Month: December 2007

Mexican economies of scope

Traffickers are drawn to musical acts because they provide an easy platform to launder money. There are other easy options, but none is so culturally prestigious. It is the glamour of the music scene that makes it irresistible to narcotraffickers, said Rolando Coro, a well-known disc jockey at Radio Tremendous in Morelia.

"They show up at the dances, these drug traffickers, and order the expensive whiskey, not just a glass, but the whole bottle," Coro said. "They have pretty women following them around. It’s fun for them."

Bands that make deals with drug traffickers get a crucial leg up on the competition. Tzin Tzun, the promoter, can spot them with ease.

Here is the full story, with further information about the recent killings of Mexico’s most popular musicians. I wondered about this:

"Bands start to get popular and sometimes they want to keep more of the money," Tzin Tzun said.

Department of Human Rationality

According to the San Francisco Chronicle, police found a shoe and blood in an area between the gate and the edge of the animal’s 25- to 30-foot-wide moat, raising the possibility that one of the victims dangled a leg or other body part over the edge of the moat…

One zoo official insisted the tiger did not get out through an open door and must have climbed or leaped out. But Jack Hanna, former director of the Columbus Zoo, said such a leap would be an unbelievable feat and ”virtually impossible.”

Instead, he speculated that visitors could have been fooling around and might have taunted the animal and perhaps even helped it get out by, say, putting a board in the moat.

Ron Magill, a spokesman at the Miami Metro Zoo, said it was unlikely a zoo tiger could make such a leap, even with a running start.

The story is here. And I agree with what Robin Hanson is probably thinking: it was signaling behavior. Maybe from the tiger too.

Update: Here is one story, here is more, some of you rail in the comments but the initial interpretation is looking correct. Note also that the tiger, after killing the first boy, went 300 yards to track down the other two boys and not anyone else.

Subprime fact of the day

Even with about a tenth of all subprime mortgages now in foreclosure, only a

small share of all American families — about 0.3 percent — own a home in

foreclosure…

Here is the link, from Mark Thoma. This is one big reason why I’m not yet convinced by the economic pessimists. The article also notes how many estimates of the S&L crisis of the 1980s were exaggerated, and suggests the same tendency may be happening today.

Addendum: This piece is a good statement of the case for pessimism.

The latest evidence on racial discrimination and wages

I haven’t read through this closely, but it seems to be a very important paper:

…we show that, relative to white wages, black wages: (a) vary negatively

with a measure of the prejudice of the "marginal" white in a state; (b)

vary negatively with the prejudice in the lower tail of the prejudice

distribution, but are unaffected by the prejudice of the most

prejudiced persons in a state; and (c) vary negatively with the

fraction of a state that is black. We show that these results are

robust to a variety of extensions, including directly controlling for

racial skill quality differences and instrumental variables estimates.

We present some initial evidence to show that racial wage gaps are

larger the more racially integrated is a state’s workforce, also as

Becker’s model predicts.

Here is the paper. This version is $5 cheaper.

What have we learned about economic growth

Not as much as you think. Here is Charles Kenny’s closer:

In short, the last six years has not changed the basic conclusion that the growth literature has taught us much less about how to get rich than it has about who is already rich. There is nothing particularly new in recent growth theory, but perhaps that is no surprise because there is remarkably little new in growth, either – the rich today are by and large those who were rich yesterday. That there might not be a holy grail of growth policy, however, is no reason for people of economic faith to stop looking, so no doubt the next six years will see another 13,000 articles on the subject to review.

Five books from Germany

Jeff, a Facebook friend, wrote on my Wall:

Which five German books should I read, before I return to Amerika [my translation]?

He seems to read German. I will recommend: Goethe’s Faust, Rilke’s Duino Elegies or Sonnets to Orpheus, Thomas Mann’s Buddenbrooks, Franz Kafka short stories (don’t forget "Ein Landarzt,"), and Hermann Hesse’s Glass Bead Game. Non-fiction does seem to count for the query, although it would not crack my list of top five. Schopenhauer tempts as well. Do you have better ideas for him?

The tastiest sentence I read today

The trigger for the large, calorie-hungry brains of ours is cooking,

argues Richard W. Wrangham, the Ruth B. Moore Professor of Biological

Anthropology at Harvard University’s Peabody Museum of Archaeology and

Ethnology.

Here is another bit:

…it turns out that there are no records of people having a large amount of their food come from raw food.

Here is much more, interesting throughout. Thanks to Yan Li for the pointer.

Ron Paul as President

Bryan Caplan defends the prospect of a Ron Paul presidency. Here is Megan McArdle. Here’s yet another perspective. Here is Ezra Klein. Here is Paul himself.

The Ron Paul phenomenon reminds me of the old America First movement, with Misesian 100 percent reserve banking theory on top. He is making (one version of) libertarianism much more popular by allying it with nationalist and also states’ rights memes. That includes his stances on immigration, NAFTA, China, devolution of powers, and "The Constitution." Even when the policy recommendations stay libertarian, I fear that the wrong emotions will have the staying power. Evaluating a politician is not just about policy positions; for instance personally I am skeptical of most forms of gun control but I worry when a candidate so emphasizes a pro-gun stance.

Many libertarians see the Paul candidacy as their chance to have an impact and they may well be right. There is also no one else for them to support. But, raw milk or not, I am not myself tempted to take a stance this year in favor of any of the candidates, Paul included. Liberty is lacking in the United States but I’d like to see it more closely bundled with reasonableness, moderation, and yes pragmatism; I

am looking to advance on all fronts at the same time. Call me fussy if you wish.

I fear that Ron Paul is so taken with his own ideas that he is unable to see how or when his views might ever be wrong; it is in that sense I consider him insufficiently intellectual. (Admittedly all the other candidates are too open to whatever is politically popular at the moment.) Openness also means ability to improvise, which is a critical leadership quality; many of the challenges of the presidency are the surprises, 9/11 being one example of many.

The America Firsters, by the way, were right about many things, but

they were very wrong about a few very big things, such as World War II

and the civil rights movement. They also suffered a virtually total

eclipse for decades. I don’t see nationalist and states’ rights memes as a path toward a future with more human liberty.

Ron Paul is changing the ideological landscape of American politics and the fabric of modern classical liberalism. No matter what your point of view, I recommend that you take the Ron Paul phenomenon very seriously indeed.

Addendum: Here are good remarks from Arnold Kling and Steve Horwitz.

Rental markets in everything

Fancy handbags. That’s in case you didn’t get the gift you wanted today.

Thanks to Josh Chaffin for the pointer.

On the Uses of Mistletoe

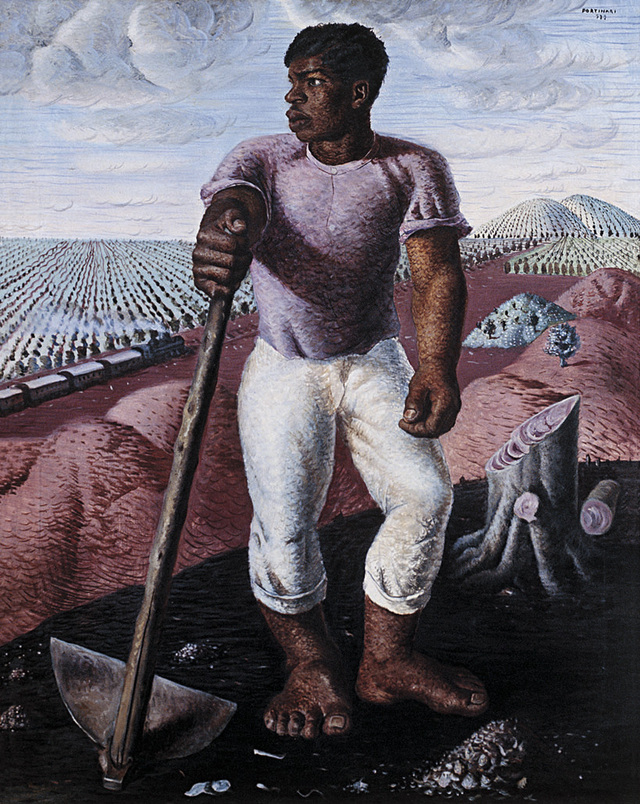

Stolen

It’s one of my favorites, let’s hope they give it back. In the meantime, Merry Christmas everybody!

Father Christmas?

A conversation between the 6yr old and the 9yr old.

"Big fat man. Flying reindeer. All around the world in one night. That’s crazy."

"Yeah."

"But who does bring the presents? Do you think Daddy brings the presents?"

"Nah, if it was Daddy we would just get cash."

Markets in everything, lawsuit edition

…some wealthy investors are starting to dabble in lawsuit investment, bankrolling some or all of the heavy upfront costs in return for a share of the damages in the event of a win…

Here is the full story, thanks to John De Palma for the pointer.

Wrong on Race

Here is Bruce Bartlett´s new book, here is an overview. Incendiary, etc. The positive suggestion is that the Republicans should, and will need to, start courting black voters, and that greater electoral competition in this manner will help the courted parties. The main theoretical question is when the statute of limitations runs out for holding the background of a party against that party. I don’t have a clear view on that question, although for individual candidates I think that the time horizon should be quite long.

Addendum: Here is a Matt-Bruce exchange. Perhaps I posted this link without enough explanation. What I find so interesting is why Bartlett remains a Republican, or from the synopsis seems to. After all, he has come close to endorsing Hillary. Whether you like that or not, it is a big step for someone from his market-oriented background. Does he stay a Republican because he thinks Republicans are better on race issues? I haven’t read the book, but I thought there were many interesting issues going on in this new work of his. I am sorry to have given rise to an exchange with nasty comments. They’ve been deleted. I might add I believe there is plenty of racism all around; the interesting positive question is why it takes one form (more open) in Republican circles and another very different form in Democratic circles. Wage and other data show that discrimination is not especially concentrated in Republican areas, I hope to post more on that topic soon.

Inefficient credit booms

This paper studies the welfare properties of competitive equilibria in an economy with financial frictions hit by aggregate shocks. In particular, it shows that competitive financial contracts can result in excessive borrowing ex ante and excessive volatility ex post. Even though, from a first-best perspective the equilibrium always displays under-borrowing, from a second-best point of view excessive borrowing can arise. The inefficiency is due to the combination of limited commitment in financial contracts and the fact that asset prices are determined in a spot market. This generates a pecuniary externality that is not internalized in private contracts. The model provides a framework to evaluate preventive policies which can be used during a credit boom to reduce the expected costs of a financial crisis.

Here is the paper, here is an ungated version. If I understand this model correctly, People invest too much ex ante. If those (correlated) investments turn bad ex post, they have to sell lots of their assets to pay off their debts. Those sales make asset prices more volatile, and what appear to be pecuniary externalities (falling and volatile prices) in fact bring real macroeconomic costs, as should be familiar to any observer of the current scene. One implication is that government should prevent overborrowing, for instance by instituting capital requirements. Bad outcomes are then less likely to require a fire sale of assets.

Expect to see more along these lines. It may not sound like the Austrian theory of the trade cycle, but in both cases entrepreneurs overinvest in holding vulnerable positions. The Austrians postulate a "thin skull" response to low interest rates (too much investment in long-term production processes); this model starts with a distinction between private and social returns. Here is another interesting paper by the same researcher.