Month: January 2014

Thoughts about children

“All Joy and No Fun” inspired me to think differently about my own experience as a parent. Over and over again, I find myself bored by what I’m doing with my children: How many times can we read “Angelina Ballerina,” or watch a “Bob the Builder” video? And yet I remind myself that such intimate shared moments, snuggling close, provide the ultimate meaning of life. I have never quite sorted out the conundrum of how I could be distracted into thinking about something as tiresome as email when I was with my beloved kids. If I lost all my emails, I’d manage, and if I lost my children, I’d never recover; yet still I sometimes find it hard to stay in the moment with them. Senior demonstrates that there is no contradiction in this seeming paradox; she understands that tolerating our children is the cornerstone of loving them.

That is from Andrew Solomon.

Does immigration expand or contract the welfare state?

Bryan Caplan reports:

If you look at the fifty United States, however, immigration has no detectable effect on TANF/AFCD, K-12 education, or Medicaid spending. This is true for both per capita and total spending…

He is drawing on a new Cato study (pdf) by Zachary Gochenour and Alex Nowrasteh.

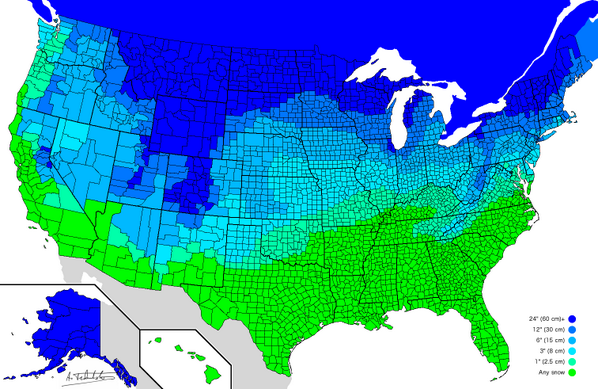

How much snow it takes to cancel school

The pointer is from Ángel Cabrera, link here.

What happens when we correct for publication bias?

There is a recent paper by Leif D. Nelson, Uri Simonsohn, and Joseph P. Simmons on this topic, the abstract is this:

Journals tend to publish only statistically significant evidence, creating a scientific record that markedly overstates the size of effects. We provide a new tool that arrives at unbiased effect size estimates while fully ignoring the unpublished record. It capitalizes on the fact that the distribution of significant p-values, p-curve, is a function of the true underlying effect. Researchers armed with only the sample sizes and p-values of the published findings can fully correct for publication bias. We demonstrate the use of p-curve by reassessing the evidence for the impact of “choice overload” from the Psychology literature, and the impact of minimum wage on unemployment from the Economics literature.

When it comes to both the choice overload effect and the minimum wage, correcting for publication bias implies a lack of significance in the overall tenor of the results. In passing I am not sure the minimum wage is the best example here, since a “no result” paper on that question seems to me entirely publishable these days and indeed for some while.

For the pointer I thank Kevin Lewis. And Kevin Drum adds comment.

Assorted links

1. The Cato session on glamour, with Virginia Postrel, myself, and Sam Tanenhaus.

2. Does exposure to fast food diminish your happiness? (speculative) and electronic tongue can identify brands of beer.

3. Robot directing traffic in Congo.

4. The shaming culture that is China.

6. Social liberalism as class warfare, another home run post by Ross Douthat.

New issue of Econ Journal Watch

The link is here, here are the contents:

One Swallow Doesn’t Make a Summer: In a 2014 AER article, Zacharias Maniadis, Fabio Tufano, and John List grapple with the problem of the credibility of empirical results by presenting a framework for statistical inference. Here Mitesh Kataria discusses some of the assumptions and restrictions of their framework and simulation, suggesting that their results do not, in fact, allow for general recommendations about which inference approach is most appropriate. Maniadis, Tufano, and List reply to Kataria.

Should the modernization hypothesis survive the research of Daron Acemoglu, Simon Johnson, James Robinson, and Pierre Yared? New evidence and analysis is provided by Hugo Faria, Hugo Montesinos-Yufa, and Daniel Morales, supporting the hypothesis that there is a long-run positive relation between socio-economic development and political democracy.

Ill-Conceived, Even If Competently Administered: In a 2013 JEP article, Stuart Graham and Saurabh Vishnubhakat argue that the Patent and Trademark Office (PTO) is doing a good job of interpreting patent law, and suggest that the “smart phone wars” and related disputes are not evidence that the patent system is broken. Here Shawn Miller and Alexander Tabarrok argue that the main problem is not with the PTO but with patent law as it has been applied, particularly to software, resulting in patents that are overly broad and ambiguous, and hence vexing and stifling.

Ragnar Frisch and Norway: Arild Sæther and Ib Eriksen contend that for several decades bad policy derived in part from the climate of opinion among the country’s eminent economists.

The ideological evolution of Milton Friedman: Lanny Ebenstein explores developments in Friedman’s thinking, particularly after the mid-1950s.

EJW Audio: Lanny Ebenstein on Milton Friedman’s Ideological Evolution

A model of Catalonian independence

There is a September 2013 paper (pdf) on this topic by Ryan D. Griffiths, Pablo Guillen, and Ferran Martinez i Coma:

We propose a game theoretical model to assess the capacity of Catalonia to become a recognized, independent country with at least a de facto European Union (EU) membership. Support for Catalan independence is increasing for reasons pertaining to identity and economics. Spain can avoid a vote for independence by effectively ‘buying-out’ a proportion of the Catalan electorate with a funding agreement favorable to Catalonia. If, given the current economic circumstances, the buying-out strategy is too expensive, a pro-independence vote is likely to pass. Our model predicts an agreement in which Spain and the European Union accommodate Catalan independence in exchange for Catalonia taking a share of the Spanish debt. If Spain and the EU do not accommodate, Spain becomes insolvent, which in turn destabilizes the EU. The current economic woes of Spain and the EU both contribute to the desire for Catalan independence and make it possible.

My worry however is this. If Catalan took away its share of the Spanish debt, or even more than its share, I don’t think this would help the Spanish fiscal situation. For similar reasons, I have never been convinced that the debt-to-gdp ratio is such an important variable. I myself put greater stress on the ability of a government to rule its territory, command the wealth and allegiance of its subjects, and continue to generate a more or less stable political equilibrium. Every developed country has the wealth to pay off its debts, if at least it has the political willingness to do so. If you view fiscal stability in this kind of macro public choice framework, the unwilling loss of a major piece of wealthy, high status territory is a much, much bigger fiscal blow than can be offset by a marginal improvement in the debt-to-gdp ratio. Besides, which part of Spain might be then next in line with demands for greater autonomy?

I am entirely fine with the idea of a Catalonian independence referendum in normal economic times, however, as I do not in general wish to maintain nation-states on those who are truly unwilling. I am very happy for instance that Estonia is no longer part of Russia/USSR, and in turn one can see that an Estonian independence referendum would pass in either good economic states or bad. If the same is true for Catalonia, we should all be willing to wait.

Assorted links

1. Prose vs. poetry in the culture that is Russia. And why did Uzbeki growth go so well? (pdf)

2. Two new poems by Sappho (pdf)?

3. Silver service vs. butler service.

4. A summary of Obama’s MyRA proposal.

5. The hidden hierarchy of (some) string quartets.

6. Arnold Kling’s new macro book (free, I like it very much).

Do scholars produce too much and revise too little?

Art Carden asks me:

…do you think scholars spend too much time producing new content and too little time revising and refining their arguments? I’m thinking about the Scholars of Old (e.g. Smith) taking their work through multiple editions. Thomas Sowell is good about producing revised versions of some of his books, but a glance at my shelf makes me wonder if Eminent Scholar should’ve revised his/her first book instead of writing a second or third or fourth.Do you think books go through the optimal number of revisions? Is the editing process so good today that the first edition usually should be the last?

In music, Brahms is notorious for having spent a lot of time revising his drafts. Pierre Boulez explicitly revised and improved many of his pieces, after adding in years of extra work. Stravinsky’s later 1947 version of Petrouchka is much sharper and cleaner than his 1911 release. In all of these cases the revisions are worthwhile, because these works were very special and worth improving. Brahms’s first symphony might have done better with some further revisions yet.

When it comes to economics, individual works are less and less special all the time, unlike in the days of Adam Smith. Smith waited, more or less perfected his book, and in the meantime he was not really scooped. Today it is the collective body of work which carries the force. We also live in the age of the working paper, where it is the first released draft which matters most. There is an institutional failure that first released drafts are released too soon, for the purposes of receiving attention and credit. Yet I don’t think there is a corresponding problem of too few editions of the working paper. Ideally there should be no more than two. A first “here I am” version, to stimulate discussion and feedback, and eventually a final version which maximizes accuracy.

In fact if scholars had to commit to only two versions of the paper, they might be induced to make the early release more accurate in advance, knowing they cannot magically revise away errors a week later with the magic of word processing and web re-posting. This move toward fewer editions would offset some of the costs of premature release. Again, we do not see a case where a greater number of revisions would be better.

The scarcity of attention is the key reason why a very small number of accuracy-enhancing revisions is more or less optimal.

How much does social mobility ever change?

Here is Dylan Matthews interviewing Gregory Clark about his new book The Son also Rises:

Another remarkable feature of the surname data is how seemingly impervious social mobility rates are to government interventions. In all societies, what seems to matter is just who your parents are. At the extreme, we see in modern Sweden an extensive system of public education and social support. Yet underlying mobility rates are no higher in modern Sweden than in pre-industrial Sweden or medieval England.

There was one case where government interventions did seem to promote mobility, which was in Bengal, in India. There the strict quota system in educational institutions had benefited significantly people with surnames associated with the Scheduled Castes.

But the bizarre element here is that these quotas did not help those truly at the bottom of the social ladder. Instead, the benefits went to families of average social status whom the British had mistakenly classified as Scheduled Caste. These families have now become a new elite. The truly disadvantaged, such as the large Muslim community, have been correspondingly further burdened by being excluded from these quotas.

Interestingly, in China, the extreme social intervention represented by the Communist Revolution of 1949, which included executing large numbers of members of the old upper class, has not resulted in much of an increase in social mobility. Surnames of high status in the Imperial and Republican era continue to be overrepresented among modern elites, including Communist Party officials.

The families that have high social competence, whatever the social system is, typically find their way to the top of the social ladder.

The interview is interesting throughout. And you will of course note the new Chetty results — created with entirely different methods and data — showing economic mobility has not much changed in the United States for decades.

For the initial pointer I thank Samir Varma.

Arrived in my pile

1. The Myth of Achievement Tests: the GED and the Role of Character in American Life, edited by James J. Heckman, John Eric Humphries, and Tim Kautz.

2. Dale W. Jorgenson, Richard J. Goettle, Mun S. Ho, and Peter J. Wilcoxen, Double Dividend: Environmental Taxes and Fiscal Reform in the United States.

3. Arnon Grünberg, Mit Haut und Haaren. This Dutch novel, now translated into German, is partially set in the economics department at George Mason University, circa the turn of the millennium. A quick browse revealed one scene with a character clearly based on Andrew Sellgren, I wonder who else shows up? The author is best known for writing Tirza, however.

Equalizing the rate of tax on income and capital gains

I don’t usually like to recycle old material, but @ModeledBehavior just linked to this 2007 MR post, which remains relevant to current debates. Here is one excerpt:

My uninformed-by-ever-having-been-a-tax-lawyer sense is that loss offsets for the capital gains tax are worth a great deal to some investors. Sell your winners to coincide with selling some losers and claim a net gains income of zero or very low. Let the asset winners ride and they will end up in your bequest and have their taxable values reset upon your death. If your option values line up the right way, you have enough diversification, and you are not liquidity constrained, it seems that for many people the de facto rate of capital gains taxation is not 15 percent but rather close to zero. (Maybe not quite zero in expected value terms; it’s tricky because if the losses exceed the gains you can deduct only $3000 of the losses from regular income but on the upside you’re taxed all the way. On the other hand, you can offset with charitable deductions.)

Let’s say we raised the book rate of tax on capital gains to forty percent. For some people the net real rate of tax on capital gains could still be zero. For other people it would be forty percent.

Let’s say we raised the book rate of tax on capital gains to eighty percent. For some people the net real rate of tax on capital gains could still be zero. For other people it would be eighty percent.

Under which of these scenarios have we equalized the tax rates on capital gains and labor income?

Counter Intuitive Nudges

Incentives don’t always work in the way we expect and neither do nudges. The British found that different slogans to encourage organ donation had markedly different effects.

…the least successful message was: “Every day thousands of people who see this page decide to register [as an organ donor],” which ran alongside a picture of a group of smiling people.

….The most successful slogan was one which read: “If you needed an organ transplant, would you have one? If so, please help others.”

Ex-post it’s easy to come up with explanations for these differences but ex-ante these are difficult to predict. The unsuccessful slogan, for example, lets people know about a social norm; an approach that has been said to be very successful at reducing binge drinking and electricity consumption, so why didn’t it work for organ donation?

Here’s another peculiar nudge in NYC:

A counterintuitive “pilot program” aimed at reducing garbage in subway stations by removing trash cans appears, against all logic, to be working.

The idea of removing the trash cans came to the MTA in 2011 as a possible method of combating rats…But when the cans were removed from 10 stations, the agency found that not only did rat populations decrease, the amount of litter decreased, too.

My suspicion is that if this is true (and not random noise) then it’s a non-generalizable partial-equilibrium effect. If the trash cans have been removed only in some stations then people may be holding on to their trash knowing that they can dump it at the next station or in a trash can on the street. If you were to remove all or most of the cans this won’t happen.

Do you have other examples of counter-intuitive nudges? And what other explanations can you offer for the trash can effect?

Hat tip: Holman Jenkins.

Assorted links

1. EpsteinUniversity: “Epstein speaks quickly, so pay close attention and rewind frequently.”

2. AngryBear on the teen minimum wage.

3. Josh Barro on….California hamburgers, if you know what I mean. And you know what, he’s right. Let’s puncture another myth about SoCal.

4. “I’m too tired to say it anyway and nobody cares.” More from Will. Here is a very good and useful Thomas Edsall review of Piketty.

The South African rate hike isn’t working

South Africa’s central bank lifted its benchmark interest rate by 0.5 percentage point to 5.5 per cent as concerns over the wilting currency outweighed the weakness of the local economy, but it proved insufficient to impress currency markets.

The South African rand jumped around during the presentation of the rate announcement, but eventually slumped to 11.339 against the US dollar, down 2.7 per cent in the day as investors were unimpressed by the tentative nature of the increase.

The decline was mirrored in other currencies, with the Turkish lira slumping 1.6 per cent after an early day gain of as much as 3 per cent.

There is more from the FT here, more in general here, where you also will see reports that the positive impact of the Turkish rate hike is falling fast.