Month: June 2012

The Google-Trolley Problem

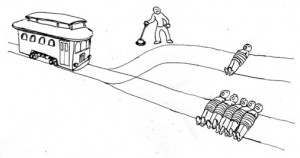

As you probably recall, the trolley problem concerns a moral dilemma. You observe an out-of-control trolley hurtling towards five people who w ill surely die if hit by the trolley. You can throw a switch and divert the trolley down a side track saving the five but with certainty killing an innocent bystander. There is no opportunity to warn or otherwise avoid the disaster. Do you throw the switch?

ill surely die if hit by the trolley. You can throw a switch and divert the trolley down a side track saving the five but with certainty killing an innocent bystander. There is no opportunity to warn or otherwise avoid the disaster. Do you throw the switch?

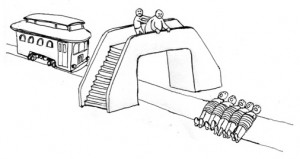

A second version is where you stand on a bridge with a fat man. The only way to stop the trolling killing five is to push the fat man in front of the trolley. Do you do so? Some people say no to both and many say yes to switching but no to pushing, referring to errors of omission and commission. You can read about the moral psychology here.

A second version is where you stand on a bridge with a fat man. The only way to stop the trolling killing five is to push the fat man in front of the trolley. Do you do so? Some people say no to both and many say yes to switching but no to pushing, referring to errors of omission and commission. You can read about the moral psychology here.

I want to ask a different question. Suppose that you are a programmer at Google and you are tasked with writing code for the Google-trolley. What code do you write? Should the trolley divert itself to the side track? Should the trolley run itself into a fat man to save five? If the Google-trolley does run itself into the fat man to save five should Sergey Brin be charged? Do your intuitions about the trolley problem change when we switch from the near view to the far (programming) view?

I think these questions are very important: Notice that the trolley problem is a thought experiment but the Google-trolley problem is a decision that now must be made.

A bit of longer term perspective on state and local governments

That is from Matt Mitchell, the source is here. Josh Barro has a very good post on the rising costs of employing public sector workers.

More food writers should be making this kind of point

Arabic Knowledge@Wharton: So when companies like Wal-Mart bring their logistics ability to Africa, it actually could be a good thing for the poor people of Africa?

Cowen: It’s exactly what we need more of. Yes.

Arabic Knowledge@Wharton: Yet there’s a fear Wal-Mart will put the smaller stores out of business.

Cowen: Yes, they do so sometimes, but they do so by charging lower prices. It makes it more accessible and more reliable. It’s not just the pricing at any one point and time. It’s what happens in the very worst periods. Companies like Wal-Mart are very, very good at keeping up supply and being regular.

Here is more, in interview form. Much of the discussion is about the Middle East:

Plus, it depends on which country in the Middle East you’re talking about. So Tunisia is better run than most places. Lebanon has a saner agricultural policy than most places. Yemen is a total disaster. Algeria and Egypt have not gone so well. So there’s a lot of variety within the Middle East. If you think of a model like Turkey, which isn’t technically in the Middle East, they’ve liberalized and encouraged agribusiness. Turks are much better fed than 20 years ago. When you ask a country like Iran, what should we do? It’s hard to know even where to start.

And this:

I’m not even sure Yemen is even a viable country because there’s some chance, they will literally run out of water in the next 20 years in a lot of parts of the country. At this point, I don’t know what they can do.

Is Spain finally going to be for rent?

Now, the Popular Party (PP) government of Prime Minister Mariano Rajoy is planning to bring more flexibility to the rental market with a set of measures that make it easier for landlords to get their properties back and for tenants to terminate their lease.

For instance, once the reforms are enacted, owners may demand that a tenant leave the property at any time regardless of the duration of the lease, while tenants will be able to walk out with just one month’s notice. Until now, contracts were for five years by default, and a further three if neither party said anything to the contrary. The executive wants to bring these periods down to three years and one year, respectively.

Here is more, mostly covering the reasons why Spain has overinvested in home ownership.

Assorted links

Is Jesus cheaper than a buffalo? (ZMP gods)

At upwards of US$500, the cost of slaughtering a buffalo to revive a relative condemned to ill-health by the spirits has pushed the Jarai indigenous minority residents of Somkul village in Ratanakkiri to a more affordable religious option: Christianity.

In the village in O’Yadav district’s Som Thom commune, about 80 per cent of the community have given up on spirits and ghosts in favour of Sunday sermons and modern medicine.

Sev Chel, 38, said she made the switch because when she used to get sick, it could cost her hundreds of dollars to appease the gods with a sacrificial package that might include a cow or buffalo, a chicken, bananas, incense and rice wine.

“So if I sold that buffalo and took the money to pay for medicine, it is about 30,000 riel to 40,000 riel [for them to] get better, so we are strong believers in Jesus,” she said. “If I did not believe in Jesus, maybe at this time I would still be poor and not know anything besides my community.”

A small wooden church has emerged in Somkul commune where the word of Jesus Christ, or “Yesu Yang” to the Jarai, is preached instead of the mixture of animism and Theravada Buddhism they have traditionally followed.

Kralan Don, 60, said he and the four other members of his family began attending the church about five years ago because of their poor standard of living.

“We believe in Christianity because we are poor; we don’t have money to buy buffaloes, chickens and pigs to pray for the spirits of the god of land or the god of water when those gods make us get sick,” he said.

Klan Ly, 56, said she had completely abandoned her fears of black magic after making the conversion.

For the pointer I thank WK.

Zingales on Education Equity

Luigi Zingales has a good op-ed on education in today’s NYTimes:

… scholars like me…work in the least competitive and most subsidized industry of all: higher education.

We criticize predatory loans by mortgage brokers, when student loans can be just as abusive. To avoid the next credit bubble and debt crisis, we need to eliminate government subsidies and link tuition financing to the incomes of college graduates…Just as subsidies for homeownership have increased the price of houses, so have education subsidies contributed to the soaring price of college.

…These subsidies also distort the credit market. Since the government guarantees student loans, lenders have no incentive to lend wisely. All the burden of making the right decision falls on the borrowers. Unfortunately, 18-year-olds aren’t particularly good at judging the profitability of an investment…

Last but not least, these subsidized loans keep afloat colleges that do not add much value for their students, preventing people from accumulating useful skills.

Instead of subsidies Zingales, drawing a page from Milton Friedman, proposes income-contingent loans.

Investors could finance students’ education with equity rather than debt. In exchange for their capital, the investors would receive a fraction of a student’s future income — or, even better, a fraction of the increase in her income that derives from college attendance. (This increase can be easily calculated as the difference between the actual income and the average income of high school graduates in the same area.)

As I wrote about earlier, Bill Clinton received a loan like this from Yale’s law school and later created a national program but it didn’t get very far (although Obama wants to expand the program). Australia, however, implemented an income contingent loan program in 1989. Australian students don’t pay anything for university when they attend but once their income reaches a certain threshold they are charged through the income tax system. Many other countries are experimenting with income contingent loans.

Lumni is a private organization, started by economist Miguel Palacios (here is his book and Cato paper on human capital contracts), that is funding loans like this right now.

One point that Zingales doesn’t examine is adverse selection – an income-contingent loan will appeal most to people who want careers with low-income prospects, say in the non-profit sector. (Redistribution of this type was one of the reasons for the Yale law school program.) Thus, the program works best when incomes differ due to luck. My guess is that the adverse-selection problem can be handled if education venture capitalists are left free to price.

Is Iceland a role model?

Or call it the wisdom of Kevin Drum:

…it’s worth pointing out a couple of things. First, Iceland has about the population of Bakersfield. So when they made foreign creditors take most of the losses in the wake of their banking failure, the rest of the world could afford to let it happen. There were no systemic risks involved. Also worth noting: the Icelandic krona got devalued a lot. In 2008 a euro bought 90 krona. Today it buys 160 krona. That means imports are a lot more expensive than they used to be. And state spending, although it went up in krona terms, was cut sharply in real terms. Iceland isn’t really an anti-austerity poster child.

Iceland is certainly an interesting example of how to handle a financial crisis, and there may even be some lessons there for the rest of us. But I’d be pretty cautious about those lessons. What worked for Iceland doesn’t necessarily scale up to work for the rest of the world.

As Krugman recognizes, Icelandic gdp is still below its previous peak. Matt offers further comment.

East Asian public health bleg

What are the best sources to read on the significant public health improvements of the East Asian tigers, including in the years which preceded their spectacular bursts of economic growth? In particular where did those improvements come from and to what extent were they driven by specific policies? Your suggestions are much appreciated.

*The Great Divide: Nature and Human Nature in the Old World and the New*

That is the new book by the very active and very smart Peter Watson, due out soon but I bought a copy in the UK.

Why has the New World been so different from the Old World? What a splendid seventeenth and eighteenth century question. Imagine Jared Diamond — and with comparable scope — yet with shamans, peyote, and El Niño playing a role in the argument. I recommend it to everyone who can keep in mind how speculative the argument will be.

If we had to sum up what has gone before and describe in a few words the main features shaping early life in the Old World, those words would be: the weakening monsoon, cereals (grain), domesticated mammals and pastoralism, the plough and the traction complex, riding, megaliths, milk, alcohol. One way to highlight the differences between the two worlds is to perform the same summing-up exercise for the Americas…For the New World the crucial and equivalent words would be: El Niño, volcanoes, earthquakes, maize (corn), the potato, hallucinogens, tobacco, chocolate, rubber, the jaguar, and the bison.

Unlike Diamond, this book assigns ideology a central role in the story. Europe and the Middle East generate the ideas of the shepherd, the New World the ideas of the shaman, some of which may have been picked up or carried from the Chukchi of Siberia. Perhaps my favorite point in the book is the observation that the Old World had a greater diversity of ideologies.

Watson touches on many Hansonian themes about the differences between gatherers and foragers. Here is a Guardian review. Here is an Independent review. Here is a Matthew Price review.

This is an easy book to criticize, see the reviews or for instance take this passage:

…artwork was not developed [in the early stages of the New World] because there was no need to establish either dedicated territories or tribal identities. And/or food was in such plentiful supply that they had no need to keep records that assisted their memory of animal habits.

One really does have to take this book as a scenario, not as science. It is nonetheless interesting if used with care.

We are all stagnationists now

Here is Jim Hamilton, on peak oil, scary tag at the end:

…we should not dismiss the possibility that there may also have been a nontrivial contribution of simply having been quite lucky to have found an incredibly valuable raw material that for a century and a half or so was relatively easy to obtain. Optimists may expect the next century and a half to look like the last. Benes and coauthors are suggesting that instead we should perhaps expect the next decade to look like the last.

On this issue I am more optimistic than Hamilton.

Alternatively, here is Cardiff Garcia from the FT, with a survey of recent pessimistic thought on productivity, citing (but not necessarily endorsing) Nomura:

…we think it more likely that the economy will grow at a trend pace near 2.5%, which, coupled with normalization in productivity, implies the sustainable underlying pace of monthly gains in private payrolls is in the low-100k range or lower.

Karl Smith has a very useful blog post. Addressing me, he writes:

My position perhaps more clearly stated is that if all markets were clearing then phenomena such as: lack of educational improvement, globalization, de-industrialization, skew of technological improvement towards information technology, energy shortages, etc would show up in wages.

My view is this. When real factors are slow, it takes much longer for the private sector to manufacture its own ngdp and also of course rgdp. (You can pursue a separate argument about how quickly the Fed can fix things, but given that they haven’t, for whatever reason, the previous claim still holds. We can make multiple margins of comparison, even if a perfect Fed would clear everything up. We don’t have a perfect Fed.) Much of North Dakota has full employment, but most of the nation does not. With a stronger real economy along the right dimensions, we would have more jobs, but we don’t. The long term where everything shows up in wages can take a while to arrive. Nothing in this view requires one to tell stories — be they true or not — about companies which cannot find quality computer programmers. A final point is that labor force participation may be the job market number that really matters.

Here is an excellent post by Will Wilkinson on Obama, Romney, meanness, and Ben Friedman.

HFT versus the sub-optimal Tick

Felix Salmon has an interesting follow-up to my post, Should Stocks Trade in Increments of $.0001? First he notes (as did Chris Stuccio) that for stocks above say $50 the sub-penny rule doesn’t make much difference.

Here’s the chart, from Credit Suisse via Cardiff Garcia:

The y-axis shows the bid-offer spread on any given stock, in basis points; the x-axis shows the price of the stock, in dollars. Clearly, there’s an artificial clustering around that curve. For a lot of stocks trading at less than $50 a share, the market would happily provide bid-offer spreads of less than a penny if it could; but it can’t. And when stocks get really cheap, the bid-offer spread becomes enormous. For instance, an eye-popping 3.766 billion shares of Citigroup were traded on December 17, 2009, when the stock fell 7.25% to $3.20. At that level, a one-penny bid-offer spread is equivalent to a whopping 31 basis points; if Apple traded at a 31bp spread, then its bid-offer spread would be almost $2.

Clearly, the traders were the big winners when Citi was trading at a very low dollar price — if you make the assumption that traders capture half the bid-offer spread on each trade, then the traders made almost $20 million trading Citigroup alone, in one day.

On the other hand, it seems that the market almost never trades stocks at a bid-offer spread much below 2bp. Which in turn means that for stocks over $50 per share, we’re pretty much already living in Stuccio’s ideal world, where the spread is determined by traders, rather than by an artificial rule barring increments of less than a penny.

Salmon then makes another point – firms may use stock splits and IPO pricing to deliberately price their stocks below $50. Salmon says this is in part to grease their relationship with Wall Street but one could also say this is done in order to create more liquidity. In fact, there is good evidence for Salmon’s hypothesis that firms care about nominal share price; In Tick Size, Share Prices, and Stock Splits (JSTOR, H/T OneEyedMan) James Angel makes the interesting point that even as the S&P and CPI soared between 1924 and 1994 the average nominal price of a stock was very flat near $32. Angel’s explanation is that firms use the IPO price and splits to keep a consistent relationship between tick size and share price because:

A large relative tick size also encourages dealers to make a market in a stock….a larger tick provides a higher minimum round-trip profit to a dealer who can buy at the bid and sell at the offer.

Angel even notes the potential for rent-seeking that motivated the original argument to eliminate the sub-penny rule:

If the relative tick size is too big, the profits from a wider tick size may be dissipated through vigorous competition for order flow and payment for order flow.

Overall, I find these arguments continue to favor eliminating the sub-penny rule but these results indicate that firms already have some control over the extent of HFT so the net benefits may be smaller than at first imagined. It is probably easier to split than to combine shares to raise price, however, and social benefits may exceed private benefits so I still see an argument for eliminating the rule. See Felix’s post also for a number of very good comments.

Assorted links

1. Haitian garbage can, via Michael Clemens.

2. Elizabeth Anderson on libertarianism and freedom by contract.

3. There is no great stagnation.

4. What happens if you keep on playing Civilization II for ten years? (hint: it is not a real rate of return on equity of seven percent or more).

Assorted links

Karl Storchmann reports from the front: French wines vs. Jersey wines

At the Princeton tasting, led by George Taber, 9 wine judges from France, Belgium and the U.S. tasted French against New Jersey [TC: that’s the New Jersey] wines. The French wines selected were from the same producers as in 1976 including names such as Chateau Mouton-Rothschild and Haut Brion, priced up to $650/bottle. New Jersey wines for the competition were submitted to an informal panel of judges, who then selected the wines for the competition. These judges were not eligible to taste wines at the final competition The results were similarly surprising. Although, the winner in each category was a French wine (Clos de Mouches for the whites and Mouton-Rothschild for the reds) NJ wines are at eye level. Three of the top four whites were from New Jersey. The best NJ red was ranked place 3. An amazing result given that the prices for NJ average at only 5% of the top French wines.

A statistical evaluation of the tasting, conducted by Princeton Professor Richard Quandt, further shows that the rank order of the wines was mostly insignificant. That is, if the wine judges repeated the tasting, the results would most likely be different. From a statistically viewpoint, most wines were undistinguishable. Only the best white and the lowest ranked red were significantly different from the others wines.

There was a third similarity to the Paris tasting. In Paris, after the identity of wines was revelared, Odette Kahn, editor of La revue Du Vin De France, demanded her score card back. Apparently, she was not happy with having rated American wines number one and two.

At the Princeton blind tasting, while both French judges preferred NJ red wines over the counterparts from Bordeaux. After disclosing the wines’ identity the French judges were surprised but did not complain. In contrast, several tasters from the U.S. did not want their wine ratings to be published.

All results and the statistical analysis can be found here:

http://wine-economics.org/WineTastings/Judgment_of_Princeton_no_comments.html

Orley Ashenfelter also refers me to www.liquidasset.com, click on “tastings” and then “the latest” for data.