects. He had antennae out, he knew exactly…

Robert: People’s weak spots?

Seth: Oh yes, it was extraordinary.

Ronna: You continued talking to Bloom often over the years, didn’t you?

Seth: Pretty often. But he was often was distracted. He got impatient if you could not say what you wanted to say in more than half a sentence.

Robert: The pressure of the sound bite.

Seth: I remember the last time he came. He was about to write the book and he asked me what I thought the Phaedrus was about. I summed it up in a sentence, and it didn’t make any impressions.

Ronna: Do you remember what the sentence was?

Seth: Something about the second speech turning into the third speech, and how this was connected to the double character of the human being. I managed to get it into one sentence, but it wasn’t something he wanted to hear.

A fun book. For all the criticisms you hear of Straussians, the few I have known I find are quite willing to speak their actual views and state of mind very clearly and directly.

Not as good as Cowen-Tabarrok

Russia is preparing a new economics textbook for university students that aims to challenge what its authors call a “myth” that democracy drives economic growth and to revive the socialist economic theories of Soviet leader Josef Stalin, the head of a Kremlin-linked advisory body said.

Moscow has ramped up efforts to enforce its view of history and global politics in schools since launching its full-scale invasion of Ukraine in 2022, introducing mandatory patriotic classes and rewriting history curricula to align with the Kremlin’s wartime narratives.

Valery Fadeyev, chairman of Russia’s presidential human rights council, told the RBC news website that he is leading work on the textbook, which could be introduced as early as the next academic year for students of sociology, political science and history.

The 350-400-page book, tentatively titled “Essays on Economics and Economic Science,” is intended to present a broader view of economic development than mainstream liberal theory, Fadeyev said.

Here is the full story, via Frank W. The Kyiv School of Economics it ain’t…

What should I ask Joe Studwell?

He has a new and excellent book coming out, namely How Africa Works: Success and Failure on the World’s Last Developmental Frontier, which I consumed eagerly. You probably know his earlier book How Asia Works. So what should I ask him?

For additional context, here is the opening of his home page (no Wikipedia page?):

Hello. I am an author, journalist, public speaker and occasional university teacher. I am based much of the time in Cambridge. In the 2000s I restored and lived in a home in a still unspoiled area of central Italy (the photo at the top of the page is a view from the house).

So what should I ask him?

Stories Beyond Demographics

The representation theory of stories, where the protagonist must mirror my gender, race, or sexuality for me to find myself in the story, offers a cramped view of what fiction can do and a shallow account of how it actually works. Stories succeed not through mirroring but by revealing human patterns that cut across identity. Archetypes like Hero, Caregiver, Explorer, and Artist, and structures like Tragedy, Romance, and Quest are available to everyone. That is why a Japanese salaryman can love Star Wars despite never having been to space or met a Wookie and why an American teenager can recognize herself in a nineteenth-century Russian novel.

Tom Bogle makes this point well in a post on Facebook:

I have no issue with people wanting representation of historically marginalized people in stories. I understand that people want to “see themselves” in the story.

But it is more important to see the stories in ourselves than to see ourselves in the stories.

When we focus on the representation model, we recreate a character to be an outward representation of physical traits. Then the internal character traits of that individual become associated with the outward physical appearance of the character and we pigeonhole ourselves into thinking that we are supposed to relate only to the character that looks like us. Movies and TV shows have adopted the Homer Simpson model of the aloof, detached, and even imbecilic father, and I, as a middle-aged cis het white guy with seven kids could easily fall into the trap of thinking that is the only character to whom I can relate. It also forces us to change the stories and their underlying imagery in order to fit our own narrative preferences, which sort of undermines the purpose for retelling an old story in the first place.

The archetypal model, however, shifts our way of thinking. Instead of needing to adapt the story of Little Red-Cap (Red Riding Hood) to my own social and cultural norms so that I can see myself in the story, I am tasked with seeing the story play out in myself. How am I Riding Hood? How am I the Wolf? How does the grandmother figure appear in me from time to time? Who has been the Woodsman in my life? How have I been the Woodsman to myself or others? Even the themes of the story must be applied to my patterns of behavior or belief systems, not simply the characters. This model also enables us to retain the integrity of the versions of these stories that have withstood the test of time.

So if your goal is actually to affect real social change through stories, I would encourage you to consider how the archetypal approach may actually be more effective at accomplishing your aims than the representational approach alone (as they are not necessarily in conflict with one another).

What I’ve been reading

Michael Wachtel, Viacheslav Ivanov: A Symbolist Life. 615 pp. of what Russian/Soviet cultural life was like in the early 20th century. Focuses on broader strands, rather than just the most famous names. Ivanov today is largely forgotten, but he was at the time arguably the most influential figure of that period. “They were mostly a bunch of nuts” is one of my takeaways.

Herbert Breslin and Anne Midgette, The King and I: The Uncensored Tale of Luciano Pavarotti’s Rise to Fame by his Manager, Friend, and Sometime Adversary. Usually people tell me books like this are “delightful,” and then they bore me to tears. This one actually is fantastically fun. “To tell the truth, though, Luciano didn’t care about the money at the beginning. In the early years, he never asked me how much he was going to get paid for a recital. He had only one condition: it had to be sold out.”

Alan Manning, Why Immigration Policy is Hard and How to Make it Better is a thoughtful and balanced look at its topic, recommended.

Alex Mayyasi, Planet Money: A Guide to the Economic Forces that Shape Your Life is a useful introduction to economic concepts.

Nicolas Niarchos, The Elements of Power: A Story of War, Technology, and the Dirtiest Supply Chain on Earth is a good treatment of minerals issues as they relate to the Congo today. It will not make you more bullish on Rwanda, or for that matter the Congo.

Eve MacDonald, Carthage: A New History covers what we do know about those people. That isn’t much at the conceptual level, and I wonder why archaeology has not taught us more there.

I expect I will very much agree with Brink Lindsey, The Permanent Problem: The Uncertain Transition from Mass Plenty to Mass Flourishing.

What should I ask Henry Oliver?

Yes, I will be doing a Conversation with him. We will focus on our mutual readings of Shakespearer’s Measure for Measure, with Henry taking the lead. But I also will ask him about the value of literature, Jane Austen, Adam Smith, Bleak House, his book on late bloomers, and more.

Here is Henry’s (free) Substack. Here is Henry on Twitter.

So what should I ask him?

Dan Wang 2025 letter

Self-recommending, here is the link, here is one excerpt:

People like to make fun of San Francisco for not drinking; well, that works pretty well for me. I enjoy board games and appreciate that it’s easier to find other players. I like SF house parties, where people take off their shoes at the entrance and enter a space in which speech can be heard over music, which feels so much more civilized than descending into a loud bar in New York. It’s easy to fall into a nerdy conversation almost immediately with someone young and earnest. The Bay Area has converged on Asian-American modes of socializing (though it lacks the emphasis on food). I find it charming that a San Francisco home that is poorly furnished and strewn with pizza boxes could be owned by a billionaire who can’t get around to setting up a bed for his mattress.

And:

One of the things I like about the finance industry is that it might be better at encouraging diverse opinions. Portfolio managers want to be right on average, but everyone is wrong three times a day before breakfast. So they relentlessly seek new information sources; consensus is rare, since there are always contrarians betting against the rest of the market. Tech cares less for dissent. Its movements are more herdlike, in which companies and startups chase one big technology at a time. Startups don’t need dissent; they want workers who can grind until the network effects kick in. VCs don’t like dissent, showing again and again that many have thin skins. That contributes to a culture I think of as Silicon Valley’s soft Leninism. When political winds shift, most people fall in line, most prominently this year as many tech voices embraced the right.

Interesting throughout, plus Dan writes about the most memorable books he read in 2025.

What is the greatest artwork of the century so far?

That question is taken from a recent Spectator poll. Their experts offer varied answers, so I thought at the near quarter-century mark I would put together my own list, relying mostly on a seat of the pants perspective rather than comprehensiveness. Here goes:

Cinema

Uncle Boonmee, In the Mood for Love, Ceylan’s Winter Sleep, Yi Yi, Artificial Intelligence, Her, Y Tu Mama Tambien, Four Months Three Weeks Two Days, from Iran A Separation, Oldboy, Silent Light (Reygadas), The Three Burials of Melquiades Estrada, Get Back, The Act of Killing, Master and Commander, Apocalypto, and New World would be a few of my picks. Incendies anyone?

Classical music (a bad term these days, but you know what I mean):

Georg Friedrich Haas, 11,000 Strings, Golijov’s Passion, John Adams Transmigration of Souls, The Dharma at Big Sur, Caroline Shaw, and Stockhausen’s Licht operas perhaps. Typically such works need to be seen live, as streaming is no substitute. As for recordings, recorded versions of almost every classic work are better than before, opera being excluded from that generalization. So the highest realizations of most classical music compositions have come in the last quarter century.

Fiction

Ferrante, the first two volumes of Knausgaard, Submission, Philip Pullman, and The Three-Body Problem. The Marquez memoir and his kidnapping book, both better than his magic realism. The Savage Detectives. Sonia and Sunny maybe?

Visual Arts

Bill Viola’s video art, Twombly’s Lepanto series, Cai Guo-Qiang and Chinese contemporary art more generally (noting it now seems to be in decline), the large Jennifer Bartlett installation that was in MOMA, Robert Gober. Late Hockney and Richter works. The best of Kara Walker. The second floor of MOMA and so much of what has been shown there.

Jazz

There is so much here, as perhaps the last twenty-five years have been a new peak for jazz, even as it fades in general popularity. One could mention Craig Taborn, Chris Potter, and Marcus Gilmore, but there are dozens of top tier creators. Cecile McLorin Salvant on the vocal side. Is she really worse than Ella Fitzgerald? I don’t think so.

Popular music (also a bad term)

The best of Wilco, Kanye, D’angelo, Frank Ocean, Bob Dylan’s Love and Theft. How about Sunn O)))? No slight intended to those listed, but I had been hoping this category would turn out a bit stronger?

Television

The Sopranos, the first two seasons of Battlestar Galactica, Srugim, Borgen, and Curb Your Enthusiasm.

Assorted

Hamilton, and there is plenty more in theater I have not seen. At the very least one can cite Stoppard’s Coast of Utopia and Leopoldstadt. There is games and gaming. People around the world, overall, look much better than ever before. The Museum of Islamic Art in Doha and the reoopened Great Egyptian Museum in Cairo. The new wing at MOMA. Architecture might need a post of its own, but I’ll start by citing the works of Peter Zumthor. (Here is one broader list, it strikes me as too derivative in style, in any case it is hard to get around and see all these creations, same problem as with judging theatre.) I do not follow poetry much, but Louise Glück and Seamus Heaney are two picks, both with many works in the new century. The top LLMs, starting (but not ending) with GPT-4. They are indeed things of beauty.

Overall, this list seems pretty amazing to me. We are hardly a culture in decline.

What should I ask Kim Bowes?

Yes, I will be doing a Conversation with her. Here is Wikipedia:

Kimberly D. Bowes (born 1970) is an American archaeologist who is a professor of Classical Studies at the University of Pennsylvania. She specializes in archeology, material culture and economics of the Roman and the later Roman world. She was the Director of the American Academy in Rome from 2014–2017.[2] She is the author of three monographs…

While she is continuously focused on the archaeology and material culture of the Roman and later Roman worlds, her research interests have shifted from late antiquity and the archeologies of religion and elite space to historical economies with a distinct focus on poverty and the lived experience of the poor. Her forthcoming study on Roman peasants in Italy reflects a greater attention to non-elites in the studies of Roman archaeology and economic history and a shift in her methodology, integrating archaeological and scientific data, anthropological theory and historical economics become.

I am a big fan of her new book Surviving Rome: The Economic Lives of the Ninety Percent. So what should I ask her?

*38 Londres Street*

The author is Philippe Sands and the subtitle is

So recommended, and added to my own list. And yes I did buy another book by Philippe Sands, the acid test of whether I really liked something.

Harvey Mansfield on Rousseau and the dilemma of our age

Thus, it would seem that Rousseau compels us to choose either science or morality. If we choose morality ,we must enforce ignorance by maintaining political control over the sciences and the arts. We must believe in something like creationism because it says that nature was created for our good, and not believe in technology that exploits nature by exposing its disadvantages and hardships, such as cloning human beings to avoid the troubles of natural birth. But if we choose science, we run the risk of an explosion as human morals worsen as human power grows…There is hardly any issue today more fateful than the questison of whether modern science is the friend of politics and morality, as Hume says, or the enemy, as Rousseau says.

That is from Mansfield’s forthcoming book The Rise and Fall of Rational Control.